The Wall Street Comeback: Analyzing The Reversal Of Bear Market Trends

Table of Contents

Economic Indicators Signaling a Wall Street Comeback

Several key economic indicators suggest a potential Wall Street comeback and a subsequent bull market rebound. These signals, when considered collectively, paint a picture of a recovering economy and increased investor confidence.

Inflation Cooling and Interest Rate Adjustments

Easing inflation is a crucial factor driving the potential Wall Street comeback. High inflation erodes purchasing power and discourages investment. The correlation between inflation rates and stock market performance is often inverse; lower inflation generally leads to better market performance.

- Inflation and Stock Market Performance: Historically, periods of high inflation are associated with lower stock market returns. As inflation cools, investor confidence improves, leading to increased investment and higher stock prices.

- Interest Rate Adjustments: The Federal Reserve's interest rate adjustments significantly impact the economy. Rate cuts reduce borrowing costs for businesses and consumers, stimulating economic activity and boosting corporate profits. This positive feedback loop contributes to a healthier market environment, fueling the Wall Street comeback.

- Data and Statistics: Examining the Consumer Price Index (CPI) and Producer Price Index (PPI) alongside Federal Reserve statements on interest rate policy provides valuable insights into the current economic climate and its potential impact on the stock market recovery.

Stronger-Than-Expected Corporate Earnings

Positive corporate earnings reports are another strong indicator of a Wall Street comeback. Exceeding earnings expectations demonstrates robust business performance and increased profitability, bolstering investor confidence.

- Examples of Exceeding Expectations: Analyzing quarterly earnings reports from major corporations across various sectors reveals which companies are thriving and contributing to the overall market recovery. Strong performances in technology, healthcare, and consumer staples, for example, contribute significantly to a positive market sentiment.

- Impact on Sector-Specific Market Performance: Specific sectors showing resilience and strong earnings growth will naturally outperform others during a recovery. Identifying these high-growth sectors is key to developing a successful investment strategy during the Wall Street comeback.

- Analyzing Earnings Reports: Thoroughly analyzing corporate earnings reports, including revenue growth, profit margins, and future guidance, is essential for informed investment decisions. This careful analysis helps investors discern companies poised for continued growth and those that might lag behind.

Resurgence in Consumer Spending

A resurgence in consumer spending is a vital component of economic recovery and fuels the Wall Street comeback. Increased consumer confidence leads to higher spending, driving demand and boosting business activity.

- Analyzing Consumer Spending Data: Monitoring retail sales figures, consumer confidence indices, and other relevant economic data provides a clear picture of consumer spending trends.

- Factors Contributing to Increased Consumer Spending: Reduced inflation, increased job security, and pent-up demand after periods of economic uncertainty all contribute to increased consumer spending.

- Impact on Various Sectors: The resurgence in consumer spending positively impacts various sectors, including retail, hospitality, travel, and entertainment. These sectors often see significant growth during periods of economic recovery.

Investor Sentiment and Market Psychology in the Wall Street Comeback

Understanding investor sentiment and market psychology is crucial for interpreting market trends and participating effectively in the Wall Street comeback. A shift from fear and pessimism to optimism is a significant indicator of a market bottom and potential rebound.

Shifting Investor Attitudes and Risk Tolerance

The change in investor psychology from fear and pessimism to optimism and a willingness to take on more risk is a critical factor in the market recovery.

- Analyzing Shifts in Investor Sentiment Indices: Indices such as the VIX (Volatility Index) and various investor sentiment surveys provide valuable insights into the prevailing market mood. A decrease in the VIX often signifies reduced fear and increased market stability.

- Investor Fear and Greed: The interplay between investor fear and greed is a powerful driver of market movements. Understanding these psychological factors is key to navigating market fluctuations effectively.

- Examples of Investor Behavior: Observing how investors react to news events, economic data releases, and corporate announcements provides valuable insights into shifts in market sentiment.

The Role of Institutional Investors

Institutional investors, such as pension funds and mutual funds, play a significant role in shaping market trends. Their buying activity can accelerate a market rebound.

- Strategies of Institutional Investors: Institutional investors often employ sophisticated strategies and have access to vast resources, allowing them to influence market direction significantly.

- Impact on Market Direction: Large-scale purchases by institutional investors can create positive momentum and reinforce the Wall Street comeback. Their actions often serve as a signal to other investors, leading to a snowball effect.

Increased Market Volatility and its Implications

Increased market volatility is often observed during market recoveries. While volatility presents risk, it also presents opportunities for skilled investors.

- Causes of Market Volatility: Various factors, including unexpected economic data, geopolitical events, and shifts in investor sentiment, can contribute to market volatility.

- Strategies for Managing Risk: Diversification of investments, hedging strategies, and careful risk assessment are crucial for managing volatility during a market comeback.

- Importance of Diversified Investment Portfolios: A well-diversified portfolio is essential for mitigating risk during periods of increased market volatility. This approach reduces the impact of any single investment performing poorly.

Strategies for Navigating the Wall Street Comeback

To effectively navigate the Wall Street comeback and capitalize on potential growth opportunities, investors need a well-defined strategy incorporating risk management and diversification.

Identifying Potential Growth Sectors

Identifying sectors poised for growth during the recovery phase is crucial for maximizing returns. Focusing on companies and industries expected to benefit from economic recovery allows investors to position themselves for success.

- Sectors Expected to Benefit: Sectors like technology, renewable energy, and healthcare are often seen as growth sectors during an economic upswing. These sectors typically show resilience and strong growth potential.

- Importance of Fundamental Analysis: Thorough fundamental analysis, including reviewing financial statements, assessing management quality, and evaluating competitive landscapes, is crucial for selecting stocks with strong growth potential.

Risk Management and Diversification

Diversification is a cornerstone of sound investment strategy. Spreading investments across different asset classes and geographic regions helps mitigate risk during market fluctuations.

- Benefits of Diversification: Diversification reduces the impact of any single investment underperforming. It helps to smooth returns and reduce overall portfolio volatility.

- Strategies for Managing Investment Risk: Implementing risk management strategies, such as stop-loss orders and hedging techniques, helps protect investments during market downturns.

Long-Term Investment vs. Short-Term Trading

Choosing between long-term investment and short-term trading depends on individual risk tolerance and investment goals. Both strategies have benefits and drawbacks during a market comeback.

- Time Horizon for Different Investment Goals: Long-term investors focus on sustained growth over extended periods, while short-term traders aim for quick profits based on short-term market movements.

- Adjusting Strategies Based on Market Conditions: Investors need to adapt their strategies based on changing market conditions. A flexible approach allows them to capitalize on opportunities and mitigate risks during market fluctuations.

Conclusion

The potential "Wall Street comeback" presents both opportunities and challenges for investors. Analyzing economic indicators, understanding investor sentiment, and implementing appropriate risk management strategies are crucial for navigating this evolving market landscape. By carefully monitoring inflation rates, corporate earnings, consumer spending, and investor psychology, you can make informed investment decisions during this period of market recovery. Remember to carefully consider your individual risk tolerance and investment goals when developing your strategy for benefiting from the ongoing Wall Street comeback and its associated bull market trends. Don't miss the opportunity to leverage the potential of this market shift – start planning your Wall Street comeback investment strategy today!

Featured Posts

-

B And W Trailer Hitches Heavy Hitters Smith Mountain Lake Bass Fishing Tournament 100 000 Prize

May 11, 2025

B And W Trailer Hitches Heavy Hitters Smith Mountain Lake Bass Fishing Tournament 100 000 Prize

May 11, 2025 -

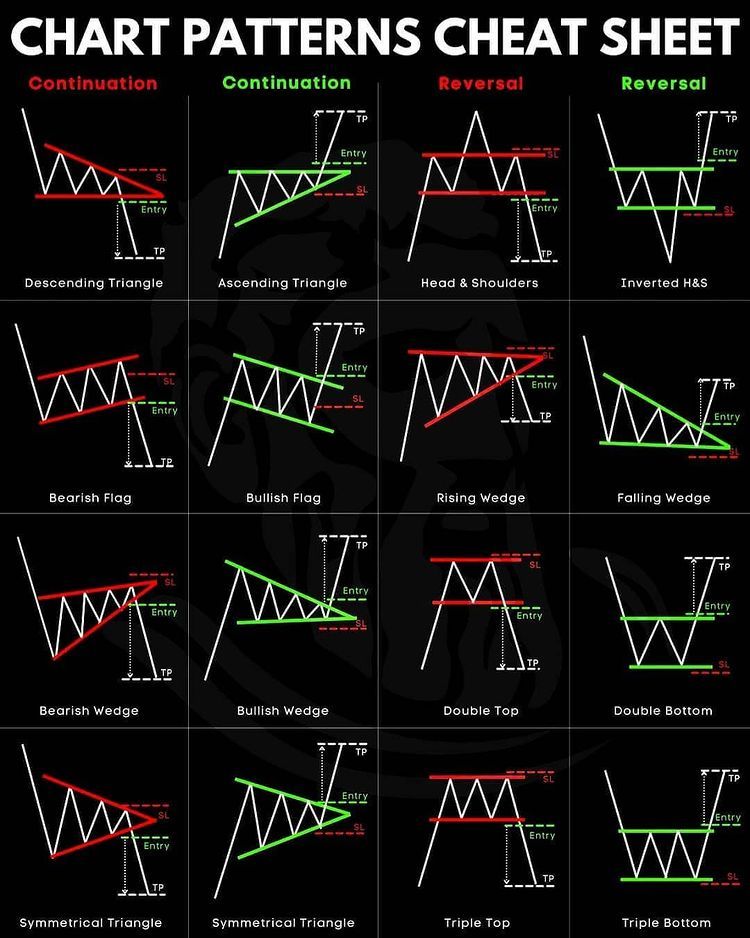

Graham Rahals Ultra Rare Porsche 911 Gt 3 Rs 4 0 A Performance Showcase

May 11, 2025

Graham Rahals Ultra Rare Porsche 911 Gt 3 Rs 4 0 A Performance Showcase

May 11, 2025 -

Bradley Wiggins Opens Up About His Post Cycling Life Addiction And Financial Difficulties

May 11, 2025

Bradley Wiggins Opens Up About His Post Cycling Life Addiction And Financial Difficulties

May 11, 2025 -

More Than Representation The Need For Authentic Asian And Asian American Stories

May 11, 2025

More Than Representation The Need For Authentic Asian And Asian American Stories

May 11, 2025 -

Could Aaron Judge Join Team Usa For The 2026 World Baseball Classic

May 11, 2025

Could Aaron Judge Join Team Usa For The 2026 World Baseball Classic

May 11, 2025