Trump Tariffs Weigh On Infineon (IFX): Sales Forecast Below Expectations

Table of Contents

The Impact of Trump Tariffs on Infineon's Supply Chain

The Trump administration's tariffs significantly disrupted Infineon's supply chain, leading to substantial challenges. These challenges are multifaceted and far-reaching, impacting various aspects of the company's operations.

-

Increased Import Costs: Tariffs imposed on raw materials and components crucial for Infineon's manufacturing process have dramatically increased import costs. This directly impacts the company's profitability, squeezing margins and making it harder to compete in a global market. The cost of essential materials like silicon wafers and specialized chemicals has risen considerably, eating into profits.

-

Supply Chain Disruptions: The tariffs didn't just increase costs; they also caused significant disruptions to the global supply chain. Production delays became more frequent, and lead times for essential components lengthened, hindering timely manufacturing and order fulfillment. This unpredictability makes efficient production planning extremely difficult.

-

Demand Forecasting Difficulties: The inherent instability introduced by fluctuating tariff policies made accurate demand forecasting extremely difficult. This uncertainty forced Infineon to adjust its production strategies frequently, adding to costs and potentially leading to missed opportunities.

-

Profitability Margin Pressure: Infineon has been forced to absorb a significant portion of the increased costs to remain competitive, resulting in considerable pressure on profitability margins. This balancing act between maintaining competitiveness and preserving profitability is a major ongoing challenge.

-

Specific Product Lines Affected: While the impact is widespread, certain product lines within Infineon's portfolio are disproportionately affected by tariff increases. These include specific power semiconductors and automotive chips reliant on imported components subject to higher tariffs.

Infineon's Revised Sales Forecast and Financial Implications

Infineon's revised sales forecast reflects the harsh realities of operating under the weight of these tariffs. The downward revision represents a significant departure from previous projections, raising concerns among investors.

-

Revised Forecast vs. Previous Projections: A detailed comparison of the revised forecast with previous projections clearly shows a substantial shortfall. This discrepancy highlights the seriousness of the impact of the tariffs on Infineon's revenue generation.

-

Impact on Financial Performance: The reduced sales forecast directly impacts Infineon's overall financial performance. Revenue is expected to be lower, impacting profits and earnings per share (EPS). This directly translates to lower returns for shareholders.

-

Long-Term Consequences: The continued uncertainty surrounding global trade and the potential for further tariff increases pose significant long-term consequences for Infineon. The company faces the challenge of adapting to a volatile and unpredictable environment.

-

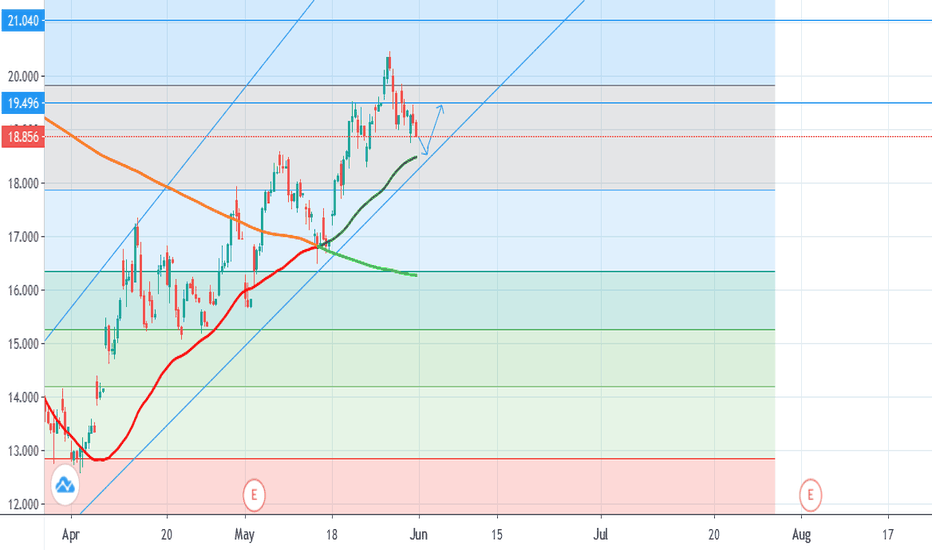

Investor Reactions and Stock Price: The announcement of the revised forecast triggered immediate market reaction, causing a dip in Infineon's stock price. This reflects investor concern about the company's future prospects.

-

Comparison to Competitors: Comparing Infineon's performance to competitors facing similar trade challenges reveals that the impact of the tariffs varies. Analyzing these variations can provide insights into the effectiveness of different mitigation strategies.

Investor Sentiment and Market Reaction

The market's response to Infineon's revised sales forecast reflects the prevalent investor sentiment.

-

Market Volatility: The news caused increased volatility in Infineon's stock price, highlighting the uncertainty surrounding the company's future. This volatility underscores the risk associated with investing in IFX.

-

Investment Strategies: Given the revised forecast and ongoing trade uncertainties, investors need to carefully reassess their investment strategies concerning Infineon. Diversification might be a prudent approach.

-

Risk Assessment: Investing in Infineon currently presents a higher risk due to the ongoing trade uncertainties. Thorough due diligence and a comprehensive risk assessment are crucial before making any investment decisions.

-

Alternative Investment Opportunities: Investors might explore alternative investment opportunities within the semiconductor sector, focusing on companies less affected by the Trump-era tariffs.

Strategies for Infineon to Mitigate the Impact of Tariffs

Infineon needs to actively pursue strategies to mitigate the negative impact of tariffs. These strategies require a multi-pronged approach.

-

Supply Chain Diversification: Diversifying its supply chain to reduce reliance on specific regions or suppliers affected by tariffs is critical. This reduces vulnerability to future disruptions.

-

Cost Reduction Strategies: Implementing rigorous cost-reduction measures across the entire operation is crucial for offsetting increased import costs and maintaining profitability.

-

Government Policy and Advocacy: Engaging in advocacy efforts to influence trade policies and potentially secure tariff reductions or exemptions is crucial. Industry-wide lobbying can make a significant impact.

-

Long-Term Strategic Adjustments: Infineon needs to consider long-term strategic adjustments to adapt to the changing global trade landscape. This might include shifting manufacturing locations or investing in new technologies.

Conclusion

The lingering effects of the Trump-era tariffs continue to significantly challenge Infineon (IFX), as clearly demonstrated by the disappointing sales forecast. Increased import costs, supply chain disruptions, and the unpredictability of future trade policies create a complex and challenging environment for the semiconductor giant. Understanding these challenges is crucial for investors and stakeholders alike. Stay informed about the evolving impact of trade policies on Infineon (IFX) and other key players in the semiconductor industry. Thoroughly research the implications of the Trump Tariffs before making any investment decisions related to Infineon or similar companies affected by global trade issues.

Featured Posts

-

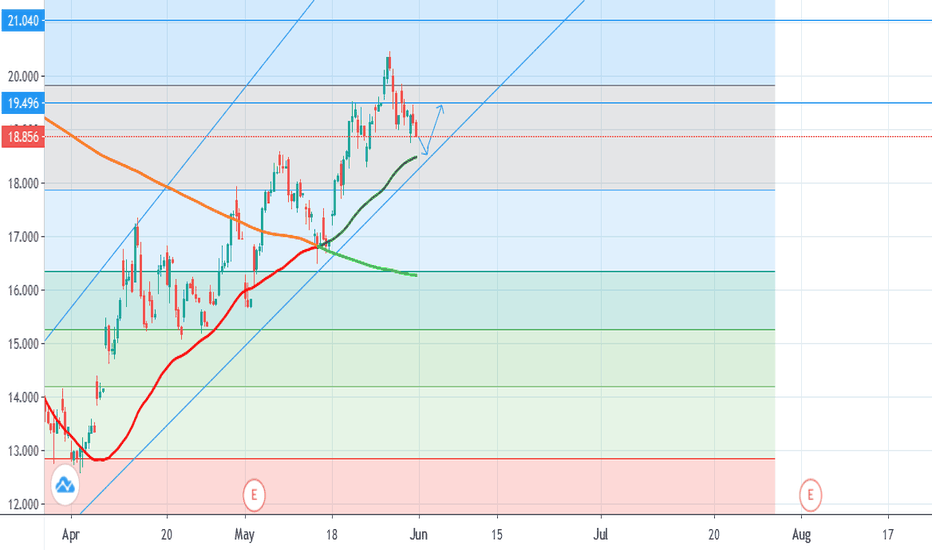

Kiem Tra Va Xu Ly Nghiem Cac Truong Hop Bao Hanh Tre Em O Co So Giu Tre Tu Nhan

May 09, 2025

Kiem Tra Va Xu Ly Nghiem Cac Truong Hop Bao Hanh Tre Em O Co So Giu Tre Tu Nhan

May 09, 2025 -

Farcical Misconduct Nottingham Families Fight For Procedural Delay

May 09, 2025

Farcical Misconduct Nottingham Families Fight For Procedural Delay

May 09, 2025 -

Samuel Dickson A Canadian Lumber Barons Legacy

May 09, 2025

Samuel Dickson A Canadian Lumber Barons Legacy

May 09, 2025 -

Fur Rondy Shorter Race Unwavering Mushers

May 09, 2025

Fur Rondy Shorter Race Unwavering Mushers

May 09, 2025 -

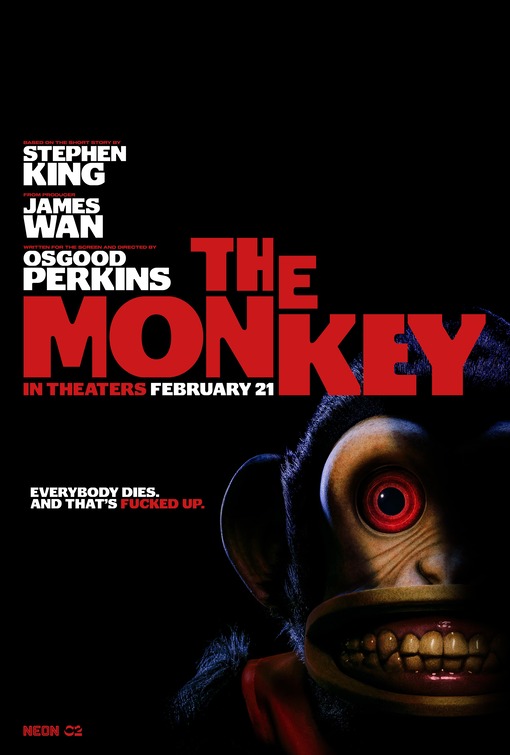

The Monkey Movie Will It Define Stephen Kings 2025 Success Or Failure

May 09, 2025

The Monkey Movie Will It Define Stephen Kings 2025 Success Or Failure

May 09, 2025