Trump Claims Imminent Trade Deals: A 3-4 Week Timeline

Table of Contents

Specific Trade Deals Mentioned by Trump

Trump's pronouncements haven't consistently specified all deals, but recurring mentions often include negotiations or renegotiations with China and Mexico. The lack of concrete details makes assessing the claims challenging. Let's examine what we know:

- China Trade Deal: Trump frequently referenced the possibility of a "Phase Two" trade deal with China, aiming to address remaining concerns about intellectual property rights, technology transfer, and agricultural purchases.

- Current Status: Negotiations have been largely stalled since the initial "Phase One" agreement. There's been limited public communication about the resumption of talks at a high level.

- Key Sticking Points: Enforcement mechanisms for existing agreements, China's state-sponsored industrial policies, and ongoing concerns about market access for US businesses remain significant obstacles.

- Recent Developments: While there have been minor trade exchanges, no significant progress toward a comprehensive "Phase Two" deal has been publicly reported. [Link to reputable news source on China trade]

- Mexico Trade Deal (USMCA): While the USMCA (United States-Mexico-Canada Agreement) is already in effect, Trump may have alluded to further amendments or side deals concerning specific sectors or trade practices.

- Current Status: The USMCA is currently operational. However, ongoing discussions may relate to enforcing existing provisions or negotiating further modifications to address specific trade imbalances or industry concerns.

- Key Sticking Points: Potential disputes around labor standards, environmental regulations, and digital trade rules may still need clarification or enforcement.

- Recent Developments: Any recent developments supporting Trump's claims would likely need to be sourced from verifiable public statements or official announcements related to USMCA enforcement or renegotiations. [Link to reputable news source on USMCA]

Analyzing the 3-4 Week Timeline

Trump's proposed 3-4 week timeline for finalizing these complex trade deals is highly ambitious, bordering on unrealistic.

Historical Precedents

Trade negotiations are notoriously lengthy and intricate. Let’s look at historical precedents:

- Examples of similar deals and their completion times: The negotiation of the original NAFTA (North American Free Trade Agreement) took years. Even seemingly smaller bilateral trade deals often take months or even years to complete.

- Factors that typically lengthen trade negotiations: These include the need for extensive legal review, internal political deliberations within each participating country, and the complexities of balancing the interests of various stakeholders.

- Analysis of the complexity of the deals Trump mentioned: The issues raised by Trump – involving intellectual property, technology transfer, and potentially significant changes to established trade practices – require extensive technical analysis and political maneuvering, making a 3-4-week timeframe extremely improbable.

Current Political Climate

The current political climate further complicates the feasibility of Trump's timeline:

- Relevant political figures and their stances: The Biden administration's approach to trade negotiations may differ significantly from Trump's, making it unlikely that deals negotiated under the previous administration will be swiftly finalized.

- Potential roadblocks from either domestic or international actors: Congress, industry groups, and even foreign governments could raise objections or demand concessions, delaying the process significantly.

- Analysis of the political feasibility: Given the inherent complexities and the need for domestic and international approvals, the political feasibility of completing such deals within the suggested timeframe is extremely low.

Potential Economic Impacts of the Deals

The potential economic impacts of these trade deals, should they materialize, are significant but depend heavily on their specific terms.

Positive Impacts

Successful trade deals could yield benefits such as:

- Specific economic sectors that could be affected: Agriculture, manufacturing, and technology sectors could see increased exports and economic growth.

- Estimates of potential economic growth: While difficult to quantify precisely, successful negotiations could boost GDP growth, depending on the agreement's scope.

- Economic models or expert opinions: Economic modelling studies analyzing the impact of similar trade deals can offer insights, albeit with inherent limitations and uncertainty.

Negative Impacts or Risks

However, rapid deal-making carries risks:

- Potential risks associated with rapid deal-making: Hasty agreements may lack sufficient scrutiny, leading to unforeseen negative consequences.

- Vulnerable industries that might suffer: Certain industries could experience job losses or increased competition if the deals lack sufficient safeguards.

- Possible unintended consequences: Rapid changes to trade policy may disrupt established supply chains and create market instability.

Conclusion

Trump's claim of imminent trade deals within a 3-4 week timeframe is met with considerable skepticism given the historical precedents, the complexity of the issues involved, and the current political climate. While successful trade deals could offer potential economic benefits like increased exports and economic growth, the risks associated with hasty negotiations, including potential job losses in vulnerable industries and unforeseen consequences, cannot be overlooked. The timeline proposed is highly unlikely, given the complexity and significant negotiation required. Stay informed about the progress of these crucial trade negotiations. Continue following news reports to track developments in Trump’s claimed imminent trade deals and their potential impact on the global economy. Further research into the specific trade agreements mentioned is crucial for understanding their potential long-term effects.

Featured Posts

-

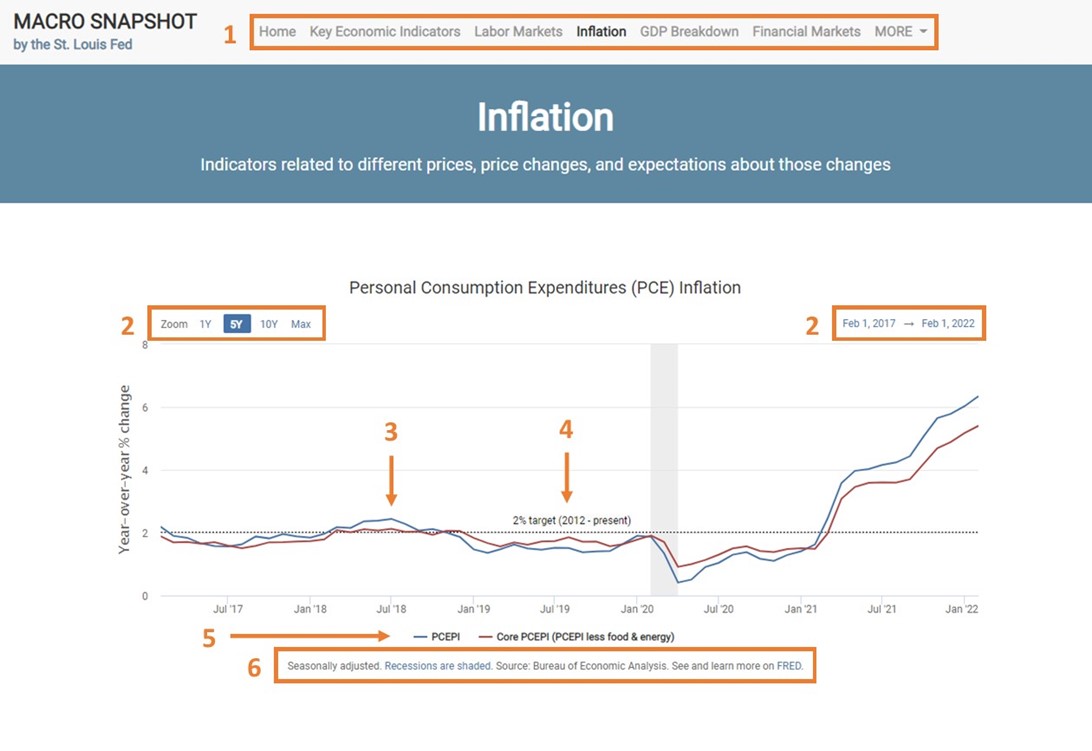

Canadian Travel Boycott A Fed Snapshot Reveals Economic Repercussions

Apr 27, 2025

Canadian Travel Boycott A Fed Snapshot Reveals Economic Repercussions

Apr 27, 2025 -

French Auction Sees Camille Claudel Bronze Sculpture Fetch 3 Million

Apr 27, 2025

French Auction Sees Camille Claudel Bronze Sculpture Fetch 3 Million

Apr 27, 2025 -

10

Apr 27, 2025

10

Apr 27, 2025 -

Gambling On Calamity Examining The Los Angeles Wildfire Betting Market

Apr 27, 2025

Gambling On Calamity Examining The Los Angeles Wildfire Betting Market

Apr 27, 2025 -

Ecbs New Task Force Simplifying Banking Regulations In Europe

Apr 27, 2025

Ecbs New Task Force Simplifying Banking Regulations In Europe

Apr 27, 2025

Latest Posts

-

A Look Back The 2000 Yankees Torre Pettitte And A Pivotal Game

Apr 28, 2025

A Look Back The 2000 Yankees Torre Pettitte And A Pivotal Game

Apr 28, 2025 -

2000 Yankees Season Joe Torres Managerial Decisions And Pettittes Dominance

Apr 28, 2025

2000 Yankees Season Joe Torres Managerial Decisions And Pettittes Dominance

Apr 28, 2025 -

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025

2000 Yankees Diary Joe Torres Meetings And Andy Pettittes Shutout Of The Twins

Apr 28, 2025 -

Yankees Rodon Leads Comeback Victory Against Historic Sweep

Apr 28, 2025

Yankees Rodon Leads Comeback Victory Against Historic Sweep

Apr 28, 2025 -

Yankees Avoid Sweep Rodon Shines In Crucial Win

Apr 28, 2025

Yankees Avoid Sweep Rodon Shines In Crucial Win

Apr 28, 2025