Trump's Embrace Of Cheap Oil: A Complex Relationship With The Energy Industry

Table of Contents

Trump's Deregulatory Approach and its Impact on Oil Prices

A cornerstone of Trump's energy policy was a significant rollback of environmental regulations impacting oil and gas extraction. This deregulatory approach aimed to unleash American energy potential, boosting domestic production and potentially influencing global oil prices. The administration's actions targeted key regulations, including aspects of the Clean Power Plan, streamlining the permitting process for drilling, and easing restrictions on fracking.

- Examples of specific regulations rolled back: The Clean Power Plan's restrictions on coal-fired power plants indirectly boosted demand for natural gas, a byproduct of oil production. Easing regulations on methane emissions from oil and gas operations reduced compliance costs for producers. Streamlined permitting processes for oil and gas drilling on federal lands accelerated project timelines.

- Statistics illustrating changes in oil production during Trump's presidency: While precise correlation is complex, US oil production saw a considerable increase during this period. Data from the Energy Information Administration (EIA) can be analyzed to illustrate the trends.

- Analysis of the correlation between deregulation and oil price fluctuations: The relationship isn't strictly causal. Global oil prices are impacted by numerous factors, including OPEC decisions and global demand. However, increased US production due to deregulation likely contributed to a greater supply, potentially exerting downward pressure on prices.

The Shale Oil Boom and its Influence on Trump's Energy Policy

The shale oil boom, fueled by advancements in fracking technology, played a crucial role in shaping Trump's energy agenda. The administration actively supported the shale oil industry, viewing it as a key driver of American energy independence and economic growth. This support translated into policies that facilitated drilling, promoted domestic energy production, and fostered a narrative of "American energy dominance."

- Explanation of the shale oil boom and its contribution to US energy production: The technological advancements in horizontal drilling and hydraulic fracturing unlocked vast reserves of shale oil and gas, significantly increasing US energy production and reducing reliance on foreign sources.

- Discussion of Trump's rhetoric regarding American energy dominance: Trump frequently emphasized the goal of making the US energy independent, even a global energy leader, reducing reliance on OPEC and other nations.

- Analysis of the economic benefits (jobs, revenue) and environmental concerns (fracking): The shale oil boom created numerous jobs in the energy sector and generated significant revenue. However, concerns persist regarding the environmental impacts of fracking, including water contamination and greenhouse gas emissions.

International Relations and the Price of Oil Under Trump

Trump's foreign policy significantly influenced global oil markets. His administration's approach to sanctions on Iran, a major oil producer, drastically altered global supply. Simultaneously, his engagement (or lack thereof) with OPEC nations like Saudi Arabia also impacted oil production quotas and overall prices.

- Analysis of the impact of sanctions on Iranian oil exports: The reimposition of sanctions on Iran significantly reduced its oil exports, impacting global supply and driving prices upward.

- Discussion of Trump's interactions with OPEC and its impact on oil production quotas: Trump's relationship with OPEC was characterized by a mix of pressure and cooperation, with varying impacts on production quotas and ultimately oil prices.

- Assessment of the overall effect on global oil prices: The combined effects of sanctions, OPEC decisions, and increased US production created volatility in global oil prices during Trump's presidency, reflecting the intricate interplay of domestic and international factors.

The Long-Term Implications of Trump's Energy Legacy

Trump's energy policies have long-term implications for the US and the globe. The emphasis on fossil fuels, while boosting short-term economic growth, raises serious environmental concerns related to climate change. The long-term sustainability of this approach remains questionable.

- Discussion of the potential long-term effects on the environment: Increased reliance on fossil fuels contributes to greenhouse gas emissions and exacerbates climate change, with potentially catastrophic long-term consequences.

- Analysis of the long-term implications for the US energy industry: While the shale oil boom created jobs, the long-term viability of the industry depends on several factors, including technological advancements and global market conditions.

- Evaluation of the sustainability of Trump's energy policies: The focus on fossil fuels without a parallel emphasis on renewable energy raises questions about the long-term sustainability of the US energy system.

Conclusion

Trump's administration's relationship with cheap oil was complex and multifaceted. His deregulatory approach, coupled with the shale oil boom, significantly impacted domestic energy production and potentially influenced global oil prices. His international relations decisions further complicated this picture, creating volatility in the global energy market. The lasting legacy, however, is a heightened concern regarding environmental sustainability, prompting crucial questions about the long-term viability of this energy strategy. To further understand the ongoing ramifications, we encourage further research on "Trump's Embrace of Cheap Oil" and its enduring effects on the energy industry and the environment. Resources from the EIA, reputable academic journals, and think tanks provide excellent starting points for deeper exploration.

Featured Posts

-

Court Denies Injunction Alberto Osuna To Miss 2025 Tennessee Baseball Season

May 12, 2025

Court Denies Injunction Alberto Osuna To Miss 2025 Tennessee Baseball Season

May 12, 2025 -

Experience The Houston Astros Foundation College Classic

May 12, 2025

Experience The Houston Astros Foundation College Classic

May 12, 2025 -

Dans Quoi Investir Mon Argent Diversification Et Securite

May 12, 2025

Dans Quoi Investir Mon Argent Diversification Et Securite

May 12, 2025 -

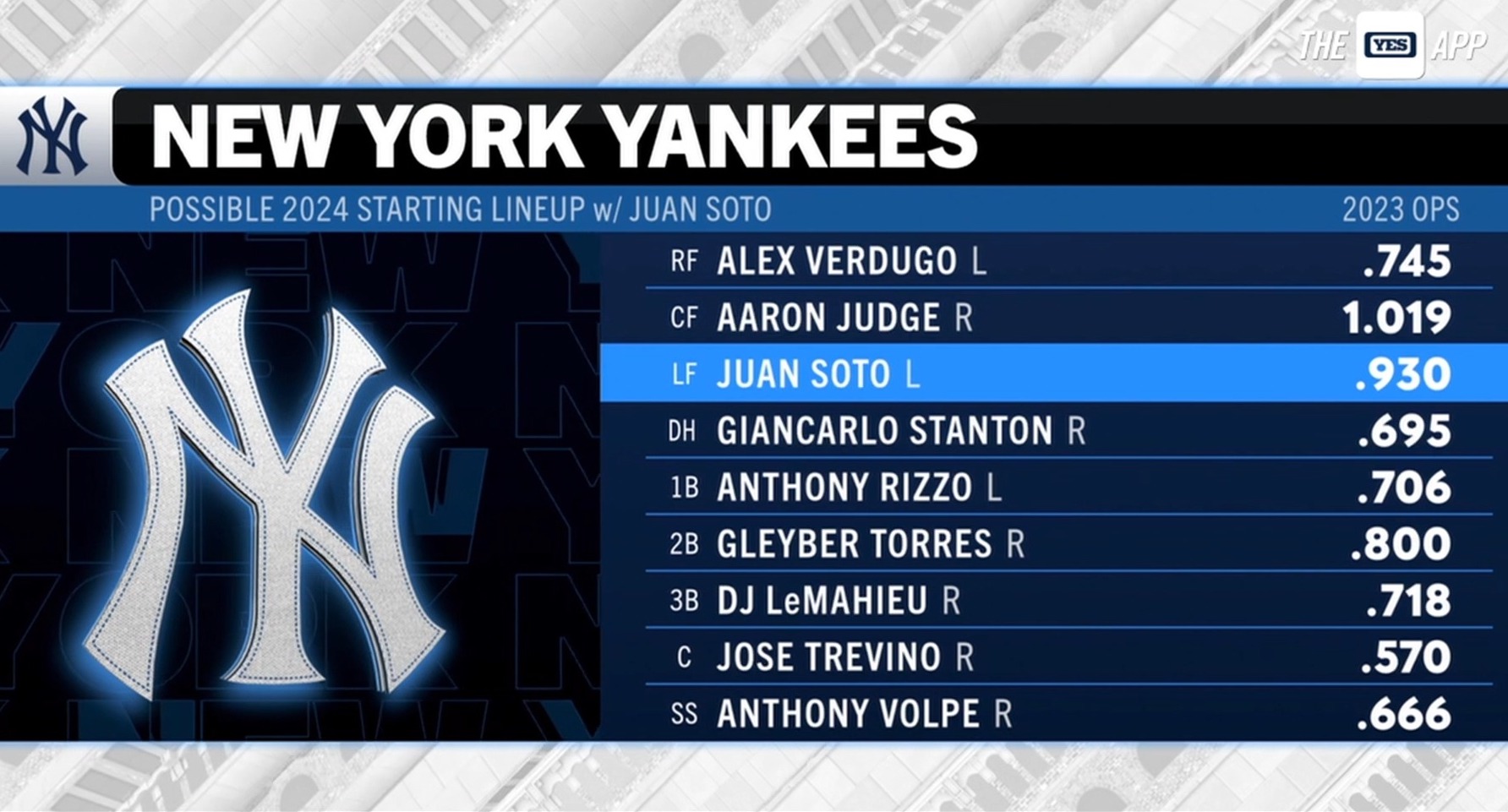

Aaron Judges Statistical Analysis Implications For The 2025 Yankees Season

May 12, 2025

Aaron Judges Statistical Analysis Implications For The 2025 Yankees Season

May 12, 2025 -

Celtics Payton Pritchard Named Nba Sixth Man Of The Year

May 12, 2025

Celtics Payton Pritchard Named Nba Sixth Man Of The Year

May 12, 2025