Trump's Tax Plan: Will A Divided GOP Deliver?

Table of Contents

Key Features of Trump's Tax Plan and Their Potential Impact

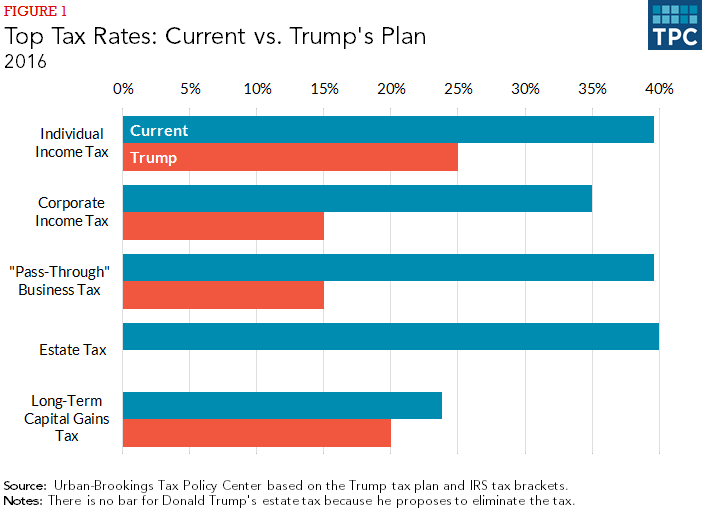

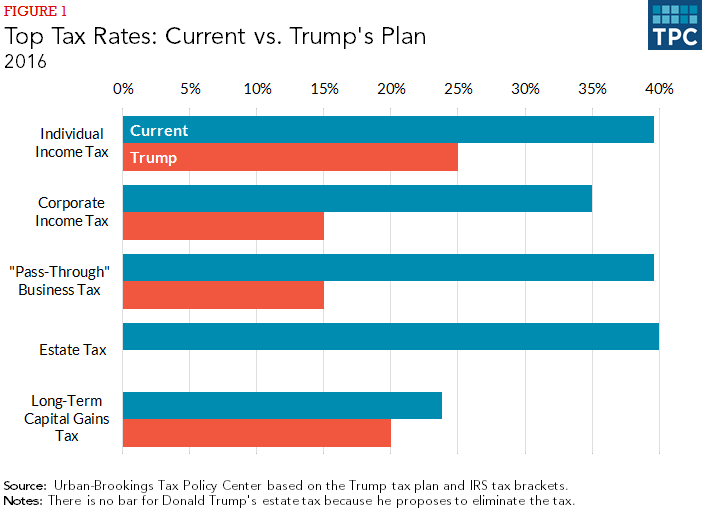

Trump's tax plan, initially enacted in 2017, featured sweeping changes impacting both corporations and individuals. Understanding these features is crucial to assessing its potential resurgence.

Corporate Tax Cuts: Examining the proposed reduction from 35% to 21% and its effect on businesses and the economy.

The centerpiece of Trump's tax plan was a dramatic reduction in the corporate tax rate, from 35% to 21%. Proponents argued this would stimulate economic growth through:

- Increased Investment: Lower taxes would free up capital for businesses to invest in expansion, new technologies, and job creation.

- Enhanced Global Competitiveness: A lower rate would make American businesses more competitive on the global stage.

- Repatriation of Overseas Profits: It was hoped this would incentivize companies to bring back profits held overseas.

However, critics pointed to potential drawbacks:

- Increased National Debt: The tax cuts significantly increased the national debt, raising concerns about long-term fiscal sustainability.

- Tax Avoidance: Concerns were raised about the potential for large corporations to exploit loopholes and avoid paying their fair share.

- Limited Job Creation: The anticipated surge in job creation did not fully materialize, prompting debate about the effectiveness of the corporate tax cuts.

Related keywords: corporate tax reform, business tax cuts, economic growth, tax loopholes.

Individual Tax Rate Changes: Analyzing the impact of changes on different income brackets and their political ramifications.

The plan also adjusted individual income tax rates, resulting in:

- Lower Rates for Many Brackets: Several individual income tax brackets saw reductions, impacting a significant portion of the population.

- Standard Deduction Increase: The standard deduction was significantly increased, simplifying tax filings for many taxpayers.

- Changes to Itemized Deductions: Certain itemized deductions were altered or eliminated, affecting some taxpayers more than others.

The political ramifications were significant:

- Increased Inequality Concerns: Critics argued the tax cuts disproportionately benefited high-income earners, exacerbating income inequality.

- Political Polarization: The tax plan became a major point of contention between the Republican and Democratic parties, further polarizing the political landscape.

- Impact on Specific Demographics: The plan's impact varied significantly across different demographics, leading to debates about its fairness and equity.

Related keywords: individual income tax, tax brackets, tax reform impact, income inequality.

Estate Tax Repeal/Changes: Exploring the elimination or modification of the estate tax and its consequences.

Trump's plan also proposed significant changes to, or even the complete elimination of, the estate tax (also known as the inheritance tax). This generated substantial debate:

- Impact on Wealthy Families: Eliminating or modifying the estate tax would have significant benefits for wealthy families, allowing for more seamless wealth transfer across generations.

- Implications for the National Budget: The estate tax generates a significant amount of revenue for the federal government. Its repeal or reduction would impact the national budget substantially.

- Arguments for and Against: Supporters of repeal argue it discourages investment and job creation, while opponents contend it is unfair and perpetuates wealth inequality.

Related keywords: estate tax, inheritance tax, wealth transfer tax, national budget.

The Divided GOP: Internal Conflicts and Political Obstacles

Even within the Republican party, significant disagreements persist regarding the optimal approach to taxation and fiscal policy, posing significant hurdles for enacting any significant changes to the tax code.

Factionalism within the Republican Party: Analyzing the different viewpoints within the GOP regarding taxation and spending.

The Republican party is not a monolith. Significant divisions exist between different factions, including:

- Fiscal Conservatives: Prioritize lower taxes and reduced government spending, often expressing reservations about increasing the national debt.

- Moderates: Seek a balance between tax cuts and government spending, potentially favoring targeted tax reforms.

- Pro-Growth Conservatives: Emphasize tax cuts as a means to stimulate economic growth.

These diverse viewpoints create internal friction and make it challenging to build a unified front on tax legislation.

Keywords: Republican Party, GOP divisions, political gridlock, fiscal conservatism.

Potential for Compromise and Amendments: Exploring the likelihood of modifications to the original plan to gain broader support.

To overcome internal divisions and potentially garner bipartisan support, significant compromises and amendments might be necessary.

- Targeted Tax Cuts: Focusing tax cuts on specific sectors or income groups could help secure broader support.

- Revenue Offsets: Identifying ways to offset revenue lost through tax cuts (e.g., through spending cuts or increased tax revenue elsewhere) is crucial.

- Role of Key Figures: The Senate Majority Leader and other key figures will play a significant role in shaping the final legislation.

Keywords: bipartisan support, legislative process, political compromise, revenue offsets.

Public Opinion and its Influence: Assessing the public's response to the proposed tax plan and how it might affect the GOP's strategy.

Public opinion plays a critical role in shaping the political landscape and will undoubtedly influence the GOP's approach to Trump's tax plan.

- Polling Data: Analyzing public opinion polls reveals varying levels of support for different aspects of the plan.

- Voter Sentiment: Understanding the concerns and priorities of different voter groups is vital for crafting a politically viable tax proposal.

- Political Strategy: The GOP's strategy will depend heavily on gauging public sentiment and adapting to potential challenges.

Keywords: public opinion polls, voter sentiment, political strategy, public support.

Conclusion: The Future of Trump's Tax Plan - A Path Forward or Political Stalemate?

The future of Trump's tax plan remains uncertain. While elements of the plan—such as corporate tax cuts—have had lasting impacts, the deeply divided GOP and the complexities of the legislative process present formidable challenges to any significant changes or a comprehensive revival of the original proposal. The likelihood of the plan, in its original form or a significantly modified version, depends heavily on the ability of Republican lawmakers to bridge internal divisions and potentially secure bipartisan support. Public opinion will also play a decisive role in shaping the political dynamics. To stay informed about developments concerning Trump's tax plan and its potential ramifications, continue to follow reputable news sources and engage in informed discussions on the topic. Understanding the nuances of Trump's tax proposals and the political complexities surrounding them is essential for informed civic engagement.

Featured Posts

-

Core Weave Crwv Stock Surge Nvidia Investment Fuels Growth

May 22, 2025

Core Weave Crwv Stock Surge Nvidia Investment Fuels Growth

May 22, 2025 -

Exclusive Details Taylor Swifts Response To The Blake Lively And Justin Baldoni Legal Battle

May 22, 2025

Exclusive Details Taylor Swifts Response To The Blake Lively And Justin Baldoni Legal Battle

May 22, 2025 -

Descubre 5 Podcasts Que Te Atraparan Si Te Gusta El Misterio Y El Terror

May 22, 2025

Descubre 5 Podcasts Que Te Atraparan Si Te Gusta El Misterio Y El Terror

May 22, 2025 -

Cassis Blackcurrant Liqueur Production Taste Profile And Cocktails

May 22, 2025

Cassis Blackcurrant Liqueur Production Taste Profile And Cocktails

May 22, 2025 -

Oplossing Voor Storingen Bij Online Betalingen Abn Amro Opslag

May 22, 2025

Oplossing Voor Storingen Bij Online Betalingen Abn Amro Opslag

May 22, 2025