Trump Tariffs: A Small Business Owner's Nightmare

Table of Contents

Increased Input Costs & Supply Chain Disruptions

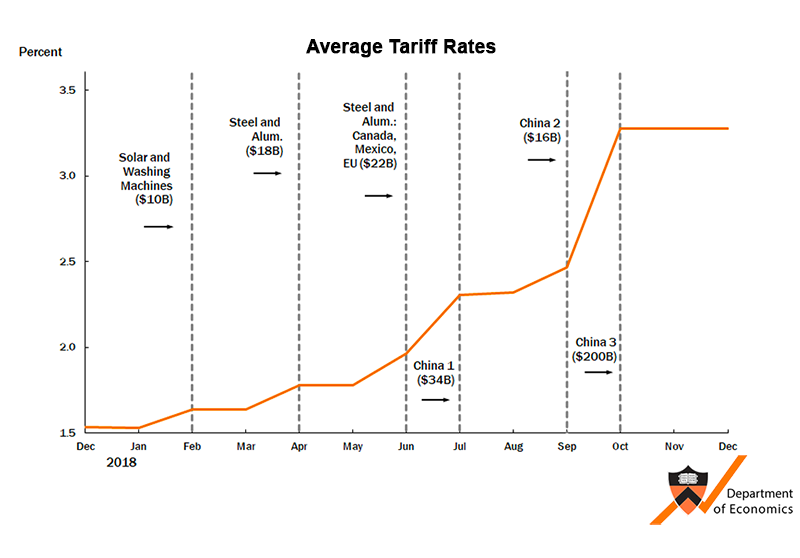

Trump-era tariffs significantly increased the cost of imported goods, creating a domino effect that impacted the supply chains of countless small businesses. These tariffs weren't limited to finished products; they also affected essential raw materials and components needed for production. This resulted in a perfect storm of challenges:

- Higher prices for raw materials: Industries reliant on imported steel, aluminum, textiles, and other materials faced dramatically increased costs. This made it harder to compete on price and maintain profit margins.

- Increased transportation costs: Trade disruptions caused by the tariffs led to longer shipping times and increased transportation costs, further adding to the burden on small businesses.

- Difficulty sourcing reliable suppliers: Trade restrictions and uncertainty made it challenging to find and maintain reliable suppliers, potentially leading to production delays and shortages.

- Industries heavily impacted: Manufacturing, retail, and agriculture were among the hardest-hit sectors, experiencing significant disruptions and increased expenses due to tariff-related challenges.

For example, a small furniture manufacturer in North Carolina, reliant on imported wood and hardware, saw their production costs rise by 20% almost overnight. This forced them to either absorb the increased cost, reducing their profit margins significantly, or raise their prices, risking a loss of customers in a competitive market.

Reduced Consumer Demand & Sales Decline

The increased costs resulting from Trump tariffs weren't confined to businesses; they were quickly passed on to consumers. This led to a decrease in consumer spending and a significant drop in demand, leaving small businesses struggling to maintain sales.

- Loss of competitiveness: Smaller businesses, with fewer resources to absorb increased costs, found themselves at a disadvantage compared to larger corporations that could better handle the price hikes.

- Decreased consumer spending: Economic uncertainty, fueled by the tariffs and subsequent price increases, caused consumers to reduce their overall spending, impacting small businesses across various sectors.

- Impact on exporters: Businesses that relied on exports experienced a decline in international demand as foreign buyers sought more competitive alternatives.

- Sales declines: Numerous reports indicated significant sales declines across various industries, particularly those heavily reliant on imported goods or exports. For example, the retail sector experienced a noticeable drop in sales as consumers tightened their budgets.

Data from the [Insert relevant source, e.g., US Census Bureau or a reputable economic research firm] showed a [Insert specific percentage or statistic] decline in sales for small businesses in the [Insert specific industry] sector during the period of peak tariff implementation.

Navigating Complex Tariff Regulations & Bureaucracy

Understanding and complying with the complex and constantly changing tariff regulations presented a significant hurdle for small businesses. The administrative burden and associated costs proved overwhelming for many.

- Difficulty in navigating the changing landscape: The frequent changes and updates to tariff schedules and regulations created significant confusion and uncertainty for small business owners.

- Increased administrative burden and compliance costs: The effort required to understand and comply with these regulations demanded significant time and resources, often diverting attention from core business operations.

- Potential for penalties and fines: Non-compliance could result in substantial penalties and fines, placing an additional strain on already struggling businesses.

- Lack of clear guidance and support: Many small businesses lacked access to clear and readily available guidance and support to navigate the complexities of the tariff system.

While some resources were available through government agencies like the [mention relevant agencies, e.g., Small Business Administration (SBA)], navigating these resources often proved difficult for small businesses lacking dedicated staff for regulatory compliance.

Long-Term Impacts on Small Business Growth and Viability

The long-term effects of Trump tariffs extended beyond immediate financial struggles. They had a lasting impact on small business investment, expansion, and overall survival.

- Reduced profitability impacting reinvestment and growth: Decreased profitability meant less money available for reinvestment in business growth, upgrades, and expansion.

- Increased risk of business closures and job losses: Many small businesses were forced to close their doors, resulting in job losses and further economic strain on communities.

- Difficulty securing loans and financing: Economic uncertainty caused by the tariffs made it harder for small businesses to secure loans and financing, further hindering their ability to grow and overcome challenges.

- Long-term impact on economic growth and competitiveness: The overall impact of the tariffs contributed to reduced economic growth and diminished competitiveness for American small businesses in the global marketplace.

Conclusion: Overcoming the Challenges of Trump Tariffs

Trump tariffs presented small businesses with a trifecta of challenges: increased input costs, reduced consumer demand, and complex regulations. These challenges had a significant negative impact on their viability and long-term growth, leading to reduced profitability, business closures, and job losses. Understanding the lasting impact of Trump tariffs is crucial for navigating future economic challenges. To mitigate the effects of such trade policies in the future, small businesses should consider strategies such as diversifying their supply chains, exploring alternative markets, and actively seeking government support and resources. Learn more about how trade policies affect small businesses and advocate for policies that protect small business owners and promote economic stability.

Featured Posts

-

Hakkari Hakim Ve Savcilari Bir Arada Iftar Sofrasinda

May 12, 2025

Hakkari Hakim Ve Savcilari Bir Arada Iftar Sofrasinda

May 12, 2025 -

Analyzing The Photos Benny Blanco And Selena Gomezs Relationship Under Scrutiny

May 12, 2025

Analyzing The Photos Benny Blanco And Selena Gomezs Relationship Under Scrutiny

May 12, 2025 -

A Happy Gilmore Sequel Sandlers Path Back To Comedy Gold

May 12, 2025

A Happy Gilmore Sequel Sandlers Path Back To Comedy Gold

May 12, 2025 -

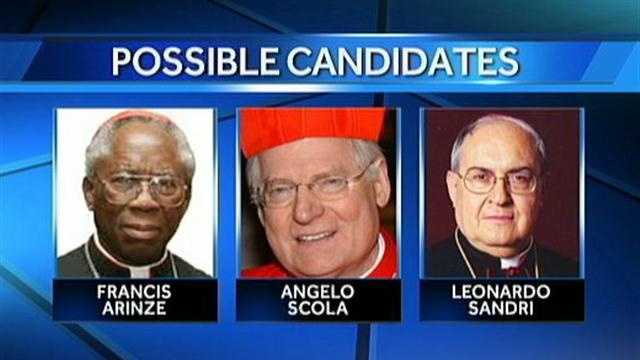

Who Could Be The Next Pope Leading Contenders And Predictions

May 12, 2025

Who Could Be The Next Pope Leading Contenders And Predictions

May 12, 2025 -

Danmark Sender Sissal Til Eurovision Song Contest 2025

May 12, 2025

Danmark Sender Sissal Til Eurovision Song Contest 2025

May 12, 2025