TikTok's "Just Contact Us" Tariff Workarounds: Are They Legit?

Table of Contents

Understanding TikTok's Import Regulations and Tariffs

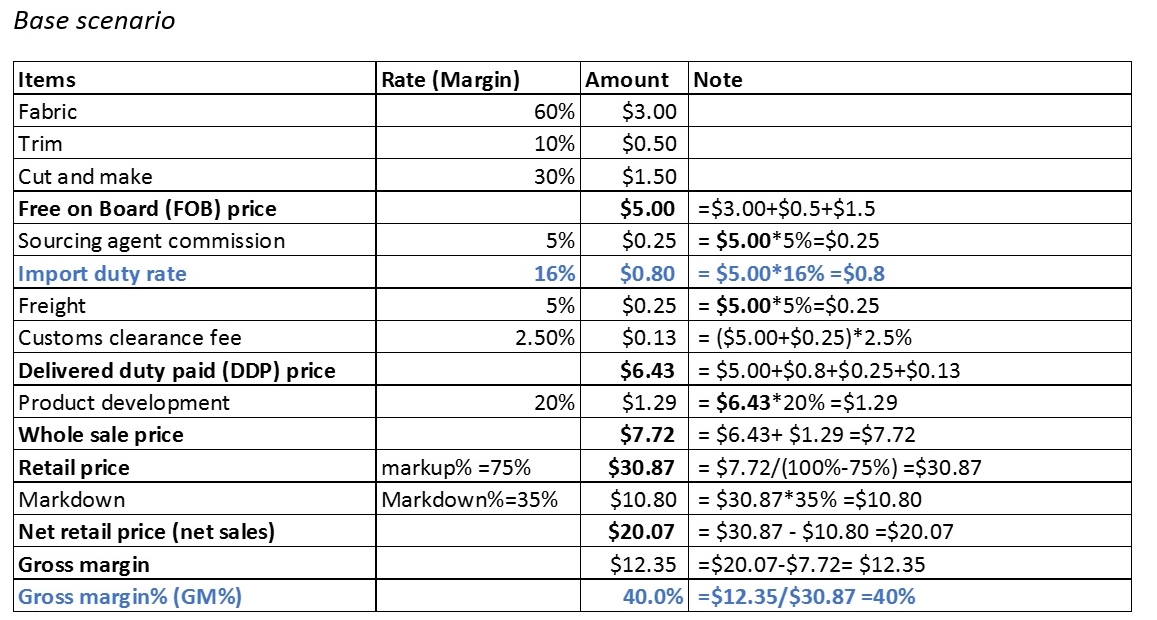

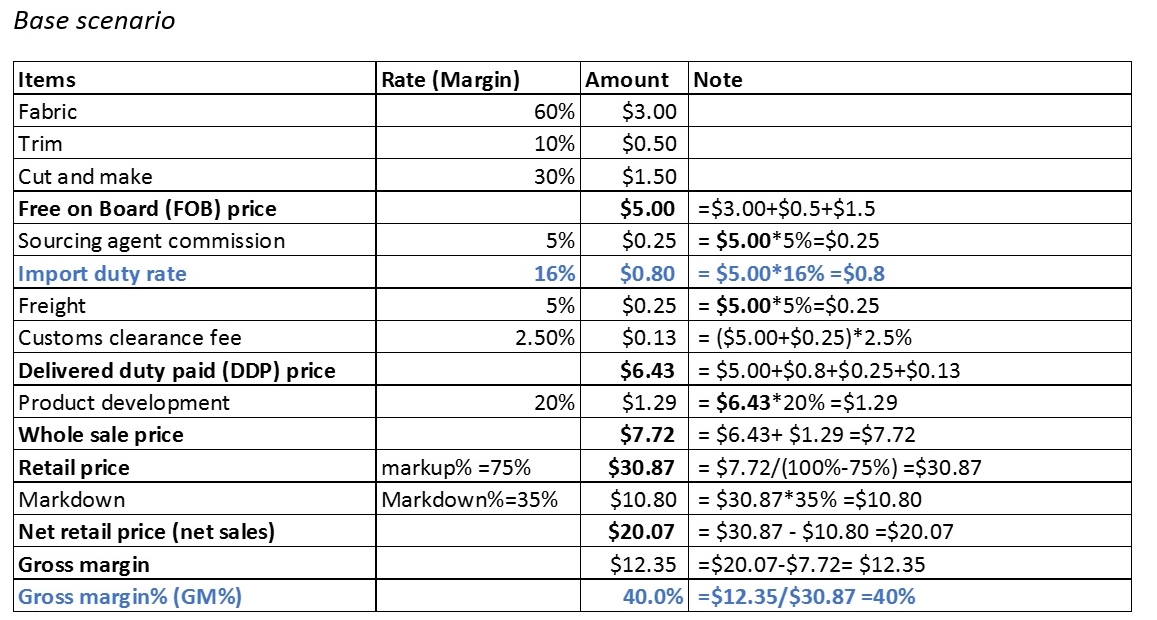

Navigating the world of TikTok import and export regulations requires understanding the basics of import tariffs and how they apply to goods brought into your country via TikTok. This includes dropshipping, merchandise sold by creators, and other TikTok-related imports. Import tariffs, also known as customs duties or import duties, are taxes levied on goods imported from another country. These tariffs are determined by various factors, including the product's classification, its country of origin, and the applicable trade agreements.

Understanding the specific tariff codes and Harmonized System (HS) codes for your products is crucial. These codes classify goods based on an internationally standardized system, influencing the applicable tariff rates. Failure to accurately classify your goods can lead to incorrect duties being assessed, potential delays, and even penalties. Accurate customs declarations are therefore paramount for smooth and legal importation.

Non-compliance with import regulations can lead to severe consequences. These penalties can range from hefty fines to the seizure of goods. The legal implications are significant, and the financial impact can be devastating for businesses.

- Different Types of TikTok-Related Imports: This includes dropshipped goods, merchandise from creators, promotional items, and even samples for reviews.

- Legal Requirements for Importing Goods: This involves proper documentation, accurate customs declarations, and adherence to all relevant regulations and trade agreements.

- Typical Tariff Rates: These vary significantly depending on the product category (e.g., clothing, electronics, cosmetics) and the country of origin. Researching the specific HS codes and tariff rates for your products is essential before importing.

Decoding "Just Contact Us" Workarounds

The internet is rife with advice suggesting contacting TikTok or the delivery company to resolve tariff issues – the infamous "Just Contact Us" approach. This method often stems from a misunderstanding of how international trade and customs regulations function. It's crucial to understand that neither TikTok nor the delivery company is typically responsible for handling or waiving import duties. These are the responsibilities of the importer (you) and the customs authorities of your country.

The "Just Contact Us" approach lacks transparency and accountability. There's no guarantee of success, and it can lead to significant delays while offering no real solution. Relying on this method could result in missed deadlines, frustrated customers, and potential financial losses.

- Examples of "Just Contact Us" Advice: Often found on forums, social media groups, and comments sections relating to TikTok imports.

- Potential Outcomes: The most likely outcome is no resolution, leading to delays or even the return of your goods. In some cases, attempts at circumventing tariffs this way may even lead to additional penalties.

- Why it's Ineffective: This method ignores the fundamental legal and procedural requirements for importing goods, offering a false sense of security and potentially causing bigger problems down the line.

Legitimate Ways to Minimize or Avoid TikTok-Related Tariffs

Minimizing or avoiding tariffs legally involves understanding and complying with import regulations. Accurate product classification and thorough documentation are essential. Employing professional help can also significantly reduce risk and complexity.

- Properly Completing Customs Declarations: Accurately detailing the product description, HS code, quantity, value, and origin is crucial.

- Utilizing Free Trade Agreements (FTAs): If your country has an FTA with the country of origin, this may reduce or eliminate tariffs.

- Seeking Professional Advice: Customs brokers and import/export specialists possess the expertise to navigate these complexities.

- Exploring Alternative Sourcing or Fulfillment Methods: Consider sourcing goods from within your country or using fulfillment centers strategically located to minimize tariffs.

Risks and Consequences of Illegal Tariff Avoidance

Attempting to evade tariffs illegally carries severe legal and financial ramifications. This includes fines, legal action, and reputational damage to businesses. Customs authorities actively investigate cases of suspected tariff evasion, and the penalties can be substantial.

- Real-World Cases: Numerous examples exist of businesses facing severe penalties for attempting to illegally avoid customs duties.

- Potential for Criminal Charges: In severe cases, criminal charges may be filed, leading to significant fines and even imprisonment.

- Impact on Business Credibility: A reputation tarnished by tariff evasion can significantly impact future import operations and business relationships.

TikTok's "Just Contact Us" Tariff Workarounds: A Risky Proposition

In conclusion, relying on "Just Contact Us" methods to resolve TikTok import tariff issues is unreliable and potentially illegal. Compliance with import regulations is not just a legal requirement but also a crucial aspect of responsible business practice. Instead of relying on uncertain workarounds, prioritize accurate product classification, complete customs declarations, and seek professional advice when needed. Avoid the risks and uncertainties of unreliable methods; learn more about legitimate ways to handle TikTok import tariffs and ensure compliance with import regulations. For further information, consult your country's customs website or seek guidance from experienced import/export specialists.

Featured Posts

-

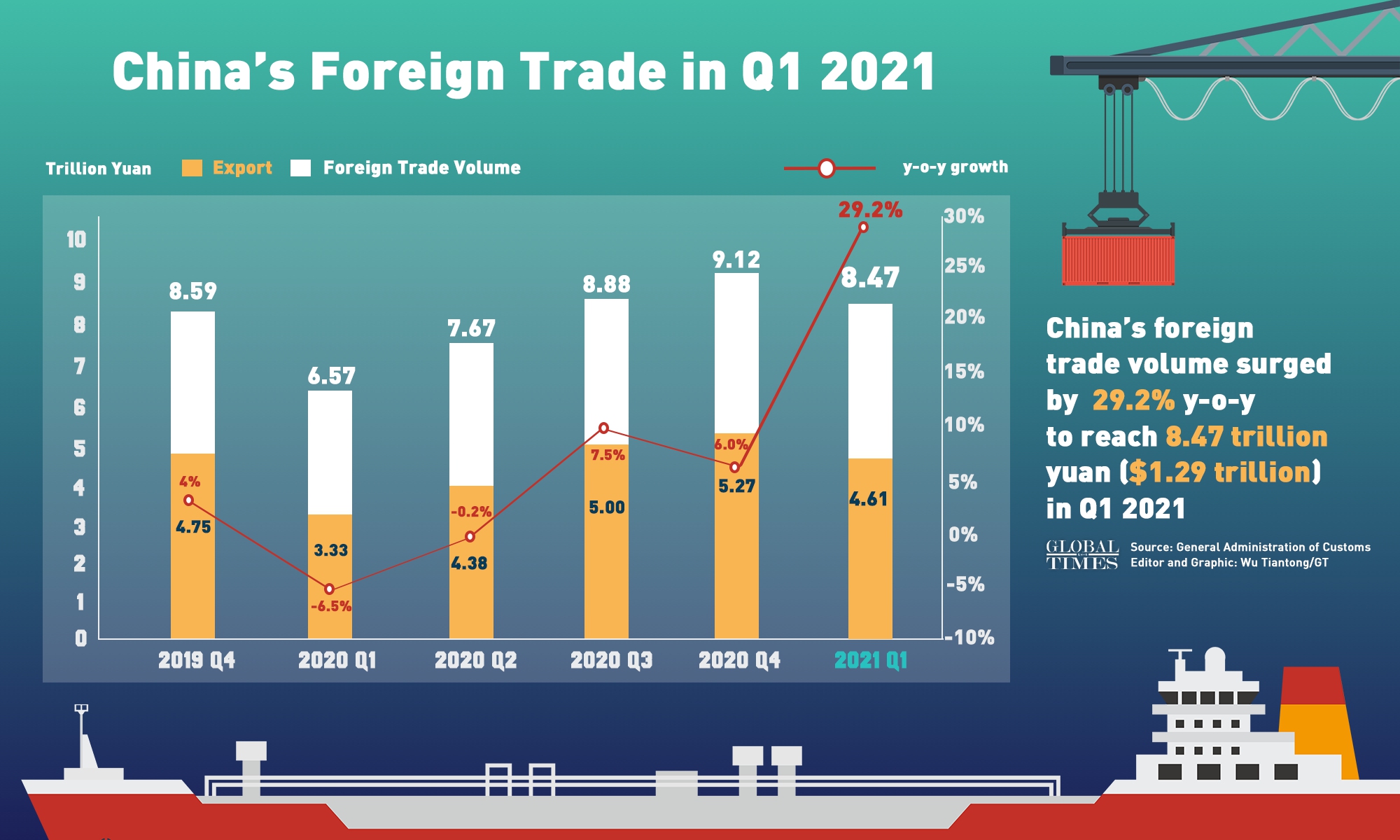

Chinas Export Dependence Vulnerability To Tariff Hikes

Apr 22, 2025

Chinas Export Dependence Vulnerability To Tariff Hikes

Apr 22, 2025 -

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Developer Conference

Apr 22, 2025

Building Voice Assistants Made Easy Key Announcements From Open Ais 2024 Developer Conference

Apr 22, 2025 -

500 Million Bread Price Fixing Settlement Canadian Hearing Set For May

Apr 22, 2025

500 Million Bread Price Fixing Settlement Canadian Hearing Set For May

Apr 22, 2025 -

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 22, 2025

Ftc Investigation Into Open Ais Chat Gpt What It Means

Apr 22, 2025 -

The English Leaders Debate 5 Important Economic Conclusions

Apr 22, 2025

The English Leaders Debate 5 Important Economic Conclusions

Apr 22, 2025