Tim Cook Announces $900M Tariff Impact On Apple Stock

Table of Contents

The Source of the $900 Million Tariff Impact

The $900 million figure represents the estimated financial impact on Apple stemming from tariffs imposed on various components sourced primarily from China. These tariffs, part of ongoing trade disputes between the US and China, significantly increased the cost of manufacturing several key Apple products. The increased costs aren't limited to a single product line; instead, they affect a range of popular devices.

- Countries Involved: The primary trade dispute is between the United States and China. However, other countries involved in the global supply chain for Apple products also indirectly experience the impact.

- Tariff Implementation Timeline: The implementation of these tariffs occurred over a period of time, with incremental increases leading to the cumulative $900 million impact. Specific dates and tariff percentages would need to be referenced from official sources for accuracy. (Note: For an accurate and up-to-date timeline, reference should be made to official government publications and financial news sources).

- Percentage Increase in Costs: The percentage increase in costs due to tariffs varies depending on the specific component and product. However, the overall impact is significant enough to warrant a public announcement by Apple's CEO. Again, precise figures would need to be obtained from reliable financial news sources.

Apple's Response to the Increased Tariffs

Apple's official statement acknowledged the $900 million negative impact on its financial performance due to tariffs. While the company hasn't announced sweeping price hikes for its products, the statement clearly indicates the burden these tariffs place on Apple’s profitability. Several strategies are likely being considered to mitigate future impacts.

- Tim Cook's Comments: Tim Cook's public statements emphasized the challenges posed by the tariffs while hinting at the company's commitment to finding solutions and navigating this complex trade environment. (Specific quotes from Tim Cook should be included here from reliable news sources.)

- Changes in Financial Forecasts: Apple's financial forecasts have likely been adjusted to account for the impact of the tariffs. This adjustment reflects the company's proactive approach to managing the situation and communicating transparently with investors. (Specific details on revised forecasts, if available, should be included here).

- Strategies for Reducing Future Tariff Exposure: Apple is likely exploring various options to reduce its reliance on components manufactured in countries subject to tariffs. This might involve diversifying its supply chain, exploring manufacturing in other regions, or redesigning products to utilize less-affected components.

Market Reaction to the Announcement: Apple Stock Performance

The announcement of the $900 million tariff impact immediately affected Apple's stock price. While the initial reaction might have been negative, the longer-term impact depends on various factors, including Apple's ability to mitigate the costs and investor confidence in the company's future prospects.

- Percentage Change in Apple's Stock Price: A specific percentage change in Apple's stock price following the announcement should be included here. This data should be sourced from reputable financial news sites and stock market data providers.

- Trading Volume Following the Announcement: Increased trading volume is usually observed immediately following such announcements. The specific volume should be mentioned and its significance discussed.

- Analyst Reactions and Predictions: Analyst opinions on the long-term effects of the tariffs on Apple's stock and future performance should be included, citing their specific predictions and the reasoning behind their assessments. (Include citations to reputable financial analysis reports).

Long-Term Implications for Apple and the Tech Industry

The $900 million tariff impact on Apple highlights a broader concern for the tech industry: the growing influence of global trade policies on corporate profits and the complexities of global supply chains.

- Potential for Future Tariff Increases: The possibility of further tariff increases or changes in trade policies poses a significant ongoing risk for Apple and other tech companies heavily reliant on global manufacturing.

- Implications for Global Supply Chains: This situation underscores the vulnerability of complex global supply chains and encourages companies to diversify their manufacturing bases.

- Potential for Increased Product Prices for Consumers: The increased costs due to tariffs might eventually be passed on to consumers in the form of higher prices for Apple products.

Conclusion: Understanding the Impact of Tariffs on Apple Stock

The $900 million tariff impact on Apple's financial performance, announced by Tim Cook, serves as a stark reminder of the significant influence of global trade policies on even the largest tech companies. Apple's response, the market's reaction, and the long-term implications for the company and the wider tech industry all require careful observation. Understanding these dynamics is crucial for both investors and consumers. Stay updated on the latest developments affecting Apple stock and the ongoing impact of tariffs by subscribing to our newsletter (link to newsletter signup) or by exploring our other insightful articles on global trade and its influence on the tech industry.

Featured Posts

-

What Was That Bang Titan Sub Implosion Captured On Footage

May 25, 2025

What Was That Bang Titan Sub Implosion Captured On Footage

May 25, 2025 -

Glastonbury Festival 2025 Full Lineup Announcement Featuring Olivia Rodrigo And The 1975

May 25, 2025

Glastonbury Festival 2025 Full Lineup Announcement Featuring Olivia Rodrigo And The 1975

May 25, 2025 -

Ai Ar

May 25, 2025

Ai Ar

May 25, 2025 -

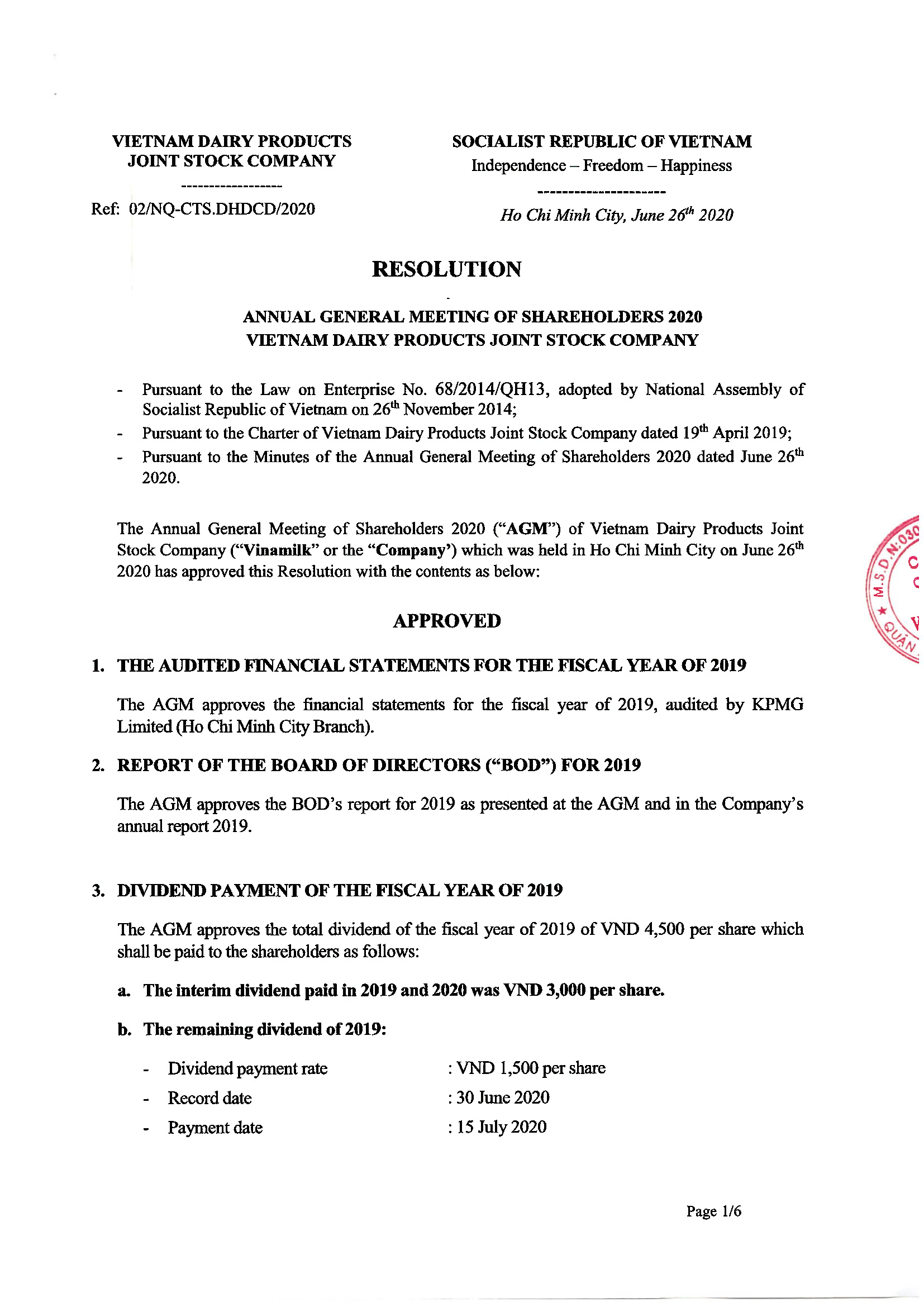

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 25, 2025

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 25, 2025 -

H Nonline Sk Nemecke Firmy A Masivne Prepustanie Dosledky Hospodarskeho Spomalenia

May 25, 2025

H Nonline Sk Nemecke Firmy A Masivne Prepustanie Dosledky Hospodarskeho Spomalenia

May 25, 2025