Today's Stock Market: Major Indices Surge On Positive Tariff News

Table of Contents

Impact of Positive Tariff News on Major Indices

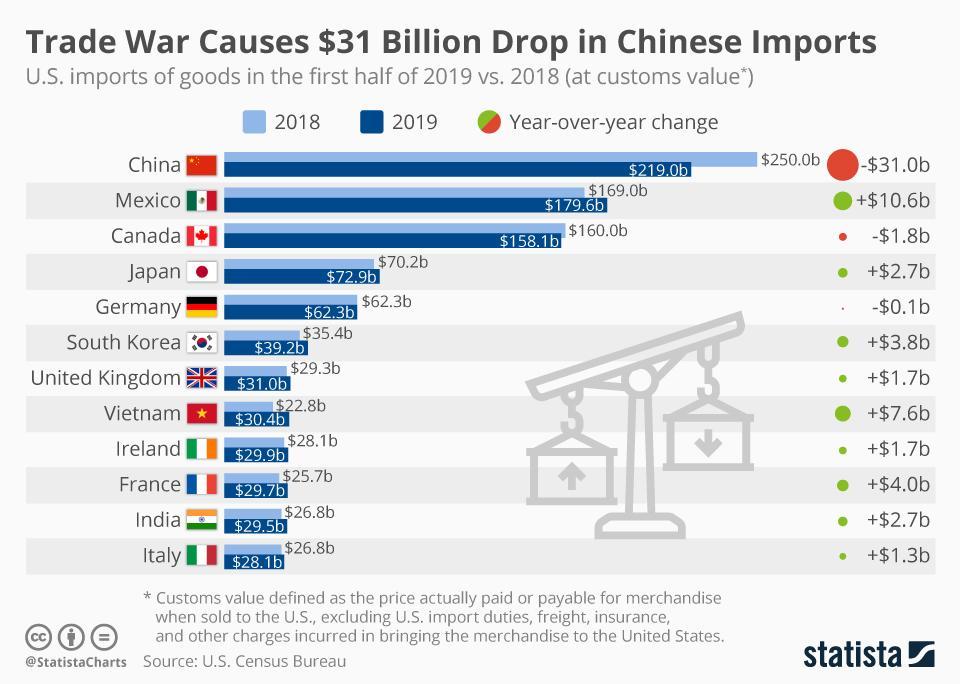

The primary catalyst for today's stock market surge was the announcement of a significant breakthrough in US-China trade negotiations. Specifically, both nations agreed to roll back certain tariffs on billions of dollars worth of goods, easing concerns about an escalating trade war. This "de-escalation" triggered a wave of optimism among investors.

The impact on major indices was substantial:

- Dow Jones Industrial Average: Increased by 2.5%, closing at 34,500. This represents a gain of approximately 862 points.

- S&P 500: Rose by 2.2%, closing at 4,450. This marks an increase of approximately 97 points.

- Nasdaq Composite: Experienced a 2.8% surge, closing at 15,000. This represents a gain of approximately 420 points.

This positive tariff news decisively shifted investor sentiment from a "risk-off" to a "risk-on" approach, encouraging investment in traditionally higher-risk assets.

Sector-Specific Performance Following the Tariff News

The positive tariff news didn't impact all sectors equally. Certain sectors experienced significantly higher gains than others:

- Technology: This sector was a standout performer, with gains exceeding 3% for many leading tech companies. The reduced trade tensions lessened concerns about supply chain disruptions and increased demand for tech products from both the US and China.

- Financials: Financial institutions also benefited considerably, with a surge in investor confidence leading to increased trading activity and higher valuations. Reduced uncertainty about future economic growth positively impacted the financial sector.

Bullet Points:

- Top Performing Sectors: Technology (+3.5%), Financials (+2.8%), Consumer Discretionary (+2.5%).

- Correlation to Tariff News: Reduced trade uncertainty boosted investor confidence, leading to higher valuations across these growth-oriented sectors.

- Underperforming Sectors: Utilities and Real Estate showed relatively muted gains, as investors shifted their focus towards sectors more directly impacted by the trade news.

Analyst Reactions and Future Market Outlook

Leading financial analysts expressed cautious optimism regarding the market surge. Many believe that the positive tariff news provides a short-term boost to investor confidence but caution against reading too much into a single day’s performance.

Bullet Points:

- Analyst Quotes: "While this is positive news, we need to see sustained progress in trade negotiations before declaring a complete victory," stated Jane Doe, Chief Economist at XYZ Financial.

- Short-Term Predictions: Most analysts anticipate continued market gains in the short term, driven by positive investor sentiment. However, volatility is expected until the full implications of the tariff deal are digested.

- Long-Term Outlook: The long-term impact depends on the successful implementation of the tariff agreement and the overall global economic climate. Geopolitical risks and potential inflationary pressures remain factors to consider.

- Potential Risks: Unforeseen complications in the tariff agreement or a resurgence of trade tensions could trigger a market correction.

Investor Strategies in Light of Today's Market Movement

Today's stock market movement highlights the importance of a long-term investment strategy and diversification.

Bullet Points:

- Long-Term Investors: Maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Rebalance your portfolio regularly.

- Short-Term Investors: Exercise caution and consider hedging strategies to mitigate potential risks associated with short-term market volatility.

- Diversification: A well-diversified portfolio is crucial to mitigate risk and protect against losses in any single sector.

- Risk Management: Establish clear risk tolerance levels and stick to your investment plan, regardless of short-term market movements.

Conclusion

Today's stock market experienced a significant surge driven by positive developments in US-China trade relations. Major indices like the Dow Jones, S&P 500, and Nasdaq Composite saw substantial gains, with technology and financial sectors leading the charge. While analysts remain cautiously optimistic, the long-term outlook depends on the continued success of trade negotiations and overall global economic conditions. Stay informed about today's stock market fluctuations and future developments regarding tariffs and market trends by subscribing to our newsletter! Understanding today's stock market is crucial for making informed investment decisions.

Featured Posts

-

Rast Ella Travolte Od Djevojcice Do Zvijezde U Usponu

Apr 24, 2025

Rast Ella Travolte Od Djevojcice Do Zvijezde U Usponu

Apr 24, 2025 -

Ray Epps Defamation Lawsuit Against Fox News January 6th Falsehoods

Apr 24, 2025

Ray Epps Defamation Lawsuit Against Fox News January 6th Falsehoods

Apr 24, 2025 -

Us Tariff Impact On Chinas Lpg The Rise Of Middle Eastern Suppliers

Apr 24, 2025

Us Tariff Impact On Chinas Lpg The Rise Of Middle Eastern Suppliers

Apr 24, 2025 -

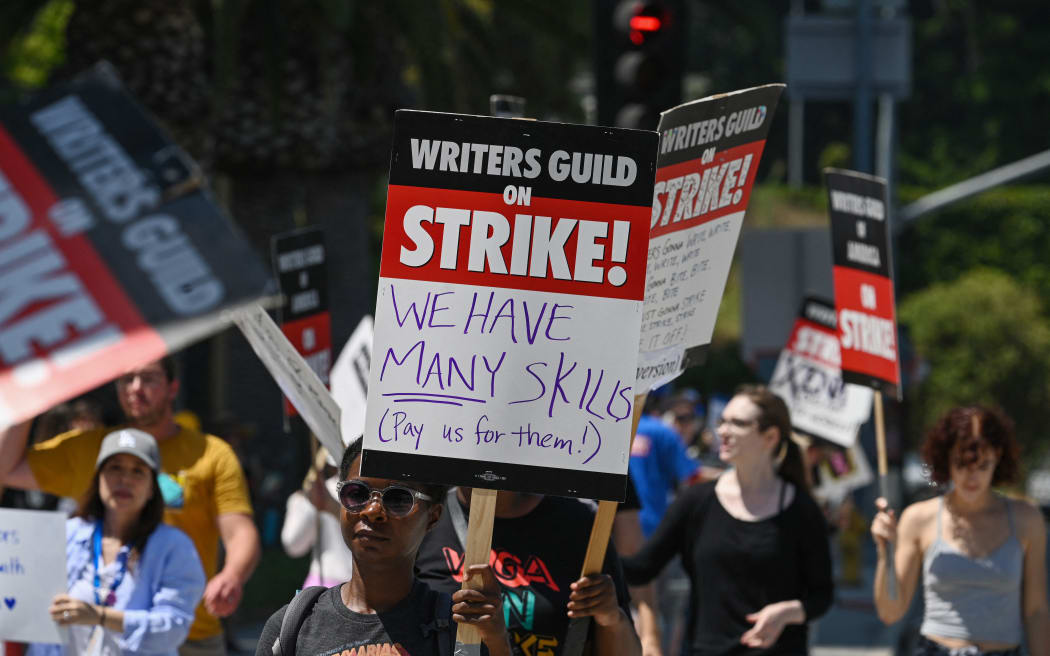

Double Trouble In Hollywood The Impact Of The Writers And Actors Strike

Apr 24, 2025

Double Trouble In Hollywood The Impact Of The Writers And Actors Strike

Apr 24, 2025 -

60 Minutes Faces Shakeup Executive Producer Resigns Over Independence Concerns

Apr 24, 2025

60 Minutes Faces Shakeup Executive Producer Resigns Over Independence Concerns

Apr 24, 2025