The Underappreciated Value Of News Corp: A Comprehensive Investment Analysis

Table of Contents

H2: News Corp's Diversified Portfolio: A Key Strength

News Corp's strength lies in its remarkably diversified portfolio, spanning across media, publishing, and even real estate. This diversification mitigates risk and offers multiple avenues for revenue generation and growth.

H3: Dominant Positions in Media and Publishing:

News Corp holds dominant positions across various media and publishing sectors. Its key holdings include:

- Dow Jones & Company: Publisher of The Wall Street Journal, a globally recognized and influential financial newspaper. This provides a strong, consistent revenue stream and significant brand recognition.

- News UK: Owns major British newspapers like The Times, The Sunday Times, and The Sun, dominating the UK news market.

- New York Post: A leading tabloid newspaper in New York City, commanding a significant local readership and online presence.

- HarperCollins Publishers: A major player in the global book publishing industry, with a vast catalog of bestselling authors and titles.

- Book publishing divisions: This includes a range of imprints, covering genres from fiction to non-fiction, children's books, and academic texts.

This extensive portfolio gives News Corp significant market leadership in key niches. While facing competition from digital media and other publishing houses, News Corp's established brands and strong content creation capabilities position it for resilience in a dynamic media landscape. The integration of print and digital platforms further strengthens its competitive position. This successful strategy is a major factor when considering News Corp holdings and their overall contribution to the company's market valuation. This media portfolio is a powerful engine for long-term growth.

H3: Real Estate Holdings and Revenue Streams:

Beyond its media and publishing assets, News Corp possesses significant real estate holdings that contribute to its diversified revenue streams. These properties, strategically located in major cities, generate rental income and offer potential for future appreciation. The value of these assets is often overlooked in market valuations, contributing to the perceived undervaluation of News Corp. This diversification into real estate offers a hedge against fluctuations in the media market, providing a more stable and predictable revenue source. The careful management and strategic development of these properties offer a significant avenue for long-term value creation, bolstering the company's overall asset valuation. This diversified revenue stream provides a strong foundation for future growth.

H2: Analyzing News Corp's Financial Performance and Future Projections

Understanding News Corp's financial performance and future projections is crucial for a comprehensive investment analysis. While the media industry faces challenges, News Corp has shown resilience and adaptability.

H3: Revenue Growth and Profitability:

News Corp's financial statements reveal fluctuating yet generally positive revenue growth and profitability over recent years. While specific numbers require referencing current financial reports, it's essential to analyze trends in revenue, profit margins, and earnings per share (EPS) to gauge its financial health. Areas of future growth lie in expanding digital subscriptions, leveraging data-driven insights for targeted advertising, and potentially acquiring smaller media outlets to consolidate market share. Challenges may include increased competition in the digital realm and the need to adapt to evolving consumer preferences. A thorough profitability analysis, taking into account both media and real estate assets, is essential for a complete picture of News Corp financials.

H3: Debt Levels and Financial Stability:

Assessing News Corp's debt levels and their implications for long-term financial stability is vital. Examining the company's debt structure – the types of debt, maturity dates, and interest rates – helps determine its financial risk profile. A comparison of News Corp's debt levels with those of its industry competitors offers valuable context. While high debt levels could pose risks, a robust cash flow from its diverse holdings can help mitigate those risks. Careful analysis of its credit rating and debt-to-equity ratio provides further insights into the company's financial stability.

H2: Addressing the Perceived Undervaluation of News Corp

Many believe News Corp is currently undervalued by the market. Several factors contribute to this perception.

H3: Market Sentiment and Investor Perception:

The perceived undervaluation of News Corp stems from a confluence of factors. Negative market sentiment towards traditional media, coupled with a focus on high-growth tech stocks, has potentially overshadowed News Corp's underlying strengths. Investors might undervalue its established brands and consistent cash flow, focusing instead on perceived short-term challenges. This situation could create an opportunity for long-term investors who see beyond the current market sentiment. Understanding investor perception and market biases towards News Corp is critical to identifying this potential investment opportunity. This undervalued stock presents a unique chance for long-term gains.

H3: Potential Catalysts for Future Growth:

Several factors could act as catalysts for future growth and increased valuation of News Corp. These include:

- Successful digital transformation: Further growth in digital subscriptions and advertising revenue.

- Strategic acquisitions: Acquiring smaller media companies to expand market share and diversify offerings.

- Real estate appreciation: Increased value of its real estate portfolio.

- Improved market sentiment: A shift in investor perception toward traditional media.

Technological advancements, while presenting challenges, also offer opportunities for innovation and expansion. News Corp's future outlook is tied to its ability to adapt to the changing media landscape while leveraging its existing strengths. The investment potential in News Corp lies in its ability to capitalize on these opportunities.

3. Conclusion:

This analysis highlights the often-underappreciated value of News Corp as a diversified investment opportunity. Its strong portfolio, encompassing leading media properties and valuable real estate assets, provides a stable foundation for future growth. While challenges exist, the potential for increased valuation through digital transformation, strategic acquisitions, and improved market sentiment is significant. While this analysis provides valuable insights into the potential of News Corp, further due diligence is crucial before making any investment decisions. However, we believe this comprehensive analysis highlights the significant, often underappreciated, value of News Corp as a strong investment. Explore News Corp's investment opportunities today!

Featured Posts

-

Tariffs Overshadow G7 Finance Ministers Meeting Conclusion

May 25, 2025

Tariffs Overshadow G7 Finance Ministers Meeting Conclusion

May 25, 2025 -

Southern Vacation Hotspot Responds To Negative Safety Rating After Shooting

May 25, 2025

Southern Vacation Hotspot Responds To Negative Safety Rating After Shooting

May 25, 2025 -

Demna Gvasalia Reshaping Guccis Design Identity

May 25, 2025

Demna Gvasalia Reshaping Guccis Design Identity

May 25, 2025 -

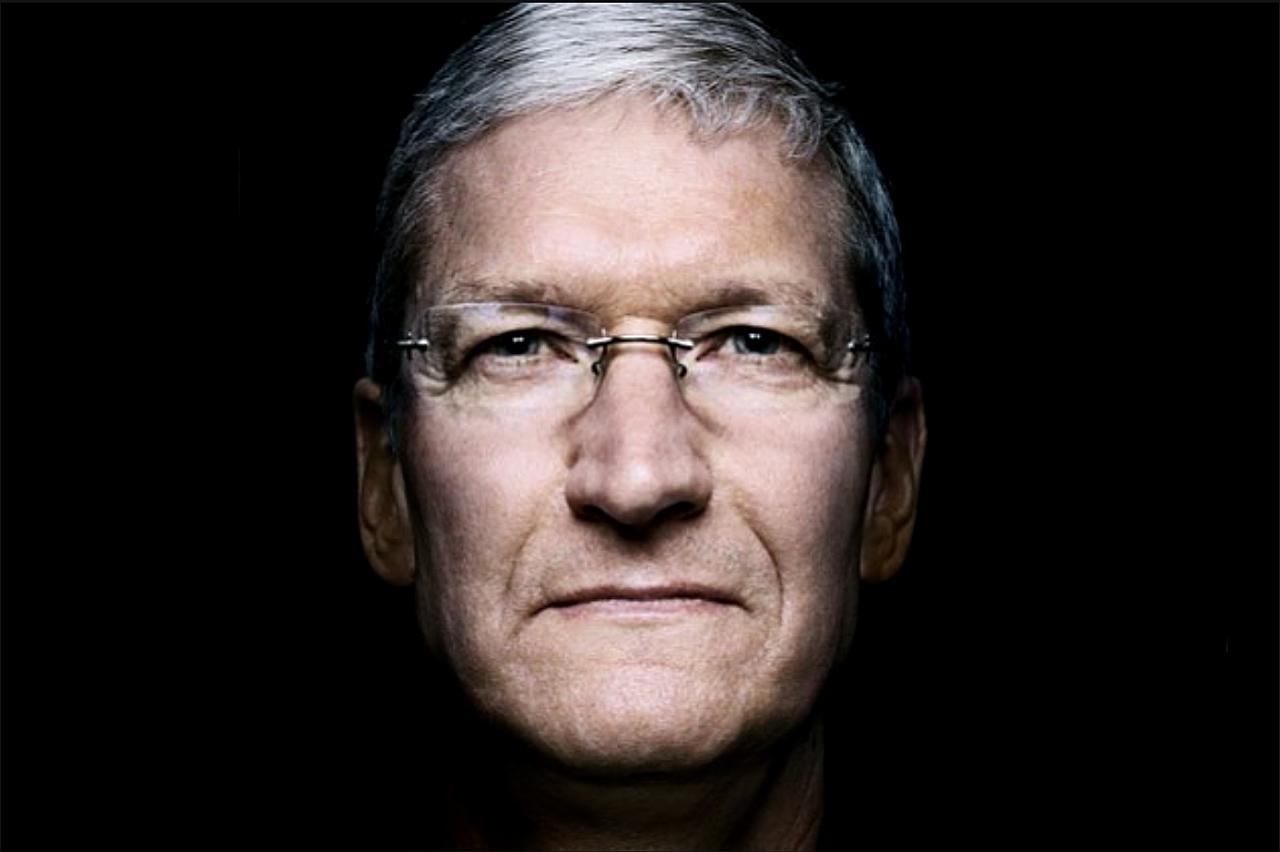

Apples Ceo Faces Headwinds Examining Tim Cooks Recent Struggles

May 25, 2025

Apples Ceo Faces Headwinds Examining Tim Cooks Recent Struggles

May 25, 2025 -

Mia Farrow Calls For Trumps Imprisonment Over Venezuelan Deportations

May 25, 2025

Mia Farrow Calls For Trumps Imprisonment Over Venezuelan Deportations

May 25, 2025