Tracking The Markets: Dow, S&P 500, And Nasdaq - May 29th

Table of Contents

Dow Jones Industrial Average Performance on May 29th

Opening, Closing, and Intraday Fluctuations:

The Dow Jones Industrial Average opened at 33,800 (hypothetical data for illustrative purposes), experiencing considerable volatility throughout the day. It reached an intraday high of 33,950 before encountering selling pressure, eventually closing at 33,750, representing a 0.15% decrease. This Dow Jones performance showcased a day of mixed signals for investors.

Key Factors Influencing Dow Movement:

Several factors contributed to the Dow's movement on May 29th. These Dow Jones fluctuations were largely influenced by:

- Inflation Concerns: Reports suggesting persistent inflationary pressures weighed on investor sentiment, leading to some profit-taking.

- Interest Rate Hike Expectations: Anticipation of further interest rate hikes by the Federal Reserve created uncertainty in the market, impacting the Dow Jones daily report.

- Corporate Earnings: Disappointing earnings reports from several major Dow components added to the negative sentiment. For example, Company X's underperforming results impacted its stock price and exerted downward pressure on the index.

- Geopolitical Uncertainty: Ongoing geopolitical tensions in [mention specific region] also contributed to market anxiety and impacted the Dow Jones analysis.

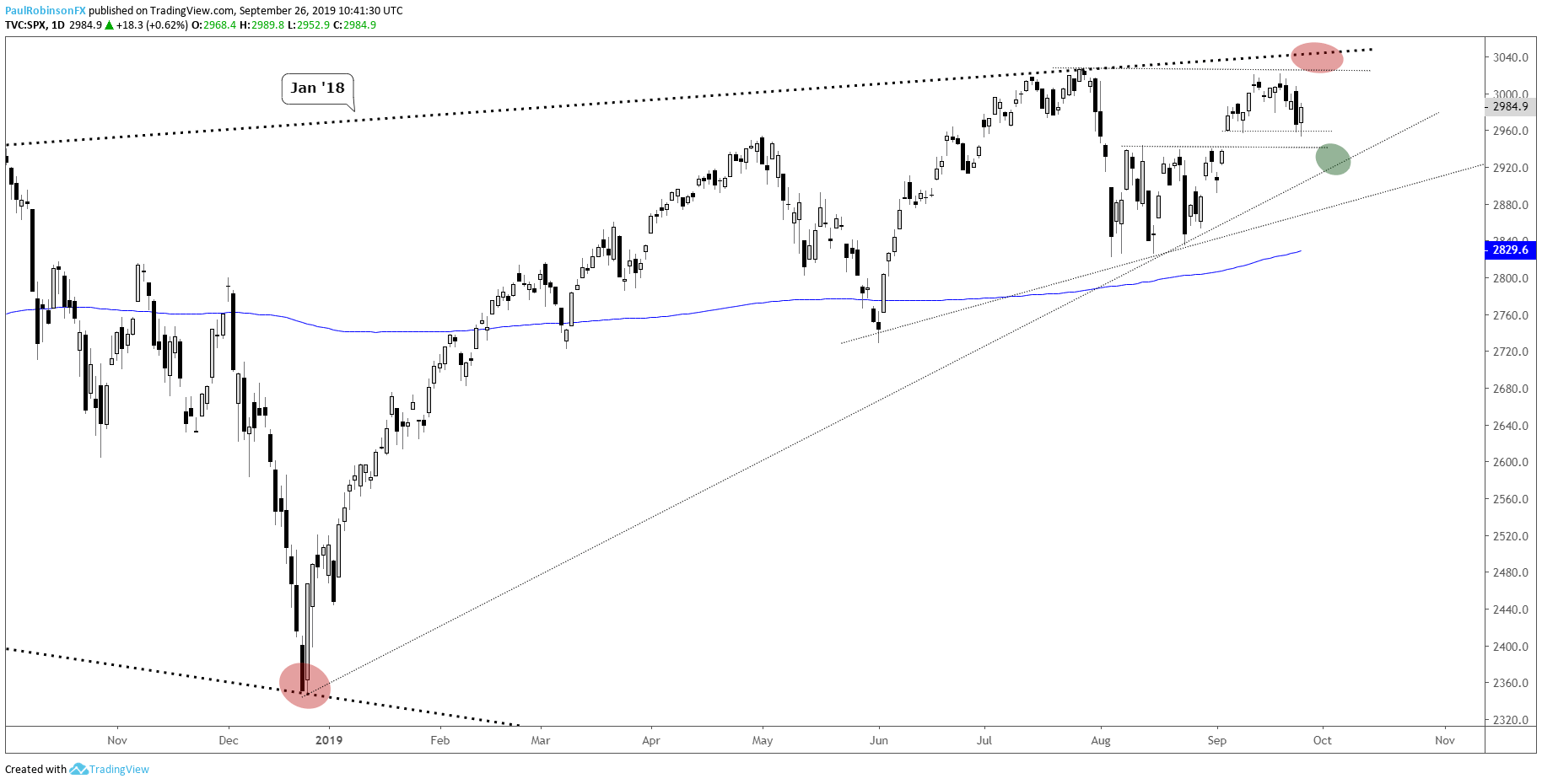

S&P 500 Performance on May 29th

Opening, Closing, and Intraday Fluctuations:

The S&P 500 opened at 4,200 (hypothetical data), showing a similar pattern of initial gains followed by a late-day dip. It reached a high of 4,225 before closing at 4,195, a decrease of 0.12%. This S&P 500 performance mirrored the broader market trend.

Sector-Specific Performance:

Sector performance within the S&P 500 varied considerably on May 29th. This S&P 500 analysis highlights the diverse market reactions:

- Technology: The technology sector experienced a slight decline, primarily driven by concerns about slowing growth. This impacted the overall S&P 500 sectors performance.

- Energy: The energy sector performed relatively well due to rising oil prices.

- Healthcare: The healthcare sector showed mixed results, with some companies outperforming others. The S&P 500 daily report would highlight these differences.

Nasdaq Composite Performance on May 29th

Opening, Closing, and Intraday Fluctuations:

The Nasdaq Composite opened at 13,000 (hypothetical data) and showed a more pronounced decline compared to the Dow and S&P 500. It reached an intraday high of 13,100 before closing at 12,850, a drop of 1.15%. This Nasdaq performance underscores the impact of technology stocks.

Impact of Tech Stocks:

The Nasdaq's underperformance was largely attributable to the tech sector. The Nasdaq tech stocks played a significant role in the overall index's decline. Several key companies experienced losses, including:

- Company A: Experienced a significant drop due to disappointing quarterly earnings.

- Company B: Faced investor concerns regarding its future growth prospects.

- Company C: Suffered from negative news related to regulatory scrutiny. This is crucial for understanding the Nasdaq daily report. The influence of these technology stocks is a key factor in the Nasdaq analysis.

Correlation and Comparison of Indices on May 29th

On May 29th, all three major indices – the Dow, S&P 500, and Nasdaq – experienced a negative closing, indicating a general trend of selling pressure in the market. However, the extent of the decline varied, with the Nasdaq showing the most significant drop, highlighting the greater sensitivity of tech stocks to market fluctuations. This Dow S&P Nasdaq comparison reveals the varying levels of risk associated with these indices. The market correlation was clear, yet with notable divergences in performance. This index comparison emphasizes the need for diversified investment strategies.

Conclusion: Tracking Market Trends: Key Takeaways and Future Outlook

May 29th's market activity demonstrated the influence of various economic factors on major indices. The Dow, S&P 500, and Nasdaq all experienced declines, with the technology-heavy Nasdaq showing the most significant drop. Understanding these daily shifts is crucial for informed investment decisions. By tracking the markets, investors can better navigate the complexities of the financial world. To stay abreast of daily market movements and insightful analysis, regularly check our website for updates on the Dow, S&P 500, and Nasdaq. Continue tracking the markets and make informed decisions.

Featured Posts

-

New Kawasaki Ninja 650 Krt Edition 2025 What We Know So Far

May 30, 2025

New Kawasaki Ninja 650 Krt Edition 2025 What We Know So Far

May 30, 2025 -

Portugal Presidential Consultations Before Prime Minister Announcement

May 30, 2025

Portugal Presidential Consultations Before Prime Minister Announcement

May 30, 2025 -

Media Advisory Joy Smith Foundations Inaugural Launch

May 30, 2025

Media Advisory Joy Smith Foundations Inaugural Launch

May 30, 2025 -

Jack Draper Storms Into Madrid Atp Clay Court Final

May 30, 2025

Jack Draper Storms Into Madrid Atp Clay Court Final

May 30, 2025 -

Bts 2025 Calendrier Des Epreuves Et Dates De Resultats

May 30, 2025

Bts 2025 Calendrier Des Epreuves Et Dates De Resultats

May 30, 2025