The Unpopularity Of 10-Year Mortgages In Canada: An Analysis

Table of Contents

Financial Uncertainty and the Canadian Housing Market

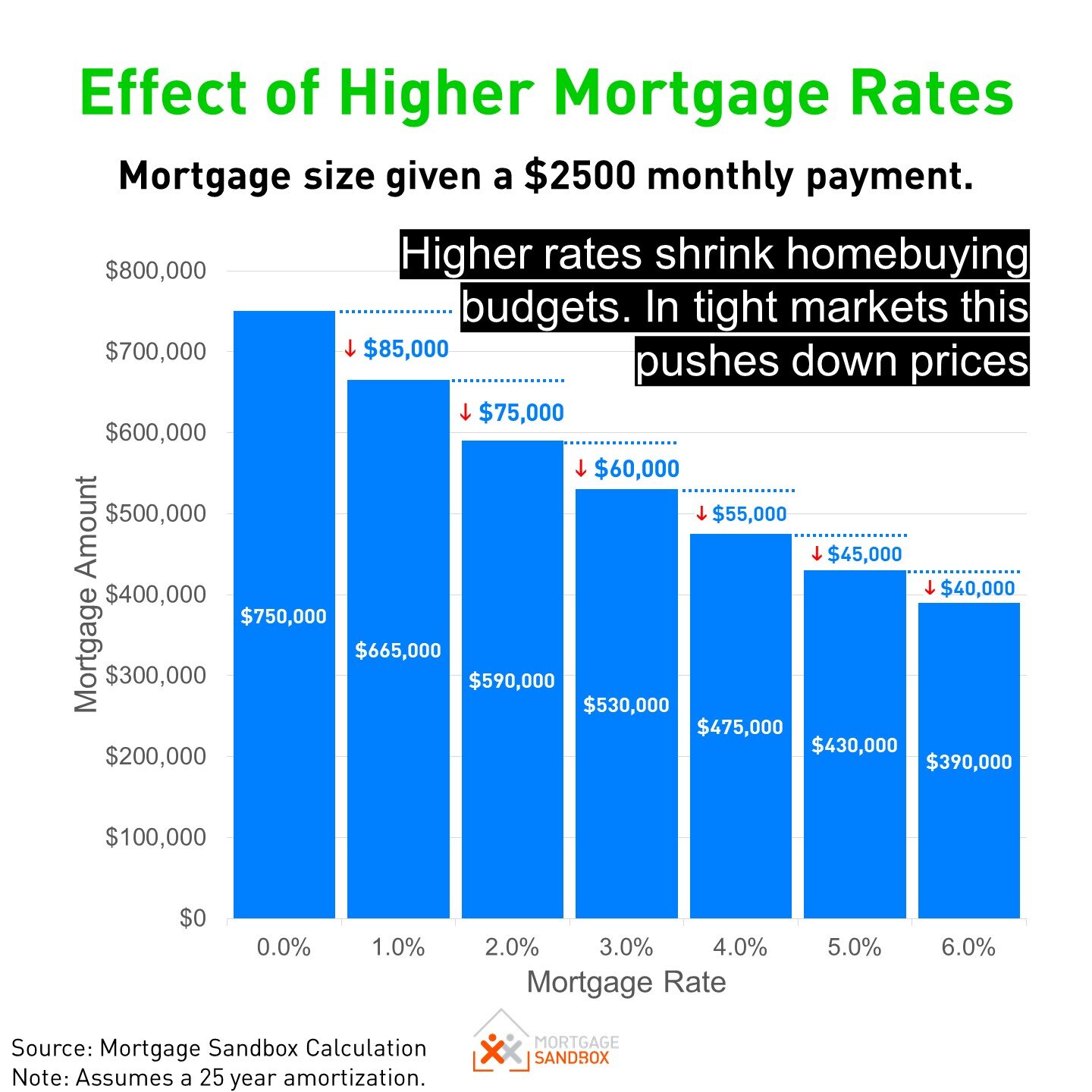

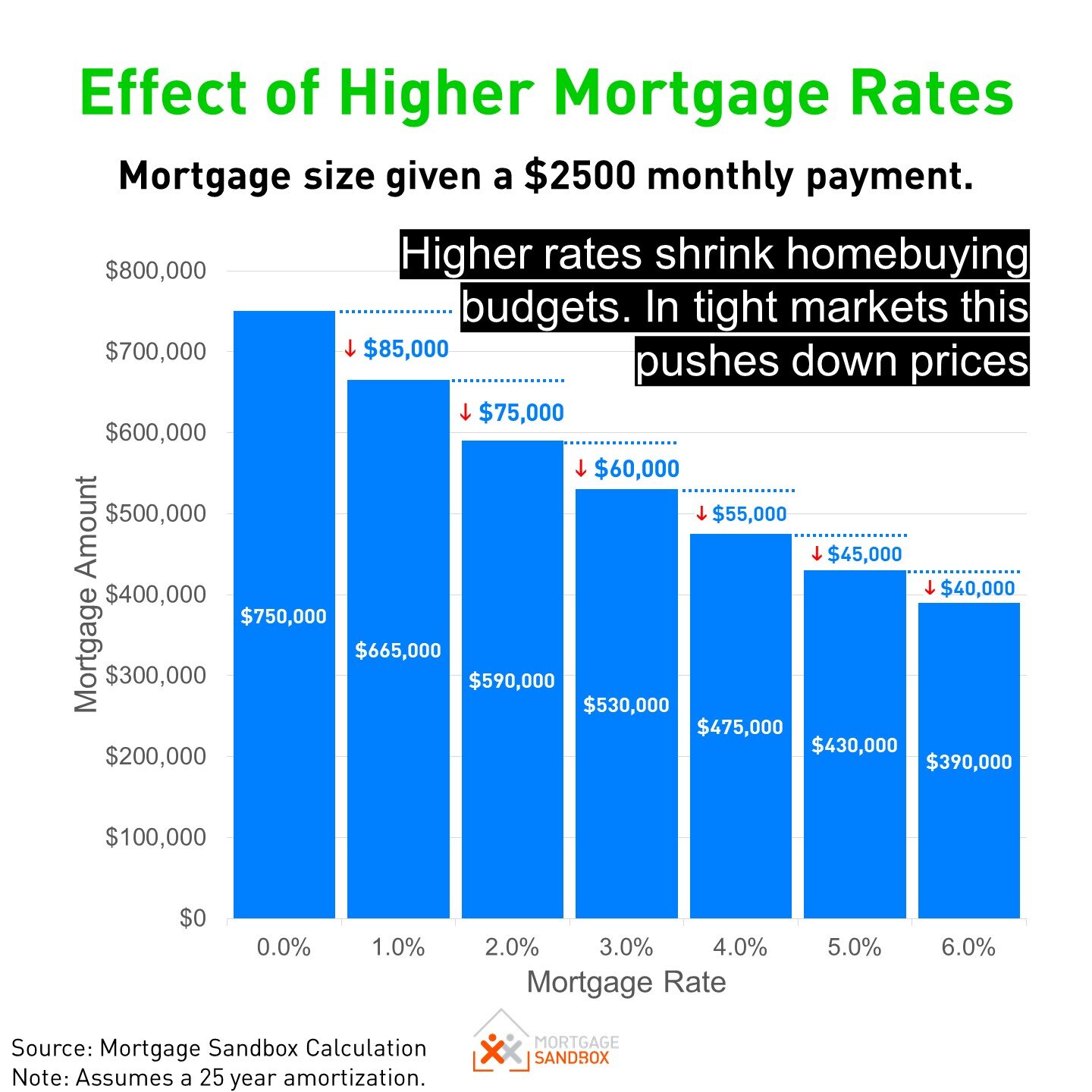

The Canadian housing market, known for its dynamism, presents significant financial uncertainty impacting long-term mortgage commitments. Fluctuating interest rates are a major concern. A 10-year mortgage locks you into a specific rate for a decade, meaning you could be paying more than someone who refinanced to a lower rate after a few years. Unforeseen economic shifts, such as job loss or market corrections, add to the risk. These factors contribute significantly to the hesitation surrounding longer-term mortgages.

- Higher risk of negative equity: Rising interest rates can dramatically increase monthly payments, potentially leading to negative equity if the property value drops.

- Uncertainty around future income potential: A stable income is crucial for a 10-year mortgage. Job loss or reduced earning potential midway through the term could create severe financial hardship.

- Potential for refinancing costs: While refinancing can offer lower rates, it incurs fees and administrative costs. This adds another layer of complexity to the long-term commitment.

Statistics from the Bank of Canada regarding interest rate fluctuations over the past decade illustrate this volatility and highlight the inherent risk associated with a long-term fixed-rate mortgage in a dynamic market. The unpredictable nature of Canadian interest rates makes the long-term commitment of a 10-year mortgage a significant financial risk for many.

The Psychological Barrier to Long-Term Commitment

Beyond the financial aspects, psychological factors play a crucial role in the preference for shorter-term mortgages. Many Canadians prefer the flexibility and perceived control offered by shorter terms, viewing a 10-year mortgage as a significant constraint. The feeling of being "locked in" and the fear of missing out (FOMO) on potentially lower interest rates in the future are significant drivers of this preference.

- Preference for shorter-term financial planning: Canadians often prefer to reassess their financial goals every few years, adjusting their mortgage accordingly.

- Fear of missing out on lower interest rates: The possibility of lower rates in the future tempts many to opt for shorter terms, allowing them to refinance and benefit from those lower rates.

- Desire to reassess financial goals every few years: Life changes, such as marriage, children, or career shifts, often necessitate a reevaluation of financial priorities, making a long-term commitment less attractive.

This psychological aversion to long-term commitment, supported by anecdotal evidence and observations from financial advisors, is a powerful factor contributing to the low uptake of 10-year mortgages in Canada.

Limited Availability and Higher Costs of 10-Year Mortgages

The relatively limited availability of 10-year mortgages from Canadian lenders further contributes to their unpopularity. Compared to the readily available 5-year and even 1-year options, 10-year mortgages are offered by fewer institutions, and often with more stringent requirements. This reduced availability is often coupled with potentially higher interest rates, acting as a further deterrent.

- Fewer lenders offering 10-year options: The selection of lenders offering 10-year terms is smaller than for shorter-term mortgages.

- Potentially higher interest rates as a risk premium: Lenders often charge higher interest rates for longer terms to offset the increased risk associated with a longer-term commitment.

- More stringent qualification criteria for 10-year mortgages: Lenders are more cautious about approving 10-year mortgages, requiring stricter criteria to ensure borrowers can maintain payments over the extended period.

A comparison of interest rates offered by various Canadian lenders for different mortgage terms highlights this disparity, demonstrating the potential cost disadvantage of opting for a 10-year mortgage.

The Role of Financial Literacy and Misconceptions

A lack of awareness regarding the long-term benefits of 10-year mortgages, coupled with prevalent misconceptions, also contributes to their low popularity. Many potential borrowers underestimate the potential cost savings associated with fixed rates over a longer period, while overestimating the inherent risks.

- Lack of awareness of potential long-term savings: Many are unaware that the interest rate advantage, even if minimal initially, can lead to significant savings over the ten years.

- Misunderstanding of the benefits of fixed interest rates: The certainty of fixed payments for a decade can be extremely beneficial for long-term financial planning.

- Overestimation of the risks associated with long-term commitments: While risks exist, many individuals overestimate the likelihood of severe financial hardship.

Improving financial literacy around mortgage choices, particularly through educational initiatives focused on long-term financial planning, could positively influence the adoption rate of 10-year mortgages.

Conclusion: Re-evaluating the Canadian Mortgage Landscape and 10-Year Mortgages

The unpopularity of 10-year mortgages in Canada stems from a complex interplay of financial uncertainty, psychological barriers, limited availability, and a lack of awareness regarding their potential benefits. While the volatility of the Canadian housing market and interest rates pose legitimate concerns, the potential long-term savings and stability offered by a 10-year mortgage shouldn't be overlooked. For individuals with stable income and long-term financial plans, a 10-year mortgage could prove a highly advantageous choice.

Before committing to a mortgage, thoroughly investigate the potential advantages of a 10-year mortgage and consult with a financial advisor to determine the best option for your unique circumstances. Consider the long-term implications of your choice and explore all available mortgage terms, including the often-overlooked benefits of a 10-year mortgage.

Featured Posts

-

Berlangas Opponent Selection Edwards Claims Money Motivates Fight Choices Avoiding Plant Targeting Munguia

May 04, 2025

Berlangas Opponent Selection Edwards Claims Money Motivates Fight Choices Avoiding Plant Targeting Munguia

May 04, 2025 -

Unanswered Contract Berlangas Preference For Munguia And Charlo Over Plant

May 04, 2025

Unanswered Contract Berlangas Preference For Munguia And Charlo Over Plant

May 04, 2025 -

Georgetown Resident Crowned 2025 Kentucky Derby Festival Queen

May 04, 2025

Georgetown Resident Crowned 2025 Kentucky Derby Festival Queen

May 04, 2025 -

Belgiums Energy Landscape Financing A Large Scale 270 M Wh Bess

May 04, 2025

Belgiums Energy Landscape Financing A Large Scale 270 M Wh Bess

May 04, 2025 -

False Reports Warren Buffett Distances Himself From Trump Tariff Support

May 04, 2025

False Reports Warren Buffett Distances Himself From Trump Tariff Support

May 04, 2025