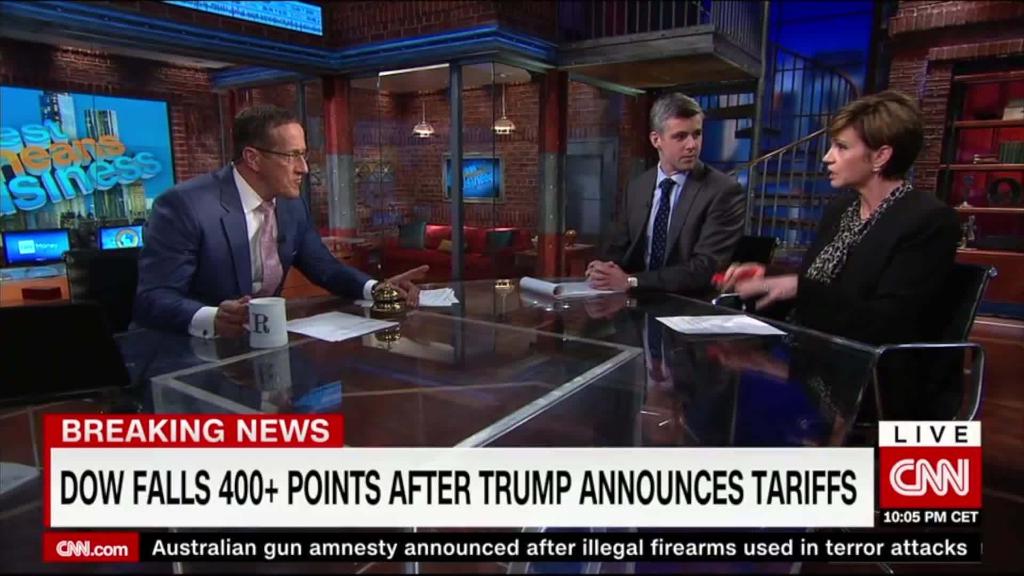

Trump's Tariff Decision Sends Euronext Amsterdam Stocks Soaring 8%

Table of Contents

The Unexpected Market Reaction

The initial market forecasts surrounding the Trump tariff decision pointed towards a significant downturn for Euronext Amsterdam and European markets in general. Analysts predicted decreased trade, reduced competitiveness for European businesses, and a consequent drop in stock values. However, the reality was starkly different. Instead of a decline, we witnessed a substantial and swift upward trend in Euronext Amsterdam stocks.

- Significant Gains Across Sectors: The surge wasn't limited to a single sector. While specific data varies depending on the stock, several sectors, including technology, energy, and consumer goods, experienced double-digit percentage gains in the hours following the announcement.

- Market Volatility: The immediate aftermath of the announcement was characterized by significant market volatility. While the overall trend was upward, there were sharp fluctuations throughout the trading day as investors reacted to the unexpected news.

- Quantifiable Gains: Preliminary data suggests that certain blue-chip stocks listed on Euronext Amsterdam saw gains exceeding 12%, while the overall index experienced an average increase of 8%, exceeding all market expectations.

Analyzing the Factors Behind the Surge

The positive response to the tariffs presents a complex puzzle. Several contributing factors may explain this unexpected surge in Euronext Amsterdam stocks.

- Increased Competitiveness: Ironically, some analysts suggest the tariffs inadvertently boosted the competitiveness of certain European companies. By raising the cost of US goods, the tariffs may have shifted consumer demand towards European alternatives, benefiting Amsterdam-listed companies that export to the US and other markets.

- Shifts in Global Trade Flows: The tariffs forced a recalibration of global trade routes. Some companies may have strategically shifted their production or sourcing to Europe, leading to increased demand for goods and services from Euronext Amsterdam-listed companies.

- Specific Company Success Stories: [Insert name of a specific company that benefited significantly, e.g., "Company X, a leading producer of renewable energy components listed on Euronext Amsterdam, experienced a 15% surge due to increased demand driven by the shift towards European energy independence."]

- Investor Sentiment and Speculation: The unexpected nature of the market reaction may have also been influenced by speculation and investor sentiment. The initial negative predictions may have created a buying opportunity for investors who anticipated a rebound, driving up prices.

The Role of Geopolitical Factors

The geopolitical landscape played a significant role in shaping the market's response.

- International Relations and Agreements: The tariff decision occurred within the context of broader geopolitical tensions and evolving international trade agreements. This complex web of relations can influence investor confidence and market behavior.

- US-EU Relations: The unexpected positive reaction could be interpreted as a sign of resilience within the European Union, suggesting that the EU may be better equipped to handle external economic shocks than initially anticipated.

- Investor Confidence in the EU: The surge may reflect growing investor confidence in the long-term stability and economic prospects of the European Union, despite the challenges posed by the Trump tariffs.

Long-Term Implications for Euronext Amsterdam

The unexpected surge in Euronext Amsterdam stocks raises important questions about the long-term implications of Trump's tariff decisions.

- Sustainability of Gains: The question remains whether these gains are sustainable. Continued trade disputes or unforeseen economic events could lead to future market fluctuations.

- Risks and Challenges: Euronext Amsterdam companies still face challenges, including the potential for retaliatory tariffs and the ongoing uncertainty surrounding global trade relations.

- Future Market Fluctuations: The volatility of the market suggests that further fluctuations are likely, and close monitoring of global events and economic indicators is crucial.

Conclusion

The 8% surge in Euronext Amsterdam stocks following Trump's tariff decision remains a surprising development, defying initial market predictions. The increase can be attributed to a complex interplay of factors including increased competitiveness for some European companies, shifts in global trade flows, specific company successes, and investor sentiment. While the long-term impact remains uncertain, the event highlights the unpredictable nature of the stock market and the significant influence of geopolitical factors on Euronext Amsterdam stocks. Stay updated on the latest news regarding Trump’s tariff decisions and their continuing effect on Euronext Amsterdam stocks by subscribing to our newsletter/following us on social media.

Featured Posts

-

Stitchpossible Weekend Box Office 2025 Showdown Could Shatter Records

May 24, 2025

Stitchpossible Weekend Box Office 2025 Showdown Could Shatter Records

May 24, 2025 -

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025 -

Shes Still Waiting By The Phone A Relatable Story

May 24, 2025

Shes Still Waiting By The Phone A Relatable Story

May 24, 2025 -

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculation

May 24, 2025

Porsche Cayenne Ev 2026 Leaked Spy Shots And Speculation

May 24, 2025 -

Tragedy Strikes Israeli Embassy Staffers Killed In Washington Shooting

May 24, 2025

Tragedy Strikes Israeli Embassy Staffers Killed In Washington Shooting

May 24, 2025