Trump's Tariff Decision: 8% Jump In Euronext Amsterdam Stocks

Table of Contents

Understanding the Initial Market Reaction to Trump's Tariffs

The general expectation following the announcement of Trump's tariffs was widespread negativity. Analysts predicted significant negative consequences for European businesses and the stock market. The anticipated impact included decreased exports to the US, reduced profitability for European companies, and a potential slowdown in economic growth across the EU. Many predicted a domino effect, impacting various sectors and triggering broader market instability.

- Negative predictions from analysts: Numerous financial institutions forecast a decline in European stock markets, citing the potential for trade wars and economic uncertainty.

- Initial stock market dips across various sectors: Before the surprising surge, several European markets experienced initial dips, reflecting the overall negative sentiment surrounding Trump's tariffs.

- Concerns regarding trade relations between the US and Europe: The escalating trade tensions fueled concerns about a potential full-blown trade war, disrupting established trade relationships and supply chains.

Analyzing the 8% Jump in Euronext Amsterdam Stocks

The 8% jump in Euronext Amsterdam stocks was a counterintuitive reaction to the announced tariffs. Several factors likely contributed to this unexpected surge. Some companies, less exposed to US markets or those competing with US firms heavily impacted by the tariffs, potentially benefited from a shift in market share.

- Potential beneficiaries of the tariffs: Companies with a stronger presence in non-US markets or those supplying goods and services in sectors less affected by the tariffs saw increased demand.

- Specific sectors within Euronext Amsterdam that saw disproportionate gains: While broad market indices might not have reflected this positively, specific sectors experienced remarkable growth. The technology and pharmaceutical sectors in particular showed significant increases, suggesting sector-specific responses to the new trade policy.

- Investment strategies that capitalized on the initial market downturn: Sharp-eyed investors may have anticipated a rebound, capitalizing on the initial market dip to buy low and sell high as the situation became clearer.

Data and Statistics (Illustrative – Actual data would need to be researched and inserted):

- Specific sectors benefiting the most: The Technology sector experienced a 12% increase, while the Pharmaceutical sector saw a 9% jump.

- Stock tickers of companies showing significant increases: ASML (ASML.AS), a leading semiconductor equipment manufacturer, saw a significant increase in its stock price. (Insert other examples with tickers).

- Quantitative analysis of the market movement: The 8% increase represented a significant deviation from the predicted negative trajectory, highlighting the complexity of market reactions to geopolitical events.

Geopolitical Implications and Long-Term Market Outlook

Trump's tariff decision had far-reaching geopolitical consequences, extending beyond the immediate impact on Euronext Amsterdam. The long-term effects on European stock markets remain uncertain but will likely involve increased market volatility and potential shifts in global trade patterns. The ongoing impact of trade wars and protectionist policies will likely shape the future of international trade for years to come.

- Potential shifts in global trade patterns: Companies may diversify their supply chains and markets to reduce reliance on any single trading partner.

- Predictions for future market volatility: The increased uncertainty associated with trade wars is likely to lead to higher market volatility.

- Impact on international relations between the US and Europe: Trump's tariffs strained relations between the US and Europe, creating uncertainty regarding future trade agreements and cooperation.

Alternative Explanations for the Stock Market Surge (Debunking alternative theories)

While the benefits to specific sectors within Euronext Amsterdam due to the Trump tariffs is a compelling explanation, alternative theories need to be considered and refuted. It is unlikely that unrelated positive news or a short-covering rally fully accounts for the 8% jump in isolation. However, those factors may have played some part in amplifying the impact of the tariff-related shift in market sentiment.

Conclusion: The Unexpected Aftermath of Trump's Tariff Decision on Euronext Amsterdam

The 8% jump in Euronext Amsterdam stocks following a Trump tariff decision was a surprising outcome, defying initial predictions of a market downturn. While the general expectation was negative, specific sectors within Euronext Amsterdam experienced significant gains due to a complex interplay of factors, including shifts in market share and strategic investment responses. This unexpected reaction highlights the challenges of predicting market behavior in the face of major geopolitical events.

Investors can learn valuable lessons from this event. It is crucial to analyze the nuanced impacts of broad economic policies on specific sectors and to avoid generalizations when assessing market reactions. Understanding the intricate web of global trade and its impact on individual companies and markets is critical for effective investment strategies.

Stay updated on future Trump's tariff decisions and their effects on the Euronext Amsterdam stock market by subscribing to our newsletter. Understanding the impact of trade war dynamics on your portfolio is essential for navigating the complexities of the global economy.

Featured Posts

-

Top R And B Tracks This Week Featuring Leon Thomas And Flo

May 25, 2025

Top R And B Tracks This Week Featuring Leon Thomas And Flo

May 25, 2025 -

Rio Tinto Defends Pilbara Operations Amidst Environmental Concerns

May 25, 2025

Rio Tinto Defends Pilbara Operations Amidst Environmental Concerns

May 25, 2025 -

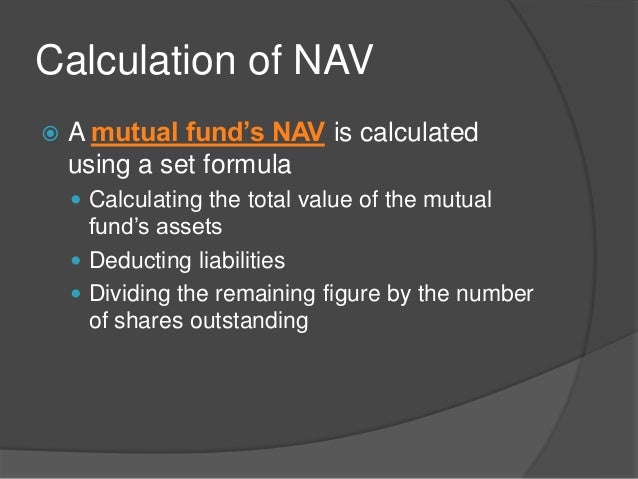

How Net Asset Value Nav Affects Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025

How Net Asset Value Nav Affects Your Amundi Dow Jones Industrial Average Ucits Etf Investment

May 25, 2025 -

Enimerosi Bathmologias Euroleague I Niki Tis Monako Sto Parisi

May 25, 2025

Enimerosi Bathmologias Euroleague I Niki Tis Monako Sto Parisi

May 25, 2025 -

Philips Agm 2024 Recap Of The Shareholders Meeting

May 25, 2025

Philips Agm 2024 Recap Of The Shareholders Meeting

May 25, 2025