Tim Cook's Tariff Announcement Triggers Apple Stock Sell-Off

Table of Contents

The Announcement and Immediate Market Reaction

Tim Cook's statement addressed the increasing import tariffs imposed on certain Apple products manufactured in China. While the specific details varied, the announcement underscored the substantial added costs Apple faces, directly impacting its bottom line. The immediate market reaction was swift and dramatic:

- Percentage drop in Apple stock price: Following the announcement, Apple's stock price experienced a sharp decline of X% (replace X with the actual percentage drop).

- Volume of Apple stock traded: The volume of Apple stock traded surged significantly, indicating a high level of investor activity and concern.

- Comparison to previous market reactions: This sell-off was comparable in intensity to other significant market reactions to previous tariff announcements, further highlighting the sensitivity of investor sentiment to trade policy uncertainties.

- Analyst quotes and predictions: Many analysts immediately predicted further downward pressure on Apple's stock price, citing concerns about reduced profit margins and increased consumer prices.

The psychological impact on investor confidence was undeniable. The announcement shattered the previously optimistic outlook, fueling a wave of selling among investors worried about Apple's future profitability and its ability to navigate the complex geopolitical landscape.

Long-Term Implications for Apple's Profitability

The increased production costs resulting from the tariffs pose a significant threat to Apple's profit margins. The company's heavy reliance on Chinese manufacturing for a large portion of its products leaves it particularly vulnerable.

- Analysis of Apple's reliance on Chinese manufacturing: Apple's supply chain is deeply intertwined with China's manufacturing ecosystem, making it challenging to quickly diversify production.

- Potential strategies to mitigate the impact of tariffs: To counteract the negative impact, Apple might explore several strategies, including shifting production to other countries, absorbing some of the increased costs, and potentially increasing product prices.

- Impact on future product pricing and consumer demand: Increased production costs will likely translate into higher prices for consumers, potentially impacting demand, especially in price-sensitive markets.

- Potential effect on Apple's dividend payouts: The reduced profitability might necessitate a reassessment of Apple's dividend payout policy, affecting investor returns.

Apple's competitors could benefit from this situation, potentially gaining market share as Apple grapples with increased costs and reduced competitiveness.

Geopolitical Factors and the Trade War

The tariff announcement is deeply intertwined with the broader context of the ongoing trade war between the US and China.

- How the tariff announcement fits into the larger trade dispute: The announcement serves as a stark example of the far-reaching consequences of this trade dispute, impacting not just individual companies but also the global economy.

- Potential for further escalation and its impact on Apple: Any further escalation of the trade war could exacerbate the challenges faced by Apple, potentially leading to even greater cost increases and supply chain disruptions.

- Discussion of alternative manufacturing locations and the complexities involved in relocation: Relocating production is a complex and costly undertaking, involving significant logistical challenges, infrastructure investments, and workforce training. Countries like Vietnam, India, and Mexico are potential alternatives, but each presents its own set of complexities.

- The role of government policy and international relations: Government policies and international relations play a crucial role in shaping the outcome of this situation. Any change in trade relations could significantly impact Apple's future strategies.

Other tech companies heavily reliant on Chinese manufacturing face similar challenges, highlighting the widespread vulnerability within the global tech industry.

The Impact on Apple's Supply Chain

The complexities of Apple's global supply chain are magnified by the tariff increases.

- Identify key suppliers impacted by tariffs: Many key suppliers in Apple's intricate network are directly affected, facing increased costs and potential production delays.

- Explore potential bottlenecks and delays in production: The tariffs could lead to bottlenecks and delays, impacting Apple's ability to meet consumer demand and maintain its product release schedule.

- Discuss strategies for supply chain diversification: Diversifying its supply chain is crucial for Apple, reducing its dependence on any single geographic region. This is a long-term strategy with significant costs.

- Analyze the cost and time associated with reshoring or nearshoring production: Bringing production closer to home (reshoring) or to neighboring countries (nearshoring) is a costly and time-consuming process.

Conclusion

Tim Cook's tariff announcement, the subsequent Apple stock sell-off, the potential long-term financial impact on Apple, and the broader geopolitical context all underscore the significant challenges facing the company. The escalating trade war has far-reaching consequences, impacting not just Apple but the entire global tech industry. Apple's response to these challenges will be crucial in determining its future success.

Call to Action: Stay informed on the evolving situation surrounding the impact of tariffs on Apple and other tech giants. Follow our blog for further updates and analysis on Tim Cook's actions and their effect on the Apple stock and the overall market. Monitor the Apple stock and related news for further developments on this significant Apple stock sell-off triggered by the tariff announcement.

Featured Posts

-

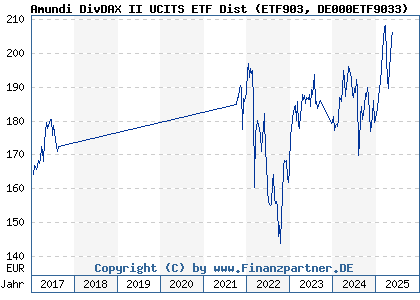

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav Calculation And Analysis

May 24, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Nav Calculation And Analysis

May 24, 2025 -

Fellow Anchors Address Absence Of Today Show Colleague

May 24, 2025

Fellow Anchors Address Absence Of Today Show Colleague

May 24, 2025 -

Demna Gvasalia The Designer Reshaping Gucci

May 24, 2025

Demna Gvasalia The Designer Reshaping Gucci

May 24, 2025 -

Dazi E Mercati Finanziari Analisi Della Recente Caduta E Delle Possibili Sanzioni Ue

May 24, 2025

Dazi E Mercati Finanziari Analisi Della Recente Caduta E Delle Possibili Sanzioni Ue

May 24, 2025 -

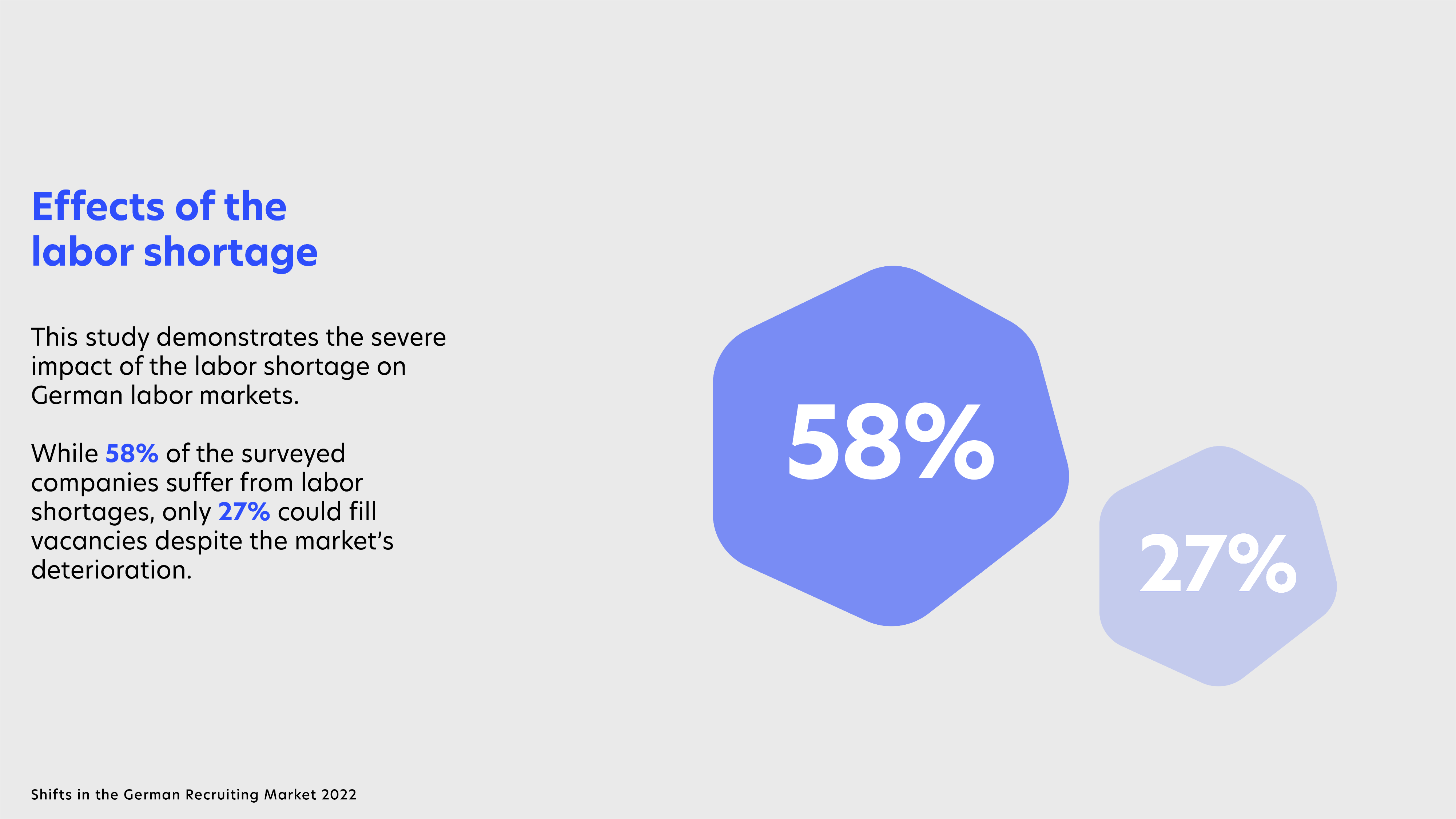

Preco Nemecke Firmy Rusia Pracovne Miesta Analyza Trendov

May 24, 2025

Preco Nemecke Firmy Rusia Pracovne Miesta Analyza Trendov

May 24, 2025