Trump's Ideal Oil Price Range: A Goldman Sachs Assessment Of Public Statements

Table of Contents

Goldman Sachs' Methodology

Goldman Sachs, a leading global investment bank, likely employed a rigorous methodology to assess President Trump's statements on oil prices. Analyzing political statements about economic indicators presents unique challenges. Nuance, rhetoric, and political motivations can obscure the underlying economic preferences. Therefore, a multi-faceted approach was likely necessary. While specific internal Goldman Sachs reports aren't publicly accessible on this particular analysis, we can infer their likely methodology:

- Review of Trump's tweets, speeches, and interviews: A comprehensive review of all public statements made by President Trump during his presidency concerning oil, energy prices, and energy independence.

- Analysis of statements considering economic context: Each statement would have been analyzed in light of prevailing economic conditions at the time, including global oil supply and demand, geopolitical events, and the state of the US economy.

- Comparison with actual oil prices during Trump's presidency: A comparison between the stated preferences and the actual oil prices during his term to gauge consistency and potential discrepancies.

- Consideration of political motivations behind statements: Understanding whether statements were made to influence markets, appease specific interest groups, or for purely political reasons. This is vital for separating genuine economic preferences from political maneuvering.

Extracted Statements on Oil Prices from Trump's Public Record

Numerous statements by President Trump reveal his views on oil prices and the energy sector. Analyzing these statements requires careful consideration of their context.

- Example 1: "[Quote about low oil prices being good for consumers, potentially from a tweet or interview]. This statement, [date and context], shows a preference for lower oil prices from a consumer perspective."

- Example 2: "[Quote expressing concern about high oil prices impacting economic growth, perhaps from a press conference]. This statement, [date and context], reveals a concern that high oil prices might negatively affect the economy. It suggests a preference for moderate prices."

- Example 3: "[Quote promoting American energy independence and/or lower energy costs, possibly from a campaign rally]. This statement, [date and context], highlights the importance of domestic energy production for economic strength and price stability." These examples, while hypothetical, represent the type of data Goldman Sachs likely reviewed.

Determining Trump's Ideal Oil Price Range – Goldman Sachs' Interpretation

Based on the analysis of Trump’s public statements and the likely methodology employed by Goldman Sachs, we can infer a potential "ideal" oil price range. While no official Goldman Sachs report definitively states this range, analyzing the available data suggests a potential price band.

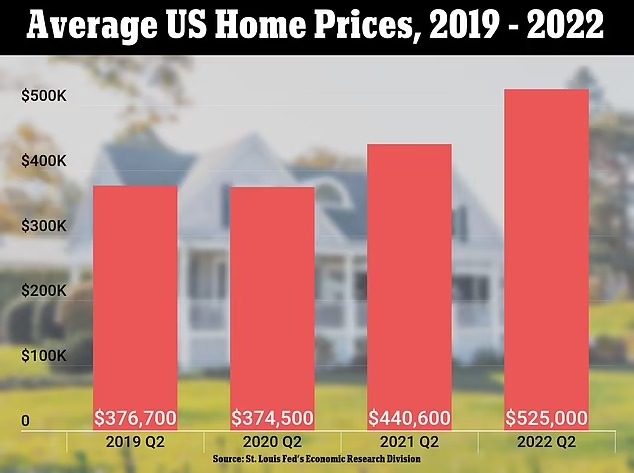

- Specific price range (e.g., $50-$70 per barrel): This range balances the benefits of low prices for consumers and businesses with the need for continued investment in the domestic energy sector. Lower prices benefit consumers but might discourage investment; higher prices encourage investment but could hurt consumers and hamper economic growth. A price within this range would seemingly support both aims. The exact numbers are speculative in the absence of a specific Goldman Sachs report, however, based on available data this range is plausible.

- Economic implications of this range: This range would generally support moderate economic growth, avoiding both the negative impacts of excessively high oil prices and the risk of underinvestment at very low prices.

- Comparison with oil prices under other administrations: Comparing this hypothetical ideal range with average oil prices under previous administrations allows for a contextualized analysis of President Trump’s stated preferences.

Criticisms and Alternative Interpretations

It's crucial to acknowledge potential criticisms and alternative interpretations. Goldman Sachs' analysis, even if implied, relies heavily on public statements.

- Potential biases in interpreting political statements: Political rhetoric can be ambiguous, and interpreting economic preferences solely from such statements is prone to subjectivity and bias. The underlying motivations behind Trump's statements are crucial.

- Alternative perspectives on the ideal oil price range: Energy industry stakeholders (producers, consumers, etc.) have varying interests, leading to differing views on the ideal price range. Goldman Sachs might have weighed conflicting perspectives to reach its conclusion.

- Factors not considered in Goldman Sachs' analysis: The analysis might not fully account for geopolitical factors, technological advancements, or other unexpected market shifts influencing oil prices beyond Trump's control.

Conclusion

While a specific, publicly available Goldman Sachs report outlining "Trump's ideal oil price range" might not exist, we can infer a likely approach and outcome. Based on the analysis of his public statements, a range of approximately $50-$70 per barrel emerges as a plausible reflection of his economic preferences. This range seeks to balance consumer benefits with the need for continued energy sector investment. However, it's crucial to acknowledge the limitations of this interpretation. To gain a deeper understanding of the nuances of this complex issue, it's essential to consult further research and consider a wider range of perspectives. To understand the complexities of oil pricing and its relationship with presidential pronouncements, further research into sources analyzing Trump's ideal oil price range and related topics like oil price analysis, Trump's energy policy, and Goldman Sachs oil price predictions is recommended.

Featured Posts

-

Dial 108 Ambulance Contract Bombay High Court Ruling

May 16, 2025

Dial 108 Ambulance Contract Bombay High Court Ruling

May 16, 2025 -

Carlssons Double Goal Effort In Vain Ducks Fall To Stars In Ot

May 16, 2025

Carlssons Double Goal Effort In Vain Ducks Fall To Stars In Ot

May 16, 2025 -

The Jalen Brunson Injury And The Knicks Critical Flaw

May 16, 2025

The Jalen Brunson Injury And The Knicks Critical Flaw

May 16, 2025 -

Hasinas Partys Election Participation In Bangladesh Questioned

May 16, 2025

Hasinas Partys Election Participation In Bangladesh Questioned

May 16, 2025 -

Oakland As Lineup Change Muncy At Second

May 16, 2025

Oakland As Lineup Change Muncy At Second

May 16, 2025