Trump Tax Plan Unveiled: Key Details From House Republicans

Table of Contents

Individual Income Tax Changes

This section details how the proposed Trump Tax Plan affects individual taxpayers. Understanding the changes to your tax bracket and deductions is crucial for planning your finances.

Changes to Tax Brackets

The Trump Tax Plan proposed significant changes to individual income tax brackets. While specific rates varied across different versions of the plan, the overall aim was to simplify the tax code and lower marginal tax rates. Keywords like "tax brackets," "marginal tax rates," "tax cuts," and "income tax rates" were central to the debate.

- Proposed Changes (Illustrative Example): While the exact numbers varied across proposals, some versions suggested a reduction from seven brackets to three or four, with lower rates across the board. This could mean substantial tax savings for many individuals.

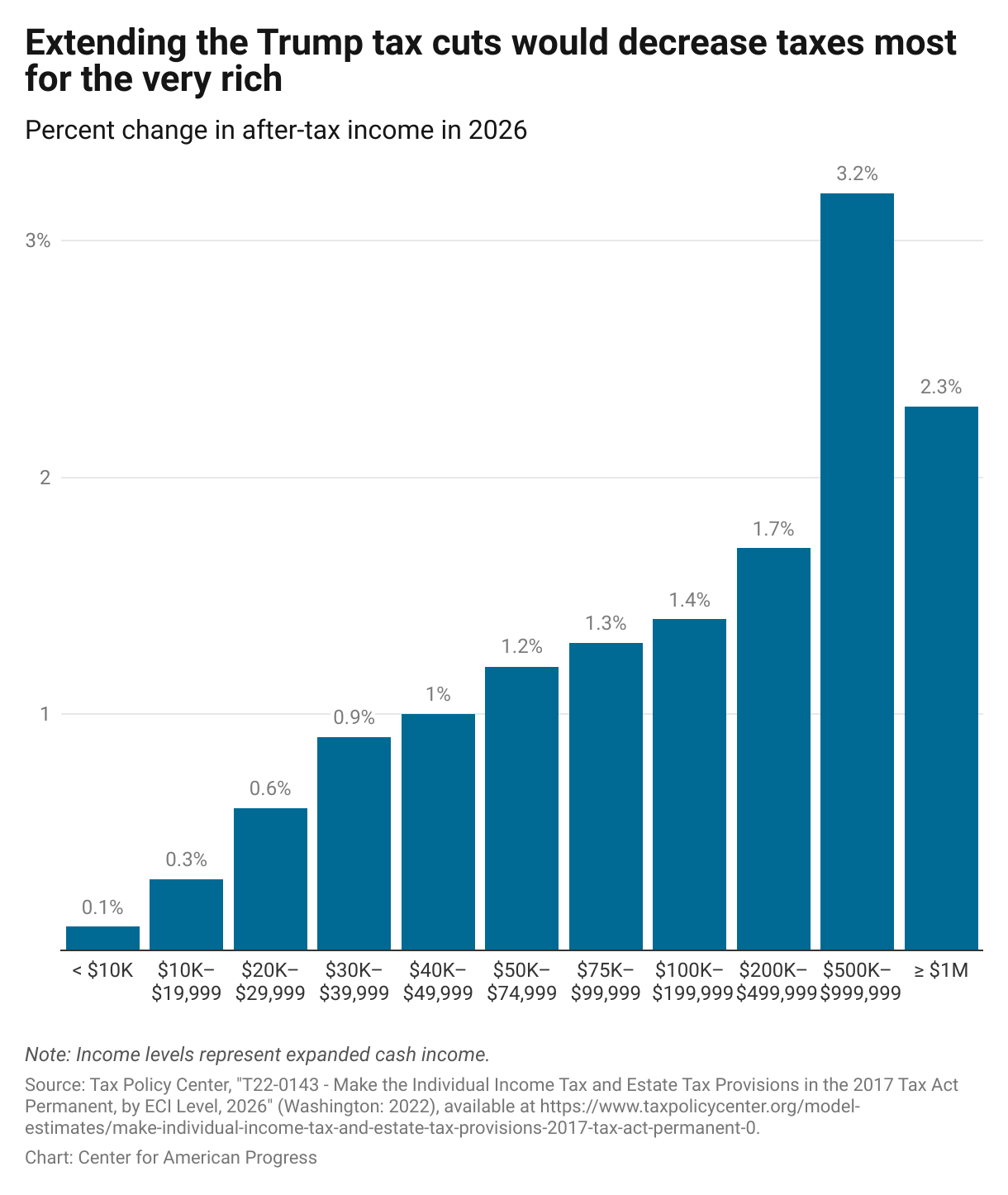

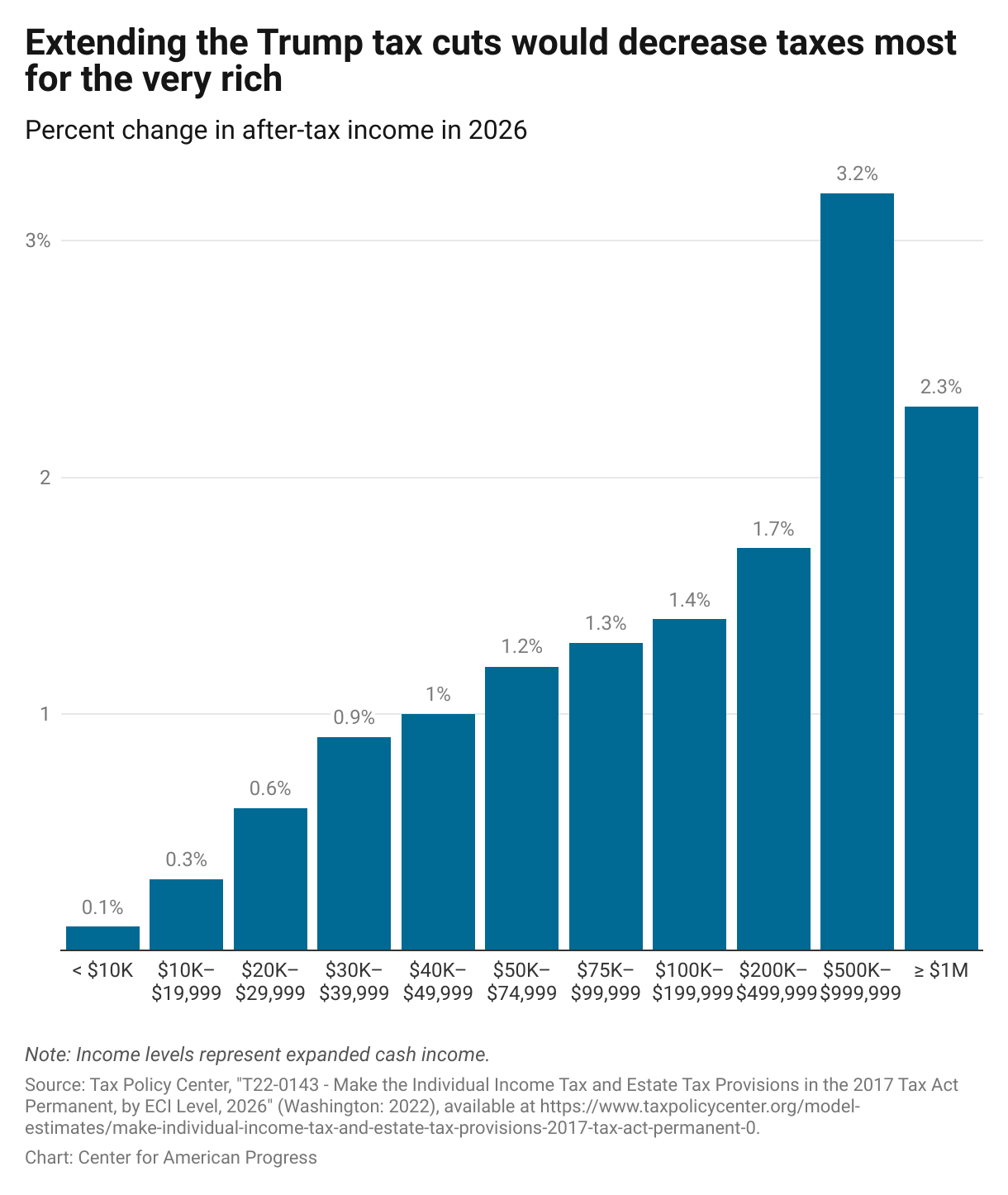

- Impact on Different Income Levels: Lower-income taxpayers might see minimal changes, while higher-income taxpayers could potentially see more significant tax reductions. The specifics depended greatly on the proposed bracket structure and applicable deductions.

- Standard Deduction and Personal Exemptions: The plan often included proposals to increase the standard deduction significantly, potentially eliminating the need for itemized deductions for many. Personal exemptions, previously used to reduce taxable income for dependents, were often eliminated in proposed plans.

Impact on Itemized Deductions

The Trump Tax Plan aimed to simplify the tax code, and a major component of this involved altering or eliminating certain itemized deductions. Keywords like "itemized deductions," "SALT deduction," "mortgage interest deduction," and "charitable deduction" were frequently debated.

- SALT Deduction (State and Local Taxes): A controversial aspect was the potential limitation or elimination of the deduction for state and local taxes. This change disproportionately affected taxpayers in high-tax states.

- Mortgage Interest Deduction: The mortgage interest deduction, a significant benefit for homeowners, was generally preserved in most proposals, though its limitations may have been altered.

- Charitable Contributions: Deductions for charitable contributions were often maintained, but the extent to which these deductions were preserved varied across different versions of the plan.

Child Tax Credit Modifications

The Trump Tax Plan often included provisions to modify the child tax credit, aiming to provide more substantial tax relief for families. Keywords such as "child tax credit," "family tax relief," and "dependent care" were frequently associated with this aspect of the proposals.

- Increased Credit Amount: Proposals suggested increasing the maximum amount of the child tax credit, potentially offering greater financial assistance to families.

- Eligibility Requirements: Changes to eligibility requirements might have broadened access to the credit for a larger number of families.

- Impact on Low-to-Moderate Income Families: While the credit benefited all families with qualifying children, the proposals aimed to make it more beneficial for low-to-moderate-income families by potentially making some or all of the credit refundable.

Business Tax Reform

The Trump Tax Plan proposed substantial changes to the US business tax system, aiming to stimulate economic growth and make the US more competitive globally.

Corporate Tax Rate Reduction

A central aspect was the reduction in the corporate tax rate. Keywords like "corporate tax rate," "business tax reform," and "economic growth" were consistently used to describe this component.

- Proposed Rate Reduction: The plan proposed a significant reduction in the corporate tax rate, from the then-current rate of 35% to a lower rate (e.g., 20% or lower, depending on the specific proposal).

- Impact on Job Creation and Investment: Proponents argued that the lower rate would incentivize businesses to invest more, create jobs, and boost economic activity. Critics cautioned that the effects might be less impactful than predicted.

Pass-Through Business Taxation

The plan also addressed the taxation of pass-through entities, such as S corporations and partnerships. Keywords like "pass-through entities," "small business tax relief," "S corporations," and "partnerships" were frequently associated with this part of the legislation.

- Proposed Changes: The proposals typically aimed to simplify the tax treatment of pass-through businesses, often including deductions or tax rate reductions aimed at benefiting small business owners.

- Benefits and Drawbacks: While the changes aimed to benefit small business owners, potential drawbacks included the complexity of implementing and ensuring fair application across various business structures.

International Tax Implications

The Trump Tax Plan sought to address the taxation of US multinational corporations and their international operations. Keywords like "international tax," "repatriation," "foreign tax credit," and "multinational corporations" were common in discussions.

- Repatriation of Profits: Proposals often included provisions to encourage the repatriation of profits held overseas by US corporations, incentivizing them to bring money back to the US.

- Foreign Tax Credits: The treatment of foreign tax credits, which offset US taxes on foreign-source income, was also subject to modification in various proposals.

- Impact on US Competitiveness: The ultimate impact on US competitiveness globally depended on how the changes interacted with the tax policies of other countries.

Potential Economic Impacts of the Trump Tax Plan

Analyzing the potential economic consequences of the Trump Tax Plan is critical. The implications for GDP growth and the national debt were extensively debated.

GDP Growth Projections

Many economic forecasts were produced regarding the potential impact on gross domestic product (GDP) growth. Keywords like "GDP growth," "economic stimulus," and "fiscal policy" were central to these analyses.

- Varying Projections: Projections from different sources varied considerably, reflecting the uncertainty inherent in forecasting the effects of large-scale tax changes.

- Potential Downsides: Concerns were raised about the potential for inflation or increased inequality as potential downsides to the projected economic stimulus.

National Debt Implications

The proposed tax cuts raised concerns about their impact on the national debt. Keywords like "national debt," "budget deficit," and "fiscal responsibility" were heavily debated.

- Increased National Debt: Most analyses predicted a significant increase in the national debt as a result of the proposed tax cuts, due to the reduced tax revenue.

- Offsetting Measures: The proposals lacked clear, concrete plans for how the revenue loss from the tax cuts would be offset, leading to significant fiscal concerns.

Conclusion

The Trump Tax Plan, as detailed by House Republicans, represents a significant shift in US tax policy. This plan proposed substantial changes to individual and corporate tax rates, deductions, and credits, potentially leading to significant impacts on various sectors of the economy. Understanding the key details of the Trump Tax Plan is crucial for individuals and businesses to prepare for its potential consequences. We've analyzed the major aspects, from individual income tax brackets to corporate tax reform and its potential effects on the national debt, offering insights to help you navigate this complex policy. To stay informed on further developments and analysis of the Trump Tax Plan, continue to follow our updates and resources.

Featured Posts

-

Svedsko Dominuje 18 Hracu Nhl Na Mistrovstvi Sveta

May 15, 2025

Svedsko Dominuje 18 Hracu Nhl Na Mistrovstvi Sveta

May 15, 2025 -

Roma Monza Sigue El Partido En Directo

May 15, 2025

Roma Monza Sigue El Partido En Directo

May 15, 2025 -

Get Ready Nhl 25 Arcade Mode Is Back

May 15, 2025

Get Ready Nhl 25 Arcade Mode Is Back

May 15, 2025 -

Dial 108 Ambulance Contract Bombay Hc Ruling

May 15, 2025

Dial 108 Ambulance Contract Bombay Hc Ruling

May 15, 2025 -

Roma Monza Partido En Directo

May 15, 2025

Roma Monza Partido En Directo

May 15, 2025