Toronto Real Estate Market Update: Sales Down 23%, Prices Fall 4%

Table of Contents

Significant Decrease in Sales Volume

Toronto real estate sales have experienced a dramatic downturn, reflecting a cooling housing market. Decreased sales in Toronto are a key indicator of the current market shift.

- Sales figures for Q3 2023 show a 23% decrease compared to the same period last year. This represents the sharpest decline in sales in 10 years.

- Increased interest rates are a major contributing factor. The Bank of Canada's aggressive interest rate hikes have significantly increased borrowing costs, making mortgages more expensive and reducing affordability for many potential buyers. This has led to decreased demand in the Toronto property market.

- Economic uncertainty is also playing a role. Inflation and concerns about a potential recession have dampened buyer confidence, leading to fewer transactions. Many potential buyers are adopting a wait-and-see approach.

- Affordability concerns are impacting the market. Even with the price drops, the Toronto real estate market remains relatively expensive compared to other Canadian cities, making homeownership unattainable for many.

Impact on Different Property Types

The impact of the slowdown is not uniform across all property types in the Toronto housing market.

- Condos: Condo sales have seen a more moderate decline compared to detached homes, likely due to their generally lower price point and appeal to first-time buyers and investors.

- Townhouses: Townhouses experienced a sales decline somewhere between condos and detached homes, reflecting their position as a mid-range option in the Toronto real estate market.

- Detached Homes: Detached homes have experienced the most significant drop in sales, reflecting their higher price points and greater sensitivity to interest rate changes. The decreased affordability of detached homes in Toronto is particularly pronounced.

(Insert graph/chart illustrating sales decline across different property types here.)

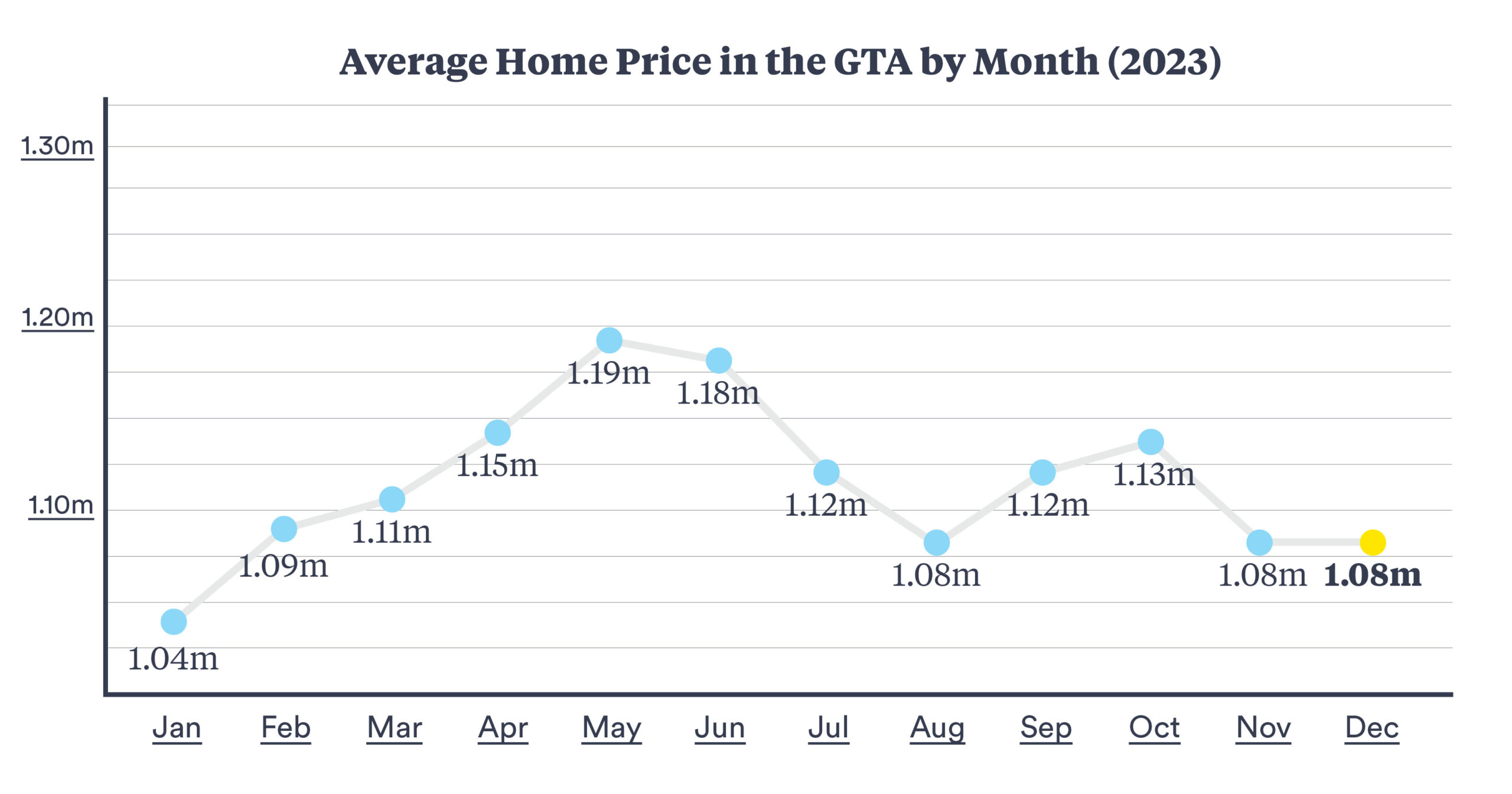

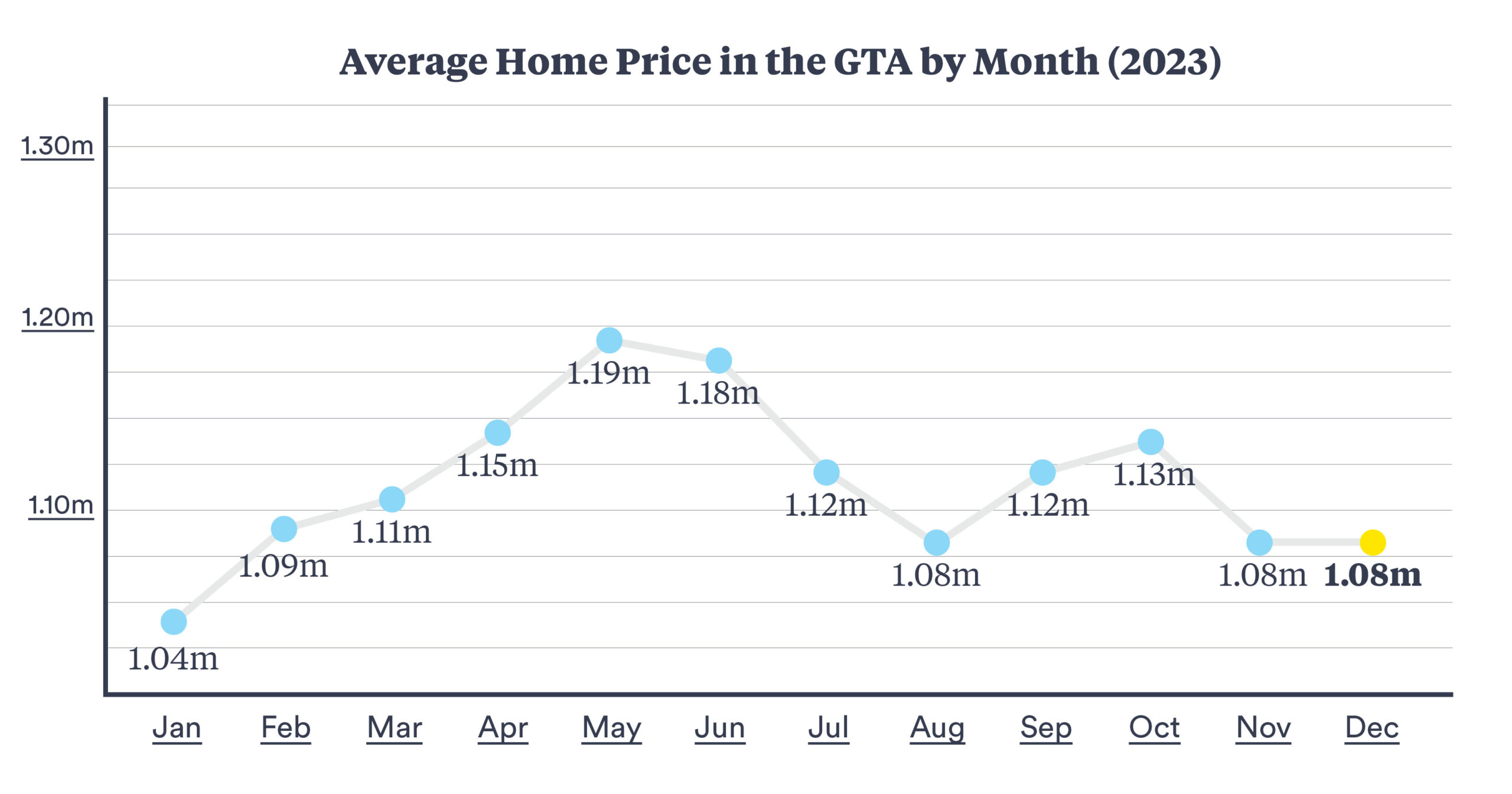

4% Drop in Average Property Prices

Average property prices in Toronto have fallen by 4% in the last quarter, indicating a softening market. This decreased house price in Toronto is a key development to watch.

- Average property prices have fallen by 4% in Q3 2023 compared to Q2 2023. This is a significant shift after years of consistent price increases.

- Price drops vary across different neighborhoods. Some areas, particularly those with higher-priced properties, have experienced more significant declines than others.

- Reduced demand is a primary driver of price decreases. Fewer buyers in the market mean less competition for properties, pushing prices downward.

- Increased inventory is further contributing to price reductions. A higher supply of homes for sale puts downward pressure on prices.

(Insert graph/chart illustrating price fluctuations across time here.)

Neighborhood-Specific Analysis

The impact of the price decrease varies across Toronto neighbourhoods.

- Downtown Core: The downtown core has seen a relatively moderate price decrease due to ongoing demand for condo units.

- Suburban Areas: Suburban areas have seen larger price drops, particularly in areas with a higher proportion of detached homes.

- Emerging Neighbourhoods: New developments and infrastructure projects can still support prices in emerging neighbourhoods.

Factors Contributing to the Market Slowdown

Several interconnected factors are contributing to the slowdown in the Toronto real estate market. Understanding these factors is key to navigating the Toronto housing market.

- Rising interest rates: The Bank of Canada's interest rate hikes are the most significant factor, impacting borrowing power and affordability.

- Inflation and economic uncertainty: Inflation erodes purchasing power, and economic uncertainty reduces buyer confidence.

- Increased inventory: The increased supply of homes on the market has intensified competition among sellers, forcing price reductions.

- Government policies: While not as dominant a factor as interest rates, government policies related to housing affordability might indirectly influence the market.

Outlook for the Toronto Real Estate Market

Predicting the future of the Toronto real estate market is challenging, but several factors point to a period of stabilization.

- Short-term outlook: A period of moderate price stability is expected in the short term, with a gradual decrease in inventory.

- Long-term outlook: The long-term outlook depends on macroeconomic factors and government policies. Increased housing supply could moderate price growth.

- Potential for a market rebound: If interest rates stabilize or begin to decline, a rebound is possible, but this is uncertain.

Conclusion:

In summary, the Toronto real estate market is experiencing a significant correction, with a 23% drop in sales and a 4% decrease in average prices. Rising interest rates, economic uncertainty, and increased inventory are the key drivers of this slowdown. While the short-term outlook suggests stability, the long-term trajectory will depend on various economic and policy factors. For buyers and sellers navigating this shifting Toronto real estate market, seeking expert advice is crucial. Connect with a knowledgeable real estate professional today to understand the current market conditions and make informed decisions regarding your property investments. Stay updated on the latest Toronto real estate market trends by subscribing to our newsletter or visiting our website for more insights into Toronto real estate.

Featured Posts

-

Ansany Asmglng Awr Kshty Hadthe Ka Mqdmh Mraksh Myn 4 Mlzman Grftar

May 08, 2025

Ansany Asmglng Awr Kshty Hadthe Ka Mqdmh Mraksh Myn 4 Mlzman Grftar

May 08, 2025 -

El Golazo De Arrascaeta Define La Victoria Del Flamengo En La Taca Guanabara

May 08, 2025

El Golazo De Arrascaeta Define La Victoria Del Flamengo En La Taca Guanabara

May 08, 2025 -

Bitcoin Madenciliginin Gelecegi Karlilik Ve Zorluklar

May 08, 2025

Bitcoin Madenciliginin Gelecegi Karlilik Ve Zorluklar

May 08, 2025 -

Jayson Tatum Injury Update Will He Play Tonight Against The Nets

May 08, 2025

Jayson Tatum Injury Update Will He Play Tonight Against The Nets

May 08, 2025 -

Oficial Sergio Hernandez Dirigira Al Flamengo

May 08, 2025

Oficial Sergio Hernandez Dirigira Al Flamengo

May 08, 2025