Trump's Comments On Powell: Stability For The Federal Reserve?

Table of Contents

The History of Trump's Criticism of Powell

President Trump's relationship with former Federal Reserve Chairman Jerome Powell was notoriously turbulent. His public criticism spanned several key instances, often fueled by disagreements over monetary policy. These criticisms weren't subtle; they were frequently aired via highly visible platforms like Twitter and in press interviews.

-

Interest Rate Hikes (2018-2019): Trump repeatedly attacked Powell for raising interest rates, arguing that this action hindered economic growth and hampered his administration's economic agenda. These criticisms came at a time when the US economy was experiencing robust growth, but Trump felt the Fed was unnecessarily tightening monetary policy. The keyword here is Trump Powell criticism, specifically focused on interest rate decisions.

-

Monetary Policy During the COVID-19 Pandemic (2020): While the initial response to the pandemic saw some alignment, Trump later criticized the Fed's continued low-interest-rate policies, contrasting them with his own calls for greater stimulus. This highlights how even during times of crisis, the Trump Powell Federal Reserve dynamic remained tense, with disagreements over the appropriate monetary response.

-

"Too Slow" Response to Inflation (2021-2022): As inflation surged, Trump criticized Powell for being too slow to raise interest rates, arguing that the Fed was not effectively managing price increases. This criticism further emphasized the ongoing tension regarding Federal Reserve interest rates and the broader monetary policy Trump approach.

The Impact of Trump's Comments on Market Volatility

Trump's public attacks on Powell undeniably created market volatility. Each instance of criticism triggered measurable reactions:

-

Stock Market Fluctuations: The stock market often experienced immediate drops following highly critical statements from the President. These drops reflected investor uncertainty and concern about the potential for political interference in the Federal Reserve's operations. This impacted market volatility Trump Powell.

-

Bond Yield Shifts: Bond yields, a key indicator of investor sentiment and expectations of future interest rates, also reacted to Trump's pronouncements. Increases in yields reflected fears about potential inflationary pressures or instability resulting from the Trump Powell Federal Reserve conflict.

-

Increased Economic Uncertainty: The constant barrage of criticism generated considerable economic uncertainty. This uncertainty made it difficult for businesses to plan investments and for consumers to make purchasing decisions, further impacting investor confidence Federal Reserve. Data from this period showed clear correlations between Trump's comments and spikes in the VIX (Volatility Index), a key measure of market fear.

Powell's Response and the Federal Reserve's Independence

Powell, throughout his tenure, largely maintained a posture of defending the Fed's independence. He generally avoided direct responses to Trump's attacks, emphasizing the importance of the central bank's autonomy from political influence. This demonstrated a commitment to preserving Federal Reserve independence. The potential threats to this independence are significant:

-

Erosion of Public Trust: Political interference, even in the form of public criticism, can erode public trust in the Fed's ability to make unbiased decisions based solely on economic data.

-

Compromised Monetary Policy Decisions: The fear of political retribution could pressure the Fed to adopt policies that are not in the best interest of the long-term economic health of the nation.

-

Weakening of the US Dollar: Political uncertainty surrounding the Fed's independence could negatively affect the value of the US dollar in global markets.

The historical context and legal framework supporting the Fed's independence are crucial to understanding the gravity of these threats. The Powell response Trump was primarily a steadfast defense of the institution's principles.

Long-Term Effects on the US Economy

Trump's actions and rhetoric regarding the Trump Powell Federal Reserve dynamic could have significant long-term economic consequences. The uncertainty created by these attacks could potentially:

-

Increase Inflation: If the Fed is pressured to prioritize short-term political goals over long-term price stability, it could lead to sustained higher inflation rates.

-

Slow Economic Growth: Uncertainty and a lack of confidence in the central bank can hinder investment and economic expansion.

-

Damage the US Dollar's Global Status: The undermining of the Federal Reserve's independence could negatively impact the global status and stability of the US dollar.

Experts across the economic spectrum have voiced concerns about the potential for lasting damage resulting from this unprecedented political pressure on the Federal Reserve.

Conclusion

Trump's comments on Powell did, undoubtedly, create significant challenges to the Federal Reserve's stability. The short-term consequences included heightened market volatility and increased economic uncertainty. The long-term impacts, however, remain to be fully seen. The overarching issue is the importance of the Federal Reserve's independence for a healthy US economy. This independence is not merely a matter of institutional pride; it's a cornerstone of sound monetary policy and economic stability. To fully grasp the ongoing and future implications for the US and global economy, continue to follow developments regarding the relationship between President Trump (or his successors) and the Federal Reserve. Stay informed on the latest news and analysis concerning the Trump Powell Federal Reserve dynamic. Further research into the Federal Reserve's independence is crucial for understanding future economic stability.

Featured Posts

-

The Bold And The Beautiful Liams Collapse Spoilers And Predictions For His Survival

Apr 24, 2025

The Bold And The Beautiful Liams Collapse Spoilers And Predictions For His Survival

Apr 24, 2025 -

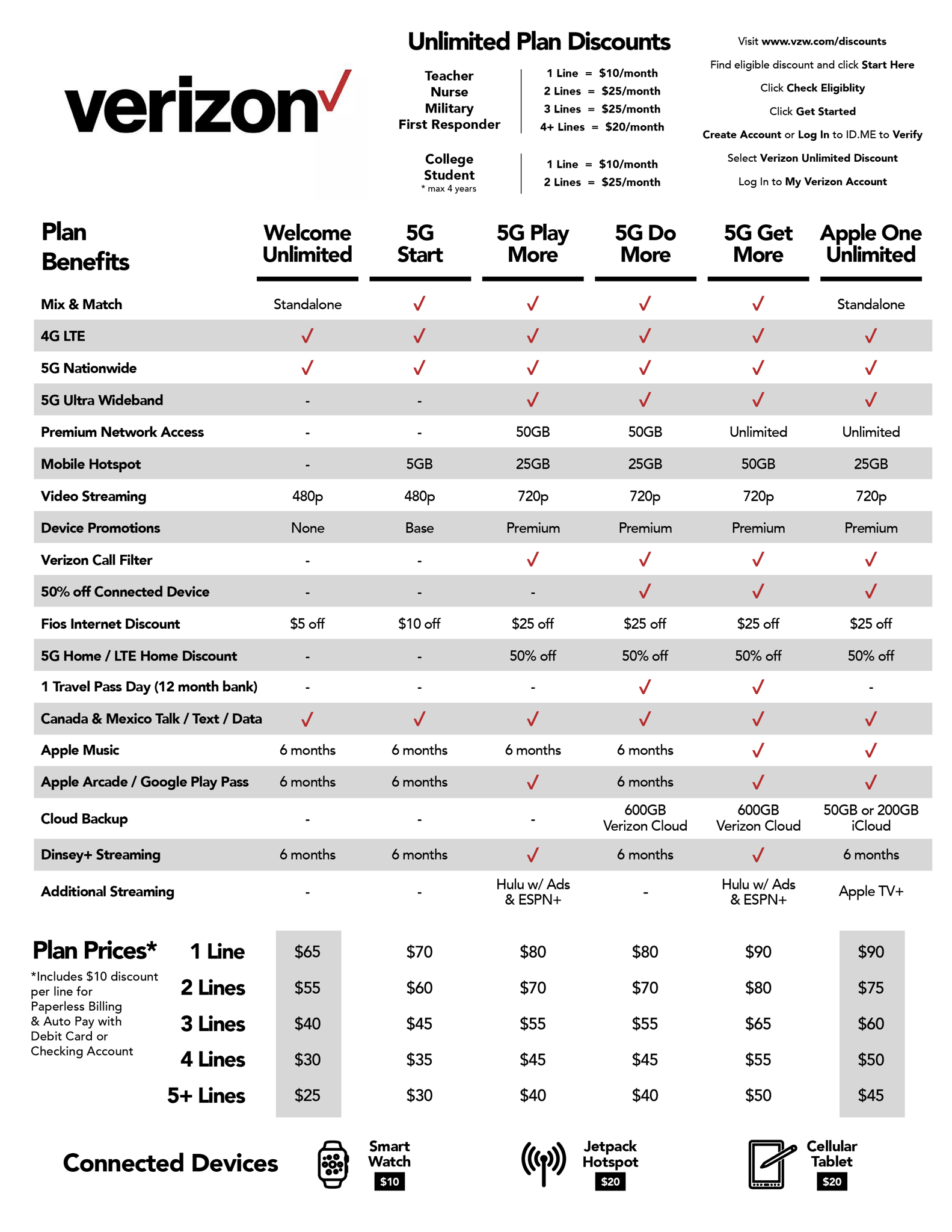

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025 -

Bold And The Beautiful Recap April 3 Liams Health Crisis Following Fight With Bill

Apr 24, 2025

Bold And The Beautiful Recap April 3 Liams Health Crisis Following Fight With Bill

Apr 24, 2025 -

Ja Morant Probe Nba Launches Investigation Following Latest Report

Apr 24, 2025

Ja Morant Probe Nba Launches Investigation Following Latest Report

Apr 24, 2025 -

Blazers Fall To Warriors Hield And Paytons Impact Off The Bench

Apr 24, 2025

Blazers Fall To Warriors Hield And Paytons Impact Off The Bench

Apr 24, 2025