Trump's Tariff Revenue: A Realistic Replacement For Income Taxes?

Table of Contents

Analyzing Trump's Tariff Revenue Generation

During the Trump administration, tariffs were implemented on a wide range of goods, aiming to protect American industries and generate revenue. However, the actual revenue generated from Trump's tariff revenue fell far short of replacing income tax revenue. Let's examine the numbers:

- Total tariff revenue collected under Trump: While specific figures require detailed analysis from government financial reports, the overall increase in tariff revenue compared to previous administrations was relatively modest in relation to the overall federal budget.

- Breakdown of revenue by tariff type: Revenue varied significantly depending on the targeted goods and the countries imposing retaliatory tariffs. Some tariffs yielded substantial revenue, while others generated little or resulted in net losses due to decreased trade.

- Comparison to historical tariff revenue: Trump's tariff revenue, while increased, didn't reach levels seen in earlier periods of higher tariffs. Historical context shows that tariff revenue as a percentage of GDP is typically far less than income tax revenue.

- Impact of retaliatory tariffs on revenue: Retaliatory tariffs imposed by other countries significantly offset the gains from Trump's tariffs, reducing the net revenue collected and even creating losses in specific sectors. This highlights a crucial limitation: tariff revenue is highly susceptible to global trade dynamics.

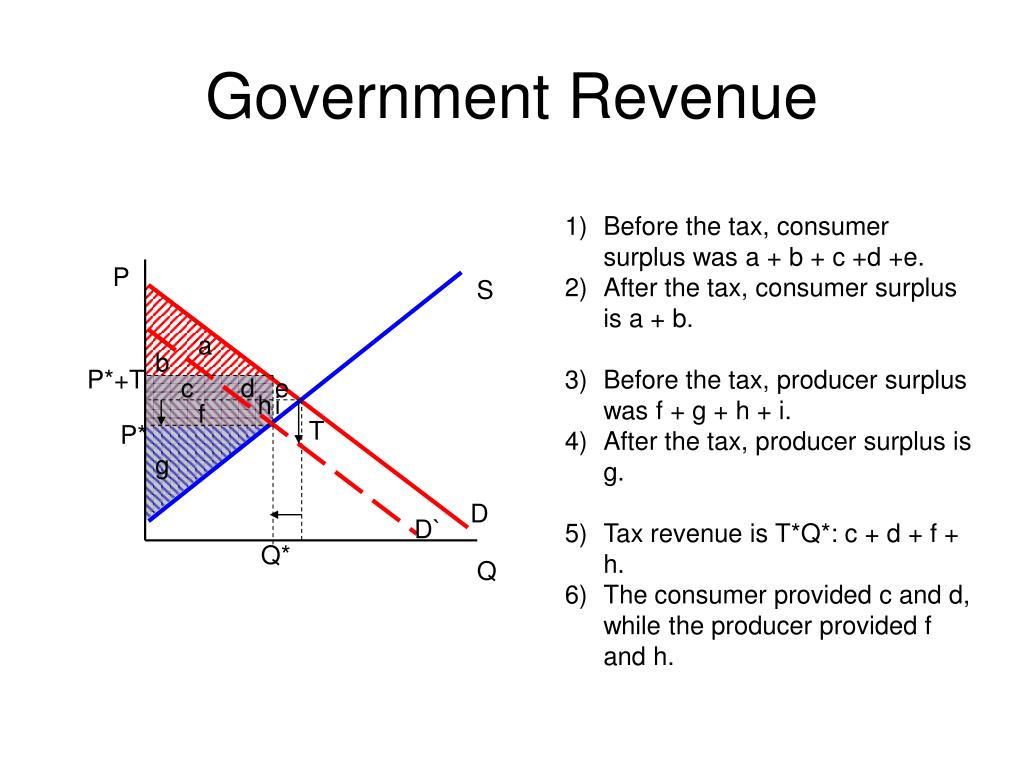

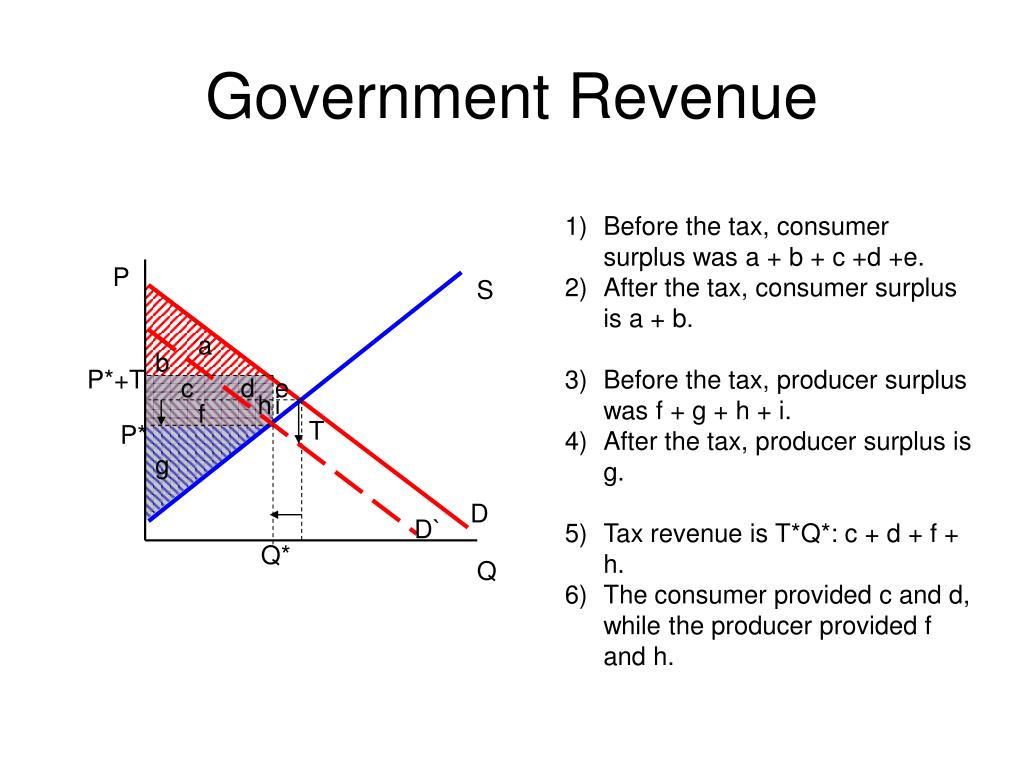

The following chart (which would be inserted here in a real published article) would visually represent the comparison between tariff revenue and income tax revenue during the Trump administration. It would clearly show the substantial disparity, making the idea of a complete replacement unrealistic.

The Economic Impact of Replacing Income Taxes with Tariffs

Solely relying on tariff revenue to fund the U.S. government would have catastrophic economic consequences. The implications extend across multiple sectors:

- Inflationary pressures from increased prices: Higher tariffs directly increase the prices of imported goods, leading to inflation and reducing consumer purchasing power. This would disproportionately impact lower-income households.

- Potential for trade wars and economic retaliation: The Trump administration's aggressive use of tariffs triggered retaliatory measures from other countries, leading to trade wars and disruptions in global supply chains. A complete reliance on tariffs would likely exacerbate these tensions.

- Impact on specific industries (e.g., agriculture, manufacturing): Certain industries, like agriculture and manufacturing, are particularly vulnerable to tariff increases. These industries often rely heavily on international trade, and tariffs can severely impact their competitiveness and profitability.

- Effects on economic growth and employment: Higher tariffs can stifle economic growth by reducing overall trade and investment. This, in turn, can lead to job losses and increased unemployment.

The Political and Practical Challenges of a Tariff-Based Tax System

A tariff-based tax system faces insurmountable political and practical challenges:

- Political opposition to high tariffs: High tariffs are unpopular among many businesses and consumers due to their inflationary effects and impact on international trade. Maintaining such a system would require significant political capital and could lead to considerable political instability.

- Difficulty in predicting tariff revenue: Global trade is inherently unpredictable. Events like economic downturns, natural disasters, and geopolitical tensions can significantly impact tariff revenue. The instability of tariff revenue makes it unreliable as a primary source of government funding.

- Vulnerability to global economic shocks: External economic shocks could drastically reduce tariff revenue, creating significant budget deficits and jeopardizing essential government services.

- Issues with fairness and equity in a tariff-based system: A system relying solely on tariffs would likely be inequitable, disproportionately impacting lower-income households who spend a larger percentage of their income on imported goods.

International Trade Relations and Retaliatory Tariffs

Trump's tariff strategy significantly damaged international trade relations. Retaliatory tariffs imposed by other countries neutralized much of the intended revenue generation. This highlights the interconnected nature of global trade and underscores the limitations of using tariffs as a primary revenue source. The long-term consequences include damaged trust among trading partners and reduced global economic stability.

Conclusion: Is Trump's Tariff Revenue a Viable Alternative to Income Taxes? A Final Verdict

Our analysis clearly demonstrates that replacing income taxes with Trump's tariff revenue is not a viable option. The actual revenue generated was insufficient, and the economic, political, and practical challenges are insurmountable. The potential for inflation, trade wars, economic instability, and inequitable distribution of the tax burden render such a system unsustainable.

Understanding the complexities of Trump's tariff revenue is crucial for informed discussions about future tax policy. Continue your research to form your own informed opinion on this critical topic.

Featured Posts

-

Documentario Mostra Trump Beyonce E Jay Z Em Festas Privadas De P Diddy

Apr 30, 2025

Documentario Mostra Trump Beyonce E Jay Z Em Festas Privadas De P Diddy

Apr 30, 2025 -

Canada Election Looms Trumps Remarks On Us Canada Dependence

Apr 30, 2025

Canada Election Looms Trumps Remarks On Us Canada Dependence

Apr 30, 2025 -

Impact Of Trumps Decision To Fire Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025

Impact Of Trumps Decision To Fire Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025 -

Strong Q Quarter Number Results Send Norwegian Cruise Line Nclh Stock Up

Apr 30, 2025

Strong Q Quarter Number Results Send Norwegian Cruise Line Nclh Stock Up

Apr 30, 2025 -

Peace Bridge Duty Free Shops Receivership A Consequence Of Reduced Travel

Apr 30, 2025

Peace Bridge Duty Free Shops Receivership A Consequence Of Reduced Travel

Apr 30, 2025