Trump's Economic Policies And Their Potential Effect On Bitcoin's Price

Table of Contents

Deregulation and its Impact on Bitcoin Investment

Deregulation, a hallmark of Trump's economic agenda, could significantly influence Bitcoin investment. Reduced financial regulation might foster a more accessible environment for cryptocurrency investments, potentially attracting a larger pool of investors. This increased access could lead to higher demand and, consequently, a price increase.

However, this isn't without risk. Less oversight increases the potential for market manipulation and fraud. The absence of robust regulations could make Bitcoin more vulnerable to scams and price crashes.

- Increased ease of access to financial markets: Deregulation could simplify the process of buying, selling, and trading Bitcoin, drawing in retail and institutional investors.

- Potential for increased institutional investment: Reduced regulatory hurdles might encourage institutional investors, such as hedge funds and pension funds, to allocate a portion of their portfolios to Bitcoin, driving up demand.

- Risks associated with less oversight: The lack of stringent regulations increases the potential for market manipulation, pump-and-dump schemes, and other fraudulent activities, leading to price volatility.

Fiscal Policy and Bitcoin's Safe-Haven Status

Trump's expansionary fiscal policies, characterized by increased government spending, could inadvertently boost Bitcoin's appeal as a safe-haven asset. If these policies lead to inflation or increased national debt, investors might seek refuge in Bitcoin, perceiving it as a hedge against economic uncertainty. The inherent scarcity of Bitcoin, unlike fiat currencies, could make it a more attractive store of value during times of economic instability.

However, the opposite could also occur. Increased government control over the financial system, a potential outcome of expansive fiscal policies, might lead to stricter regulations on cryptocurrencies, dampening Bitcoin's price.

- Inflationary pressures: If inflation rises due to fiscal policies, Bitcoin's value might increase as investors seek to preserve their purchasing power.

- Increased uncertainty in traditional markets: Economic uncertainty stemming from fiscal policies might drive investors towards Bitcoin's perceived stability.

- Potential negative impact of increased government control: Conversely, increased government intervention in the financial system might lead to tighter regulations on cryptocurrencies, negatively impacting Bitcoin's price.

Trade Wars and Global Economic Uncertainty's Effect on Bitcoin

Trade wars and global economic uncertainty, common features of the Trump era, often trigger a flight to safety in financial markets. Bitcoin, with its decentralized nature, could benefit from this, attracting investors seeking to diversify away from volatile traditional assets. Geopolitical instability and economic downturns could fuel demand for Bitcoin as a hedge against risk.

However, a global economic slowdown could also decrease investor appetite for riskier assets, potentially depressing Bitcoin's price. The outcome would largely depend on the severity and duration of the economic downturn.

- Increased demand during market uncertainty: Times of geopolitical tension and economic instability can boost Bitcoin's demand as a safe-haven asset.

- Price fluctuations based on trade conflict resolution: The escalation or de-escalation of trade disputes could significantly influence Bitcoin's price, reflecting investor sentiment.

- Impact of global economic slowdown: A global recession might reduce investor appetite for high-risk assets like Bitcoin, negatively affecting its price.

The Role of Trump's Stance on Cryptocurrency

Trump's direct or indirect statements and actions regarding cryptocurrency significantly influence market sentiment. While he didn't explicitly address Bitcoin frequently, any official stance from his administration or related regulatory changes could have a profound effect on the market.

- Impact of positive or negative rhetoric: Positive statements about cryptocurrencies could boost confidence and drive up prices; conversely, negative comments could trigger price drops.

- Analysis of executive orders or regulatory proposals: Any potential executive orders or regulatory proposals impacting cryptocurrencies from his administration would have immediate and substantial market consequences.

- Comparison to the stance of other world leaders: Comparing Trump's approach to cryptocurrency regulation with the stances of other global leaders provides valuable context for understanding potential future trends.

Conclusion: Understanding the Complex Relationship Between Trump's Economic Policies and Bitcoin's Price

The relationship between Trump's economic policies and Bitcoin's price is multifaceted and unpredictable. Deregulation could boost investment but also increase risks; fiscal policies might drive Bitcoin's safe-haven appeal but also potentially lead to tighter regulations; and trade wars could increase demand yet also depress overall market sentiment. Trump's own statements and potential policy changes add another layer of complexity. Understanding these intricate interactions requires ongoing monitoring and analysis.

To stay informed, continue researching and monitoring "Trump's Economic Policies and Bitcoin's Price." Follow reputable financial news sources and cryptocurrency analysts for updated insights. Remember to conduct thorough research before making any investment decisions in Bitcoin or other cryptocurrencies.

Featured Posts

-

Thunder Grizzlies Showdown Key Game Preview And Prediction

May 08, 2025

Thunder Grizzlies Showdown Key Game Preview And Prediction

May 08, 2025 -

Jwazat Sfr Jely Awr Bhyk Mangne Myn Mlwth Tyn Khwatyn Grftar

May 08, 2025

Jwazat Sfr Jely Awr Bhyk Mangne Myn Mlwth Tyn Khwatyn Grftar

May 08, 2025 -

Warfare 5 Films That Deliver Both Action And Emotion

May 08, 2025

Warfare 5 Films That Deliver Both Action And Emotion

May 08, 2025 -

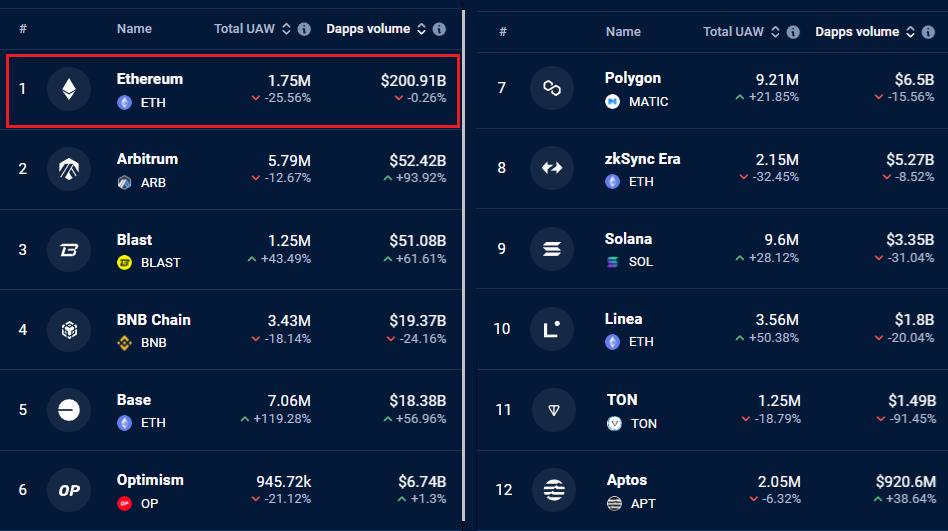

Recent Ethereum Price Action Hints Of An Impending Rally

May 08, 2025

Recent Ethereum Price Action Hints Of An Impending Rally

May 08, 2025 -

James Gunns Superman A 5 Minute Look At Kryptos Role

May 08, 2025

James Gunns Superman A 5 Minute Look At Kryptos Role

May 08, 2025