Trump's Tariffs And The US Manufacturing Sector: Winners And Losers

Table of Contents

Industries that Benefited from Trump's Tariffs

While the overall impact of Trump's tariffs was negative for the US economy, certain sectors experienced temporary gains. These benefits, however, were often short-lived and came at a cost to other parts of the economy.

Steel and Aluminum

Tariffs on imported steel and aluminum were among the first major trade actions taken by the Trump administration. These steel tariffs and aluminum tariffs aimed to protect domestic producers from cheaper foreign competition. The result was, at least initially, increased production and employment in some US steel and aluminum mills.

- Nucor Corporation and Steel Dynamics, for example, reported increased profits in the periods following the tariff implementation.

- Some smaller steel mills also saw a boost in orders and employment.

However, this protection came at a cost. The increased prices of steel and aluminum significantly impacted downstream industries that relied on these materials, leading to higher production costs and reduced competitiveness for manufacturers of cars, appliances, and other goods. The domestic steel production increase did not offset the negative consequences throughout the broader manufacturing sector.

Certain Agricultural Products

Certain agricultural products, at least initially, appeared to benefit from trade diversion caused by the tariffs. However, this benefit proved to be highly volatile and often short lived.

- Soybeans initially saw increased domestic demand as importers sought to avoid tariffs on foreign soybeans. However, this was quickly countered by retaliatory tariffs from China, significantly harming US soybean exports.

- Other agricultural products received tariff exemptions or experienced temporary boosts in demand due to trade disruptions elsewhere.

Understanding the impact of agricultural tariffs requires a complex analysis accounting for both the initial shifts in demand and the significant retaliatory measures which followed. Furthermore, the use of farm subsidies played a significant role in mitigating losses, but at a significant cost to taxpayers.

Limited Success Stories

It is crucial to note that the positive impact of Trump's tariffs was far from widespread. The successes were largely concentrated in specific, heavily protected sectors. The overall economic benefits did not outweigh the negative consequences for a much larger segment of the US manufacturing sector.

Industries that Suffered from Trump's Tariffs

The negative consequences of Trump's tariffs were far more widespread than the benefits, affecting multiple sectors and impacting countless businesses.

Import-Reliant Industries

Many US industries rely heavily on imported materials and components. Import tariffs significantly increased the costs of these inputs, reducing their competitiveness in both domestic and international markets.

- Furniture manufacturers faced higher costs for imported wood and components.

- Electronics assemblers struggled with increased costs for imported chips and other parts.

- Automotive parts suppliers saw reduced profitability due to higher costs for imported steel, aluminum, and other materials.

The resulting manufacturing costs increases led to job losses and reduced output in these industries. The increased prices were largely passed on to consumers, leading to higher prices for finished goods, impacting consumer purchasing power. Supply chain disruptions became prevalent as businesses scrambled to find alternative, often more expensive, sources of materials.

Export-Oriented Industries

US businesses exporting goods faced severe challenges due to retaliatory tariffs imposed by other countries. These actions significantly reduced the competitiveness of US exports in global markets.

- The US agricultural exports, particularly soybeans, suffered dramatically due to Chinese retaliatory tariffs.

- Automotive manufacturers faced reduced demand for their vehicles in markets impacted by retaliatory tariffs.

This escalation of trade disputes, often referred to as trade wars, created significant economic uncertainty and harmed the long-term prospects of export-oriented businesses. Export competitiveness was severely undermined, reducing US influence on the global market.

Small and Medium-Sized Businesses

Small and medium-sized businesses (SMBs) were disproportionately affected by Trump's tariffs. They often lack the resources to navigate complex tariff regulations and adjust their supply chains to accommodate fluctuating trade policies. The tariff compliance costs represented a significant burden for many SMBs, pushing some to the brink of failure. The small business impact was severe, contributing to job losses and economic hardship in communities across the US.

Long-Term Economic Consequences of Trump's Tariffs

The economic consequences of Trump's tariffs extend far beyond the immediate impact on specific industries.

Inflationary Pressures

Tariffs contributed to inflationary pressures in the US economy. Increased prices for imported goods and materials led to higher consumer prices, eroding purchasing power and reducing overall economic growth. The impact on consumer prices was substantial, adding to the overall economic burden. The impact on the trade deficit was complex, with some arguing that it remained largely unchanged or even worsened.

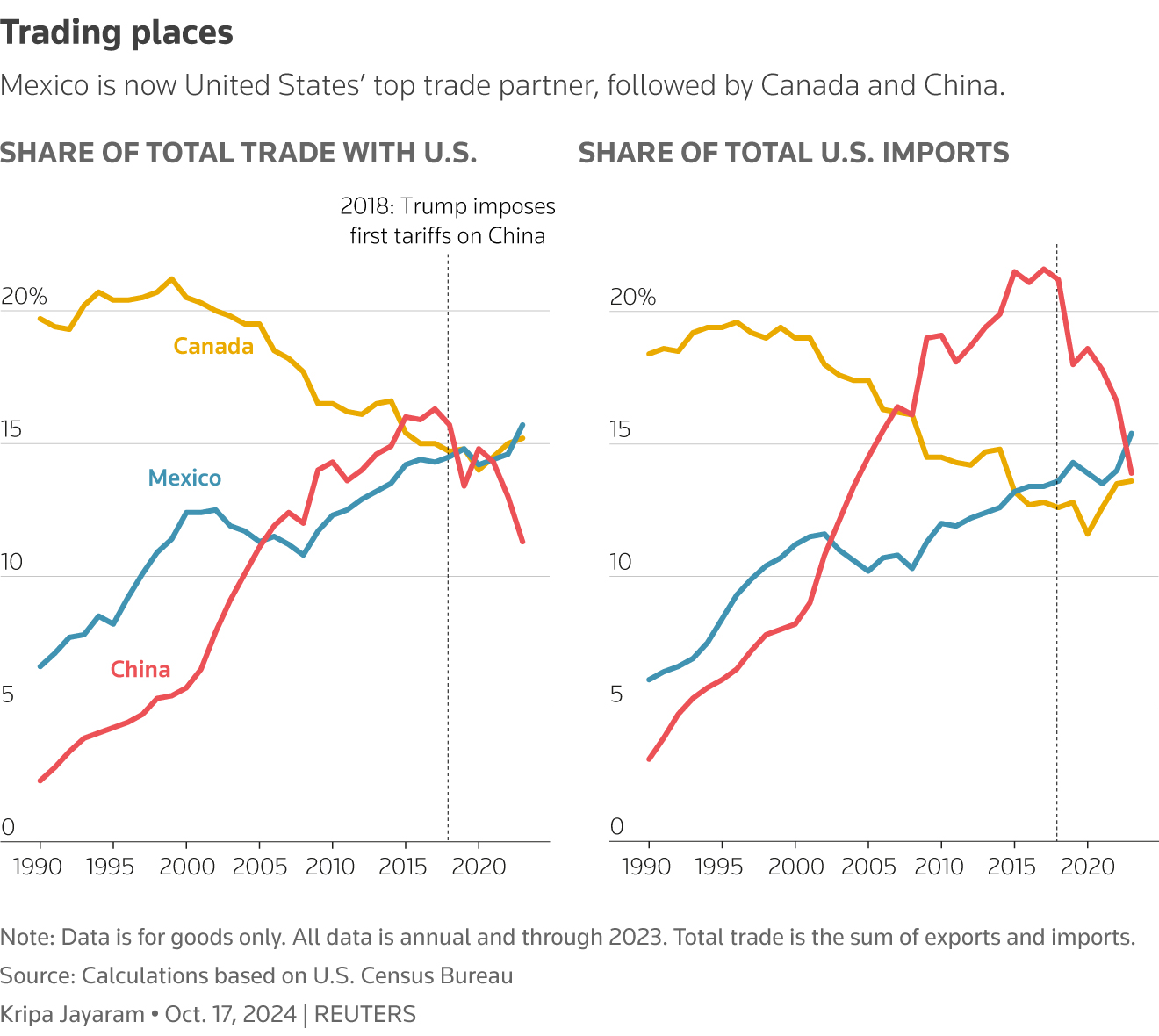

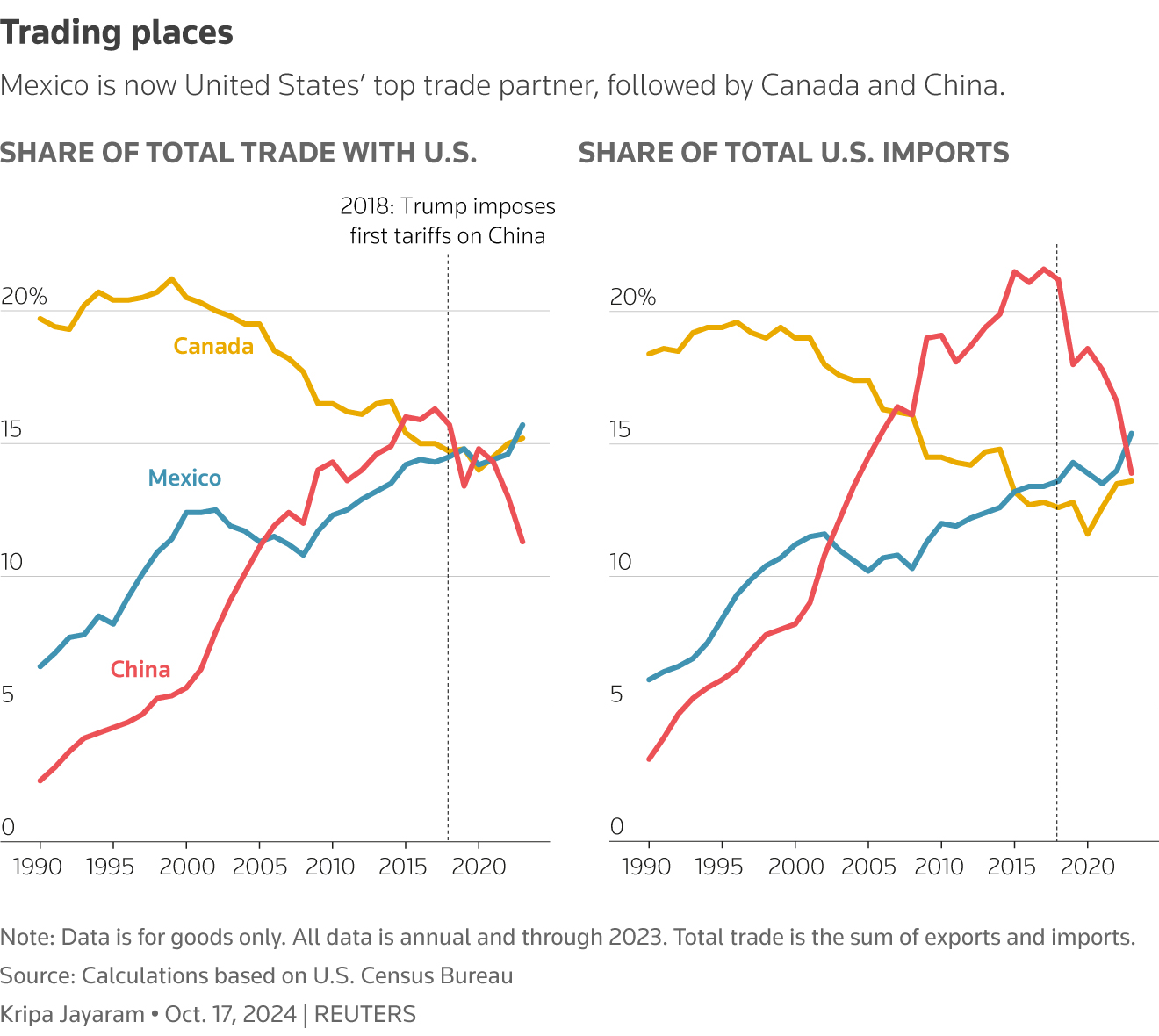

Global Trade Relations

Trump's tariffs severely damaged global trade relations. The resulting trade disputes and retaliatory actions undermined international cooperation and created uncertainty in global markets. The damage to trade agreements and trade relationships had long-lasting consequences for the global economy, impacting trade flows and economic growth across many countries.

Uncertainty and Investment

The constant threat of new tariffs and the overall uncertainty surrounding US trade policy negatively impacted business investment. Businesses hesitated to make long-term investments in new facilities, equipment, or technologies due to the unpredictable nature of the trade environment. This uncertainty contributed to slower economic growth and reduced job creation.

Conclusion

Trump's tariffs created a complex and uneven impact on the US manufacturing sector. While some industries, such as steel and aluminum production, experienced temporary benefits from protectionist measures, many others suffered significantly due to increased costs, supply chain disruptions, and retaliatory tariffs. The long-term economic consequences, including inflationary pressures, damaged global trade relations, and reduced investment, largely outweighed any short-term gains. Understanding the lasting impact of Trump's tariffs on the US manufacturing sector requires further analysis and debate. Continue researching the effects of Trump's Tariffs and the US Manufacturing Sector to gain a deeper understanding of this complex issue.

Featured Posts

-

Betty Gilpins Oh Mary Broadway Run A List Stars Pay Tribute

May 06, 2025

Betty Gilpins Oh Mary Broadway Run A List Stars Pay Tribute

May 06, 2025 -

Compston And Rodgers New Celtic Fc Advertising Campaign

May 06, 2025

Compston And Rodgers New Celtic Fc Advertising Campaign

May 06, 2025 -

April 29th Celtics Vs Magic Game 5 Live Stream And Tv Schedule

May 06, 2025

April 29th Celtics Vs Magic Game 5 Live Stream And Tv Schedule

May 06, 2025 -

Ayo Edebiri Responds To Death Threats Amidst Elon Musk Controversy

May 06, 2025

Ayo Edebiri Responds To Death Threats Amidst Elon Musk Controversy

May 06, 2025 -

Tracee Ellis Ross Back On The Runway For Marni Three Decades Later

May 06, 2025

Tracee Ellis Ross Back On The Runway For Marni Three Decades Later

May 06, 2025