Tracking The Net Asset Value (NAV) Of Amundi MSCI All Country World UCITS ETF USD Acc

Table of Contents

Accessing Real-Time and Historical NAV Data for Amundi MSCI All Country World UCITS ETF USD Acc

Knowing where to find accurate and timely Net Asset Value (NAV) data is the first step in effective ETF investment management. For the Amundi MSCI All Country World UCITS ETF USD Acc, several reliable sources provide this crucial information.

Official Sources:

The most accurate and reliable NAV data always comes directly from the source. For the Amundi MSCI All Country World UCITS ETF USD Acc, you should check:

- Amundi's Official Website: Amundi, the ETF provider, typically publishes daily NAV information on its investor relations section. Look for a dedicated ETF section or a fund fact sheet. [Insert Amundi Website Link Here – replace with actual link if available].

- Exchange Data Feeds: Many stock exchanges provide real-time and historical NAV data for listed ETFs. The specific exchange will depend on where the ETF is listed. Contact your broker or financial institution for details on accessing this data.

- Official Press Releases and Announcements: Significant events affecting the ETF, such as changes in the underlying assets or methodology, will usually be announced through official press releases. Check Amundi's news section for relevant updates.

Third-Party Data Providers:

Numerous financial websites and platforms offer NAV data for ETFs, including the Amundi MSCI All Country World UCITS ETF USD Acc. However, remember that the accuracy and update frequency may vary.

- Bloomberg Terminal: Bloomberg provides highly accurate real-time data but usually comes with a subscription fee. Search for the ETF ticker symbol within the terminal to find its NAV.

- Yahoo Finance: Yahoo Finance is a free resource offering historical and often near real-time NAV data, but it may lag behind official sources slightly. Search for the ETF ticker symbol.

- Google Finance: Similar to Yahoo Finance, Google Finance offers free access to NAV data, but accuracy and timeliness might not be as consistent as paid professional services.

Understanding NAV Calculation Methodology:

The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is calculated daily by valuing all the underlying assets in the ETF's portfolio at their market prices. This involves a complex process considering:

- Market Values of Underlying Assets: The value of each stock, bond, or other asset in the portfolio is determined by its market price.

- Currency Exchange Rates: Since the ETF holds global assets, currency exchange rates play a vital role in converting the values into the base currency (USD).

- Accrued Income: Any accrued interest or dividends on the underlying assets are also included in the NAV calculation.

Interpreting NAV Changes in the Amundi MSCI All Country World UCITS ETF USD Acc

Understanding the factors that drive NAV fluctuations is critical for informed investment decisions.

Factors Affecting NAV Fluctuations:

The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is influenced by numerous factors, including:

- Global Economic Conditions: Economic growth or recession in major global economies will significantly impact the value of underlying assets.

- Interest Rates: Changes in interest rates affect the value of bonds and other fixed-income securities within the ETF's portfolio.

- Inflation: High inflation can erode the purchasing power of the ETF's assets, potentially leading to a decrease in NAV.

- Geopolitical Events: Significant geopolitical events (wars, political instability) can create market volatility and impact the ETF's NAV.

- Market Sentiment: Overall investor sentiment (optimism or pessimism) greatly affects asset prices and thus the ETF’s NAV.

Comparing NAV to Share Price:

While NAV represents the intrinsic value of the ETF's assets, the market price reflects the price at which the ETF shares are traded. These values might deviate, creating a premium (market price > NAV) or discount (market price < NAV). This deviation can be influenced by supply and demand dynamics in the market.

- Implications of Deviation: A significant premium or discount might indicate market inefficiencies or investor sentiment not fully reflected in the NAV.

Using NAV for Investment Decisions:

NAV data can inform various investment strategies:

- Dollar-Cost Averaging: Investing a fixed amount regularly regardless of NAV fluctuations can mitigate risk.

- Value Investing: Buying the ETF when the market price is significantly below the NAV can potentially offer higher returns.

Tools and Techniques for Effective NAV Tracking

Several tools can simplify NAV tracking for the Amundi MSCI All Country World UCITS ETF USD Acc.

Spreadsheet Software:

Using spreadsheets like Microsoft Excel or Google Sheets is a straightforward way to track NAV changes.

- Data Entry: Manually enter the daily NAV data you collect from reliable sources.

- Formula Usage: Use formulas to calculate daily, weekly, or monthly returns based on the NAV changes.

Financial Portfolio Tracking Software:

Specialized portfolio tracking software can automate much of the process and offer advanced analytical features.

- Examples: Many platforms (like Personal Capital or similar) allow for automated ETF NAV tracking and portfolio performance analysis. (Note: Always check the accuracy and reliability of the platform before using it).

Setting Up Alerts:

Receiving timely notifications about significant NAV changes can be very helpful.

- Platforms Offering Alerts: Many brokerage platforms and financial websites offer price alert features. Set up an alert to notify you when the NAV deviates beyond a certain threshold.

Conclusion: Mastering NAV Tracking for the Amundi MSCI All Country World UCITS ETF USD Acc

Regularly monitoring the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for informed investment decision-making. Utilizing both official sources and reputable third-party platforms for accurate data, combined with effective tracking tools, will empower you to manage your investment effectively. By understanding the factors influencing NAV fluctuations and employing appropriate tracking strategies, you can maximize your investment returns in this globally diversified ETF. Remember to always prioritize official sources for accurate NAV data and consider further research into the ETF's underlying holdings for a complete investment picture. Start tracking the NAV of your Amundi MSCI All Country World UCITS ETF USD Acc today!

Featured Posts

-

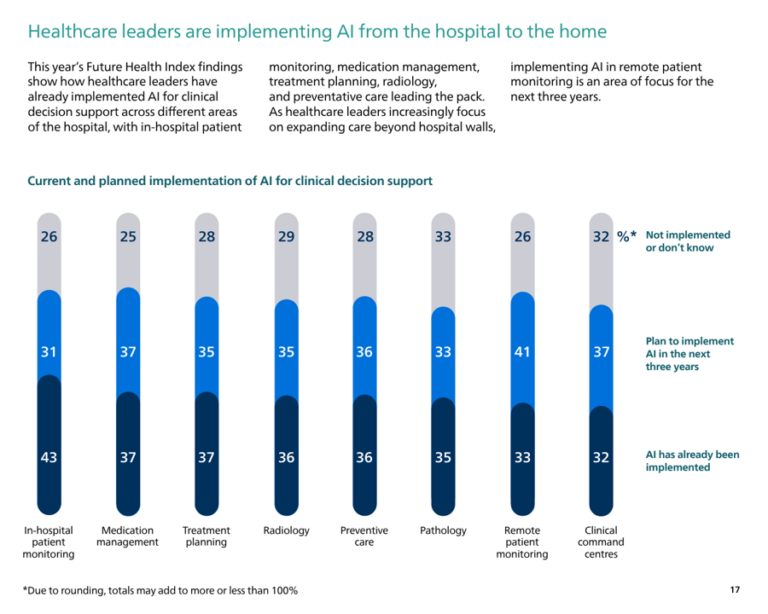

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 24, 2025

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 24, 2025 -

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025

Amsterdam Exchange Down 2 Following Trumps Latest Tariff Increase

May 24, 2025 -

Quebec Impose Des Quotas Pour Le Contenu Francophone Sur Les Plateformes De Diffusion En Continu

May 24, 2025

Quebec Impose Des Quotas Pour Le Contenu Francophone Sur Les Plateformes De Diffusion En Continu

May 24, 2025 -

Joe Jonas Responds To Couples Dispute About Him

May 24, 2025

Joe Jonas Responds To Couples Dispute About Him

May 24, 2025 -

New Matt Maltese Album Her In Deep A Deep Dive Into Intimacy And Personal Growth

May 24, 2025

New Matt Maltese Album Her In Deep A Deep Dive Into Intimacy And Personal Growth

May 24, 2025