Trump Tariffs' Devastating Effect On Fintech IPOs: Examining The Affirm Holdings (AFRM) Situation

Table of Contents

The Economic Climate Created by Trump Tariffs and its Impact on Investor Sentiment

The Trump administration's tariffs, designed to protect American industries, ignited a trade war with significant global economic consequences. These tariffs led to increased inflation, disrupted supply chains, and ultimately dampened economic growth. This created a climate of uncertainty that profoundly impacted investor sentiment. Investors, faced with unpredictable trade policies and rising costs, became increasingly risk-averse.

This heightened uncertainty had a direct impact on the Fintech sector:

- Increased uncertainty regarding future profitability for Fintech companies: The unpredictable nature of trade wars made it difficult for Fintech companies to forecast future revenue and profitability, deterring potential investors.

- Reduced investor appetite for riskier investments, including IPOs: In a climate of uncertainty, investors favored safer, more established investments, leading to a decline in investment in riskier ventures like Fintech IPOs.

- Negative impact on global market sentiment impacting IPO valuations: The overall negative sentiment in the global markets due to trade tensions translated into lower valuations for IPOs, including those in the Fintech sector.

- Increased volatility in the stock market: The trade war and resulting economic uncertainty contributed to increased volatility in the stock market, making it a challenging environment for IPOs to thrive.

Affirm Holdings (AFRM) and its Vulnerability to Tariff-Induced Economic Slowdown

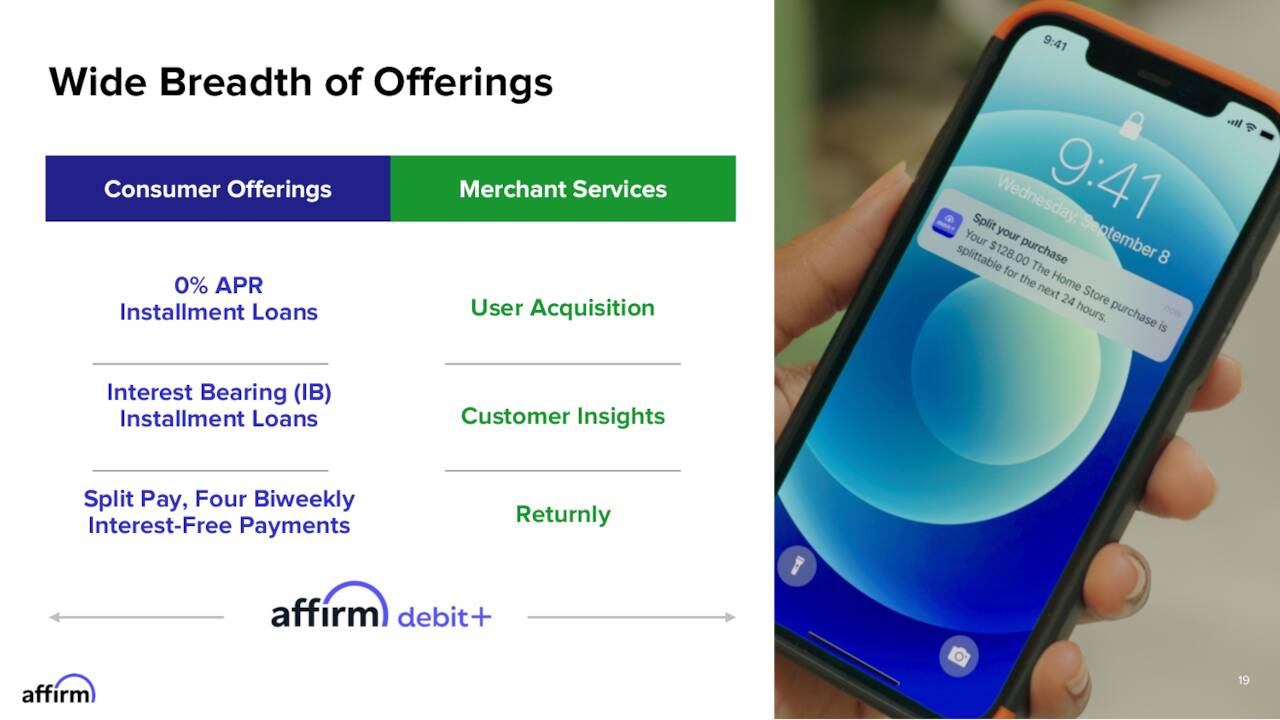

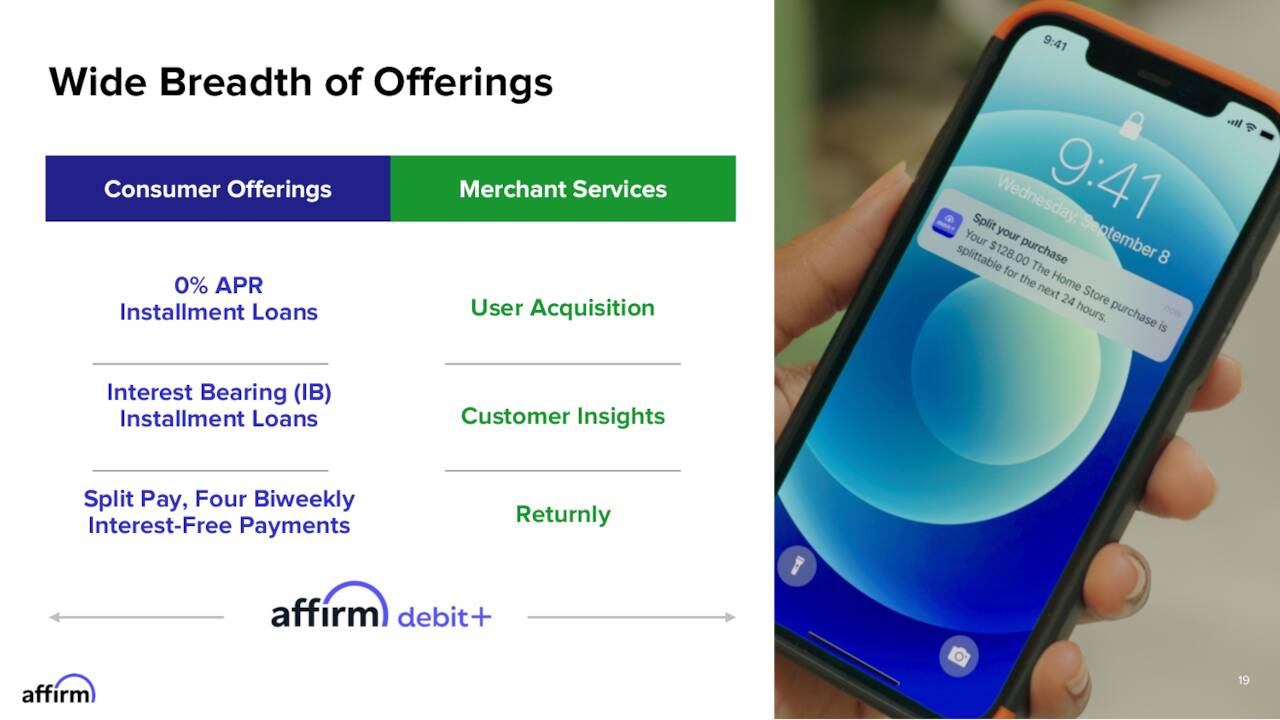

Affirm Holdings (AFRM), a buy now, pay later (BNPL) fintech company, operates within a sector particularly sensitive to economic downturns. Its business model relies heavily on consumer spending and discretionary purchases. The economic slowdown caused by the Trump tariffs directly impacted Affirm's revenue streams.

- Dependence on consumer discretionary spending: A significant portion of Affirm's revenue comes from consumer purchases of non-essential goods and services – a segment particularly vulnerable to economic slowdowns. Tariffs contributed directly to the slowdown.

- Increased loan defaults in an economic downturn: As consumers faced higher prices and economic uncertainty, the likelihood of loan defaults increased, negatively affecting Affirm's profitability.

- Reduced merchant adoption of Affirm's payment platform: With reduced consumer spending, merchants were less likely to adopt Affirm's payment platform as a means of stimulating sales.

- Pressure on AFRM's stock price: The combination of these factors put considerable pressure on AFRM's stock price following its IPO.

Specific Examples of How Tariffs Affected AFRM's IPO and Post-IPO Performance

Affirm's IPO occurred during a period of significant tariff implementation. Analyzing AFRM's stock performance in relation to tariff-related news reveals a noticeable correlation.

- Comparison of AFRM's IPO valuation with similar Fintech IPOs unaffected by tariffs: A comparison with other Fintech IPOs less exposed to tariff-related effects can show the potential negative impact of the trade policies on the valuation.

- Stock price performance before, during, and after the period of significant tariff implementation: Charting AFRM's stock price reveals dips correlating with announcements of new tariffs or escalating trade tensions, which affected investor confidence.

- Analysis of investor statements and reports concerning the impact of tariffs on AFRM: Investor statements and reports often cited the broader economic uncertainty as a key factor impacting AFRM's performance and valuation in the post-IPO period.

The Role of Supply Chain Disruptions in Impacting Fintech Growth

Beyond the direct economic impact, the Trump tariffs significantly disrupted global supply chains. This had a cascading effect on Fintech companies, including Affirm.

- Increased costs of hardware and software needed for operations: Disruptions in supply chains led to increased costs for essential hardware and software components, impacting Affirm's operational expenses.

- Delays in product development and deployment due to supply chain issues: The inability to access necessary components on time caused delays in product development and deployment, impacting Affirm's growth trajectory.

- Impacts on customer service due to logistical disruptions: Supply chain issues also affected customer service, leading to delays in order fulfillment and increased customer support costs.

Conclusion

The Trump-era tariffs significantly impacted investor confidence, creating a challenging environment for Fintech IPOs like Affirm Holdings (AFRM). The economic uncertainty and supply chain disruptions negatively affected AFRM's performance, highlighting the vulnerability of this sector to global trade policies. Understanding the devastating effects of trade policies, like the Trump tariffs, on the Fintech sector is crucial for investors and entrepreneurs. Further research into the impact of Trump Tariffs Fintech IPOs is needed to mitigate future risks and develop more resilient business strategies. Continue learning about the intricacies of global trade and its impact on financial markets.

Featured Posts

-

Conquer Dynamax Sobble A Pokemon Go Max Battle Guide For Max Mondays

May 14, 2025

Conquer Dynamax Sobble A Pokemon Go Max Battle Guide For Max Mondays

May 14, 2025 -

Is Kanye West And Bianca Censoris Marriage On The Mend

May 14, 2025

Is Kanye West And Bianca Censoris Marriage On The Mend

May 14, 2025 -

Dernieres Nominations Au Sein De Societe Generale

May 14, 2025

Dernieres Nominations Au Sein De Societe Generale

May 14, 2025 -

Zegler Present Gadot Absent Snow White Spain Promotional Event

May 14, 2025

Zegler Present Gadot Absent Snow White Spain Promotional Event

May 14, 2025 -

Epl Awoniyi Fit For Newcastle Clash Confirms Santo

May 14, 2025

Epl Awoniyi Fit For Newcastle Clash Confirms Santo

May 14, 2025