Trump's Tax Bill: Republican Opposition And Potential Roadblocks

Table of Contents

Fiscal Conservatism vs. Tax Cuts

Many fiscally conservative Republicans worried about the long-term budgetary impact of the significant tax cuts proposed. The Trump administration's tax plan promised substantial reductions in both corporate and individual income taxes, a core tenet of the Republican platform. However, this ambition clashed with the concerns of a faction within the party deeply committed to fiscal responsibility.

- Increased national debt concerns: The sheer scale of the tax cuts raised serious questions about the ballooning national debt. Critics argued that the cuts lacked sufficient offsetting spending reductions, leading to a further expansion of the deficit.

- Lack of offsetting spending cuts: The absence of meaningful spending cuts to counterbalance the revenue loss from the tax cuts fueled concerns about long-term economic stability. This lack of fiscal discipline was a major point of contention.

- Potential for future economic instability: Some Republicans argued that the tax cuts, while stimulating short-term economic growth, could lead to long-term economic instability due to increased debt burdens. They favored a more gradual approach to tax reform.

- Focus on responsible budgeting versus short-term economic gains: The debate highlighted a fundamental ideological split within the Republican party: a focus on responsible budgeting and long-term fiscal health versus prioritizing short-term economic gains through immediate tax cuts. This disagreement created a major hurdle in the bill's passage.

The sheer cost of the tax cuts created a significant division within the Republican party, pitting those focused on fiscal responsibility against those prioritizing immediate economic stimulus. This disagreement created a major hurdle in the legislative process. The debate highlighted the tension between ideological commitment to lower taxes and the pragmatic concerns about responsible fiscal management.

Specific Policy Disagreements

The bill's specific provisions, such as the corporate tax rate reduction and individual tax bracket changes, faced opposition from various factions within the party. Even those generally in favor of tax cuts expressed concerns about certain aspects of the bill's design.

- Concerns over the corporate tax rate reduction benefiting large corporations disproportionately: Some Republicans argued that the significant reduction in the corporate tax rate would primarily benefit large corporations, exacerbating income inequality rather than stimulating broad-based economic growth.

- Debate over the individual tax bracket changes and their impact on different income levels: The proposed changes to individual tax brackets sparked debate about their fairness and impact on different income levels. Some argued that the benefits were skewed towards higher-income earners.

- Disagreements on the elimination of certain deductions and credits: The elimination of certain deductions and credits, intended to offset the cost of the tax cuts, generated opposition from those who benefited from these provisions, including individuals and businesses in specific sectors.

- Opposition from Senators and Representatives representing specific states or industries negatively impacted: Senators and Representatives from states or industries negatively impacted by specific provisions of the bill actively opposed its passage, further complicating the legislative process.

Even amongst those generally supportive of tax cuts, disagreements over the specifics of the bill's design created significant roadblocks. These detailed policy disputes led to numerous amendments and negotiations, delaying the process and potentially jeopardizing the bill's ultimate success.

Procedural Challenges and Senate Filibusters

The Senate's unique procedural rules, such as the filibuster, presented substantial challenges to passing the tax bill. The narrow Republican majority in the Senate made passing the bill even more difficult.

- Need for 60 votes to overcome a filibuster: To overcome a filibuster and bring the bill to a final vote, Republicans needed 60 votes in the Senate, a significant hurdle given their narrow majority.

- Pressure to compromise and garner bipartisan support (which proved challenging): The need for 60 votes put pressure on Republicans to compromise and potentially garner bipartisan support, a challenging task given the partisan nature of the issue.

- Potential for amendments that could weaken or derail the legislation: The amendment process offered opportunities for senators to introduce amendments that could weaken or even derail the legislation, requiring constant vigilance from Republican leadership.

- Use of reconciliation to bypass the filibuster, which limited amendment opportunities: Republicans ultimately utilized the reconciliation process to bypass the filibuster, but this strategy limited amendment opportunities and further fueled opposition from those who felt their concerns were not adequately addressed.

The narrow Republican majority in the Senate heightened the importance of maintaining party unity. A single defection could have killed the bill. Navigating the procedural hurdles within the Senate proved a significant challenge, requiring skillful maneuvering and strategic compromises.

The Role of Lobbying and Public Opinion

Powerful lobbying groups representing various interests exerted influence on the legislative process, adding to the complexity of the bill's passage. Public opinion also played a significant role.

- Influence of corporate lobbyists advocating for specific provisions: Corporate lobbyists played a significant role in shaping the bill's final form, advocating for provisions that benefited their clients.

- Public opinion polls influencing lawmakers' decisions: Public opinion polls, reflecting the public's response to the proposed tax cuts, influenced lawmakers' decisions and added another layer of complexity to the legislative process.

- Impact of media coverage framing the debate and public perception: Media coverage played a significant role in framing the debate and shaping public perception, influencing both lawmakers and public opinion.

The political climate and public sentiment played an important role in shaping the debate and influencing the outcome. The interplay between lobbying efforts, media narrative, and public opinion added another layer of complexity to the already challenging legislative process.

Conclusion

The passage of President Trump’s tax bill was far from certain, facing significant opposition from within the Republican party itself. Fiscal conservatism concerns, specific policy disagreements, and challenging Senate procedures all created substantial roadblocks. Understanding the intricacies of this opposition is crucial to comprehending the political climate surrounding major legislative initiatives. To further explore the complexities of this landmark legislation and the internal political battles it generated, delve deeper into the archives and analyses of the Trump tax bill, paying close attention to the Republican dissent and the procedural battles fought to pass this controversial piece of legislation. Analyzing such political maneuvers offers valuable insights into the legislative process and the dynamics within the Republican party. Understanding the intricacies of the opposition to the Trump tax bill provides valuable insight into the challenges of passing major legislation, especially when faced with internal divisions.

Featured Posts

-

Missing In Las Vegas The Case Of The British Paralympian

Apr 29, 2025

Missing In Las Vegas The Case Of The British Paralympian

Apr 29, 2025 -

Shen Yun A Graceful Return To Mesa

Apr 29, 2025

Shen Yun A Graceful Return To Mesa

Apr 29, 2025 -

North Carolina University Campus Shooting Casualties Reported

Apr 29, 2025

North Carolina University Campus Shooting Casualties Reported

Apr 29, 2025 -

Schumer Stays Put No Plans To Pass The Torch Says Senate Majority Leader

Apr 29, 2025

Schumer Stays Put No Plans To Pass The Torch Says Senate Majority Leader

Apr 29, 2025 -

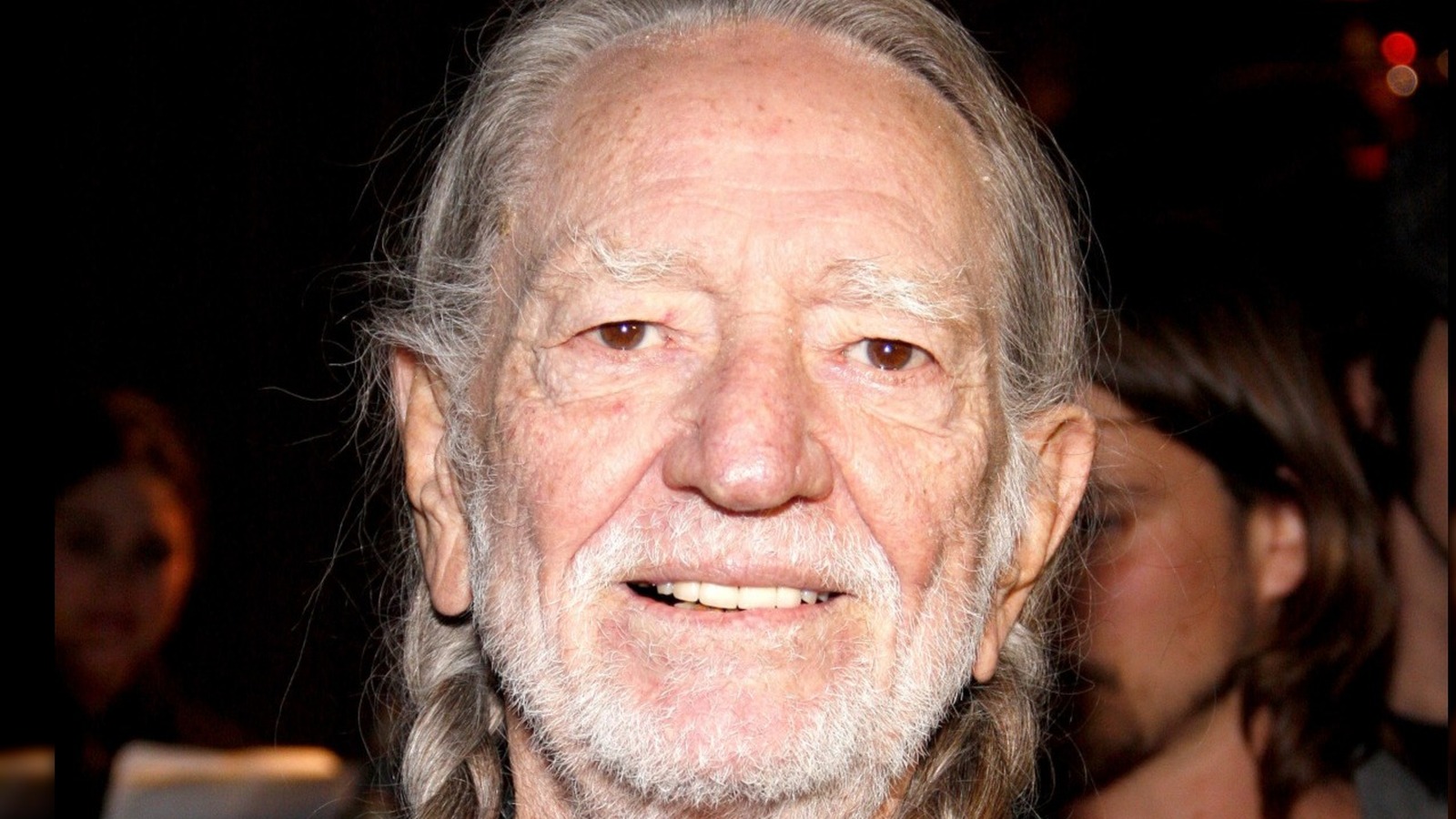

Willie Nelson Honors His King Of The Road Crew In New Documentary

Apr 29, 2025

Willie Nelson Honors His King Of The Road Crew In New Documentary

Apr 29, 2025