Treasury Market Insights: Key Takeaways From April 8th

Table of Contents

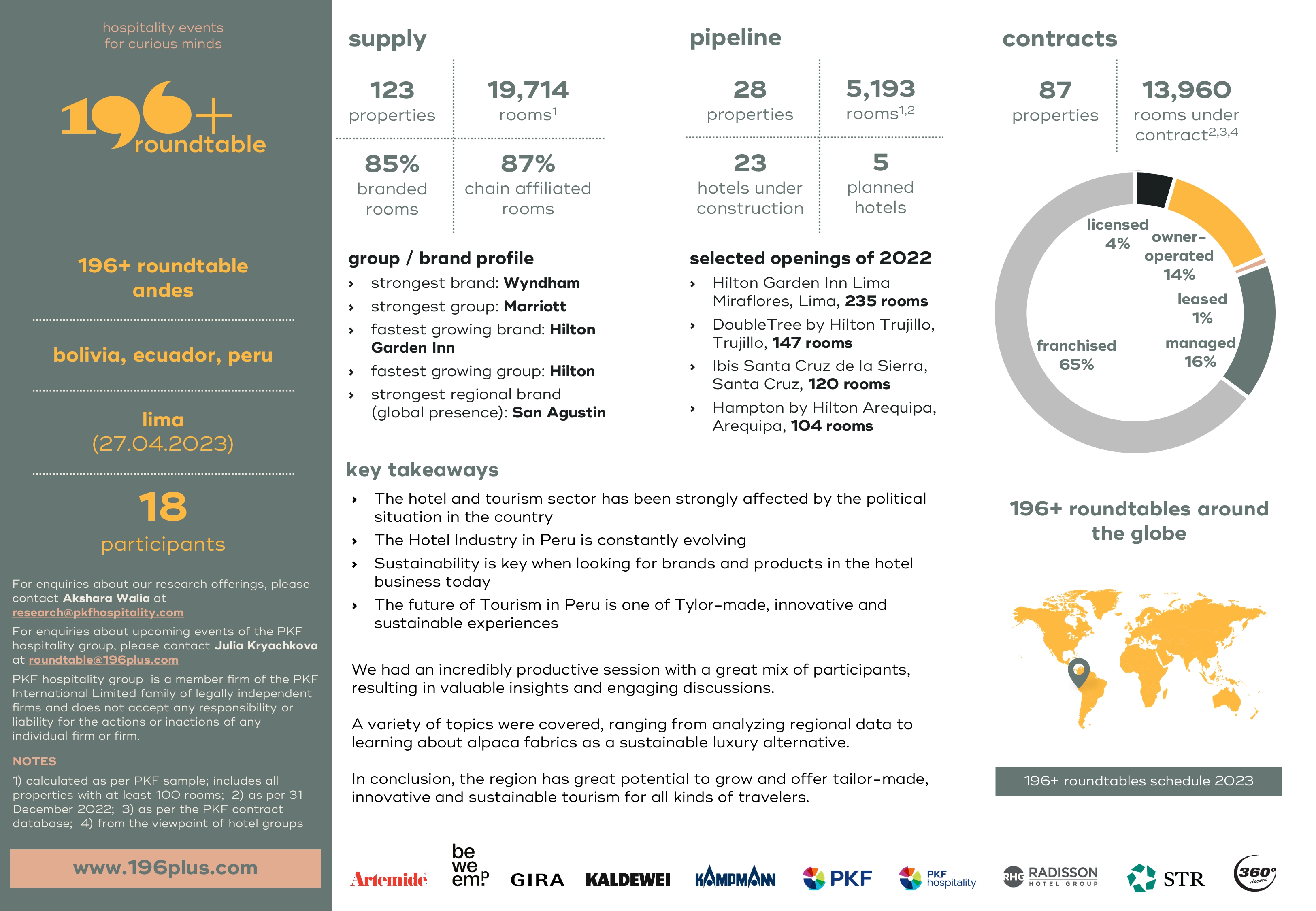

Yield Curve Movements on April 8th

The yield curve on April 8th exhibited a [Insert: Steepening, flattening, or inversion – choose the accurate descriptor based on the actual data from April 8th]. This overall shape was influenced by significant movements in yields across various Treasury maturities.

- 2-year Treasury yield: [Insert: Specific yield change and percentage].

- 10-year Treasury yield: [Insert: Specific yield change and percentage].

- 30-year Treasury yield: [Insert: Specific yield change and percentage].

These yield curve shifts were primarily driven by [Insert: Specific reasons, e.g., unexpectedly strong inflation data, anticipation of a Fed rate hike, increased risk aversion in the market]. The implications for investment strategies varied depending on the investor's horizon and risk tolerance. For instance, investors with shorter-term horizons might have adjusted their strategies in response to the changes in the 2-year yield, while long-term investors may have focused on the shifts in the 30-year yield. The changing shape of the yield curve also provided insights into market expectations regarding future economic growth and interest rate policies.

Impact of Economic Data Releases

April 8th saw the release of [Insert: Specific economic data released, e.g., Consumer Price Index (CPI), Producer Price Index (PPI), employment report]. These data points significantly influenced Treasury market trading.

- Specific Data Points: [Insert: Specific values of the released data points, e.g., CPI rose by 0.4%, unemployment rate fell to 3.5%].

- Market Reaction: The market reacted to [Insert: Specific data point] with a [Insert: risk-on or risk-off] sentiment, leading to [Insert: Description of the market's response, e.g., a sell-off in longer-term Treasuries, increased demand for shorter-term bonds].

- Expectations vs. Reality: [Insert: Analysis comparing market expectations before the data release and the actual market reaction. This should highlight any surprises or confirmations of prevailing sentiment]. The discrepancy between expectations and reality directly impacted the volatility of Treasury yields and trading volume.

Federal Reserve Influence

[Insert: Mention any statements or actions by the Federal Reserve that impacted the Treasury market on April 8th. For example, did the Fed release minutes from a recent meeting? Was there a press conference?]. The market interpreted these [Insert: Statements or actions] as signaling [Insert: The market's interpretation of the Fed's intentions regarding future interest rate policy].

- Fed Communications: [Insert: Summary of relevant Fed communications and their key messages].

- Market Response: The market responded to the Fed's communication with [Insert: Description of market response, e.g., a decline in yields, increased trading volume]. This reaction showcased the significant influence the Federal Reserve holds over the Treasury market and interest rate expectations.

- Implications for Monetary Policy: These actions and statements have [Insert: Analysis of the potential implications for future monetary policy, considering the impact on inflation and economic growth].

Trading Volume and Volatility

Trading volume in the Treasury market on April 8th was [Insert: Higher or lower than average] compared to recent averages. This was coupled with [Insert: High or low] price volatility.

- Trading Volume Comparison: [Insert: Specific data comparing the trading volume on April 8th to recent averages. Provide percentage changes or volume figures].

- Price Fluctuations: [Insert: Description and analysis of the magnitude of price fluctuations in Treasury securities].

- Volume and Volatility Relationship: [Insert: Explain the relationship between the observed trading volume and volatility. Higher volume often correlates with higher volatility, but not always. Explain the reasons behind the observed relationship]. Understanding this relationship is critical for effective risk management in the Treasury market.

Conclusion: Key Takeaways and Call to Action

April 8th’s Treasury market activity highlighted the interplay between economic data releases, Federal Reserve actions, and investor sentiment. Yield curve movements reflected shifting expectations about future interest rates and economic growth. The significant impact of economic data underscores the importance of monitoring key economic indicators. Finally, the Federal Reserve’s influence on market expectations remains paramount, making central bank communications a crucial factor in Treasury market analysis.

Stay informed about the ever-changing landscape of the Treasury market. Subscribe to our newsletter for regular updates and in-depth Treasury market insights to refine your trading strategies and make informed investment decisions. Understanding Treasury market dynamics, including the impact of economic indicators and Federal Reserve policy, is vital for navigating the complexities of the bond market and achieving optimal investment outcomes.

Featured Posts

-

Reliance Earnings Beat Expectations Boost For Indian Large Cap Stocks

Apr 29, 2025

Reliance Earnings Beat Expectations Boost For Indian Large Cap Stocks

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets Registration Purchase And Faqs

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Registration Purchase And Faqs

Apr 29, 2025 -

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Apologizes

Apr 29, 2025

Shedeur Sanders Prank Call Son Of Falcons Defensive Coordinator Apologizes

Apr 29, 2025 -

Estudio Del Gol De Alberto Ardila Olivares Tecnica Y Eficacia

Apr 29, 2025

Estudio Del Gol De Alberto Ardila Olivares Tecnica Y Eficacia

Apr 29, 2025 -

Adhd In Adults With Autism And Intellectual Disability A New Study

Apr 29, 2025

Adhd In Adults With Autism And Intellectual Disability A New Study

Apr 29, 2025