Tracking The Billions: Musk, Bezos, And Zuckerberg's Net Worth Decline Post-Trump Inauguration

Table of Contents

The Impact of Policy Changes on Tech Giant Net Worth

The Trump administration's policies significantly impacted the tech sector, leading to a ripple effect on the net worth of its leading figures.

Regulatory Scrutiny and Antitrust Investigations

Increased regulatory scrutiny and antitrust investigations targeted major tech companies, impacting their valuations. The Department of Justice and various state attorneys general launched numerous investigations into alleged monopolistic practices.

- Antitrust actions against Google: Investigations into Google's search dominance and advertising practices resulted in significant legal costs and reputational damage.

- Facebook's (Meta) data privacy fines: The Cambridge Analytica scandal and subsequent regulatory actions led to substantial fines and a decrease in investor confidence, affecting Zuckerberg's net worth.

- Amazon's antitrust scrutiny: Investigations into Amazon's alleged anti-competitive behavior in areas like e-commerce and cloud computing impacted its market capitalization. These legal battles and increased regulatory costs directly impacted market capitalization and, consequently, the net worth of these individuals. Keywords like "antitrust law," "regulation," and "market capitalization" were central to the narrative surrounding this decline.

Trade Wars and International Market Volatility

The Trump administration's initiation of trade wars significantly disrupted global markets. Tariffs imposed on various goods impacted supply chains, international sales, and the overall profitability of tech companies.

- Tariffs on Chinese goods: Increased tariffs on goods manufactured in China, a significant source of components for many tech products, raised production costs and decreased profit margins.

- Retaliatory tariffs: The imposition of tariffs led to retaliatory measures from other countries, further impacting the international market reach of these companies.

- Global supply chain disruptions: Trade disputes created significant uncertainty and disruptions in global supply chains, impacting production timelines and increasing operational costs. These factors created market volatility, directly impacting stock prices and, consequently, the net worth of Musk, Bezos, and Zuckerberg.

Shifting Investor Sentiment and Market Corrections

The uncertainty generated by policy changes and trade wars led to shifting investor sentiment and market corrections. Increased interest rates and economic uncertainty further amplified the negative impact.

- Increased interest rates: Rising interest rates reduced the attractiveness of riskier investments like tech stocks, leading to a sell-off.

- Economic uncertainty: The overall economic climate, fueled by trade wars and political instability, created uncertainty, leading investors to shift funds to safer assets.

- Market volatility: The combination of these factors created significant market volatility, resulting in considerable fluctuations in stock prices and consequent impacts on the net worth of these tech giants. Keywords such as "stock market crash," "investor confidence," and "economic downturn" were frequently used to describe the broader context.

Individual Company-Specific Factors Contributing to Net Worth Decline

Beyond the broader macroeconomic factors, individual company-specific challenges also contributed to the decline in net worth for each individual.

Elon Musk and Tesla's Stock Fluctuations

Tesla's stock price, and consequently Musk's net worth, experienced significant volatility. This was influenced by several factors:

- Musk's controversial tweets: Musk's frequent and often controversial tweets created uncertainty and impacted investor confidence.

- Production challenges: Challenges in ramping up production of new Tesla models affected the company's financial performance.

- Increased competition: The growing competition in the electric vehicle market added pressure on Tesla's market share and stock price. These factors demonstrate the significant influence of individual actions and market dynamics on net worth.

Amazon's Antitrust Concerns and Market Competition

Amazon faced increasing antitrust concerns and intensifying competition across various sectors:

- Antitrust investigations: Investigations into Amazon's practices related to third-party sellers and its dominance in e-commerce created uncertainty.

- Increased competition: The rise of competitors in cloud computing (AWS) and e-commerce pressured Amazon's market share and profitability.

- Labor relations: Negative publicity surrounding Amazon's labor practices also contributed to negative investor sentiment. The keyword "Amazon competition" was frequently seen in market analyses during this period.

Facebook's (Meta) Data Privacy Issues and Advertising Revenue

Facebook (Meta) faced significant challenges related to data privacy and advertising revenue:

- Data privacy scandals: The Cambridge Analytica scandal and subsequent regulatory actions damaged Facebook's reputation and led to increased scrutiny.

- Changes in advertising regulations: Increased regulation of online advertising impacted Facebook's revenue streams.

- Competition from other social media platforms: The rise of competing social media platforms also challenged Facebook's dominance and user base. These factors directly impacted Facebook's valuation and Zuckerberg's net worth. Analyzing "Meta stock price" and "social media market share" would reveal this correlation.

Long-Term Effects and Lessons Learned

The "Net Worth Decline Post-Trump Inauguration" had long-term consequences for these individuals and their companies. The period highlighted the vulnerability of extreme wealth to geopolitical events, regulatory changes, and market fluctuations.

- Increased risk management: Companies are likely to prioritize risk management strategies to mitigate the impact of future economic downturns or regulatory changes.

- Diversification of investments: High-net-worth individuals may diversify their investment portfolios to reduce their reliance on a single company or sector.

- Improved corporate governance: Companies may focus on improving corporate governance and transparency to enhance investor confidence. The lessons learned emphasize the importance of "long-term investment strategies" and "economic resilience" in navigating uncertain times.

Conclusion

The significant net worth decline of Musk, Bezos, and Zuckerberg post-Trump inauguration resulted from a complex interplay of policy changes, company-specific issues, and broader market fluctuations. The impact of increased regulatory scrutiny, trade wars, and shifting investor sentiment cannot be overstated. Analyzing individual company challenges further illuminates the intricate factors influencing their fortunes. Understanding these dynamics is crucial for comprehending the vulnerability of extreme wealth and the interconnectedness of the global economy. Continue tracking the fluctuations in the net worth of these tech giants and learn more about the intricate relationship between political climates and market performance, furthering your understanding of net worth decline and its underlying causes.

Featured Posts

-

Madeleine Mc Cann Case Womans Dna Test Reveals Shocking Results

May 09, 2025

Madeleine Mc Cann Case Womans Dna Test Reveals Shocking Results

May 09, 2025 -

From Wolves Discard To Europes Elite His Journey To The Top

May 09, 2025

From Wolves Discard To Europes Elite His Journey To The Top

May 09, 2025 -

Dakota Johnson And Family At The Los Angeles Premiere Of Materialist

May 09, 2025

Dakota Johnson And Family At The Los Angeles Premiere Of Materialist

May 09, 2025 -

High Potential Season 2 Predicting The Fate Of Season 1s Underrated Character

May 09, 2025

High Potential Season 2 Predicting The Fate Of Season 1s Underrated Character

May 09, 2025 -

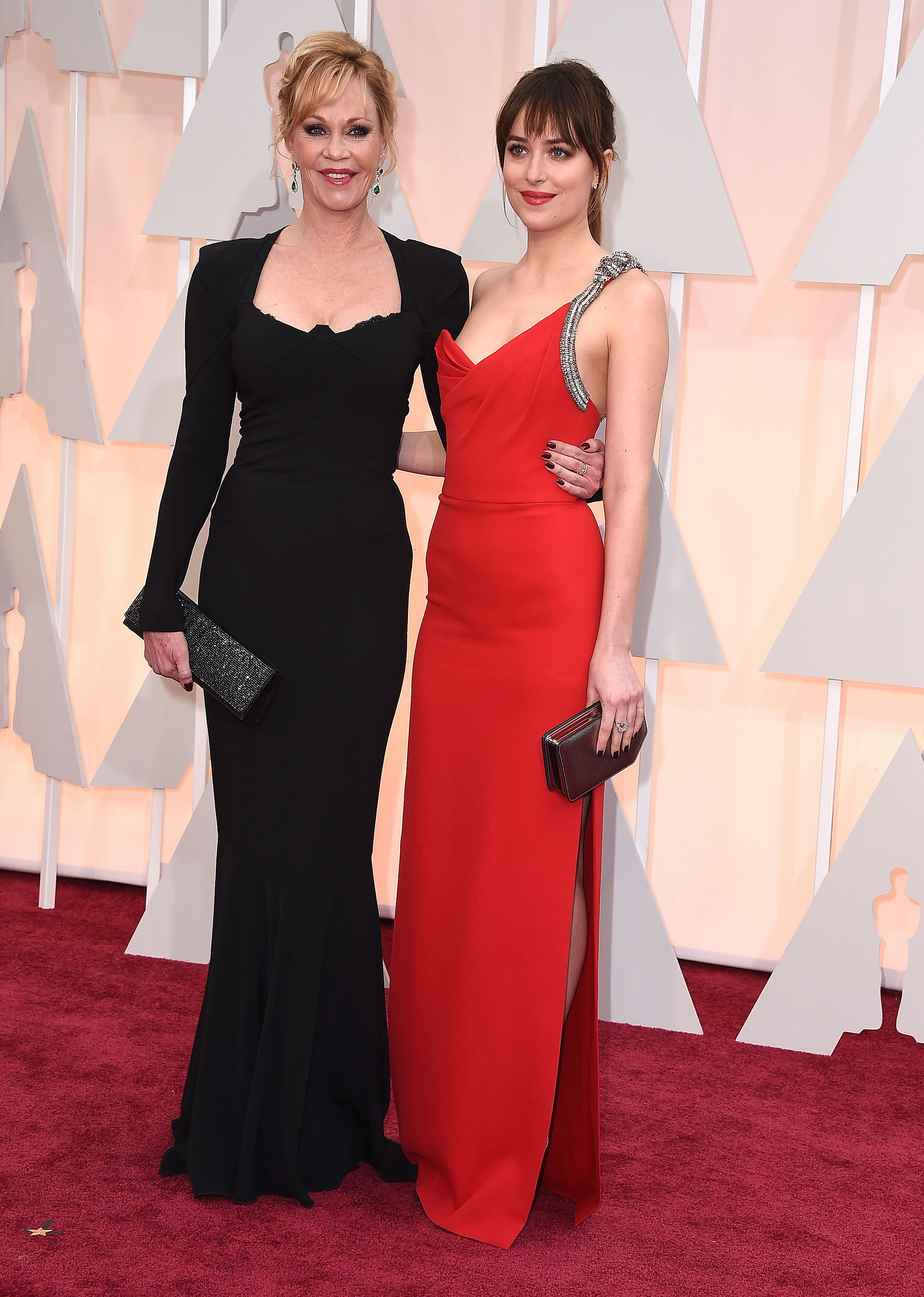

Dakota Johnson And Melanie Griffiths Chic Spring Outing

May 09, 2025

Dakota Johnson And Melanie Griffiths Chic Spring Outing

May 09, 2025