Today's Personal Loan Interest Rates: Factors Affecting Your Rate

Table of Contents

A personal loan interest rate is the cost of borrowing money, expressed as a percentage of the loan amount. Lower interest rates mean lower monthly payments and less total interest paid over the life of the loan, significantly impacting your overall finances. This article will examine your credit score, loan amount and term, lender type, and other factors affecting today's personal loan interest rates.

Your Credit Score: The Cornerstone of Your Interest Rate

Your credit score is the most significant factor determining your personal loan interest rate. Lenders use your credit score to assess your creditworthiness – essentially, your ability to repay the loan. A higher credit score indicates a lower risk to the lender, resulting in a lower interest rate. Conversely, a poor credit score can lead to higher interest rates or even loan denial.

-

How Credit Scores Are Calculated: Credit scoring models like FICO consider several factors:

- Payment History (35%): Consistent on-time payments are crucial.

- Amounts Owed (30%): High credit utilization (using a large percentage of your available credit) negatively impacts your score.

- Length of Credit History (15%): A longer history of responsible credit use generally improves your score.

- New Credit (10%): Opening many new accounts in a short period can lower your score.

- Credit Mix (10%): Having a variety of credit accounts (credit cards, loans) can be beneficial, but only if managed responsibly.

-

Impact of a Poor Credit Score: A low credit score can significantly increase your personal loan interest rate, sometimes by several percentage points. You may also face loan denial or be offered less favorable terms.

-

Improving Your Credit Score: You can improve your credit score by consistently making on-time payments, reducing your credit utilization, and avoiding opening too many new accounts. Resources like allow you to check your credit report for free annually.

-

Credit Score Ranges and Interest Rates: Generally, higher credit scores correspond to lower interest rates. For example:

- 750+ (Excellent): Likely to receive the lowest interest rates.

- 650-699 (Fair): May receive higher interest rates than those with excellent credit.

- Below 650 (Poor): May face significantly higher rates or loan denial.

Loan Amount and Term: How Much You Borrow and For How Long

The amount you borrow and the loan term significantly influence your personal loan interest rates and monthly payments.

-

Loan Amount: Larger loan amounts may come with slightly higher interest rates because they represent a greater risk to the lender.

-

Loan Term: The loan term (the length of time you have to repay the loan) impacts both your monthly payment and the total interest paid. A longer loan term means lower monthly payments but higher overall interest charges. Conversely, a shorter term results in higher monthly payments but lower total interest.

-

Example Scenarios:

- A $10,000 loan over 3 years might have a lower interest rate and higher monthly payments than a $10,000 loan over 5 years. However, the total interest paid over 5 years would be considerably higher.

-

Choosing the Right Loan Term: Consider your budget and financial goals when selecting a loan term. While a longer term offers lower monthly payments, it increases the total cost of the loan. Aim for a balance that allows for affordable monthly payments while minimizing the total interest paid.

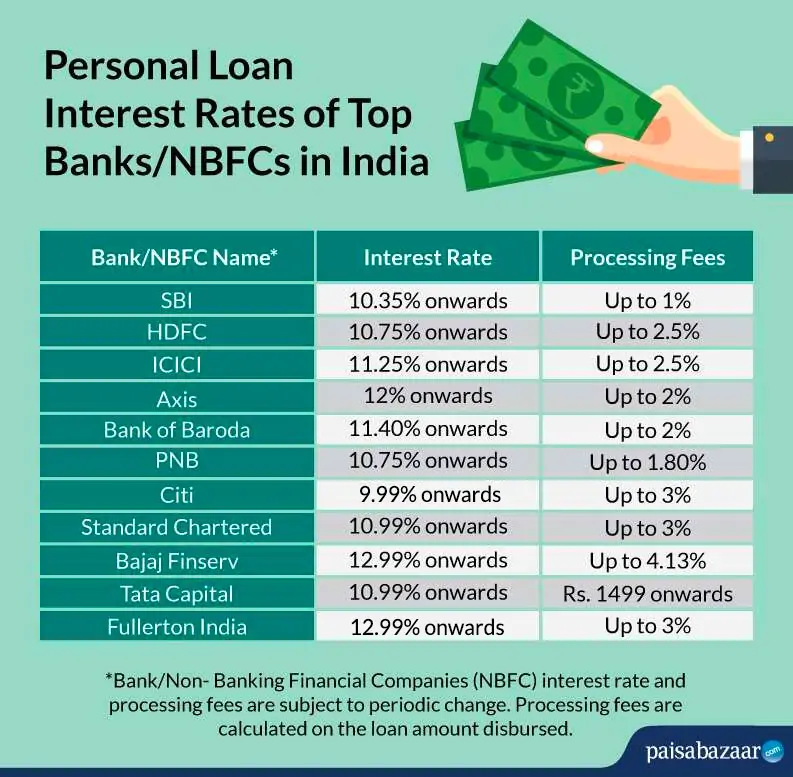

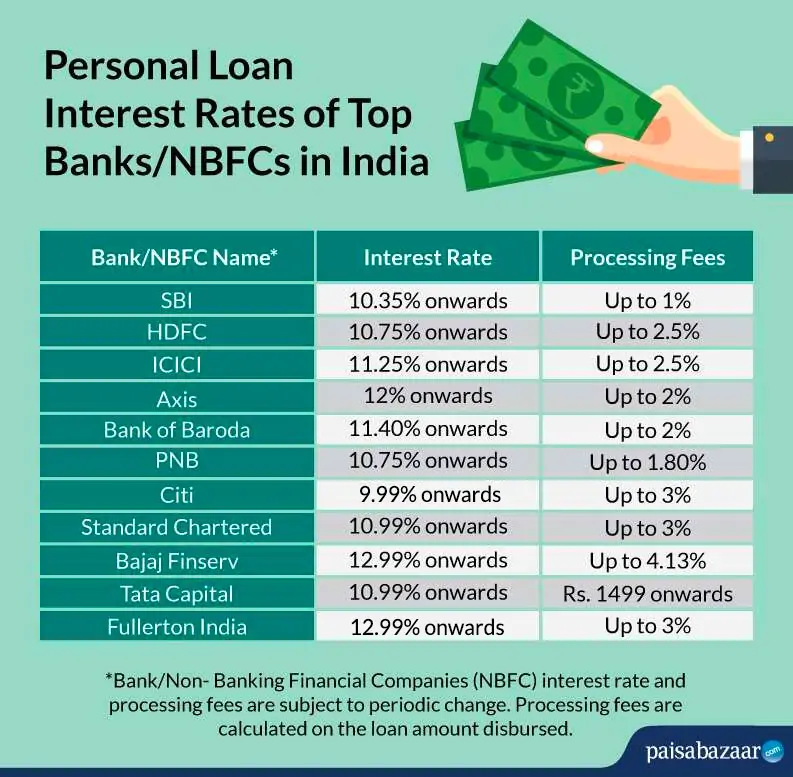

Lender Type and Competition: Shopping Around for the Best Deal

Different lenders offer varying personal loan interest rates. Comparing offers from multiple lenders is crucial to securing the most competitive rate.

-

Lender Types:

- Banks: Established institutions offering a wide range of financial services, often with a strong reputation but potentially higher fees.

- Credit Unions: Member-owned cooperatives that often provide lower interest rates and better member benefits.

- Online Lenders: Offer convenience and potentially competitive rates but may lack the personalized service of traditional banks or credit unions.

-

Comparing Loan Offers: Focus on the Annual Percentage Rate (APR), which includes the interest rate and any fees. Also, compare loan terms, repayment options, and any prepayment penalties.

-

Negotiating Interest Rates: Don't hesitate to negotiate with lenders. If you have a strong credit score and multiple offers, you may be able to negotiate a lower interest rate.

Other Factors Influencing Your Personal Loan Interest Rate

Several other factors can influence your personal loan interest rate:

-

Debt-to-Income Ratio (DTI): A high DTI (the percentage of your gross monthly income that goes towards debt payments) suggests a higher risk to lenders, potentially leading to higher interest rates.

-

Type of Loan: Secured loans (backed by collateral) typically carry lower interest rates than unsecured loans (not backed by collateral).

-

Income and Employment History: A stable income and consistent employment history demonstrate your ability to repay the loan, potentially securing a lower interest rate.

-

Geographic Location: Average interest rates can vary by state due to local regulations and market conditions.

Finding the Right Personal Loan Interest Rate for You

Securing the best personal loan interest rate involves understanding and optimizing several key factors: your credit score, loan amount and term, the lender you choose, and other influencing factors discussed above. Remember, comparing offers from multiple lenders and negotiating are crucial steps to obtaining the most favorable terms. Don't delay your financial goals! Start comparing today's personal loan interest rates from multiple lenders to secure the best deal for your situation. [Link to a reputable loan comparison website (optional)]

Featured Posts

-

Manchester Uniteds Strong Position In The Race For Rayan Cherki

May 28, 2025

Manchester Uniteds Strong Position In The Race For Rayan Cherki

May 28, 2025 -

Nintendos Bold New Era A Calculated Risk

May 28, 2025

Nintendos Bold New Era A Calculated Risk

May 28, 2025 -

Real Value Top Memorial Day Deals To Consider

May 28, 2025

Real Value Top Memorial Day Deals To Consider

May 28, 2025 -

2025 American Music Awards Jennifer Lopez As Host

May 28, 2025

2025 American Music Awards Jennifer Lopez As Host

May 28, 2025 -

Hujan Di Bandung Besok 22 April Cek Prakiraan Cuaca Jawa Barat

May 28, 2025

Hujan Di Bandung Besok 22 April Cek Prakiraan Cuaca Jawa Barat

May 28, 2025