The Unexpected Fallout: Tariff Shock's Effect On Bond Yields

Table of Contents

The Mechanism: How Tariffs Influence Bond Yields

Tariffs create ripples throughout the financial system, impacting bond yields in several key ways.

Increased Uncertainty and Risk Aversion

Tariffs introduce significant uncertainty into the economic outlook. This uncertainty makes investors nervous, leading them to shift away from riskier assets like stocks and towards the perceived safety of bonds. This increased demand for bonds pushes their prices up. Remember, bond prices and yields have an inverse relationship; when prices rise, yields fall.

- Reduced corporate investment due to tariff uncertainty: Businesses hesitate to invest when facing unpredictable trade policies, slowing economic growth.

- Lower consumer confidence impacting economic growth forecasts: Tariffs can lead to higher prices for goods, impacting consumer spending and dampening economic growth predictions.

- Flight to safety driving up bond prices: Investors seek the relative safety of government bonds, increasing demand and pushing prices higher, resulting in lower yields. This effect is particularly noticeable in government bonds, often seen as the safest investment.

Inflationary Pressures and Yield Expectations

Tariffs can act as a tax on imported goods, increasing their prices and contributing to inflation. Central banks often respond to inflationary pressures by raising interest rates. Higher interest rates, in turn, typically lead to higher yields on newly issued bonds to match the prevailing market rates.

- Impact of tariffs on inflation expectations: The anticipation of rising prices due to tariffs can influence inflation expectations, leading to adjustments in bond yields.

- Central bank responses to inflationary pressures: The actions taken by central banks to manage inflation directly affect interest rates and consequently bond yields.

- How inflation expectations influence long-term bond yields: Long-term bond yields are significantly impacted by expectations of future inflation, with higher inflation expectations translating to higher long-term yields.

Currency Fluctuations and Their Impact

Trade wars often result in currency fluctuations. A weaker domestic currency makes imported goods more expensive, further exacerbating inflationary pressures. This currency volatility adds another layer of uncertainty for investors, influencing their decisions regarding bond investments, both domestically and internationally.

- The impact of a weaker currency on import prices: A weaker currency increases the price of imported goods, contributing to inflation and affecting bond yields.

- Currency volatility and investor confidence: Uncertainty in currency markets can reduce investor confidence, affecting investment decisions across various asset classes, including bonds.

- How currency fluctuations affect foreign bond yields: Changes in exchange rates impact the returns on foreign bonds for domestic investors, adding another layer of complexity to investment decisions.

Case Studies: Examining Past Tariff Shock Impacts on Bond Yields

Analyzing historical data helps illustrate the relationship between tariffs and bond yields.

-

Example 1: The Smoot-Hawley Tariff Act of 1930: This act significantly increased tariffs, contributing to the Great Depression. While a direct causal link to bond yields is complex, the economic downturn resulted in depressed bond yields as investors sought safety.

-

Example 2: Recent US-China Trade Wars: The imposition of tariffs between the US and China in recent years led to increased uncertainty in global markets. This uncertainty drove investors towards safe-haven assets, causing a temporary decline in government bond yields in some markets, while others experienced increased volatility and less predictable yield movements depending on the credit rating and risk profile of the bond. Corporate bond yields were particularly affected, reflecting increased credit risk.

These examples, while not perfectly isolating the effect of tariffs, demonstrate how trade-related uncertainty can impact investor behavior and bond yields. The response varied depending on whether it was a government bond or corporate bond, the currency involved, and overall global economic conditions.

Long-Term Implications: The Enduring Effects of Tariff Wars on Bond Markets

The long-term effects of tariff shocks on bond yields and market stability are significant and can be far-reaching.

-

Long-term shifts in investor preferences: Persistent uncertainty caused by tariffs can lead to lasting changes in investor behavior, potentially favoring lower-risk investments and affecting overall market liquidity.

-

The impact on long-term economic growth: The sustained impact of trade friction and the uncertainty surrounding tariffs can impede long-term economic growth, ultimately affecting the demand for and pricing of bonds.

-

The role of government policy in influencing bond yields: Government interventions, including monetary and fiscal policies, attempt to mitigate the negative impacts of tariff shocks on the bond market and the broader economy. These actions directly affect interest rates, and thus bond yields.

Conclusion

The impact of tariff shocks on bond yields is multifaceted and complex, influenced by investor sentiment, inflation expectations, and currency fluctuations. Understanding these intricate relationships is crucial for investors navigating the bond market. While a decrease in yields might initially seem beneficial to bondholders, the underlying economic uncertainty and potential for long-term inflationary pressures require careful consideration. By monitoring economic indicators, analyzing historical patterns, and carefully assessing the broader economic environment, investors can better predict and manage the risks associated with Tariff Shock's Effect on Bond Yields. Stay informed and make well-informed investment decisions to navigate the complexities of this evolving market dynamic.

Featured Posts

-

Analysis Of Jurickson Profars 80 Game Suspension For Ped Use

May 12, 2025

Analysis Of Jurickson Profars 80 Game Suspension For Ped Use

May 12, 2025 -

Grown Ups 2 Review Is It Worth Watching

May 12, 2025

Grown Ups 2 Review Is It Worth Watching

May 12, 2025 -

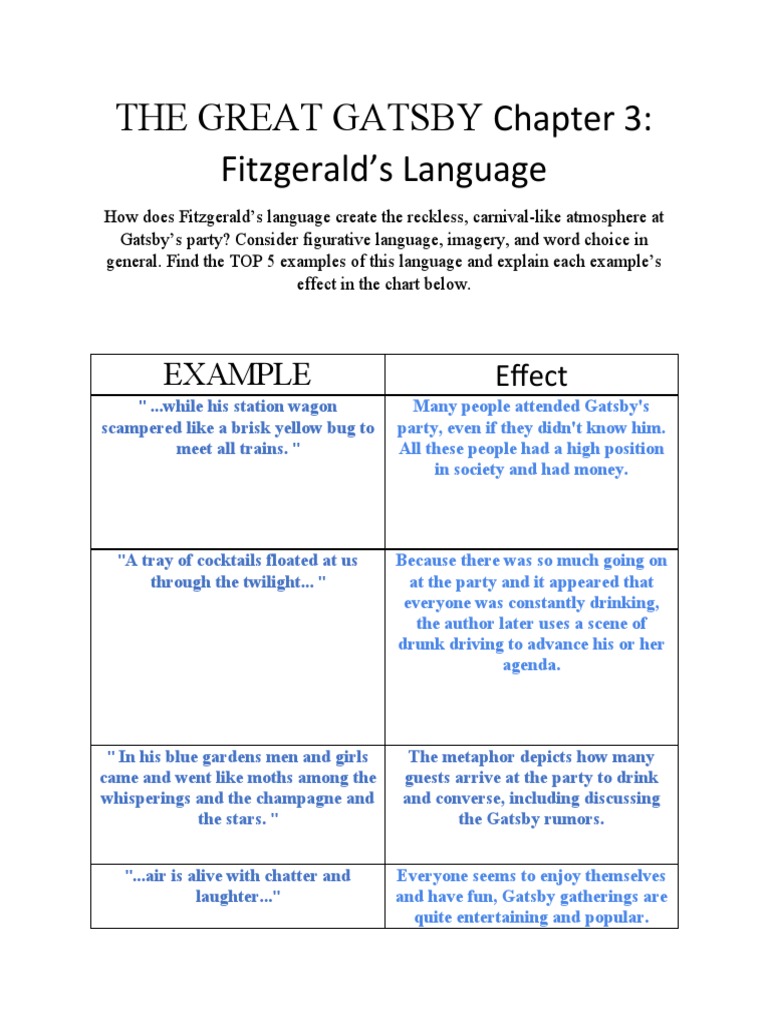

The Real Life Models For The Great Gatsby Uncovering Fitzgeralds Inspirations

May 12, 2025

The Real Life Models For The Great Gatsby Uncovering Fitzgeralds Inspirations

May 12, 2025 -

Speedway Classic Key Discussion Points With Mlb Commissioner Rob Manfred

May 12, 2025

Speedway Classic Key Discussion Points With Mlb Commissioner Rob Manfred

May 12, 2025 -

Karlyn Pickens Historic 78 2 Mph Fastball Redefining Ncaa Softball

May 12, 2025

Karlyn Pickens Historic 78 2 Mph Fastball Redefining Ncaa Softball

May 12, 2025