Top 3 Financial Mistakes Women Make & How To Fix Them

Table of Contents

Many women unknowingly make financial missteps that can significantly impact their long-term financial well-being. This article identifies the top three financial mistakes women often make and provides actionable solutions to help you take control of your finances and build a secure future. We'll explore strategies for overcoming these challenges and empowering you to achieve your financial goals. Let's build a stronger financial future, together.

Underestimating the Importance of Retirement Planning

Securing a comfortable retirement is a crucial aspect of long-term financial planning, yet it's an area where many women fall short. Failing to prioritize retirement savings can lead to significant financial hardship later in life. Let's examine the reasons behind this and explore how to rectify the situation.

The Gender Retirement Gap

A significant disparity exists in retirement savings between men and women, often referred to as the gender retirement gap. This gap is not merely a matter of chance; it's influenced by several factors:

- Lower average salaries: Women often earn less than their male counterparts for comparable work, leading to less disposable income for savings.

- Career breaks for family: Many women take time off work to raise children or care for family members, interrupting their career progression and reducing their overall earnings and contributions to retirement plans.

- Longer lifespans: Women, on average, live longer than men, meaning their retirement savings need to last longer, requiring larger nest eggs.

Statistics highlight the severity of this gap. [Insert relevant statistic here, e.g., "According to a recent study by [Source], women on average have [percentage]% less in retirement savings than men."] This disparity underscores the critical need for women to proactively address their retirement planning.

Actionable Steps:

- Start saving early: Even small, consistent contributions to a retirement account can make a significant difference over time due to the power of compounding.

- Maximize tax-advantaged accounts: Contribute to employer-sponsored retirement plans like a 401(k) and consider Individual Retirement Accounts (IRAs) to take advantage of tax benefits.

- Increase contributions regularly: Aim to increase your contributions annually, even if it's just a small percentage, to keep pace with inflation and build your savings faster.

Ignoring Compound Interest

Compound interest is the eighth wonder of the world, and understanding its power is vital for successful retirement planning. Compound interest means earning interest on your initial investment and on the accumulated interest. This snowball effect significantly increases your savings over time.

- The snowball effect: The earlier you start saving and investing, the more time your money has to grow through compounding.

- Time is your greatest asset: The benefits of compound interest are exponential, meaning the longer your money is invested, the greater the returns.

Actionable Steps:

- Invest early and consistently: Start investing as early as possible, even if it's a small amount, and make regular contributions.

- Seek professional advice: A financial advisor can help you develop a personalized investment strategy that aligns with your retirement goals and risk tolerance.

Neglecting Emergency Funds and Debt Management

Unexpected expenses can derail even the most meticulous financial plans. Having a robust emergency fund and a sound debt management strategy is crucial for navigating financial uncertainties.

The Importance of an Emergency Fund

An emergency fund acts as a safety net, providing financial security during unexpected events such as:

- Job loss: Having savings to cover living expenses while searching for a new job can alleviate significant stress.

- Medical emergencies: Unexpected medical bills can be devastating financially, highlighting the need for an emergency fund.

- Car repairs or home maintenance: These unforeseen expenses can quickly drain your resources if you lack savings.

A generally recommended emergency fund size is 3-6 months of living expenses.

Actionable Steps:

- Automate savings: Set up automatic transfers from your checking account to your savings account to build your emergency fund consistently.

- Identify areas to cut expenses: Review your budget to identify areas where you can reduce spending and allocate those savings to your emergency fund.

The High Cost of High-Interest Debt

High-interest debt, such as credit card debt, can quickly spiral out of control, hindering your ability to save and invest. The high interest rates compound quickly, making it difficult to pay down the principal balance.

- High interest rates: Credit card interest rates are typically much higher than other forms of debt, leading to rapid accumulation of interest charges.

- Snowballing debt: If you're only making minimum payments, you'll be paying off mostly interest, which keeps the debt from decreasing significantly.

- Negative impact on credit score: High levels of debt can significantly damage your credit score, making it harder to obtain loans and credit in the future.

Actionable Steps:

- Create a debt repayment plan: Prioritize high-interest debts and create a plan to systematically pay them off. Consider strategies like the debt snowball or debt avalanche methods.

- Explore debt consolidation options: Debt consolidation can help you simplify your debt repayment by combining multiple debts into a single loan with a potentially lower interest rate.

Lack of Financial Literacy and Planning

Many women lack the knowledge and tools to effectively manage their finances. Understanding your finances is the cornerstone of sound financial decision-making.

Understanding Your Finances

Tracking income and expenses is the first step in developing financial literacy. Tools available include:

- Budgeting apps: Many user-friendly apps can track your spending and help create a budget.

- Spreadsheets: A simple spreadsheet can provide a clear overview of your income and expenses.

- Financial tracking software: Sophisticated software can provide more detailed financial analysis.

Understanding budgeting methods, such as the 50/30/20 rule (50% needs, 30% wants, 20% savings & debt repayment) or zero-based budgeting, can further aid in effective financial management.

Actionable Steps:

- Track spending for a month: Monitor your expenses to understand where your money is going.

- Create a realistic budget: Develop a budget that aligns with your income and financial goals.

- Review budget regularly: Regularly review and adjust your budget to reflect changes in your income and expenses.

Seeking Professional Financial Advice

Seeking advice from a qualified financial advisor can provide invaluable support in navigating complex financial matters.

- Financial planners: Can help you develop a comprehensive financial plan tailored to your individual needs.

- Certified Financial Planners (CFPs): Hold a recognized professional designation and are bound by a code of ethics.

- Fee-only advisors: Charge a set fee for their services, avoiding potential conflicts of interest associated with commission-based advisors.

Actionable Steps:

- Research financial advisors: Look for advisors with experience and a good reputation.

- Schedule a consultation: Discuss your financial goals and concerns with a potential advisor.

- Ask clarifying questions: Ensure you understand the advisor's fees, services, and investment strategies.

Conclusion

Avoiding these three common financial mistakes—underestimating retirement, neglecting emergency funds and debt, and lacking financial literacy—can significantly improve your long-term financial health and security. Taking proactive steps today will lead to a more financially stable and fulfilling future.

Call to Action: Take control of your financial future! Start planning today by addressing these common mistakes women make and building a solid financial foundation for yourself. Learn more about effective financial planning by downloading our free budgeting worksheet [link to worksheet]. Remember, empowering your financial future starts with you.

Featured Posts

-

Solve Wordle Today March 17 Hints Clues And Answer For 1367

May 22, 2025

Solve Wordle Today March 17 Hints Clues And Answer For 1367

May 22, 2025 -

Limited Funds Actionable Steps To Improve Your Financial Situation

May 22, 2025

Limited Funds Actionable Steps To Improve Your Financial Situation

May 22, 2025 -

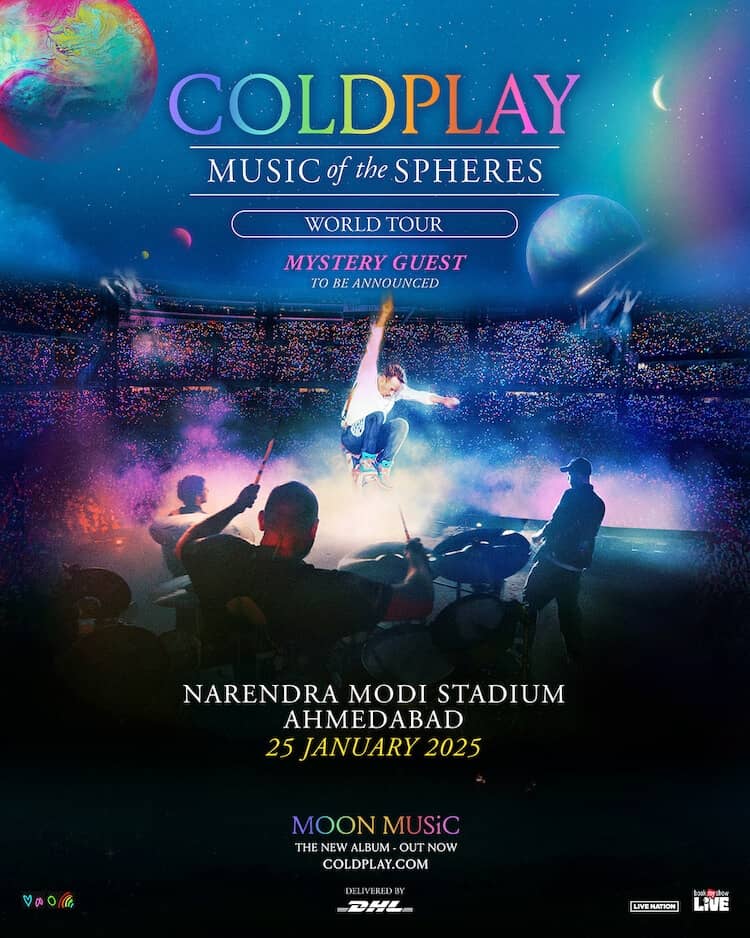

Experiencing Coldplay Live A Night Of Music Lights And Powerful Messages

May 22, 2025

Experiencing Coldplay Live A Night Of Music Lights And Powerful Messages

May 22, 2025 -

Understanding The Wednesday Increase In Core Weave Crwv Share Price

May 22, 2025

Understanding The Wednesday Increase In Core Weave Crwv Share Price

May 22, 2025 -

Betaalbare Huizen Nederland De Visie Van Geen Stijl En Abn Amro

May 22, 2025

Betaalbare Huizen Nederland De Visie Van Geen Stijl En Abn Amro

May 22, 2025