Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF Dist

Table of Contents

- Where to Find the Official Amundi MSCI World II UCITS ETF Dist NAV

- Understanding the Factors Affecting Amundi MSCI World II UCITS ETF Dist NAV

- Tools and Techniques for Tracking Amundi MSCI World II UCITS ETF Dist NAV

- Interpreting NAV Changes in the Amundi MSCI World II UCITS ETF Dist

- Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist NAV Tracking

Where to Find the Official Amundi MSCI World II UCITS ETF Dist NAV

Accurate NAV data is the cornerstone of effective ETF investment. The Amundi MSCI World II UCITS ETF Dist's NAV, reflecting the value of its underlying assets, is updated daily, typically at market close. Relying on unofficial sources can lead to inaccurate information and poor investment decisions. Always prioritize official channels for the most reliable data.

- Amundi's Official Website: The primary source for accurate NAV information is Amundi's official website. Look for dedicated ETF pages where the daily NAV is usually displayed prominently. (Insert link to Amundi's ETF page if available).

- Major Financial Data Providers: Reputable financial data providers like Bloomberg, Refinitiv, and others offer comprehensive ETF data, including real-time and historical NAV information. These platforms usually require subscriptions but offer extensive data analysis tools.

- Your Brokerage Platform: Most online brokerage accounts display the current NAV of your ETF holdings directly within your portfolio dashboard. This provides convenient access to your specific investment's NAV.

Key Websites and Platforms for NAV Publication:

- Amundi Website (Insert link if available)

- Bloomberg Terminal (subscription required)

- Refinitiv Eikon (subscription required)

- Your Online Brokerage Account (e.g., Interactive Brokers, Fidelity, Schwab)

Understanding the Factors Affecting Amundi MSCI World II UCITS ETF Dist NAV

Several factors influence the daily fluctuations in the Amundi MSCI World II UCITS ETF Dist's NAV. Understanding these factors is essential for interpreting NAV changes accurately and avoiding misinterpretations.

- Market Fluctuations: The performance of the underlying assets within the ETF (tracking the MSCI World Index) is the primary driver of NAV changes. Positive market movements generally lead to NAV increases, while negative movements result in decreases.

- Currency Exchange Rates: Since the ETF holds globally diversified assets, fluctuations in currency exchange rates can impact the NAV, particularly if a significant portion of the portfolio is denominated in a currency different from your base currency.

- Dividend Distributions: When the ETF distributes dividends, the NAV typically decreases by the amount of the dividend paid to shareholders. This is because the ETF's assets are reduced by the dividend payout.

- MSCI World Index Performance: The Amundi MSCI World II UCITS ETF Dist tracks the MSCI World Index. Therefore, the ETF's NAV is directly correlated with the performance of this benchmark index.

Key Factors Influencing NAV Changes:

- Market movements (bullish vs. bearish)

- Currency exchange rate fluctuations

- Dividend payouts

- Performance of the MSCI World Index

- Other underlying asset performance

Tools and Techniques for Tracking Amundi MSCI World II UCITS ETF Dist NAV

Tracking the NAV effectively requires choosing tools and techniques appropriate for your investment approach and technical skills.

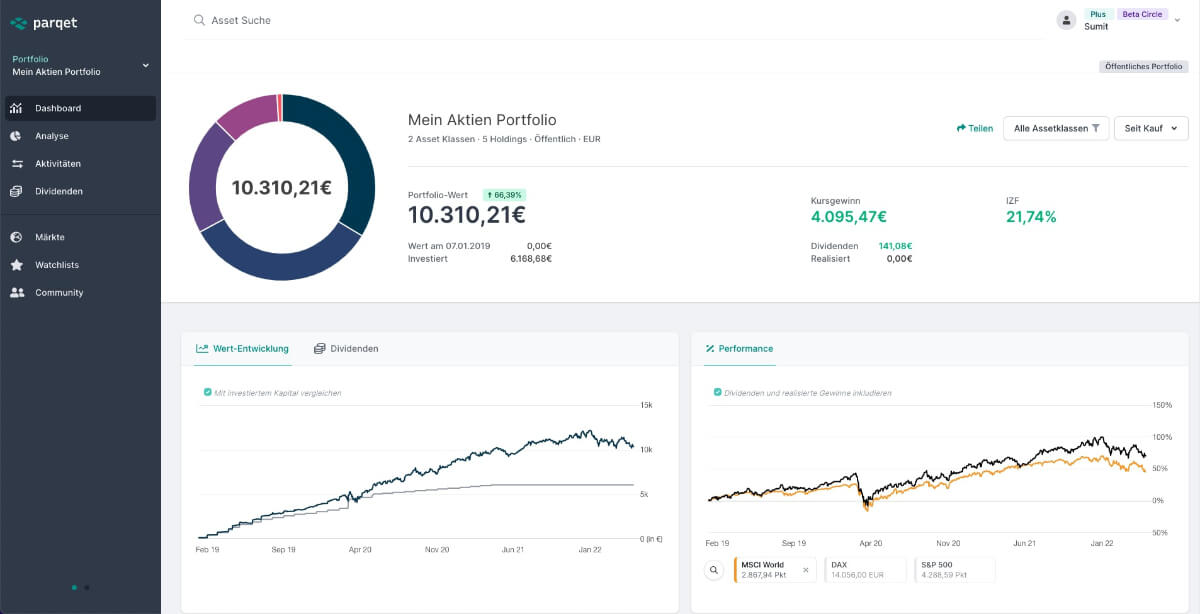

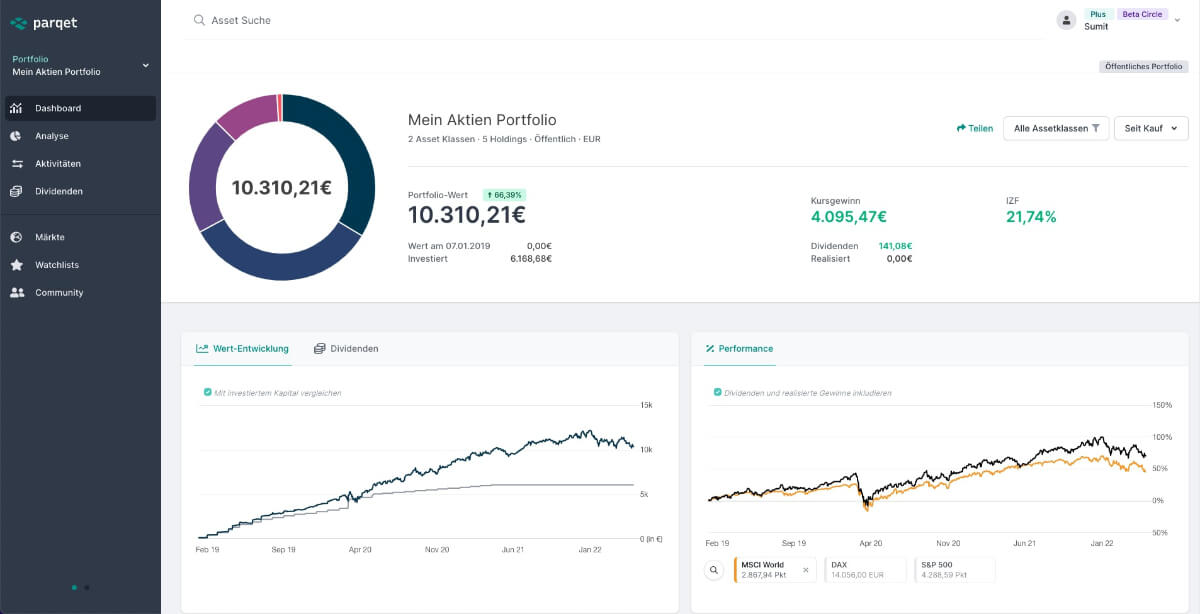

- Online Brokerage Platforms: Most brokerage platforms provide real-time and historical NAV data directly within your account. This is a convenient option for individual investors.

- Financial Data Terminals (Bloomberg, Refinitiv): These professional-grade terminals offer comprehensive data, charting tools, and analysis capabilities, ideal for sophisticated investors and financial professionals.

- Spreadsheet Software (Excel, Google Sheets): For more hands-on tracking, you can download historical NAV data and use spreadsheet software to create custom charts and track performance over time.

- Dedicated ETF Tracking Websites/Apps: Several websites and mobile apps specialize in providing ETF data and analysis. These can simplify the process of monitoring multiple ETFs.

Tools and Platforms for NAV Tracking:

- Online Brokerage Accounts

- Bloomberg Terminal

- Refinitiv Eikon

- Microsoft Excel/Google Sheets

- Dedicated ETF tracking apps (e.g., Yahoo Finance, Google Finance)

Interpreting NAV Changes in the Amundi MSCI World II UCITS ETF Dist

Analyzing NAV changes requires understanding the context and comparing performance to relevant benchmarks.

- Short-Term vs. Long-Term Analysis: Short-term NAV fluctuations can be volatile, influenced by daily market events. Long-term analysis provides a clearer picture of the ETF's underlying trend.

- Benchmark Comparison: Compare the Amundi MSCI World II UCITS ETF Dist's NAV performance against its benchmark, the MSCI World Index. This helps assess the ETF's tracking efficiency.

- Contextual Understanding: Consider economic factors, geopolitical events, and industry trends when interpreting NAV changes. Don't just focus on the numbers; understand the reasons behind them.

Tips for Effective NAV Interpretation:

- Analyze NAV changes over different time horizons.

- Compare NAV to the MSCI World Index performance.

- Consider broader economic and market factors.

- Focus on long-term trends rather than short-term volatility.

Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist NAV Tracking

Effectively tracking the NAV of your Amundi MSCI World II UCITS ETF Dist holdings is vital for informed investment decisions. By utilizing official sources like Amundi's website and reputable financial data providers, and by understanding the factors influencing NAV movements, you can make better-informed choices. Actively track your Amundi MSCI World II UCITS ETF Dist NAV using the tools and techniques discussed above. Consistent NAV monitoring allows you to assess your investment's performance, adapt your strategy if necessary, and ultimately, optimize your portfolio for long-term success. Start monitoring your ETF's NAV today to enhance your investment strategy and make informed decisions. Effective NAV tracking is key to maximizing your returns with the Amundi MSCI World II UCITS ETF Dist.

Canadian Automotive Leaders Urge Bold Response To Trump Administrations Policies

Canadian Automotive Leaders Urge Bold Response To Trump Administrations Policies

Terrapins Softball Edges Delaware In Thrilling 5 4 Win

Terrapins Softball Edges Delaware In Thrilling 5 4 Win

The Woody Allen Controversy Sean Penns Support And The Renewed Focus On Sexual Abuse Allegations

The Woody Allen Controversy Sean Penns Support And The Renewed Focus On Sexual Abuse Allegations

900 Euro Fuer Bessere Noten Skandal Erschuettert Uni Duisburg Essen

900 Euro Fuer Bessere Noten Skandal Erschuettert Uni Duisburg Essen

Your Escape To The Country Property Considerations And Costs

Your Escape To The Country Property Considerations And Costs