Trump's Oil Price Outlook: Insights From Goldman Sachs' Social Media Review

Table of Contents

Goldman Sachs' Social Media Sentiment on Trump's Energy Policies

Goldman Sachs, a leading global investment bank, frequently uses social media platforms like Twitter and LinkedIn to communicate its views on market trends. Analyzing their social media sentiment regarding Trump's energy policies offers valuable insights. We can examine their posts to gauge their assessment of the deregulation efforts, their impact on domestic oil production (especially shale oil), and the overall effect on global oil supply.

-

Positive Sentiments: Goldman Sachs' social media posts during the Trump administration may have expressed optimism regarding increased oil production due to deregulation. Statements highlighting potential economic growth spurred by readily available energy resources could also be found. Increased domestic energy independence may have been another recurring theme.

-

Negative Sentiments: Conversely, some posts might have reflected concerns about environmental consequences associated with increased fossil fuel extraction and the potential for exacerbating climate change. Geopolitical risks linked to increased reliance on domestic production might also have been mentioned.

-

Neutral Statements: Many of Goldman Sachs' comments likely focused on market volatility. The bank probably acknowledged the inherent uncertainty linked to Trump's policies and their potential for both positive and negative impacts on oil prices and the overall energy market.

Impact on Oil Prices: A Goldman Sachs Perspective (from Social Media)

Examining Goldman Sachs' social media activity reveals their assessment of the correlation between Trump's policies and oil price fluctuations. Did their social media posts predict price increases or decreases following specific policy announcements? How did their predictions compare to actual market behavior? This section aims to answer these questions.

-

Specific Examples: We can look for instances where Goldman Sachs commented on oil price movements immediately following major policy announcements – perhaps a tweet mentioning price spikes after a specific deregulation move or a LinkedIn post discussing price dips after a particular international incident related to oil supply.

-

Influencing Factors: Goldman Sachs' social media probably addressed other factors influencing oil prices alongside Trump's policies. This would include OPEC's decisions regarding production quotas, changes in global demand, and unforeseen geopolitical events.

-

Price Trend Illustration: By compiling data from various sources, we can create graphs and charts illustrating oil price trends during the Trump administration, comparing predicted price movements (as implied through Goldman Sachs’ social media) to the actual price movements. This visual representation will help to clarify the correlation between Trump's policies and market behavior, as perceived by Goldman Sachs.

Geopolitical Implications Highlighted by Goldman Sachs

Trump's foreign policy significantly influenced global oil supply, and analyzing Goldman Sachs' social media activity can reveal their perspective on these geopolitical implications. Did they comment on potential supply disruptions from the Middle East or the impact of sanctions on oil-producing nations?

-

Geopolitical Events: This section would explore specific events during the Trump administration that impacted oil prices—for example, sanctions on Iran or changes in US relations with Saudi Arabia.

-

Social Media Reactions: We will examine Goldman Sachs' social media posts reacting to these events, looking for clues about how they assessed their potential impact on oil prices.

-

Stability and Prices: The section should analyze the connection between geopolitical stability (or instability) in oil-producing regions and the resulting price fluctuations, as reflected in Goldman Sachs' social media commentary.

Long-Term Effects on the Oil Price Outlook

Based on the insights gained from analyzing Goldman Sachs' social media, we can discuss the lasting impact of Trump's policies on the long-term oil price outlook. This necessitates considering shifts in energy demand, the rise of renewable energy sources, and the continued influence of his administration's deregulation efforts. What did Goldman Sachs say about the future of oil demand in a post-Trump world? Did they touch on the possible acceleration of the transition to sustainable energy? These are crucial questions to address.

Conclusion

This analysis of Goldman Sachs' social media activity offers valuable insights into their assessment of Trump's impact on the oil price outlook. By examining their publicly available commentary, we gain a better understanding of the complex interplay between political decisions and global energy markets. Goldman Sachs' perspective, as gleaned from their social media, helps to paint a clearer picture of the market dynamics during and following the Trump presidency.

To stay informed about the ever-evolving oil price outlook and the impact of political decisions, continue to follow reputable financial institutions like Goldman Sachs and stay updated on their analyses through various channels, including their social media presence. Understanding Trump's legacy on oil prices is key to navigating future energy market fluctuations.

Featured Posts

-

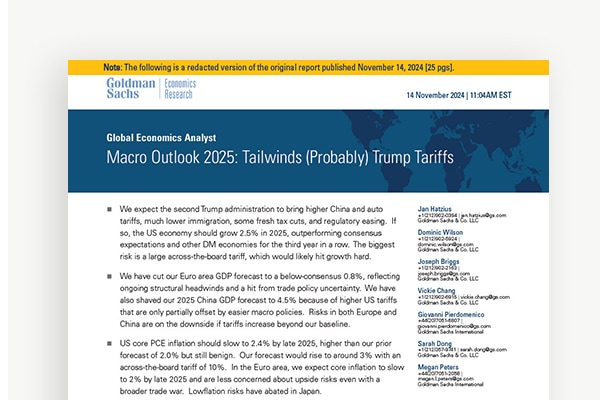

Egg Prices Plummet Dozen Now 5 After Record Highs

May 15, 2025

Egg Prices Plummet Dozen Now 5 After Record Highs

May 15, 2025 -

Padres Vs Pirates Expert Mlb Predictions And Best Betting Odds

May 15, 2025

Padres Vs Pirates Expert Mlb Predictions And Best Betting Odds

May 15, 2025 -

Foot Lockers New Global Headquarters A Florida Relocation

May 15, 2025

Foot Lockers New Global Headquarters A Florida Relocation

May 15, 2025 -

Boston Celtics Vs Detroit Pistons Prediction And Betting Odds

May 15, 2025

Boston Celtics Vs Detroit Pistons Prediction And Betting Odds

May 15, 2025 -

Star Wars Andor Novelization Axed Over Ai Generated Content Worries

May 15, 2025

Star Wars Andor Novelization Axed Over Ai Generated Content Worries

May 15, 2025