Trump Tariffs, Apple, And Buffett: A Look At Potential Stock Market Impacts

Table of Contents

The Direct Impact of Tariffs on Apple's Stock Price

Apple, a global tech giant heavily reliant on international supply chains, felt the direct brunt of the Trump tariffs. The increased costs and disruptions significantly impacted its stock price and overall performance.

Increased Production Costs

Tariffs on imported components dramatically increased Apple's manufacturing costs, squeezing profit margins.

- Higher costs for iPhones, iPads, and MacBooks: The tariffs directly increased the cost of producing Apple's flagship products.

- Potential price increases for consumers: To maintain profitability, Apple faced pressure to pass these increased costs onto consumers through higher prices.

- Reduced consumer demand due to higher prices: Higher prices led to a potential decrease in consumer demand, affecting sales and revenue.

- Impact on Apple's overall revenue and profitability: The combined effect of increased costs and potential reduced demand negatively impacted Apple's bottom line.

Supply Chain Disruptions

The tariffs disrupted Apple's intricate global supply chain, leading to delays and uncertainties.

- Reliance on Chinese manufacturing: A significant portion of Apple's manufacturing relies on Chinese factories, making them particularly vulnerable to US-China trade tensions.

- Challenges in diversifying supply chains: Shifting manufacturing away from China proved complex and costly, requiring significant investment and time.

- Geopolitical risks associated with tariff disputes: The unpredictability of tariff policies added significant geopolitical risk to Apple's operations.

- Impact on production timelines and product availability: Supply chain disruptions resulted in delays in product launches and potential shortages.

Investor Sentiment and Market Reaction

Investor concerns regarding Apple's future profitability, directly linked to the tariffs, heavily influenced its stock price.

- Stock price fluctuations: Apple's stock price experienced significant volatility throughout periods of tariff uncertainty.

- Analyst predictions and ratings: Analysts adjusted their predictions and ratings for Apple based on the impact of the tariffs on the company’s performance.

- Investor confidence: Investor confidence in Apple wavered as the uncertainty surrounding the tariffs continued.

- Comparison of Apple's performance to other tech companies: Apple's performance was compared to other tech companies less exposed to tariffs to gauge the specific impact of the trade policies.

Warren Buffett's Investment Strategies Amidst Tariff Uncertainty

Warren Buffett, renowned investor and head of Berkshire Hathaway, navigated the turbulent waters of tariff uncertainty with his characteristic long-term perspective.

Berkshire Hathaway's Portfolio Adjustments

Buffett's investment decisions in response to tariff-related market volatility provide a case study in effective risk management.

- Shifting investment focus: Berkshire Hathaway might have adjusted its investment focus towards sectors less vulnerable to tariff impacts.

- Increased diversification: Diversification across different sectors and geographies could have been a key strategy to mitigate tariff-related risks.

- Potential purchases of undervalued companies affected by tariffs: Buffett’s strategy may have included identifying and investing in undervalued companies negatively impacted by tariffs.

- Long-term investment strategy: Buffett's long-term approach likely cushioned Berkshire Hathaway from short-term market shocks caused by tariffs.

Buffett's Public Statements on Tariffs

Buffett's public commentary on trade wars and tariffs influenced market sentiment.

- Influence on investor confidence: Buffett's opinions carried significant weight, influencing investor confidence and market expectations.

- Impact on market perceptions of risk: His public statements shaped market perceptions of the risks associated with trade wars and tariffs.

- Buffett's reputation and its effect on investment decisions: His reputation as a shrewd investor impacted investment decisions made by others based on his assessments.

Lessons from Buffett's Approach

Buffett's approach during this period offers valuable lessons for investors:

- Long-term perspective: Maintaining a long-term perspective helps to weather short-term market volatility.

- Risk management: Diversification and careful risk assessment are crucial in navigating uncertain economic environments.

- Focus on fundamental value: Focusing on a company's intrinsic value, rather than short-term market fluctuations, is key.

- Diversification strategies: A diversified portfolio can help mitigate the impact of specific events like tariff increases.

Broader Impacts on the Stock Market

The Trump tariffs had widespread effects beyond individual companies, creating broader market instability.

Market Volatility and Uncertainty

Trade wars and tariff uncertainties fueled increased market volatility.

- Increased market swings: The stock market experienced heightened volatility as investors reacted to news regarding tariffs.

- Investor anxieties: Uncertainty surrounding trade policies increased investor anxieties, leading to cautious investment strategies.

- Impact on consumer confidence: Tariff-related uncertainties also negatively impacted consumer confidence, affecting overall spending.

- The overall economic climate: The overall economic climate became more uncertain, leading to slower economic growth in certain sectors.

Global Economic Slowdown

Tariffs contributed to concerns about a potential global economic slowdown.

- Reduced international trade: Tariffs reduced international trade volumes as companies adapted to new trade barriers.

- Negative impact on GDP growth: Reduced trade and investment led to a decline in global GDP growth in some regions.

- Potential recessionary risks: The uncertainty created by tariffs heightened concerns about the possibility of a global recession.

- International relations and trade agreements: Trade wars strained international relations and led to renegotiations of existing trade agreements.

Sector-Specific Impacts

Specific sectors were disproportionately impacted by the Trump tariffs.

- Manufacturing: The manufacturing sector, particularly industries reliant on imported components, faced significant challenges.

- Technology: The tech sector, like Apple, was affected by increased production costs and supply chain disruptions.

- Agriculture: The agricultural sector experienced considerable difficulties due to retaliatory tariffs imposed by other countries.

- Consumer goods: Consumers faced higher prices for certain goods due to the tariffs imposed on imported products.

- Specific examples of companies and their stock performance: Several companies experienced significant stock price fluctuations based on their exposure to the tariffs.

Conclusion

The impact of Trump tariffs on the stock market, as illustrated by Apple's experience and Warren Buffett's responses, showcases the complexities of international trade policy and its impact on investment decisions. Understanding the direct and indirect effects of tariffs – including increased costs, supply chain disruptions, and market volatility – is crucial for investors. By analyzing past events and adopting a long-term perspective, akin to Buffett's approach, investors can better navigate future uncertainties related to Trump Tariffs Stock Market Impact and similar geopolitical events. Staying informed about global trade dynamics and their implications is essential for making sound investment choices in a world increasingly impacted by protectionist policies. Continue learning about the Trump tariffs stock market impact to make informed investment decisions.

Featured Posts

-

Bangladesh Business Event In Netherlands Attracts European Investors

May 24, 2025

Bangladesh Business Event In Netherlands Attracts European Investors

May 24, 2025 -

Beurzen Herstellen Na Trumps Uitstel Aex Fondsen Stijgen

May 24, 2025

Beurzen Herstellen Na Trumps Uitstel Aex Fondsen Stijgen

May 24, 2025 -

Apple Stock And Trump Tariffs Assessing The Risk To Buffetts Investment

May 24, 2025

Apple Stock And Trump Tariffs Assessing The Risk To Buffetts Investment

May 24, 2025 -

Is Sean Penn A Me Too Blind Spot His Relationship With Woody Allen Under Scrutiny

May 24, 2025

Is Sean Penn A Me Too Blind Spot His Relationship With Woody Allen Under Scrutiny

May 24, 2025 -

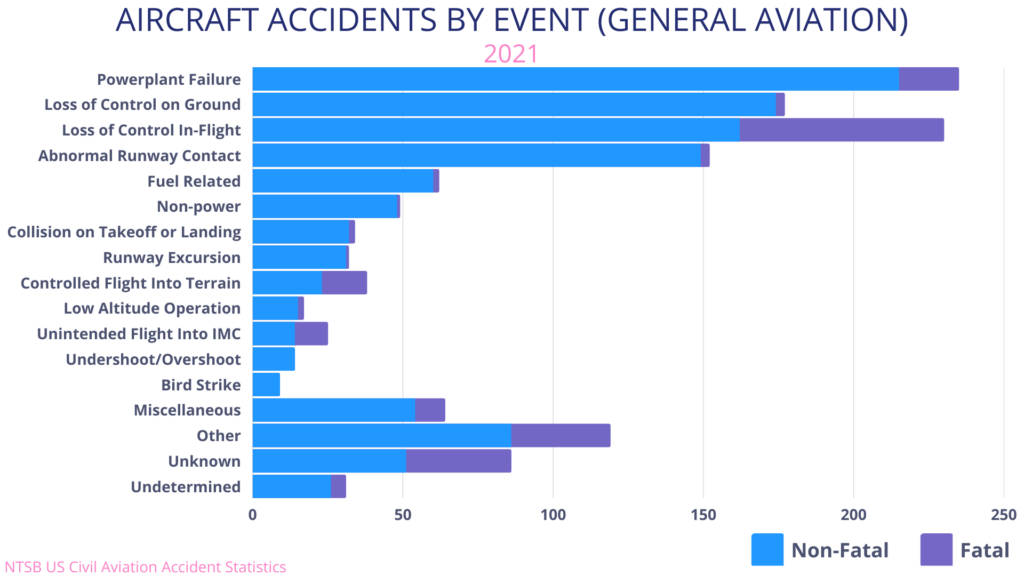

Close Calls And Crashes A Visual Exploration Of Airplane Safety

May 24, 2025

Close Calls And Crashes A Visual Exploration Of Airplane Safety

May 24, 2025