The U.S. Dollar And Presidential Performance: A Historical Perspective On The First 100 Days

Table of Contents

Early Economic Indicators and the Dollar

The first few months of a new administration offer crucial insights into its economic philosophy. Early indicators, particularly in inflation and interest rate adjustments, can significantly influence the dollar's value.

Inflation and Interest Rates

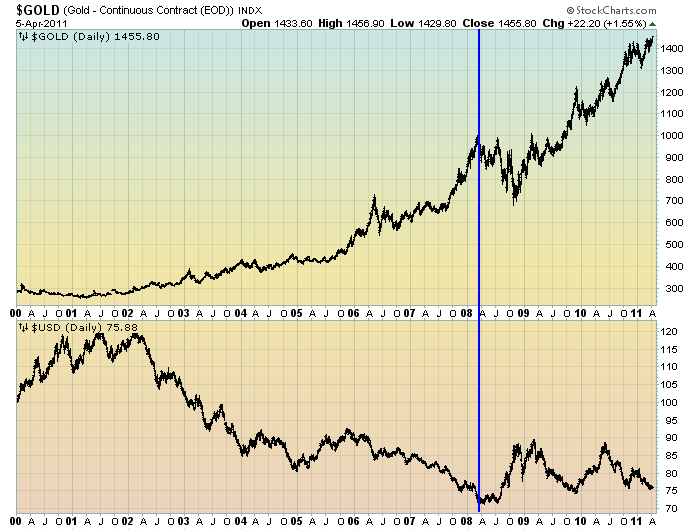

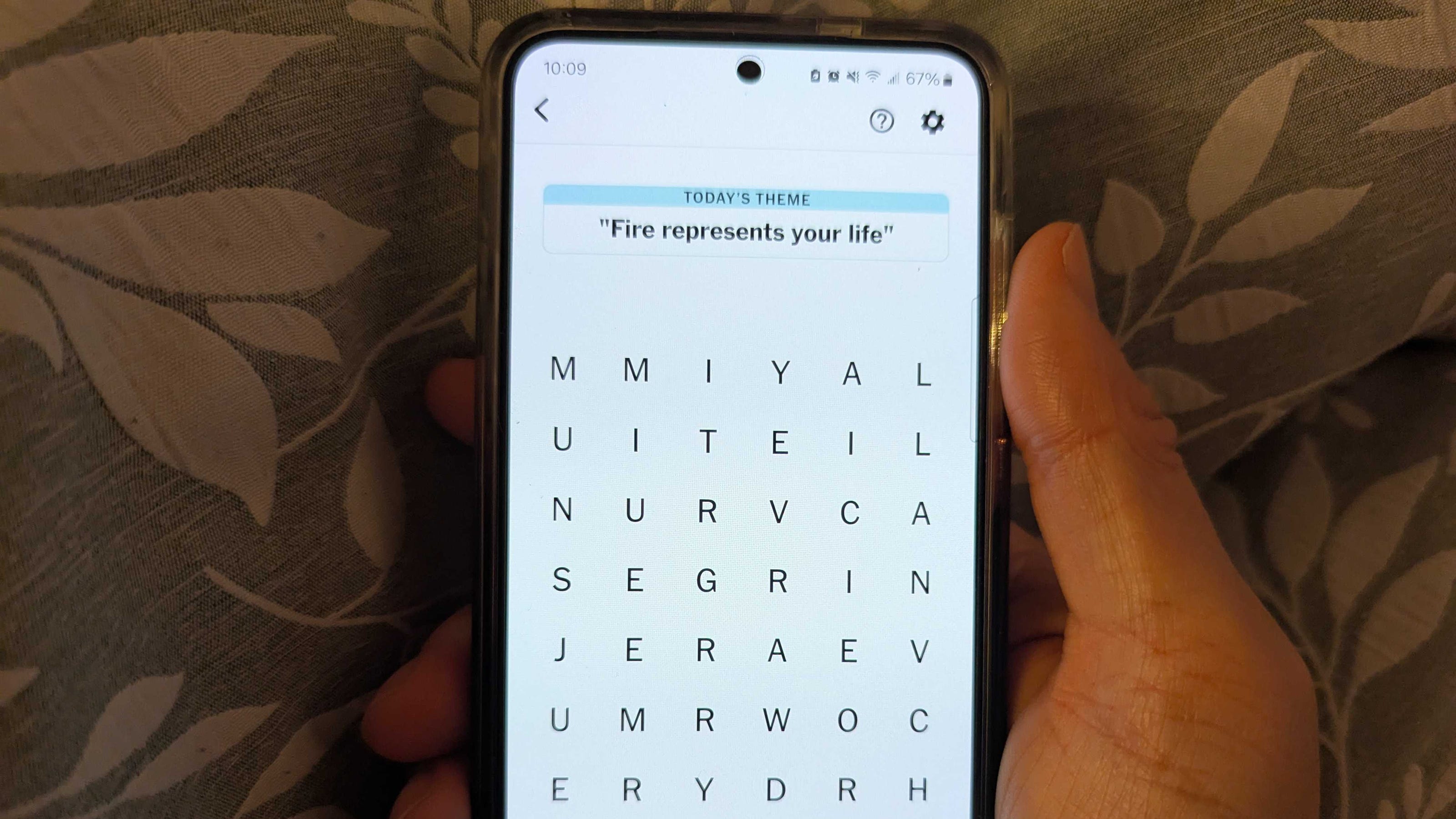

The relationship between inflation, interest rates, and the U.S. dollar is well-established. High inflation typically erodes the purchasing power of the dollar, making it less attractive to foreign investors. Conversely, raising interest rates can attract foreign investment, strengthening the dollar.

- Examples of Success: Presidents who successfully managed inflation early in their terms, often through prudent monetary policy coordinated with the Federal Reserve, frequently saw a strengthening of the U.S. dollar. A strong dollar can indicate a healthy and stable economy, bolstering investor confidence.

- Examples of Challenges: Conversely, presidents whose initial economic policies led to increased inflation often faced a weakening dollar. This can be exacerbated by inconsistent messaging or a lack of coordination between the administration and the Federal Reserve. The resulting uncertainty can trigger capital flight and depress the currency's value. The Federal Reserve's role in setting monetary policy is critical in these situations. Its independence, while essential for long-term stability, can sometimes create tension with the administration's short-term goals.

Fiscal Policy and Government Spending

Early budget proposals and spending initiatives significantly impact investor confidence and the dollar. Expansionary fiscal policies, characterized by increased government spending or tax cuts, can stimulate economic growth but also potentially increase inflation and the national debt.

- Expansionary vs. Contractionary Policies: Expansionary policies, while beneficial in the short term, can lead to a weaker dollar if they fuel inflation. Contractionary policies, on the other hand, aimed at reducing government spending and deficits, may initially dampen economic growth but can enhance long-term stability and strengthen the dollar.

- Debt Levels and Market Reaction: High levels of national debt can increase concerns about the country's fiscal health, negatively impacting the dollar's value. Market reaction to proposed budgets is swift and can be a crucial predictor of the dollar's future trajectory. A well-received, fiscally responsible budget can strengthen the dollar, while a poorly received or unsustainable budget can weaken it.

Global Economic Context and the Dollar's Performance

The U.S. dollar's value is not solely determined by domestic policies. Global economic conditions and international relations play a significant role.

International Trade and Agreements

Early trade policies and negotiations significantly influence the dollar's strength in the global market.

- Trade Wars and Agreements: Initiating trade wars can lead to uncertainty and potentially weaken the dollar as investors become hesitant. Conversely, the negotiation and implementation of favorable trade agreements can boost investor confidence and strengthen the currency. The impact often depends on the specifics of the agreement and the global economic climate.

- Influence of Global Economic Events: Global economic shocks, such as recessions or financial crises, can significantly impact the dollar's exchange rate. The dollar often serves as a safe haven currency during times of global uncertainty.

Geopolitical Factors and Currency Fluctuations

International relations and geopolitical stability significantly influence the dollar's value during the first 100 days.

- Geopolitical Crises and the Dollar: Geopolitical crises, such as wars or political instability in key regions, often lead to a flight to safety, strengthening the dollar as investors seek refuge from risk.

- International Investor Confidence: Investor confidence in the stability and predictability of the U.S. government's foreign policy is also a major factor. A clear, consistent, and predictable foreign policy usually builds confidence and supports the dollar. Uncertainty, on the other hand, can lead to capital outflows.

Market Sentiment and Investor Confidence

Market sentiment and investor confidence are crucial determinants of the dollar's value, particularly during a new administration's first 100 days.

The Role of Market Expectations

Early presidential actions and policy pronouncements shape investor expectations and influence market sentiment towards the dollar.

- Inspiring Confidence vs. Uncertainty: Presidents who inspire confidence through decisive action and clear communication tend to see a strengthening of the dollar. Conversely, administrations characterized by uncertainty or inconsistent messaging often face weaker dollar valuations.

- Market Volatility: The initial period of a new presidency is frequently marked by heightened market volatility as investors assess the new administration's economic plans. This makes accurate prediction difficult.

Stock Market Performance and its Correlation to the Dollar

The relationship between early stock market performance and the performance of the U.S. dollar is complex and not always directly proportional. However, a correlation often exists.

- Correlation Analysis: While a direct causal relationship isn't always clear, periods of robust stock market growth often coincide with a relatively stronger dollar, reflecting overall investor confidence in the U.S. economy.

- Influencing Factors: Various factors influence this correlation, including investor psychology, interest rate adjustments, and global economic conditions.

Conclusion

This article has explored the intricate relationship between presidential performance during the crucial first 100 days and the trajectory of the U.S. dollar. While no single factor dictates the dollar's value, a combination of early economic policies, global factors, and market sentiment plays significant roles. Analyzing these factors historically provides valuable insight into the potential impact of a new administration's economic strategies. Understanding the historical interplay between U.S. presidential performance in the first 100 days and the U.S. dollar's value is crucial for investors, policymakers, and citizens alike. Continue to follow developments in economic policy and their influence on the strength of the U.S. dollar to stay informed about potential future trends. Further research into specific presidential administrations and their initial economic decisions provides a deeper understanding of this complex relationship between the U.S. dollar and presidential leadership.

Featured Posts

-

Adhd Og Skole Fhi Rapport Avslorer Begrenset Medisinsk Effekt

Apr 29, 2025

Adhd Og Skole Fhi Rapport Avslorer Begrenset Medisinsk Effekt

Apr 29, 2025 -

Blue Origin Cancels Launch Vehicle Subsystem Issue Halts Mission

Apr 29, 2025

Blue Origin Cancels Launch Vehicle Subsystem Issue Halts Mission

Apr 29, 2025 -

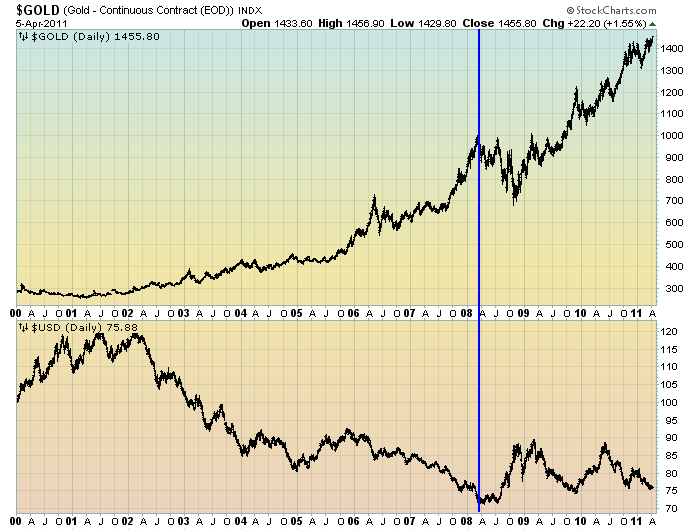

China Approves Hengrui Pharmas Hong Kong Stock Offering

Apr 29, 2025

China Approves Hengrui Pharmas Hong Kong Stock Offering

Apr 29, 2025 -

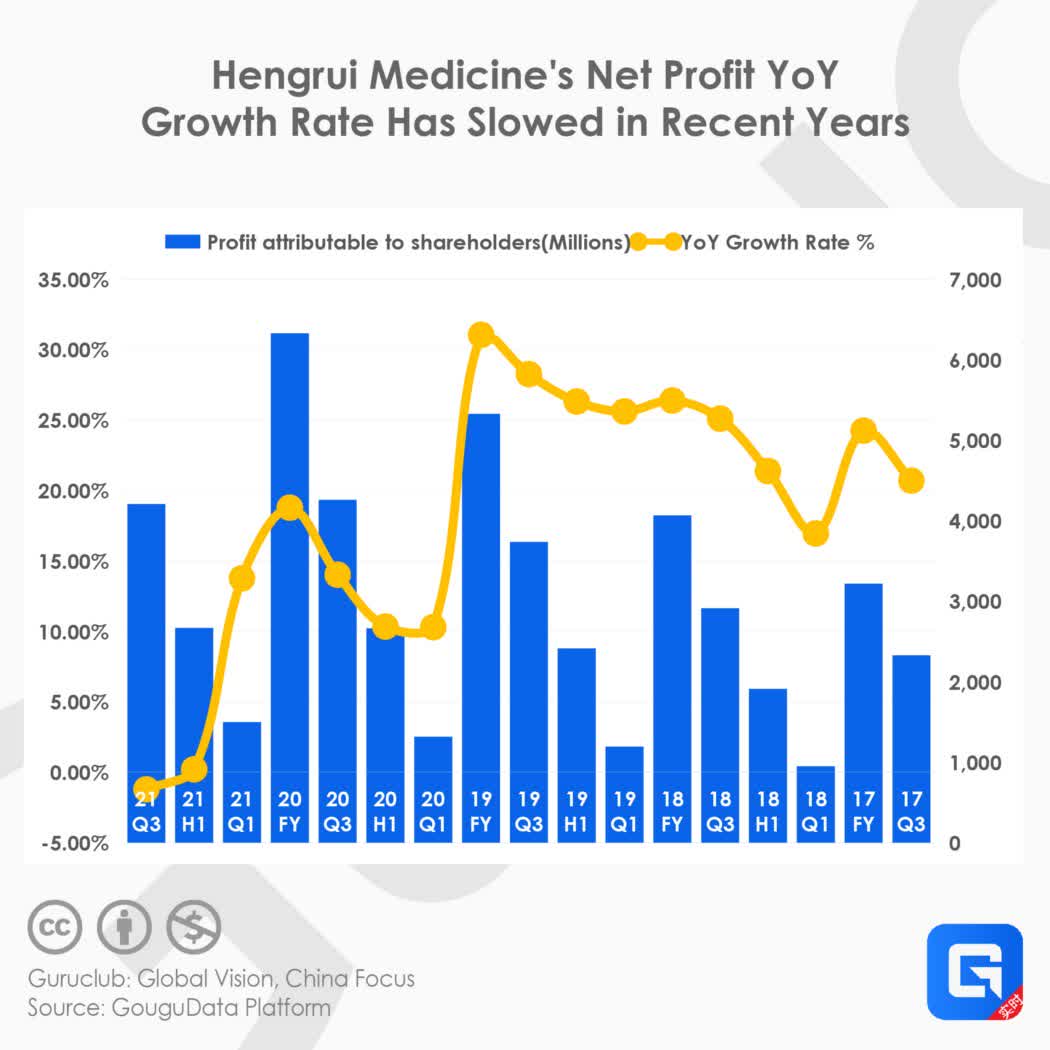

Nyt Strands February 27 2025 Complete Answers And Hints

Apr 29, 2025

Nyt Strands February 27 2025 Complete Answers And Hints

Apr 29, 2025 -

Join The Conversation Open Thread February 16 2025

Apr 29, 2025

Join The Conversation Open Thread February 16 2025

Apr 29, 2025