Tracking The Net Asset Value (NAV) Of The Amundi MSCI World Ex-US UCITS ETF Acc

Table of Contents

Sources for Finding the Amundi MSCI World ex-US UCITS ETF Acc NAV

Knowing where to find reliable and up-to-date information on the Amundi MSCI World ex-US UCITS ETF Acc NAV is the first step towards successful portfolio management. Several sources can provide this crucial data.

Official ETF Provider Website

The most reliable source for the Amundi MSCI World ex-US UCITS ETF Acc NAV is the official Amundi website. Amundi, as the ETF provider, maintains precise and timely data. You can typically find this information within their ETF listings section. Look for a dedicated page for the Amundi MSCI World ex-US UCITS ETF Acc, which usually includes historical and current NAV data.

- Location: The exact location may vary slightly; however, you will generally find it within the ETF product details page. Look for sections titled "Pricing," "Performance," or "Key Data."

- Frequency of Updates: The NAV is usually updated daily, reflecting the closing market prices of the underlying assets.

- Data Formats: Amundi often provides the NAV in various formats, including tables and potentially downloadable CSV files for easy import into spreadsheets.

Financial News Websites and Data Providers

Reputable financial news websites and data providers such as Bloomberg, Yahoo Finance, and Google Finance also offer real-time or delayed Amundi MSCI World ex-US UCITS ETF Acc NAV data. These platforms aggregate data from various sources, providing a convenient, albeit sometimes less detailed, overview.

- Bloomberg: Offers comprehensive real-time data and sophisticated analytical tools. However, access usually requires a subscription.

- Yahoo Finance: Provides free access to delayed NAV data, alongside other market information. Data accuracy may vary.

- Google Finance: Similar to Yahoo Finance, Google Finance offers free, albeit often delayed, NAV data.

Brokerage Platforms

If you hold the Amundi MSCI World ex-US UCITS ETF Acc within your brokerage account, the platform itself will likely display the current NAV alongside your portfolio holdings. This provides immediate access to your ETF's performance.

- Examples: Interactive Brokers, Fidelity, Schwab, and many others display real-time or delayed NAV data for held ETFs.

- Data Presentation: The way the NAV is presented may vary depending on your brokerage platform. Familiarize yourself with your specific platform's interface.

Understanding the Factors Affecting Amundi MSCI World ex-US UCITS ETF Acc NAV

Several factors influence the daily fluctuations of the Amundi MSCI World ex-US UCITS ETF Acc NAV. Understanding these elements is essential for interpreting NAV changes and making informed investment decisions.

Currency Fluctuations

Because the Amundi MSCI World ex-US UCITS ETF Acc invests in non-US markets, currency fluctuations significantly affect its NAV. Changes in exchange rates between the base currency (likely EUR) and the currencies of the underlying assets will directly impact the calculated NAV.

- Impact: A strengthening of the euro against other currencies will generally increase the NAV, while a weakening euro will decrease it.

- Examples: If the ETF holds Japanese equities and the Yen weakens against the Euro, the NAV will decrease, even if the underlying assets maintain their value in Yen.

Underlying Asset Performance

The performance of the underlying assets within the Amundi MSCI World ex-US UCITS ETF Acc (primarily non-US equities) directly correlates with its NAV. Positive performance in the underlying stocks will lead to a higher NAV, and vice-versa.

- Relationship: The NAV reflects the total market value of the ETF's holdings. Strong performance of the MSCI World ex-US index, which the ETF tracks, directly translates to a higher NAV.

- Impact of Individual Stocks: While the index's overall performance is the primary driver, individual stock performance within the index will also contribute to NAV fluctuations.

ETF Expenses

Management fees and other operating expenses associated with the Amundi MSCI World ex-US UCITS ETF Acc are deducted from the fund's assets. These expenses indirectly affect the NAV, though the impact is usually marginal in the short term.

- Expense Ratio: The expense ratio, typically expressed as a percentage, represents the annual cost of holding the ETF.

- Long-Term Impact: Over the long term, the cumulative effect of expenses will slightly reduce the NAV's growth.

Best Practices for Tracking Amundi MSCI World ex-US UCITS ETF Acc NAV

Regular and informed tracking of the Amundi MSCI World ex-US UCITS ETF Acc NAV is essential for effective investment management.

Regular Monitoring

Consistent monitoring allows you to stay updated on your investment's performance and make timely adjustments to your investment strategy as needed.

- Frequency: Daily checks are not always necessary for long-term investors, but weekly or monthly reviews are recommended.

- Automated Tracking: Many brokerage platforms and financial websites offer portfolio tracking tools that automatically update NAV data.

Comparing NAV to Share Price

While the NAV represents the intrinsic value of the ETF's holdings, the share price is the actual market price at which you can buy or sell shares. Discrepancies can occur due to supply and demand.

- Bid-Ask Spread: The difference between the bid (buy) and ask (sell) prices creates a spread, which can impact the share price temporarily.

- Premium/Discount: The share price might trade at a premium or discount to the NAV, especially in illiquid ETFs.

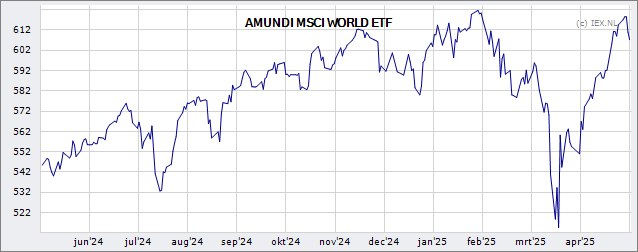

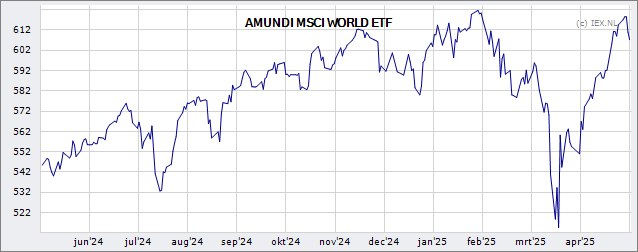

Utilizing Charts and Graphs

Visualizing the Amundi MSCI World ex-US UCITS ETF Acc NAV over time using charts and graphs can help identify trends and patterns in its performance.

- Benefits: Charts provide a clear visual representation of historical data, enabling performance analysis and the identification of trends.

- Charting Tools: Most brokerage platforms and financial websites offer charting functionalities.

Conclusion: Mastering Amundi MSCI World ex-US UCITS ETF Acc NAV Tracking

Effectively tracking the Amundi MSCI World ex-US UCITS ETF Acc NAV involves using reliable sources like the official Amundi website, reputable financial data providers, and your brokerage platform. Understanding the factors influencing the NAV—currency fluctuations, underlying asset performance, and ETF expenses—is crucial for interpreting its movements. By regularly monitoring the NAV, comparing it to the share price, and utilizing charting tools, you can make informed decisions regarding your investment in the Amundi MSCI World ex-US UCITS ETF Acc. Start monitoring your Amundi MSCI World ex-US UCITS ETF Acc NAV today to effectively manage your investment and optimize your portfolio performance. Learn to effectively track your Amundi MSCI World ex-US UCITS ETF Acc NAV and make the most of your investment strategy.

Featured Posts

-

Analisis Saham Mtel And Mbma Setelah Masuk Msci Small Cap

May 24, 2025

Analisis Saham Mtel And Mbma Setelah Masuk Msci Small Cap

May 24, 2025 -

Burclar Ve Zeka En Akilli Burclar Hangileri

May 24, 2025

Burclar Ve Zeka En Akilli Burclar Hangileri

May 24, 2025 -

Demna Gvasalia Transforming Guccis Creative Direction

May 24, 2025

Demna Gvasalia Transforming Guccis Creative Direction

May 24, 2025 -

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025

Avrupa Borsalari Duesueste Stoxx Europe 600 Ve Dax 40 Endekslerinde Gerileme 16 Nisan 2025

May 24, 2025 -

News Corp Undervalued Business Units And Investment Potential

May 24, 2025

News Corp Undervalued Business Units And Investment Potential

May 24, 2025