Trump's Billionaire Friends: How Tariffs Impacted Their Fortunes After Liberation Day

Table of Contents

The Pre-Tariff Landscape

Before the implementation of tariffs, many billionaires associated with the Trump administration held substantial assets and business interests deeply intertwined with global trade. Understanding their pre-tariff positions is crucial to assessing the impact of the subsequent trade policies.

Key Figures and Their Industries

Several prominent billionaires enjoyed close relationships with President Trump. Their business sectors varied considerably, leading to a diverse range of responses to the new tariff regime.

- Carl Icahn: A significant investor with holdings across various sectors, including energy and manufacturing, Icahn's portfolio had a considerable exposure to international trade. His pre-tariff net worth was estimated in the billions.

- Stephen Schwarzman: Chairman and CEO of Blackstone, a global investment firm, Schwarzman's vast holdings made his firm vulnerable to fluctuations in global markets influenced by trade policies. His pre-tariff net worth placed him amongst the world's wealthiest individuals.

- Robert Kraft: Owner of the New England Patriots and chairman and CEO of The Kraft Group, Kraft's business interests extended beyond sports to packaging and real estate, some of which relied on imported materials. His pre-tariff net worth reflected his diverse holdings.

- Thomas Peterffy: Chairman and founder of Interactive Brokers, a global brokerage firm, Peterffy's business was directly influenced by international trade and investment flows. His pre-tariff net worth was substantial.

- Sheldon Adelson: A casino magnate with extensive international business interests, Adelson's empire was sensitive to shifts in global tourism and the overall economic climate. His pre-tariff net worth was exceptionally high.

Global Trade Dependence

The extent to which these billionaires relied on international trade varied significantly. Some businesses were heavily reliant on importing raw materials or exporting finished goods, while others operated primarily within the domestic market.

- Import Dependence: Many manufacturing businesses, even those owned by US billionaires, relied heavily on imported components, making them vulnerable to increased tariff costs.

- Export Dependence: Companies exporting goods to international markets faced challenges from retaliatory tariffs imposed by other countries in response to Trump's trade policies.

- Supply Chain Disruptions: Global supply chains were significantly disrupted by the trade war, impacting businesses across various sectors, impacting delivery times, and increasing costs.

Data on the precise pre-tariff import/export values for each billionaire are difficult to obtain publicly, however, news reports and financial analyses at the time frequently highlighted the significant international exposure of these individuals’ business empires.

The Impact of Tariffs Post-"Liberation Day"

The implementation of tariffs after "Liberation Day" (our term for a significant policy shift) had a complex and multifaceted impact on the financial fortunes of these billionaires. Some benefited, while others experienced significant losses.

Winners and Losers

The tariffs created both winners and losers among the billionaire class. Sectors protected by the tariffs saw increased profitability, while sectors reliant on imports faced higher costs.

- Winners: Companies producing goods that now had increased domestic market share due to tariffs on imports often saw boosts in profits. Some billionaires invested in these sectors, leading to significant gains.

- Losers: Businesses reliant on imported raw materials or exporting to foreign markets experienced decreased profitability due to increased costs and reduced demand. Others saw their investments decline.

Shifting Investment Strategies

The uncertainty created by the trade war forced many billionaires to reassess their investment strategies. Some diversified their holdings, while others sought to mitigate risk through relocation or restructuring.

- Diversification: Billionaires sought to reduce reliance on specific sectors vulnerable to tariffs by investing in diverse markets and asset classes.

- Relocation of Businesses: To avoid tariffs, some companies considered relocating production facilities outside the US.

- Lobbying and Political Influence: Many billionaires engaged in increased lobbying efforts to influence trade policy decisions.

Financial analysts at the time frequently commented on the significant shift in investment strategies prompted by the uncertainty surrounding the Trump administration’s trade policies.

Long-Term Effects and Lasting Implications

The long-term consequences of Trump's tariffs on the wealth and influence of his billionaire friends are still unfolding. However, some effects are already evident.

Restructuring and Consolidation

The economic pressure from tariffs may have accelerated mergers, acquisitions, and restructuring in various industries. Companies struggling to compete under the new trade regime sought to merge or consolidate to improve their efficiency and profitability.

- Mergers and Acquisitions: Some businesses facing increased costs from tariffs were acquired by more financially stable companies. Consolidation within sectors could have led to fewer, larger players.

- Industry Restructuring: Businesses adapted to the changing economic landscape by streamlining operations, focusing on specific markets, or reducing reliance on imported goods.

Political and Social Ramifications

The tariffs and their economic consequences had broader political and social implications. The impact on the public perception of these billionaires and their influence remains a topic of ongoing discussion and analysis.

- Public Opinion: The public’s perception of the billionaires who benefited from the tariffs was often debated. Critics highlighted inequalities and questioned the fairness of the trade policies.

- Political Influence: The trade policies and their consequences could have influenced the political landscape and the billionaires’ capacity to further influence political decision-making.

Conclusion

Trump's tariffs had a complex and uneven impact on the fortunes of his billionaire friends. Some thrived while others suffered substantial losses. The uncertainty fueled by the trade war forced significant shifts in investment strategies and spurred industry restructuring. Understanding the impact of Trump's tariffs on his billionaire friends offers valuable insights into the complexities of global trade. Continue exploring the long-term effects of these policies and their implications for the future by further researching the topic of Trump's billionaire friends and the impact of tariffs.

Featured Posts

-

French Minister Calls For Stronger Eu Response To Us Tariffs

May 09, 2025

French Minister Calls For Stronger Eu Response To Us Tariffs

May 09, 2025 -

Cryptocurrencys Resilience Amidst Trade Wars A Winning Prospect

May 09, 2025

Cryptocurrencys Resilience Amidst Trade Wars A Winning Prospect

May 09, 2025 -

Alpines Message To Doohan Key Developments In Formula 1 News

May 09, 2025

Alpines Message To Doohan Key Developments In Formula 1 News

May 09, 2025 -

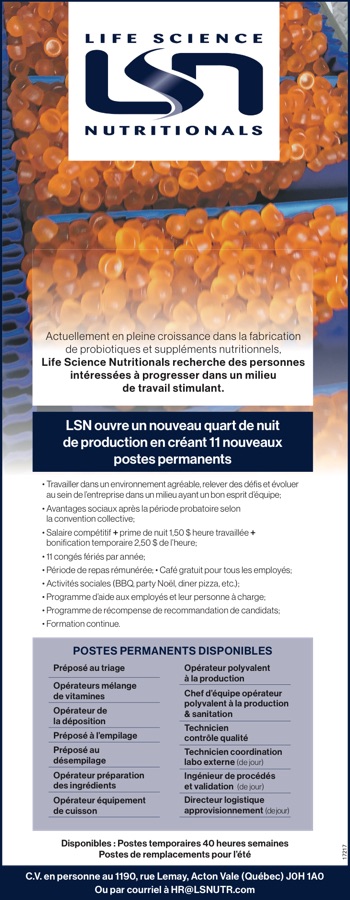

Jobs A Dijon Plusieurs Postes Disponibles Restaurants And Rooftop

May 09, 2025

Jobs A Dijon Plusieurs Postes Disponibles Restaurants And Rooftop

May 09, 2025 -

Trump Ag Pam Bondis Laughter During Comers Epstein Files Tirade

May 09, 2025

Trump Ag Pam Bondis Laughter During Comers Epstein Files Tirade

May 09, 2025