Top BSE Stocks That Surged Over 10% Following Sensex Rise

Table of Contents

Understanding the Sensex Rise and its Impact

The recent climb in the Sensex, a key indicator of the Indian stock market, wasn't a random event. Several factors contributed to this positive market trend. Analyzing these economic indicators and market trends is essential to understanding the surge and its impact on individual BSE stocks.

- Positive Economic Data Releases: Stronger-than-expected GDP growth figures, coupled with positive inflation data, boosted investor confidence and fueled the Sensex rise. This positive economic sentiment often translates into increased investment in the stock market.

- Increased Foreign Investment: A significant influx of foreign institutional investor (FII) money into the Indian market played a crucial role. This influx reflects a positive global outlook on the Indian economy and its growth potential.

- Positive Investor Sentiment: A general sense of optimism among investors, driven by government policies and positive economic indicators, contributed to increased buying and pushed the Sensex higher.

- Government Policies Impacting the Market: Supportive government policies aimed at boosting economic growth and attracting foreign investment further fueled the positive market sentiment and contributed to the Sensex rise.

Top Performing BSE Stocks: A Detailed Analysis

Several BSE stocks outperformed the market, registering gains exceeding 10% following the Sensex's rise. A detailed analysis of these high-growth stocks reveals valuable insights into current market trends and investment opportunities. Remember that past performance is not indicative of future results.

Example Stock Analysis (Note: Replace with actual data):

-

Stock Name: TechGiant Ltd.

-

Industry: Information Technology

-

Percentage Gain (%): 15%

-

Reasons for Surge: Strong Q3 earnings report exceeding analyst expectations, announcement of a major new software product launch, and increased market speculation about a potential acquisition.

-

Brief Financial Overview: Strong revenue growth, improving profit margins, and a healthy balance sheet contributed to investor confidence.

-

Stock Name: GreenEnergy Corp.

-

Industry: Renewable Energy

-

Percentage Gain (%): 12%

-

Reasons for Surge: Government initiatives promoting renewable energy, increased demand for sustainable solutions, and successful completion of a major project.

-

Brief Financial Overview: Significant increase in order backlog, strong partnerships with key players in the industry.

-

Stock Name: PharmaSolutions Inc.

-

Industry: Pharmaceuticals

-

Percentage Gain (%): 11%

-

Reasons for Surge: Successful clinical trials for a new drug, positive regulatory approvals, and strong market demand for its existing products.

-

Brief Financial Overview: Consistent revenue growth over the past few quarters, promising pipeline of new drugs.

(Repeat this format for other top-performing BSE stocks)

Investment Strategies Based on the Surge

The recent market surge underscores the importance of having a well-defined investment strategy. While the gains in these BSE stocks are attractive, responsible investing practices remain crucial.

- Importance of Thorough Research Before Investing: Never invest in a stock without conducting thorough research. Understand the company's financials, its industry position, and the overall market conditions.

- Risk Assessment and Mitigation Strategies: Assess the risk associated with each investment. Diversify your portfolio to mitigate risk and avoid putting all your eggs in one basket.

- Diversification Across Different Sectors and Stocks: Don't limit your investments to a single sector. Spread your investments across different industries to reduce the impact of sector-specific downturns.

- Long-Term vs. Short-Term Investment Approaches: Consider your investment goals and time horizon. Long-term investments generally offer better returns, but require patience and a tolerance for short-term market fluctuations.

Identifying Future Opportunities in the BSE

Predicting the future of the stock market is impossible. However, by analyzing current trends and expert opinions, investors can identify potential sectors and companies with promising growth potential in the BSE. Focus on companies with strong fundamentals, innovative products, and a solid management team. Remember to avoid speculation and always make informed decisions based on thorough research. Emerging sectors such as renewable energy, technology, and pharmaceuticals often offer attractive future investment opportunities.

Conclusion

The recent Sensex rise created significant opportunities for investors in the BSE. Several BSE stocks witnessed substantial gains, exceeding 10% in some cases. By understanding the factors driving the market surge and employing sound investment strategies, investors can navigate the market effectively. Remember that thorough research, risk management, and diversification are paramount for successful stock market investment. Stay updated on the latest movements in the BSE and identify more top BSE stocks that surge following a Sensex rise. But always conduct thorough research before making any investment decisions.

Featured Posts

-

Malapitan Leads In Caloocan Mayoral Race Against Trillanes

May 15, 2025

Malapitan Leads In Caloocan Mayoral Race Against Trillanes

May 15, 2025 -

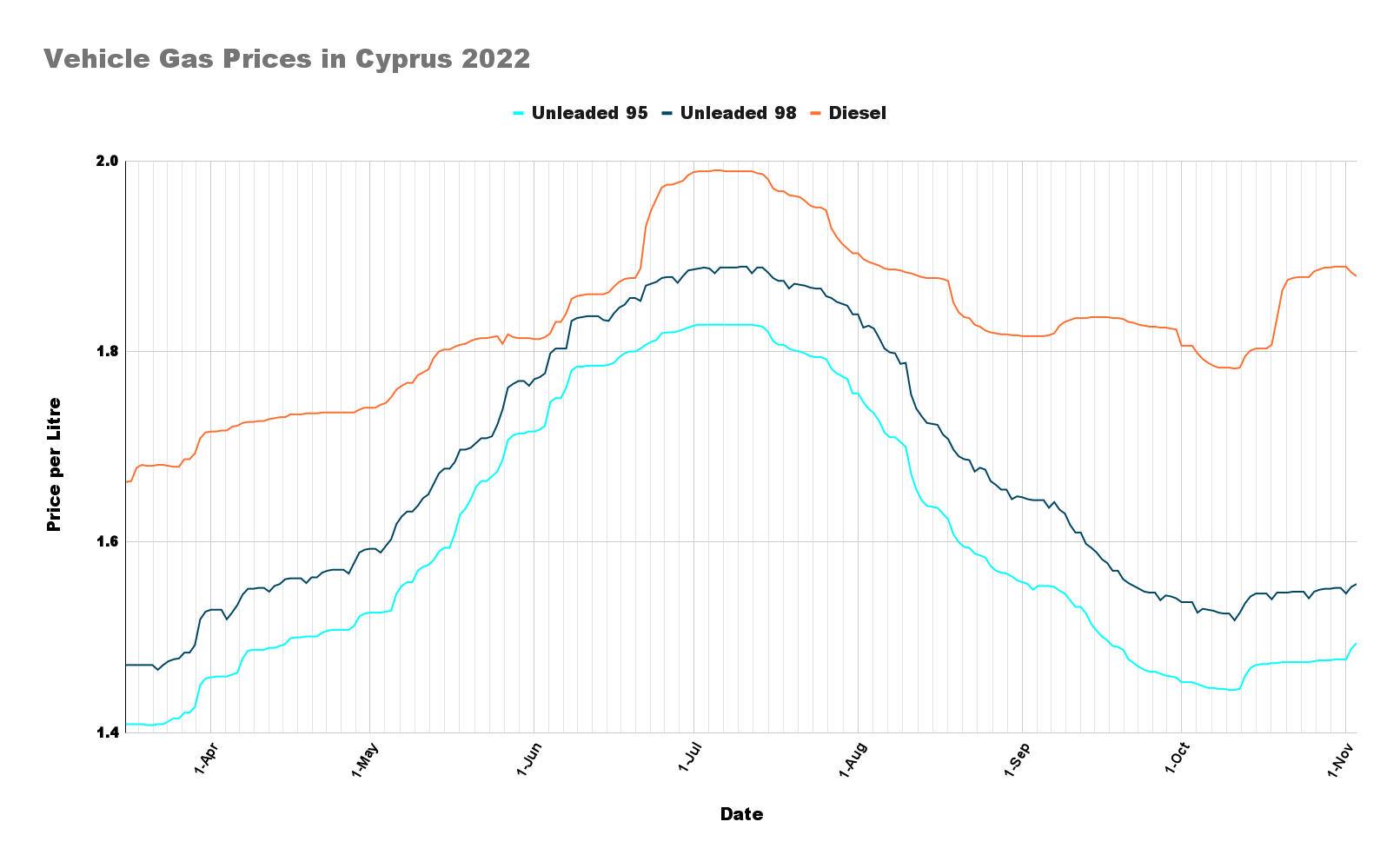

Imerisia Enimerosi Gia Tis Times Ton Kaysimon Stin Kypro

May 15, 2025

Imerisia Enimerosi Gia Tis Times Ton Kaysimon Stin Kypro

May 15, 2025 -

San Diego Padres Opening Day Game Details And Sycuan Casino Partnership

May 15, 2025

San Diego Padres Opening Day Game Details And Sycuan Casino Partnership

May 15, 2025 -

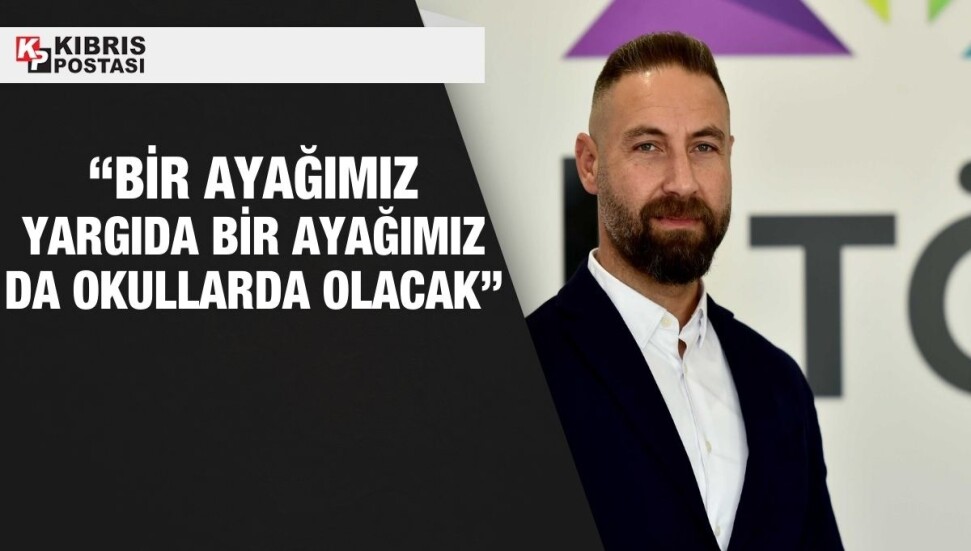

Burak Mavis Ve Akkor Davasi Aihm Yolu Ve Karma Evlilik Olasiligi

May 15, 2025

Burak Mavis Ve Akkor Davasi Aihm Yolu Ve Karma Evlilik Olasiligi

May 15, 2025 -

Padres Clinch Series Win Over Chicago Cubs

May 15, 2025

Padres Clinch Series Win Over Chicago Cubs

May 15, 2025