Trade War Update: High-Level U.S. And China Talks Scheduled

Table of Contents

The Current State of US-China Trade Relations

The US-China trade relationship is currently characterized by significant tension and a complex web of tariffs and sanctions. Understanding this context is crucial before assessing the implications of the upcoming talks.

Review of Existing Tariffs and Sanctions

Both the US and China have imposed significant tariffs on billions of dollars worth of goods. Key affected industries include:

- Agriculture: US soybean exports to China have been severely impacted, leading to significant losses for American farmers. Conversely, China faces higher costs on agricultural imports.

- Technology: The technology sector has been a major battleground, with tariffs impacting semiconductors, telecommunications equipment, and other high-tech products. This has disrupted global supply chains and spurred innovation in alternative sourcing.

- Manufacturing: Numerous manufactured goods have faced reciprocal tariffs, increasing costs for consumers in both countries and impacting global manufacturing output.

Data from the World Trade Organization shows a significant decline in bilateral trade volume since the escalation of the trade war, highlighting the substantial economic consequences. For instance, bilateral trade between the US and China fell by X% in [Year] compared to [Year], illustrating the detrimental impact of these economic sanctions.

Previous Negotiation Attempts and Outcomes

Several rounds of trade negotiations have taken place since the trade war began. While some minor concessions have been made, significant breakthroughs have remained elusive.

- The [Name of previous trade deal] aimed to address [specific issues], but ultimately failed due to disagreements over [key sticking points].

- Subsequent talks focused on [other issues], but also yielded limited results due to [reasons for failure]. A key sticking point has consistently been intellectual property rights and technology transfer.

The failure of past attempts highlights the deep-seated disagreements and the difficulty in reaching a mutually beneficial agreement.

Global Economic Impact of the Trade War

The US-China trade war extends far beyond the two countries directly involved. The disruption of global supply chains has led to:

- Increased production costs for businesses worldwide.

- Uncertainty in global markets, impacting investment and economic growth.

- A rise in protectionist sentiment in other countries.

The International Monetary Fund (IMF) has estimated that the trade war has reduced global GDP growth by [percentage] – a significant impact on the global economy.

Significance of the Scheduled High-Level Talks

The upcoming high-level talks represent a crucial opportunity to potentially de-escalate the trade war. The level of participation and the potential outcomes hold immense significance.

Key Participants and Their Roles

The talks are expected to involve high-ranking officials from both governments, including [names and titles of key participants]. The inclusion of these individuals suggests a serious commitment to finding a resolution. Their experience and authority within their respective governments indicate a potential for meaningful progress.

Potential Discussion Topics

The agenda is likely to include a range of crucial issues, including:

- Tariff reductions: Both sides may seek to reduce or eliminate some of the existing tariffs.

- Intellectual property rights: Protecting intellectual property is a key concern for the US, while China seeks to expand its technological capabilities.

- Technology transfer: Forced technology transfer remains a point of contention, with the US seeking to prevent Chinese companies from gaining unfair advantages.

- Market access: Improving market access for US companies in China is another key objective.

Successful negotiations would require compromises from both sides on these sensitive issues.

Expectations and Outcomes

The outcome of these talks remains uncertain. Several scenarios are possible:

- A comprehensive trade deal: This would involve significant tariff reductions, addressing key concerns of both countries.

- A partial agreement: This could involve agreements on specific issues, leaving others unresolved.

- A continuation of the trade war: Failure to reach an agreement could lead to further escalation of tensions and tariffs.

The success of the talks will depend on the willingness of both sides to compromise and address each other's concerns.

Market Reactions and Investor Sentiment

The announcement of high-level talks has already triggered significant market reactions.

Stock Market Response

Global stock markets initially reacted positively to the news, reflecting a cautious optimism that a resolution might be in sight. However, sustained gains will depend on the progress and outcome of the negotiations. Sectors particularly impacted by the trade war, such as technology and agriculture, have shown increased volatility.

Currency Fluctuations

The US dollar and the Chinese yuan have experienced fluctuations in response to the news, reflecting the uncertainty surrounding the talks. Currency movements often mirror investor sentiment and expectations regarding the trade negotiations.

Commodity Prices

Prices of commodities significantly affected by the trade war, such as soybeans and aluminum, have shown some sensitivity to the news. Any progress toward a trade deal could lead to price stabilization or even a decline in prices.

Conclusion

The current US-China trade war presents a complex and evolving situation. The upcoming high-level talks are a crucial juncture, offering a potential pathway towards de-escalation. The success of these talks will hinge on the willingness of both sides to find common ground on key issues like tariffs, intellectual property, technology transfer, and market access. The market reactions – in stocks, currencies, and commodity prices – will continue to reflect the trajectory of these critical negotiations. Stay informed about further developments in the ongoing US-China trade war. Regularly check for updates on the high-level talks and their impact on global trade relations. Understanding the nuances of this trade war is crucial for businesses and investors alike. Continue monitoring this critical aspect of global trade to effectively navigate the evolving economic landscape. Follow our blog for more updates on the US-China trade war and trade negotiations.

Featured Posts

-

Mraksh Ansany Asmglng Ky Wardat Kshty Hadthh Awr 4 Mlzman Ky Grftary

May 08, 2025

Mraksh Ansany Asmglng Ky Wardat Kshty Hadthh Awr 4 Mlzman Ky Grftary

May 08, 2025 -

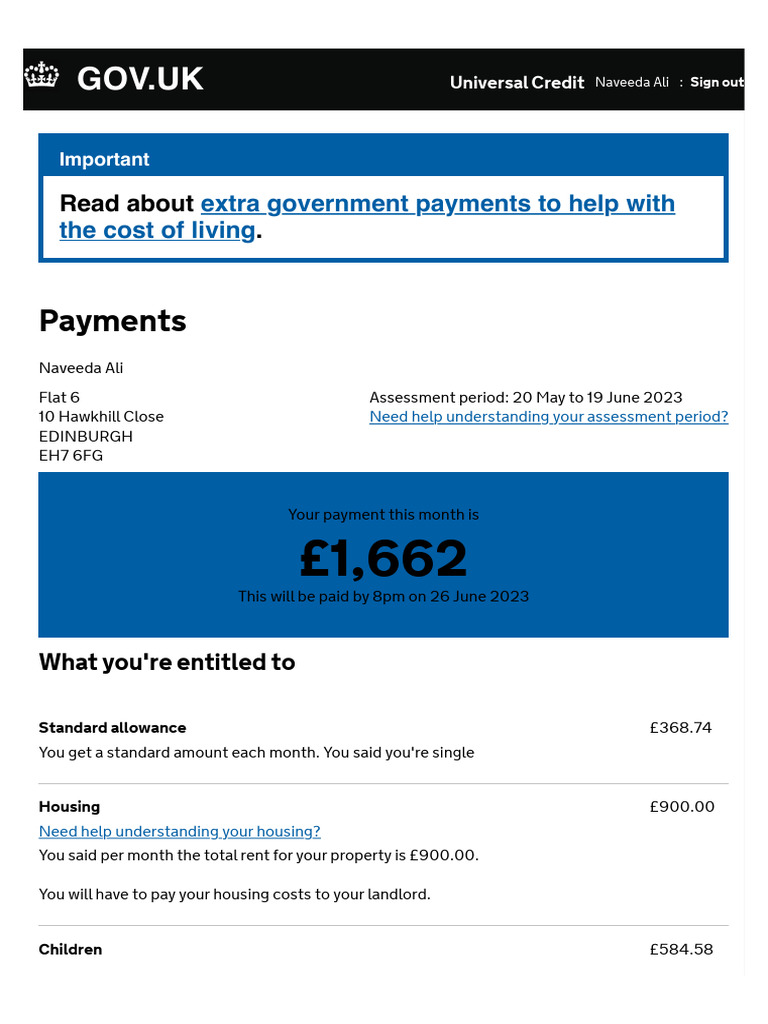

Check Your Universal Credit Payments Potential For Refunds

May 08, 2025

Check Your Universal Credit Payments Potential For Refunds

May 08, 2025 -

110 Potential The Black Rock Etf Billionaire Investors Are Buying

May 08, 2025

110 Potential The Black Rock Etf Billionaire Investors Are Buying

May 08, 2025 -

Secret Service Ends White House Cocaine Investigation Key Findings

May 08, 2025

Secret Service Ends White House Cocaine Investigation Key Findings

May 08, 2025 -

Biggest Oscars Snubs Of All Time A Look Back At Injustice At The Academy Awards

May 08, 2025

Biggest Oscars Snubs Of All Time A Look Back At Injustice At The Academy Awards

May 08, 2025