Trump Tariffs And The Fintech IPO Freeze: The Affirm Holdings (AFRM) Case Study

Table of Contents

H2: The Macroeconomic Impact of Trump Tariffs

The imposition of Trump tariffs ignited a global trade war, significantly impacting investor sentiment. This period was marked by increased economic uncertainty and market volatility, creating a challenging environment for initial public offerings (IPOs).

H3: Global Trade Wars and Investor Sentiment

The trade war fostered a climate of risk aversion. Investors, facing decreased global trade, supply chain disruptions, and increased input costs, became hesitant to invest in potentially volatile IPOs.

- Decreased global trade: Reduced international commerce dampened overall economic growth, impacting investor confidence.

- Supply chain disruptions: Tariffs and retaliatory measures created uncertainty and delays in global supply chains, increasing costs and risks for businesses.

- Increased input costs: Tariffs directly increased the cost of imported goods, squeezing profit margins and impacting business profitability.

- Negative media coverage: Extensive media coverage of the trade war further fueled negative investor sentiment, heightening concerns about the economic outlook.

H3: Increased Market Volatility and Uncertainty

The uncertainty surrounding the trade war and its potential escalation contributed to heightened market volatility. This made accurately pricing Fintech IPOs extremely difficult, increasing the risk for investors.

- Fluctuating stock markets: The stock market responded to the ongoing trade tensions with significant fluctuations, making it challenging to predict long-term returns.

- Unpredictable economic outlook: The trade war created an unpredictable economic outlook, making it difficult for businesses to plan for the future and for investors to assess risk.

- Increased inflation: Tariffs contributed to increased inflation, eroding purchasing power and creating further uncertainty.

- Potential for further tariff escalation: The constant threat of further tariff escalation fueled ongoing market volatility and uncertainty.

H2: The Specific Case of Affirm Holdings (AFRM) IPO

Affirm Holdings (AFRM), a prominent buy-now-pay-later (BNPL) Fintech company, went public during this period of economic uncertainty. Examining its IPO provides valuable insights into the challenges faced by Fintech companies during this time.

H3: Timing of AFRM's IPO and Market Conditions

Affirm's IPO coincided with a period of significant market uncertainty driven by the Trump tariffs and subsequent global trade tensions. Analyzing the timing of the IPO in relation to the VIX index (a measure of market volatility) and prevailing interest rates reveals the challenging environment AFRM faced. Comparing its IPO to other Fintech IPOs during the same period further illustrates the impact of the broader market slowdown.

H3: AFRM's Strategic Decisions in a Challenging Market

To navigate this challenging landscape, Affirm likely implemented strategic adjustments, impacting its pricing strategy, fundraising goals, marketing efforts, and investor relations. Analyzing these strategic decisions sheds light on how companies attempted to mitigate the negative effects of the economic climate on their IPOs. Details on these specifics would require accessing financial filings and market analysis reports.

H3: Post-IPO Performance of AFRM

Analyzing Affirm's post-IPO performance, including its stock price, financial results, and investor response, provides crucial insights into the long-term impacts of the tariff-induced economic uncertainty. A comparative analysis with other Fintech companies during this period would further highlight the effects of the trade war and broader market conditions.

H2: The Broader Fintech IPO Landscape During the Trump Tariff Era

Affirm's experience wasn't necessarily isolated. Many other Fintech companies likely faced similar headwinds during the Trump tariff era.

H3: Comparison to Other Fintech IPOs

By comparing Affirm's IPO and subsequent performance to other Fintech companies that went public during the same period, we can determine if its struggles were unique or indicative of a broader trend among Fintech IPOs. This comparison reveals whether the economic uncertainty disproportionately impacted the Fintech sector or if it was a more general market phenomenon.

H3: The Role of Regulatory Uncertainty

Beyond the direct impact of tariffs, regulatory uncertainty played a significant role in shaping investor sentiment towards Fintech IPOs. Regulatory changes and potential future regulations impacted investor confidence. Understanding the interplay between economic uncertainty and regulatory risk provides a more holistic understanding of the challenges faced by Fintech companies during their IPOs.

3. Conclusion: Navigating the Complexities of Fintech IPOs in a Turbulent Global Economy

Trump's tariffs significantly impacted the Fintech IPO market, creating economic uncertainty and market volatility that challenged companies like Affirm Holdings (AFRM). The trade war negatively affected investor sentiment, making it difficult for Fintech companies to accurately price their IPOs and secure necessary funding. Affirm's experience exemplifies the broader challenges faced by many Fintech companies during this period. The interplay between global trade disputes, economic uncertainty, and regulatory risks presents significant challenges for Fintech companies seeking to enter the public market.

To better understand the dynamics between global economic events and the Fintech sector, further research into the impact of "Trump tariffs" and "Fintech IPOs" is encouraged. Analyzing case studies of other Fintech companies affected by similar market conditions will provide a more complete picture of the complexities involved in navigating the complexities of Fintech IPOs in a turbulent global economy. By understanding these factors, companies can better prepare for future market challenges and navigate the complexities of the public market.

Featured Posts

-

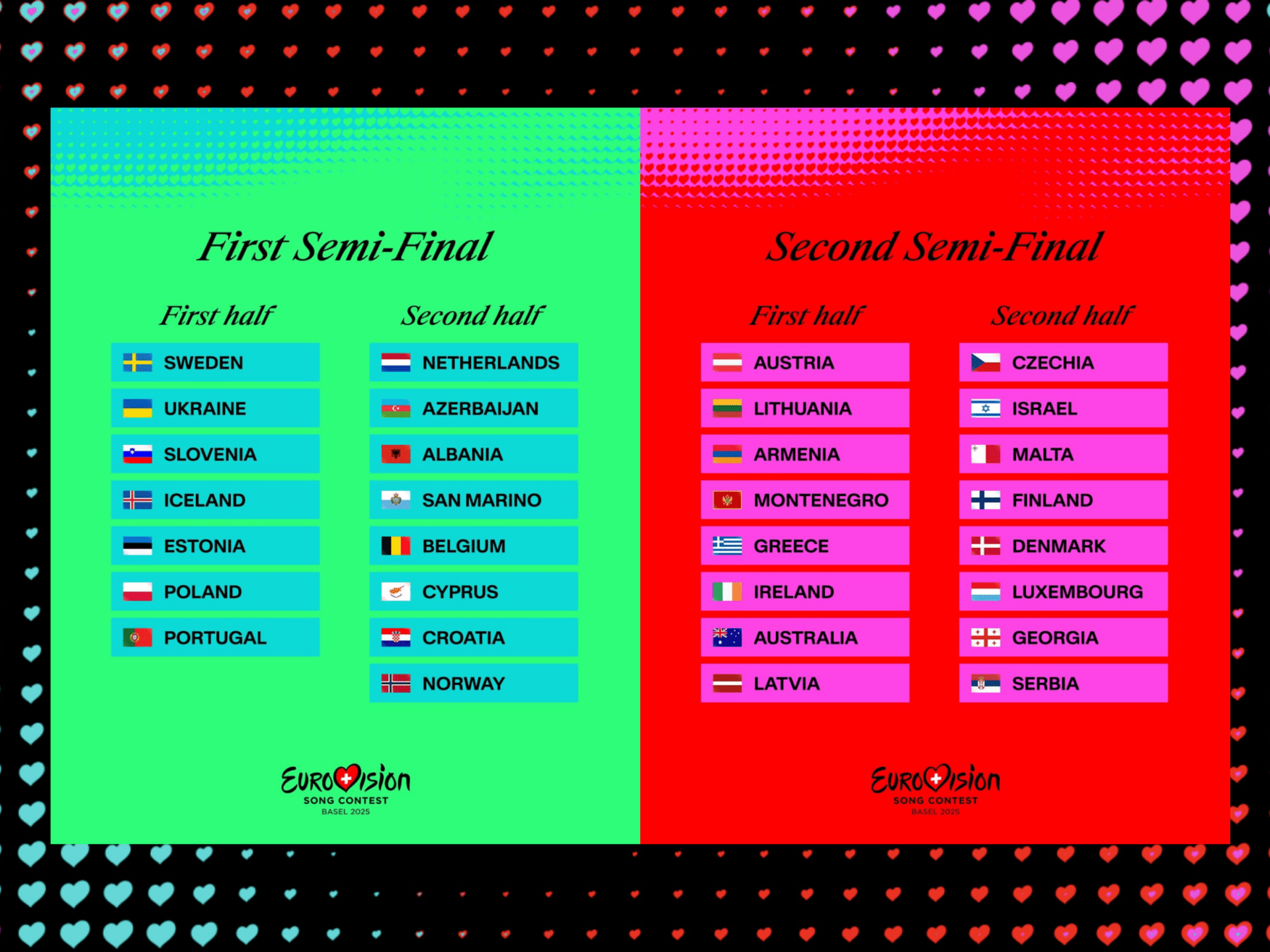

Eurovision 2025 Final And Semi Final Dates

May 14, 2025

Eurovision 2025 Final And Semi Final Dates

May 14, 2025 -

The Suits La Premiere A Deep Dive Into The Major Plot Twist

May 14, 2025

The Suits La Premiere A Deep Dive Into The Major Plot Twist

May 14, 2025 -

Eurovision 2024 Strong Swiss Franc Casts A Shadow On Fan Budgets

May 14, 2025

Eurovision 2024 Strong Swiss Franc Casts A Shadow On Fan Budgets

May 14, 2025 -

Product Recall Walmart Removes Electric Ride On Toys And Phone Chargers

May 14, 2025

Product Recall Walmart Removes Electric Ride On Toys And Phone Chargers

May 14, 2025 -

Uruguay Muere El Expresidente Jose Pepe Mujica A La Edad De 89 Anos

May 14, 2025

Uruguay Muere El Expresidente Jose Pepe Mujica A La Edad De 89 Anos

May 14, 2025