Tracking The Net Asset Value Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

The Amundi MSCI World II UCITS ETF USD Hedged Dist is an exchange-traded fund that tracks the MSCI World Index, offering diversified exposure to global equities. The "USD Hedged" designation means the fund employs strategies to mitigate the impact of currency fluctuations between the base currency of the index and the US dollar. Understanding its NAV – the net asset value per share – is essential for assessing its performance and making strategic investment choices. Tracking the NAV effectively, however, can present challenges. This article aims to provide a comprehensive guide to navigate these challenges and empower you to effectively monitor your investment in the Amundi MSCI World II UCITS ETF USD Hedged Dist.

Sources for Tracking the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Reliable and timely NAV data is the cornerstone of effective investment tracking. Several sources offer access to both real-time and historical NAV data for the Amundi MSCI World II UCITS ETF USD Hedged Dist:

- Official Amundi Website: The official source, often providing the most accurate and up-to-date information. Look for dedicated investor sections or fund fact sheets.

- Major Financial Data Providers: Bloomberg Terminal, Refinitiv Eikon, and similar professional platforms offer comprehensive real-time data, but usually come with subscription fees.

- Brokerage Platforms: Most brokerage firms that list the ETF will display its current NAV alongside other key metrics within your account portfolio. Check your brokerage's website or trading platform.

- Financial News Websites: Many financial news websites (like Yahoo Finance, Google Finance) provide ETF data, including NAV, often with a slight delay.

Data discrepancies exist. Real-time NAVs from different sources might vary slightly due to reporting lags and data processing times. It's crucial to verify data accuracy by cross-referencing information from at least two reliable sources. Remember that some providers might charge fees for access to real-time or historical NAV data.

Factors Influencing the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors interplay to determine the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

- Underlying Assets (MSCI World Index): The primary driver. The NAV directly reflects the performance of the stocks comprising the MSCI World Index. Positive market movements generally lead to NAV increases, and vice versa.

- Currency Hedging (USD Hedged): This crucial element aims to minimize the impact of currency fluctuations between the index's base currency and the US dollar. While it protects against currency risk, the hedging strategy itself can slightly influence the NAV.

- Management Fees and Expenses: These fees are deducted from the fund's assets, impacting the NAV. Lower fees generally lead to a higher NAV, all else being equal.

- Dividend Distributions: When the ETF distributes dividends, the NAV typically decreases by the dividend amount per share on the ex-dividend date.

- Market Volatility and Global Economic Events: Geopolitical events, economic news, and overall market sentiment significantly influence the performance of the underlying assets and, consequently, the NAV.

Understanding the Impact of Currency Hedging on NAV

The USD hedging in the Amundi MSCI World II UCITS ETF USD Hedged Dist is designed to minimize the impact of currency exchange rate fluctuations. If the Euro (or other currencies in the index) weakens against the US dollar, an unhedged ETF would see a decrease in its NAV. However, the hedging strategy employed by this specific ETF aims to offset these losses, keeping the NAV relatively stable compared to its unhedged counterpart. For example, if the Euro depreciates, the hedging strategy might involve shorting the Euro, generating profits that offset the losses from the weaker currency. This protection from currency risk is a significant advantage for investors.

Tools and Techniques for Effective NAV Tracking

Several tools and techniques can streamline your NAV tracking process:

- Spreadsheet Software (Excel, Google Sheets): Manually inputting NAV data allows for custom calculations, trend analysis, and portfolio performance tracking.

- Portfolio Tracking Software or Apps: Many apps (like Personal Capital, Mint) offer automated portfolio tracking, including NAV updates for your ETFs.

- Financial Data Visualization Tools: Platforms offering charting capabilities allow you to visually analyze NAV trends over time, identifying patterns and potential risks.

Choose the method that best suits your technical skills and investment needs. Regular monitoring is key; aim for at least weekly checks to understand the short-term trends and monthly checks for a longer-term perspective.

Interpreting NAV Changes and Making Informed Investment Decisions

Analyzing NAV changes requires context. Consider the following:

- Market Trends: Compare NAV changes to broader market movements. A declining NAV might reflect market corrections, not necessarily poor fund performance.

- Economic Indicators: Consider economic news and global events impacting the markets. A temporary drop in NAV might be due to short-term economic uncertainty.

- Investment Goals and Risk Tolerance: Your investment goals (long-term growth vs. short-term gains) and risk tolerance dictate how you should respond to NAV fluctuations.

Use NAV data to inform your investment decisions, but remember it's just one piece of the puzzle. Never make impulsive decisions based solely on short-term NAV changes. Consider consulting a financial advisor for personalized guidance aligned with your individual circumstances.

Conclusion: Stay Informed on Your Amundi MSCI World II UCITS ETF USD Hedged Dist Investment

Effectively tracking the Net Asset Value (NAV) of your Amundi MSCI World II UCITS ETF USD Hedged Dist investment is crucial for informed decision-making. Utilize reliable sources like the official Amundi website, your brokerage platform, or reputable financial data providers to access accurate and timely NAV information. Remember to cross-reference data from multiple sources to ensure accuracy. Regularly monitor the NAV, considering market trends, economic indicators, and your personal investment goals. By actively tracking the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV and understanding its implications, you can make sound investment decisions and maximize your portfolio's potential. Don't hesitate to consult a financial advisor for personalized guidance. Stay informed about your Amundi MSCI World II UCITS ETF USD Hedged Dist NAV—it's your key to smart investing.

Featured Posts

-

Dax Verfall Aktienmarkt Frankfurt Am 21 Maerz 2025

May 24, 2025

Dax Verfall Aktienmarkt Frankfurt Am 21 Maerz 2025

May 24, 2025 -

Tva Group Ceo Blames Streamers And Regulators For 30 Job Cuts

May 24, 2025

Tva Group Ceo Blames Streamers And Regulators For 30 Job Cuts

May 24, 2025 -

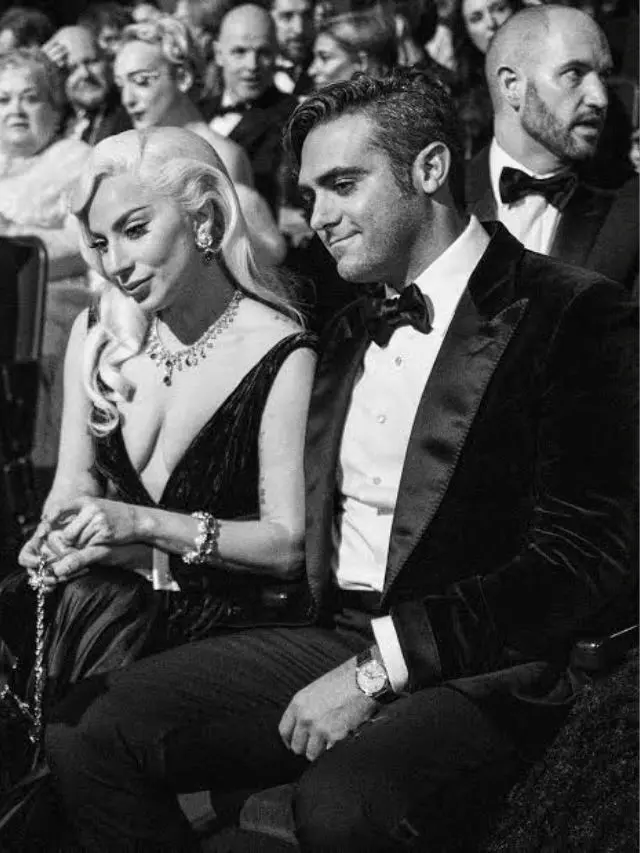

Lady Gaga And Michael Polansky At The Snl Afterparty

May 24, 2025

Lady Gaga And Michael Polansky At The Snl Afterparty

May 24, 2025 -

April 14 2025 Favorable Horoscopes For 5 Zodiac Signs

May 24, 2025

April 14 2025 Favorable Horoscopes For 5 Zodiac Signs

May 24, 2025 -

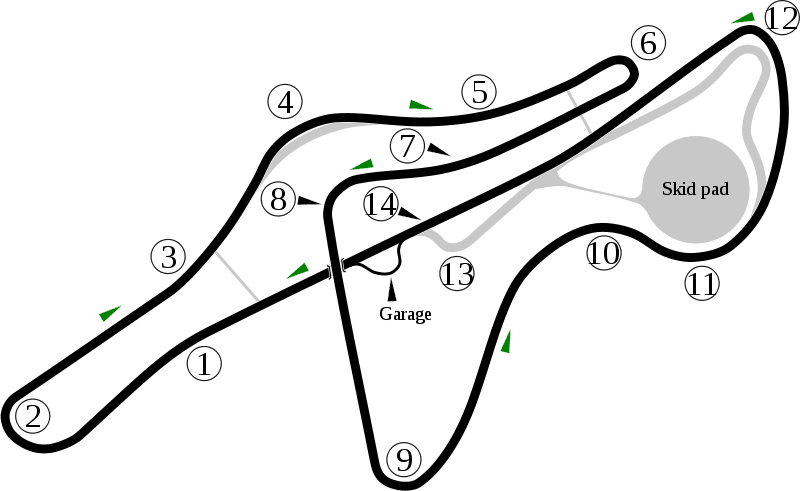

The 10 Fastest Standard Production Ferraris Around Fiorano

May 24, 2025

The 10 Fastest Standard Production Ferraris Around Fiorano

May 24, 2025