To Buy Or Not To Buy Palantir Stock Before May 5th: A Thorough Guide

Table of Contents

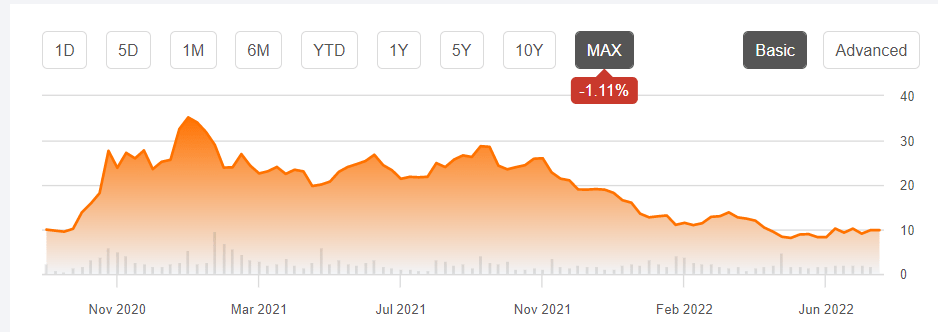

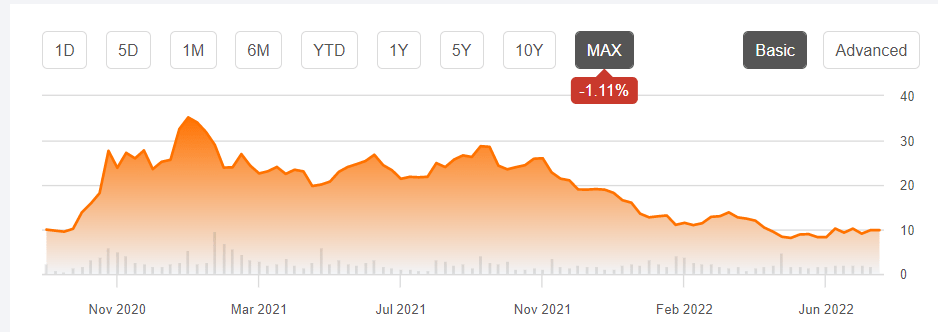

H2: Palantir's Recent Performance and Future Outlook

Palantir's recent performance and future prospects are crucial factors when considering whether to buy Palantir stock. Let's delve into the details.

H3: Q4 2022 Earnings and Key Metrics

Palantir's Q4 2022 earnings report revealed [Insert actual Q4 2022 revenue figures]. While [Insert percentage change in revenue compared to the previous year], this [fell short of / exceeded] analyst expectations of [Insert analyst revenue expectations]. Other key metrics included:

- Revenue Growth: [Insert percentage and context]

- Net Income/Loss: [Insert figures and context]

- Operating Margin: [Insert figures and context]

- Remaining Performance Obligations (RPO): [Insert figures and context - showing future revenue potential]

This performance [positively/negatively] impacted investor sentiment regarding Palantir stock.

H3: Growth Prospects and Market Position

Palantir's growth strategy centers around its two main markets: government and commercial. The company boasts a strong position in government contracts, leveraging its advanced data analytics capabilities for national security and intelligence applications. However, its expansion into the commercial sector faces stiffer competition.

- Key Growth Drivers: Government contracts, expansion into new commercial sectors (e.g., healthcare, finance), and strategic partnerships.

- Key Challenges: Intense competition from established tech giants, maintaining high profit margins, and successfully scaling its operations in new markets.

- Market Share: [Insert information about Palantir's market share and projections]

H3: Upcoming Catalysts and Risks

Beyond the May 5th earnings report, several factors could significantly impact Palantir stock.

- Potential Positive Catalysts: Securing large government contracts, launching innovative new products, and successful strategic partnerships.

- Potential Risks: Increased competition, a potential economic slowdown impacting government and commercial spending, and failure to meet projected growth targets.

H2: Analyzing Palantir's Valuation

Understanding Palantir's valuation is critical before buying Palantir stock.

H3: Price-to-Sales Ratio (P/S) and Other Key Metrics

Palantir currently trades at a P/S ratio of [Insert current P/S ratio]. This is [higher/lower] than its competitors [Mention specific competitors and their P/S ratios]. Other key valuation metrics to consider include [mention other relevant metrics and their values]. Based on these metrics, Palantir stock appears [overvalued/undervalued/fairly valued], depending on the investor's expectations for future growth.

H3: Growth Potential vs. Current Price

The relationship between Palantir's projected growth rate and its current stock price is complex. If Palantir achieves its projected growth rates [Insert projected growth rates], the current price might be justified. However, if growth is slower than expected, the stock could be overvalued. A discounted cash flow (DCF) analysis would offer a more detailed valuation.

H2: Making an Informed Investment Decision

Buying Palantir stock requires careful consideration of your personal circumstances.

H3: Risk Tolerance and Investment Goals

Palantir stock is a high-growth, high-risk investment. Before buying Palantir stock, assess your risk tolerance. Are you comfortable with significant price swings? Does the potential for high returns outweigh the risk of substantial losses? Your investment goals should align with this risk profile.

H3: Diversification and Portfolio Allocation

Palantir should be considered as part of a diversified investment portfolio. Don't put all your eggs in one basket. A well-diversified portfolio mitigates risk. Determine how much of your portfolio you are comfortable allocating to Palantir stock, considering its volatility.

H3: Alternative Investment Options

If Palantir stock doesn't fit your risk profile or investment goals, explore alternative investment options. Consider other technology stocks, bonds, or index funds, depending on your preferences and risk tolerance.

3. Conclusion

The decision of whether to buy Palantir stock before May 5th hinges on your individual risk tolerance, investment goals, and your assessment of Palantir's future prospects. While Palantir's growth potential is enticing, the risks are substantial. This analysis provides valuable insights, but it's crucial to conduct your own thorough research and consider consulting a financial advisor before making any investment decisions regarding Palantir stock. Remember, carefully analyze PLTR stock before investing. Further research into Palantir Technologies stock and its financials is highly recommended.

Featured Posts

-

Affaire Bilel Latreche A Dijon Audience Pour Violences Conjugales Fixee En Aout

May 10, 2025

Affaire Bilel Latreche A Dijon Audience Pour Violences Conjugales Fixee En Aout

May 10, 2025 -

Leaked Photos Show Microsoft And Asus Xbox Handheld Console

May 10, 2025

Leaked Photos Show Microsoft And Asus Xbox Handheld Console

May 10, 2025 -

Nottingham Attacks Survivors Voices A Journey Of Healing And Recovery

May 10, 2025

Nottingham Attacks Survivors Voices A Journey Of Healing And Recovery

May 10, 2025 -

Tonights Nhl Playoffs Oilers Vs Kings Prediction Picks And Best Bets

May 10, 2025

Tonights Nhl Playoffs Oilers Vs Kings Prediction Picks And Best Bets

May 10, 2025 -

Elizabeth Line Ensuring Seamless Travel For Wheelchair Users

May 10, 2025

Elizabeth Line Ensuring Seamless Travel For Wheelchair Users

May 10, 2025