Tongling's Warning: US Tariffs Impact Copper Market

Table of Contents

Tongling's Position and Vulnerability

Tongling Nonferrous Metals Group Co., Ltd. holds a prominent position in the global copper industry, boasting substantial production capacity and a significant export footprint. Its vulnerability to US tariffs stems from its historical reliance on the US market for a portion of its copper exports. The imposition of tariffs has directly affected its profitability and strategic planning.

- Significant Export Volume: Tongling’s precise export volume to the US isn't publicly released in granular detail, but industry analysts estimate a considerable amount, representing a significant portion of its overall export revenue.

- Public Statements: While Tongling hasn't issued a specific press release explicitly titled "Tongling's Warning," its financial reports and statements to investors have indirectly reflected the negative impact of US tariffs on their profitability. These statements often allude to decreased export revenue and increased operational costs.

- Potential Financial Losses: The tariffs have imposed significant additional costs on Tongling's US-bound copper shipments, leading to decreased profit margins and potentially substantial financial losses. This directly impacts shareholder value and overall business strategy.

The Impact of US Tariffs on Copper Prices

US tariffs on imported copper have undeniably influenced copper prices globally. While the immediate impact might seem isolated to the US market, the ripple effect extends across the global copper supply chain.

- Price Fluctuations: [Insert a chart or graph here visually demonstrating the fluctuation of copper prices before and after the implementation of US tariffs. Source the data appropriately]. The graph clearly shows a noticeable price increase post-tariff implementation, impacting both producers and consumers.

- Global Impact: The increase in copper prices in the US market has indirectly affected copper prices worldwide, as global markets are interconnected. Producers in other regions have experienced fluctuating demand due to altered US market dynamics.

- Supply and Demand Imbalance: Tariffs have created a supply and demand imbalance, with reduced demand from the US market impacting global supply chains. This dynamic forces adjustments in production and pricing strategies across the entire industry.

Increased Costs and Reduced Demand

The added costs imposed by US tariffs aren't just impacting copper producers like Tongling; they are also significantly increasing the costs for US companies importing copper. This translates to higher final product prices, thereby dampening consumer demand.

- Affected Industries: Industries heavily reliant on copper, such as construction, electronics, and automotive manufacturing, have faced increased costs, forcing them to absorb the added expense or reduce production volumes.

- Material Substitution: Facing higher copper prices, some industries are exploring the substitution of copper with alternative, potentially less efficient, materials, further impacting the overall demand for copper.

Geopolitical Implications and Trade War Concerns

The impact of US tariffs on the copper market is inextricably linked to the broader geopolitical landscape of the US-China trade relationship. It's a key component of the ongoing trade war, with far-reaching consequences.

- Other Copper-Producing Nations: The situation isn't limited to just the US and China; other major copper-producing nations like Chile, Peru, and Zambia are also affected by the fluctuating global demand and prices resulting from trade tensions.

- Retaliatory Measures: The imposition of tariffs has led to retaliatory measures from China and other countries, further exacerbating global trade tensions and impacting the stability of the copper market. This creates uncertainty for producers and consumers alike.

- Global Supply Chain Disruptions: Trade wars create disruptions in global supply chains, increasing uncertainty and making it more challenging for companies to predict and manage their copper sourcing and pricing.

The Future of the Copper Market and Potential Mitigation Strategies

Predicting the future trajectory of copper prices is challenging, but several factors point to continued volatility. However, companies are exploring mitigation strategies to reduce the negative impact of tariffs.

- Future Price Scenarios: [Include a brief analysis of potential future price scenarios, considering factors like global economic growth, technological advancements, and further trade policy changes].

- Mitigation Strategies: Diversification of markets, cost-cutting measures within operations, and strategic partnerships are all possible mitigation strategies being explored by companies like Tongling to navigate this challenging market environment.

- Long-Term Outlook: The long-term outlook for copper demand remains relatively positive, driven by the growth of renewable energy, electric vehicles, and infrastructure development. However, geopolitical uncertainties continue to pose significant risk.

Conclusion

Tongling's warning underscores the profound impact US tariffs have on the global copper market. The resulting price fluctuations, geopolitical tensions, and supply chain disruptions demand careful attention from all stakeholders. The increased costs and reduced demand are clear signals that the current situation demands strategic adaptation.

Stay informed on the ongoing implications of Tongling's warning and the future of the copper market affected by US tariffs. Monitor the impact of US tariffs on the copper market and follow Tongling's response to changing market conditions. Further research into the specific financial impact on Tongling and other major copper producers will offer a more complete understanding of this evolving situation.

Featured Posts

-

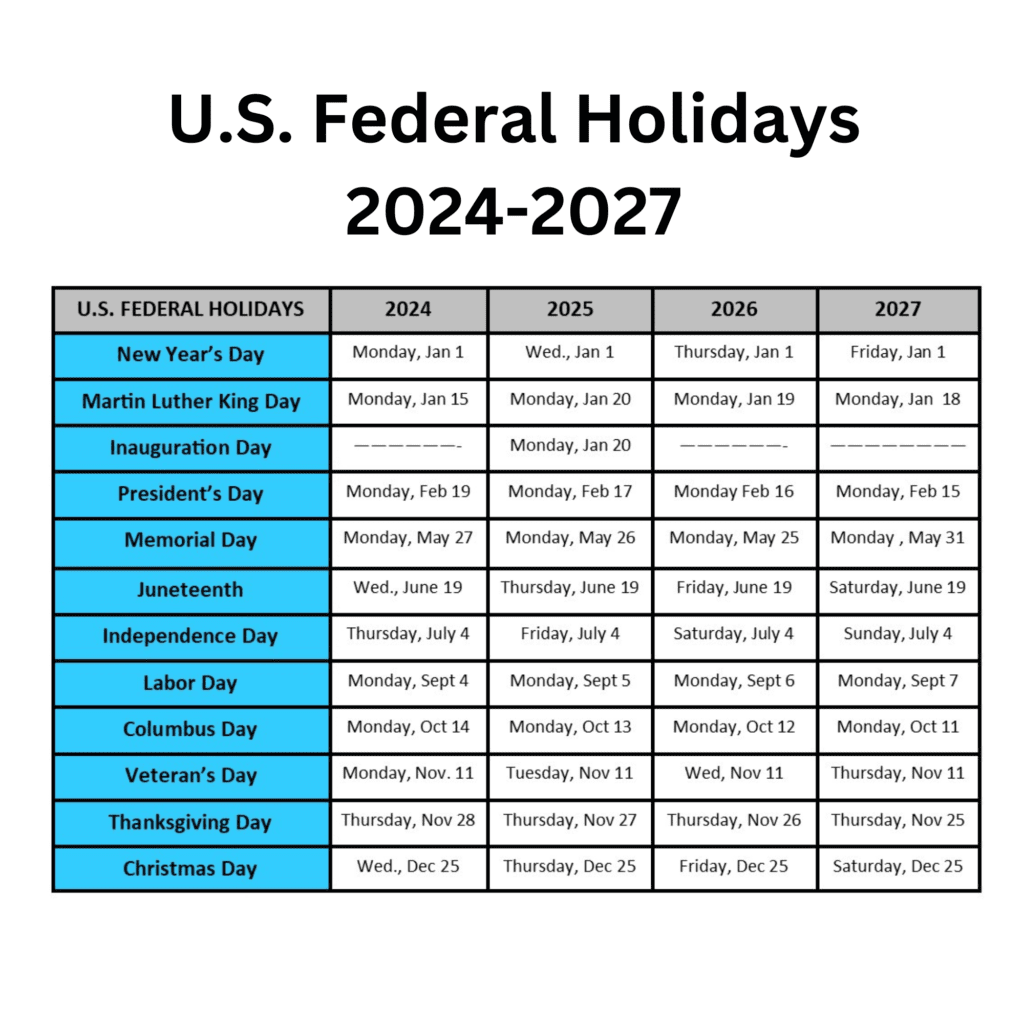

Us Holidays 2025 Full List Of Federal And Non Federal Dates

Apr 23, 2025

Us Holidays 2025 Full List Of Federal And Non Federal Dates

Apr 23, 2025 -

Strong Q Quarter Earnings For Equifax Efx Profit Beats Estimates Outlook Unchanged

Apr 23, 2025

Strong Q Quarter Earnings For Equifax Efx Profit Beats Estimates Outlook Unchanged

Apr 23, 2025 -

Otvorene Trgovine Na Uskrs Vodic Za Blagdansku Kupovinu

Apr 23, 2025

Otvorene Trgovine Na Uskrs Vodic Za Blagdansku Kupovinu

Apr 23, 2025 -

Resume De Good Morning Business Lundi 24 Fevrier

Apr 23, 2025

Resume De Good Morning Business Lundi 24 Fevrier

Apr 23, 2025 -

Yankees Victory Teamwork Trumps Powerful Bats

Apr 23, 2025

Yankees Victory Teamwork Trumps Powerful Bats

Apr 23, 2025