The Trump-Powell Feud Intensifies: President Calls For Chairman's Termination

Table of Contents

The escalating conflict between President Trump and Federal Reserve Chairman Jerome Powell has reached a fever pitch, with the President openly calling for Powell's dismissal. This unprecedented attack on the independence of the Federal Reserve raises serious questions about the future of the US economy and the delicate balance of power between the executive and independent branches of government. This article delves into the intensifying Trump-Powell feud, examining its causes, consequences, and potential implications.

<h2>The Roots of the Conflict</h2>

The Trump-Powell feud didn't erupt overnight. While the public clashes are relatively recent, underlying tensions have simmered since Powell's appointment. Historically, the relationship between Presidents and Federal Reserve Chairs has often been characterized by some level of tension, reflecting differing perspectives on economic policy. However, the Trump-Powell relationship stands out for its unprecedented level of public acrimony.

-

President Trump's criticism of Powell's interest rate hikes: Trump consistently criticized Powell's decision to raise interest rates, arguing that these hikes hampered economic growth and harmed his chances of re-election. He viewed these increases as counterproductive to his economic agenda.

-

Powell's adherence to independent monetary policy despite Trump's pressure: Despite immense pressure from the President, Powell maintained the Fed's commitment to independent monetary policy, prioritizing price stability and full employment over short-term political considerations. This adherence to the Fed's mandate became a major point of contention.

-

Trump's belief that low interest rates are crucial for economic growth: A core tenet of Trump's economic philosophy was the belief that low interest rates were essential for sustained economic expansion. He repeatedly urged the Fed to lower rates, even suggesting negative interest rates.

-

The role of economic indicators in fueling the conflict: Fluctuations in key economic indicators like inflation and unemployment further exacerbated the conflict. Disagreements over the interpretation of these data fueled the ongoing dispute, with Trump often downplaying negative indicators and criticizing Powell's response.

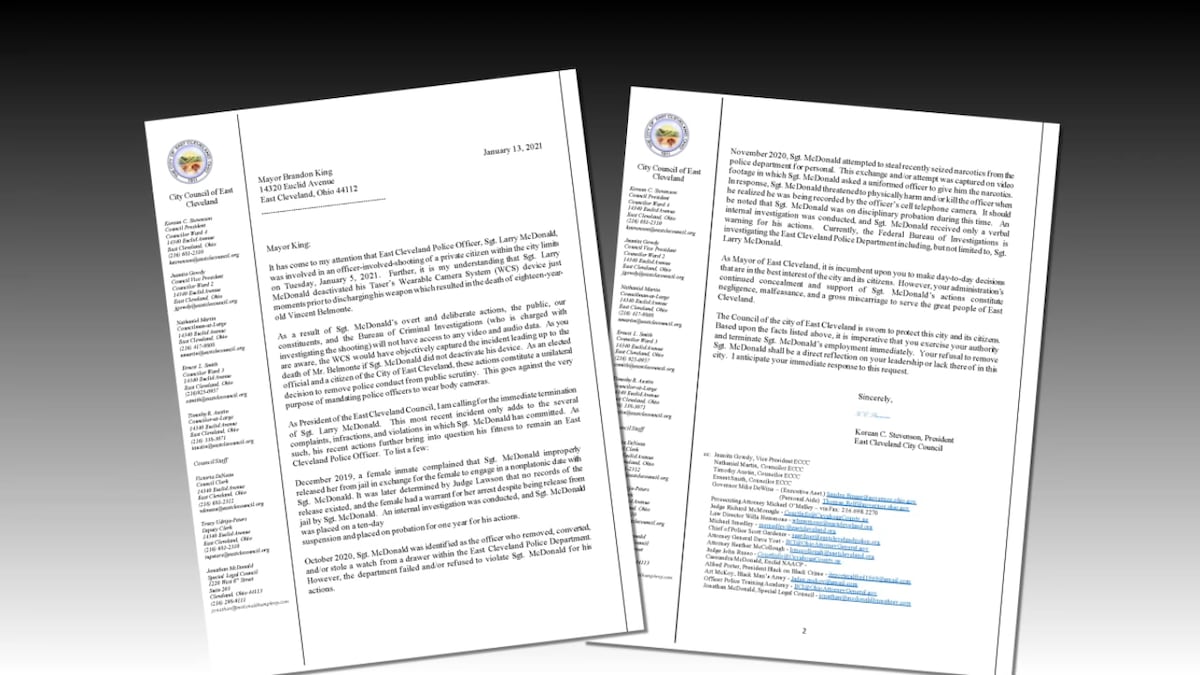

<h2>The President's Calls for Termination</h2>

President Trump's public calls for Powell's removal were frequent and forceful. These pronouncements represent a direct challenge to the traditional independence of the Federal Reserve.

-

Specific quotes from President Trump expressing his dissatisfaction: Trump frequently used Twitter and public statements to express his frustration, calling Powell's policies "terrible" and even suggesting he should be fired. These public attacks were highly unusual and unprecedented in the history of the Federal Reserve.

-

Analysis of the legal and political ramifications of removing a Federal Reserve Chairman: While the President has the authority to appoint the Federal Reserve Chairman, removing a sitting Chairman is a complex legal and political process. Such a move would likely face significant opposition and could trigger a constitutional crisis.

-

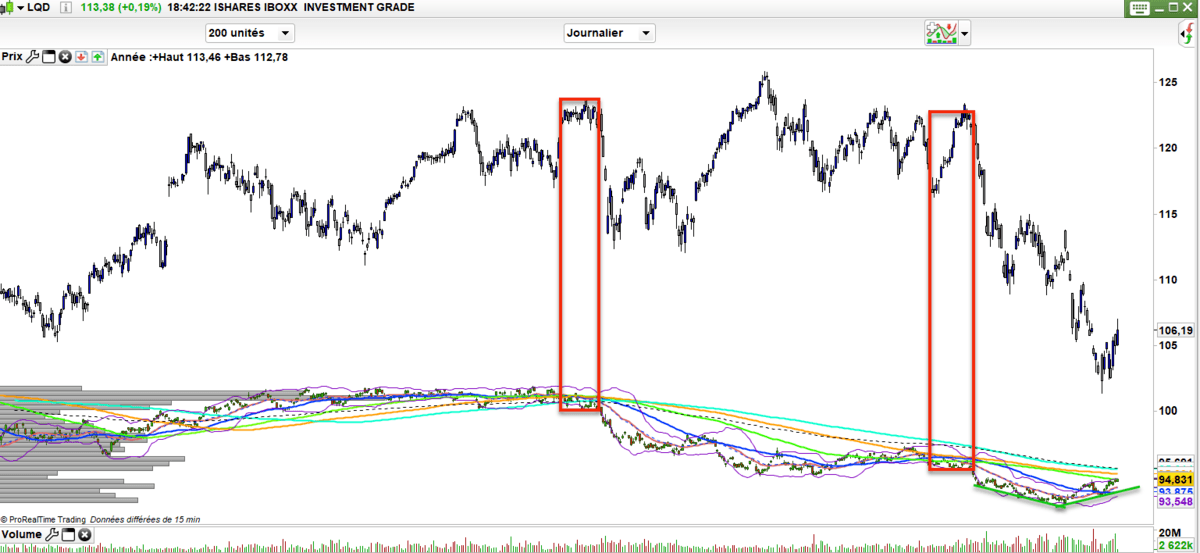

The potential impact on investor confidence and market stability: Trump's attacks on Powell significantly increased uncertainty in the financial markets. Investors worried about the potential for political interference in monetary policy, leading to increased volatility and a decline in investor confidence.

-

Discussion of the precedent this sets for future interactions between the executive and the Fed: The Trump-Powell feud established a concerning precedent, potentially undermining the long-standing tradition of the Fed's independence from political pressures. This could have lasting implications for the future of the US economy and the Fed's ability to effectively manage monetary policy.

<h2>The Impact on the US Economy</h2>

The Trump-Powell feud had significant repercussions for the US economy, generating considerable uncertainty and instability.

-

Uncertainty in the financial markets: The public clashes created significant volatility in the stock market and other financial markets, making it difficult for businesses and investors to plan for the future.

-

Potential impact on investment and consumer spending: Uncertainty about the direction of monetary policy discouraged investment and reduced consumer spending, potentially hindering economic growth.

-

The influence on inflation and interest rates: The conflict led to fluctuations in inflation and interest rates, creating further economic uncertainty and challenging the Fed's ability to effectively manage these key economic indicators.

-

Long-term effects on economic growth and stability: The long-term consequences of the feud remain to be seen, but it undoubtedly raised questions about the long-term stability and predictability of US economic policy.

<h3>International Implications of the Trump-Powell Feud</h3>

The conflict extended beyond US borders, impacting global economic dynamics.

-

The effect on the US dollar's value: The uncertainty surrounding US economic policy affected the value of the US dollar, impacting international trade and investment flows.

-

Implications for international trade and relations: The feud cast a shadow on US relationships with other countries and international institutions, raising questions about the reliability and predictability of US economic policies.

-

Potential reactions from other world leaders and central banks: Other world leaders and central banks expressed concerns about the potential for political interference in monetary policy, highlighting the global implications of the Trump-Powell dispute.

-

The broader implications for global economic stability: The feud underscored the interconnectedness of global economies and the potential for domestic political conflicts to destabilize international markets.

<h2>Potential Resolutions and Future Outlook</h2>

Several potential scenarios could have played out, each with its own implications.

-

Powell's potential resignation: Powell could have resigned, but chose to maintain his position despite the pressure.

-

Trump's ability to remove Powell: While the President had the power to appoint a new Chairman, removing Powell would have faced significant legal and political hurdles.

-

The possibility of a compromise or de-escalation: A compromise or de-escalation was unlikely given the nature of the conflict.

-

The long-term relationship between the White House and the Federal Reserve: The feud left a lasting impact on the relationship between the White House and the Federal Reserve, raising questions about the future independence of the central bank.

<h2>Conclusion</h2>

The Trump-Powell feud represents a significant challenge to the stability of the US economy and the independence of the Federal Reserve. The President's repeated calls for the Chairman's termination have created considerable uncertainty in the markets and raised concerns about the future of economic policy. Understanding the history of this conflict, its impact on domestic and international economies, and potential resolutions is crucial for navigating the complexities of this unprecedented situation. To stay informed about the evolving dynamics of the Trump-Powell feud, and its continuing effects on the economy, continue to follow reputable news sources and economic analysis. The implications of this power struggle will undoubtedly continue to shape economic policy for years to come.

Featured Posts

-

Manager Terry Franconas Illness Forces Him To Miss Brewers Game

Apr 23, 2025

Manager Terry Franconas Illness Forces Him To Miss Brewers Game

Apr 23, 2025 -

Yankees And Mets Face Challenges Finding Top Tier Relief Pitchers A Lupica Perspective

Apr 23, 2025

Yankees And Mets Face Challenges Finding Top Tier Relief Pitchers A Lupica Perspective

Apr 23, 2025 -

The Impact Of Artificial Intelligence On Wildlife Conservation Efforts

Apr 23, 2025

The Impact Of Artificial Intelligence On Wildlife Conservation Efforts

Apr 23, 2025 -

Open Ai And Chat Gpt The Ftc Investigation Explained

Apr 23, 2025

Open Ai And Chat Gpt The Ftc Investigation Explained

Apr 23, 2025 -

Fdj Hausse En Bourse Apres La Publication De Resultats 17 02

Apr 23, 2025

Fdj Hausse En Bourse Apres La Publication De Resultats 17 02

Apr 23, 2025

Latest Posts

-

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 10, 2025

Mezhdunarodnaya Izolyatsiya Zelenskogo 9 Maya Bez Gostey

May 10, 2025 -

S Sh A I Noviy Krizis Bezhentsev Vzglyad Iz Germanii

May 10, 2025

S Sh A I Noviy Krizis Bezhentsev Vzglyad Iz Germanii

May 10, 2025 -

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 10, 2025

9 Maya Vladimir Zelenskiy Ostalsya Bez Podderzhki

May 10, 2025 -

Pakistans Imf Bailout 1 3 Billion Package Under Review Amidst India Tensions

May 10, 2025

Pakistans Imf Bailout 1 3 Billion Package Under Review Amidst India Tensions

May 10, 2025 -

Zelenskiy Odin Na 9 Maya Pochemu Nikto Ne Priekhal

May 10, 2025

Zelenskiy Odin Na 9 Maya Pochemu Nikto Ne Priekhal

May 10, 2025