Thursday's D-Wave Quantum (QBTS) Stock Dip: Analysis And Reasons

Table of Contents

Market-Wide Factors Influencing QBTS Stock Performance

Several macroeconomic and industry-specific factors could have contributed to Thursday's D-Wave Quantum (QBTS) stock dip.

Broader Market Trends

The overall market sentiment on Thursday played a significant role. Increased market volatility, driven by concerns about rising interest rates and persistent economic uncertainty, impacted the performance of many tech stocks, including QBTS. The tech sector downturn saw many companies experience similar drops, indicating a broader trend rather than an isolated incident for D-Wave Quantum. Keywords like "market volatility," "tech stock downturn," and "investor sentiment" highlight the prevailing negative feelings impacting the entire market.

Quantum Computing Sector Performance

It's crucial to analyze the performance of other quantum computing companies on Thursday. Did the entire quantum computing stocks sector experience a downturn? If so, this suggests industry-wide headwinds rather than company-specific issues. Comparing QBTS's performance to its competitors provides valuable context and helps determine if the dip was unique to D-Wave or indicative of broader industry trends. Keywords like "quantum computing stocks," "competitor performance," and "industry trends" are key here.

Correlation with Other Tech Indices

Examining the correlation between QBTS stock and major tech indices like the NASDAQ and S&P 500 is vital. A strong negative correlation would suggest the dip was largely due to broader market movements. Analyzing index correlation, market indices, and stock market fluctuations provides a clearer picture of how external factors impact QBTS.

Company-Specific News and Events Affecting D-Wave Quantum (QBTS)

Beyond market forces, company-specific news and events could have triggered the D-Wave Quantum (QBTS) stock dip.

Recent Press Releases or Announcements

A thorough review of any press releases or announcements from D-Wave Quantum around the time of the dip is essential. Negative news, such as disappointing earnings reports, delays in product development, or unforeseen challenges, could easily trigger a sell-off. Examining "D-Wave press release," "company news," and "earnings report" will uncover any potentially negative information.

Analyst Ratings and Price Target Changes

Changes in analyst ratings or price targets for QBTS stock can significantly impact investor confidence and trading activity. A sudden downgrade or reduction in price target could have prompted investors to sell their shares, contributing to the dip. Tracking "analyst ratings," "price target," and "stock outlook" will reveal any significant changes in expert opinion.

Potential Insider Trading Activity

While not always a direct cause, significant insider trading activity warrants investigation. Unusual patterns of buying or selling by company insiders could signal concerns about the company's future prospects. Analyzing "insider trading" and reviewing relevant SEC filings can provide crucial context.

Technical Analysis of the QBTS Stock Chart

Analyzing the QBTS stock chart using technical analysis can offer insights into the reasons behind the dip.

Chart Patterns

Examining chart patterns leading up to and including the dip is crucial. Did the stock break through key support levels? Were there significant changes in trading volume? Identifying patterns like head-and-shoulders or double tops can provide clues about the underlying price dynamics. Keywords like "technical analysis," "chart patterns," "trading volume," and "support resistance" are valuable for this analysis.

Trading Indicators

Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can offer additional insights. Were these indicators signaling oversold conditions or bearish divergence before the dip? Understanding "RSI," "MACD," and "technical indicators" can provide early warning signs of potential price movements.

Potential Reversal Patterns

Finally, the chart should be analyzed for signs of a potential reversal or recovery. Are there bullish candlestick patterns emerging? Has the stock found a new support level? Identifying "stock reversal," "market recovery," and "price action" can help predict future price movements.

Investor Sentiment and Speculation

Investor sentiment and speculation also significantly influence stock prices.

Social Media Sentiment

Analyzing social media sentiment towards D-Wave Quantum and its stock can provide valuable clues. Were there significant negative comments or concerns expressed on platforms like Twitter or StockTwits? Tracking "social media sentiment," "investor sentiment analysis," and "online forums" can reveal the prevailing mood among investors.

News Coverage and Public Perception

The way the stock dip was covered in financial news outlets and the overall public perception of D-Wave Quantum also plays a role. Negative news coverage or criticism could negatively impact investor confidence. Therefore, analyzing "media coverage," "public perception," and "brand reputation" can provide critical context.

Conclusion: Implications of the D-Wave Quantum (QBTS) Stock Dip and Future Outlook

The D-Wave Quantum (QBTS) stock dip on Thursday was likely a result of a combination of factors, including broader market weakness, potential company-specific concerns, and prevailing investor sentiment. While the short-term outlook may seem uncertain, a thorough analysis reveals opportunities alongside risks.

The future of QBTS stock depends on several factors, including the company's ability to execute its business plan, the overall performance of the quantum computing sector, and prevailing market conditions. It's crucial to remember that investing in quantum computing stocks, and QBTS specifically, involves substantial risk.

Before making any investment decisions related to D-Wave Quantum (QBTS) stock, it’s imperative to conduct thorough due diligence. Understand the risks involved in investing in D-Wave Quantum (QBTS) stocks and the quantum computing sector as a whole. Continue your research by exploring related articles and resources to gain a deeper understanding of the factors impacting QBTS and other quantum computing investments. Remember, informed decisions are key to navigating the complexities of the D-Wave Quantum (QBTS) stock market.

Featured Posts

-

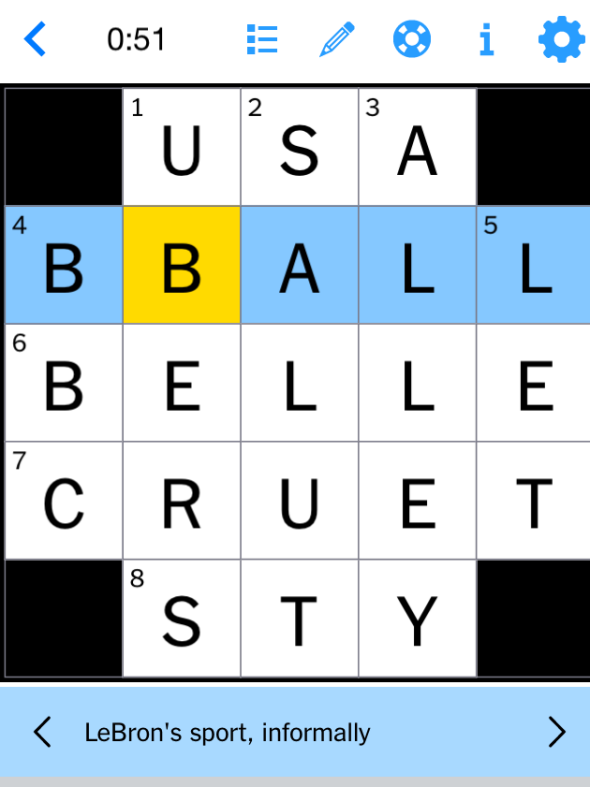

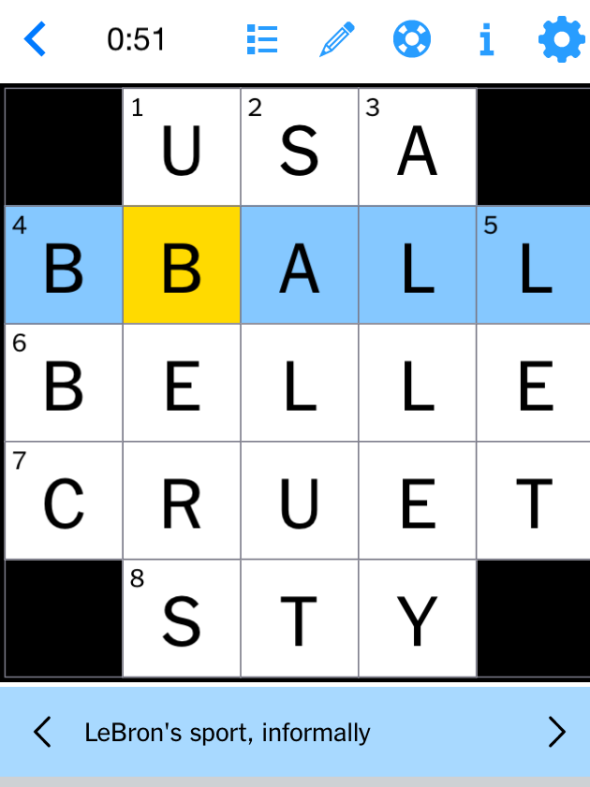

April 20 2025 Nyt Mini Crossword Answers And Clues

May 21, 2025

April 20 2025 Nyt Mini Crossword Answers And Clues

May 21, 2025 -

Finding The Answers Nyt Mini Crossword March 24 2025

May 21, 2025

Finding The Answers Nyt Mini Crossword March 24 2025

May 21, 2025 -

Kwartaalcijfers Abn Amro Aex Koers Reageert Positief

May 21, 2025

Kwartaalcijfers Abn Amro Aex Koers Reageert Positief

May 21, 2025 -

Aims Group Partners With World Trading Tournament Wtt

May 21, 2025

Aims Group Partners With World Trading Tournament Wtt

May 21, 2025 -

D Wave Quantum Qbts Explaining The Stock Price Increase On Friday

May 21, 2025

D Wave Quantum Qbts Explaining The Stock Price Increase On Friday

May 21, 2025