Trump's Time Interview: Key Takeaways On The Proposed Congressional Stock Trading Ban

Table of Contents

Trump's Stance on the Proposed Ban

Trump's position on the proposed Congressional stock trading ban, as articulated in the Trump's Time interview, was nuanced. While he acknowledged the public's concerns regarding the appearance of conflicts of interest and the potential for insider trading, he didn't offer a full-throated endorsement of a complete ban.

- Direct Quotes: (Insert direct quotes from the interview here, accurately attributed. Example: "While I understand the concerns about the optics, a complete ban might be overly restrictive," or a similar quote reflecting his actual position).

- Arguments: Trump's arguments likely centered on the potential impact on the pool of qualified candidates willing to serve in Congress, arguing that a ban might discourage individuals with financial expertise from entering public service. He might have also discussed the potential for unintended consequences.

- Inconsistencies: (If any inconsistencies or contradictions existed in his statements during the interview, highlight them here with supporting quotes).

Potential Impact of the Ban on Legislation and Policy

A Congressional stock trading ban could significantly impact the legislative process and broader political landscape.

- Efficiency of Lawmaking: A ban could potentially reduce the efficiency of lawmaking if it discourages individuals with relevant financial expertise from running for office. The loss of this expertise could hinder the effective crafting of legislation in areas like finance and economics.

- Campaign Financing and Lobbying: The ban might alter the dynamics of campaign financing and lobbying. Without the potential for financial gain through stock trading, the influence of special interests might shift, although this impact is difficult to predict definitively.

- Qualified Candidates: As mentioned earlier, a significant concern is that a strict ban could limit the pool of qualified candidates for Congress, potentially hindering the representation of diverse perspectives and expertise.

Public Perception and the Debate Surrounding Ethics Reform

Public opinion on the proposed Congressional stock trading ban is largely supportive of stricter regulations. Many believe that a ban, or at least significantly stricter regulations, is necessary to restore public trust and address the ethical concerns surrounding potential conflicts of interest.

- Poll Data: (Include relevant poll data or statistical information here, appropriately sourced. Example: "A recent poll by [Pollster Name] showed that X% of Americans support a ban on Congressional stock trading.")

- Differing Viewpoints: While public support is strong, there are dissenting opinions. Some argue that a ban infringes on individual liberties and could create an unfair advantage for wealthier candidates who don't rely on income from stock investments.

- Media Influence: Media coverage has played a significant role in shaping public opinion. Extensive reporting on instances of alleged insider trading has increased public scrutiny and fueled the demand for reform.

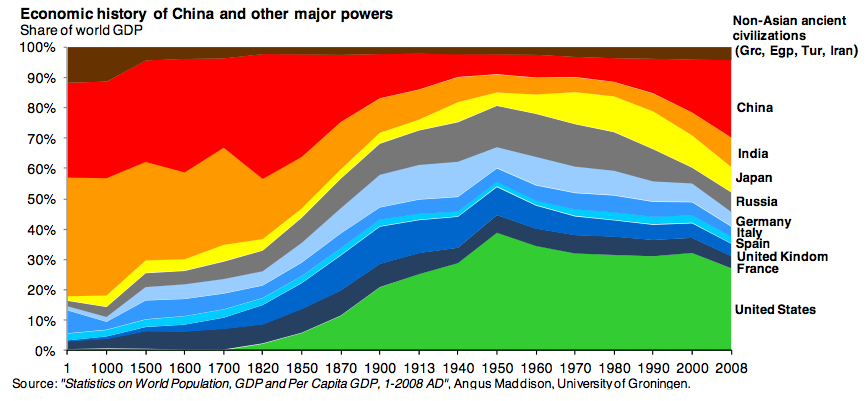

Comparison with Stock Trading Practices in Other Countries

Compared to other developed nations, the US has less stringent regulations on Congressional stock trading. Many countries have stricter rules, outright bans, or more transparent reporting mechanisms.

- Similarities and Differences: (Compare and contrast the regulations in at least two other developed countries. Cite sources for your information).

- Effectiveness of Alternatives: Analyze the effectiveness of different approaches. Do stricter regulations in other countries lead to fewer instances of perceived conflicts of interest? Do they hinder legislative effectiveness?

- Best Practices: Draw conclusions based on the comparison. What best practices could the US adopt to address the issue of Congressional stock trading while preserving the integrity of the legislative process?

The Role of Transparency and Disclosure

Increased transparency and robust disclosure mechanisms are essential for addressing concerns about Congressional stock trading. Even without a complete ban, improved transparency could help alleviate public distrust.

- Current Disclosure Requirements: Describe the current disclosure requirements for members of Congress regarding their financial holdings and stock trades.

- Potential Improvements: Discuss potential improvements to the disclosure system, such as more frequent reporting, stricter enforcement, and independent oversight bodies.

- Enforcement Mechanisms: Evaluate the effectiveness of the existing enforcement mechanisms and suggest improvements for better accountability. How does this relate to Trump's comments? Did he advocate for stronger enforcement, or focus solely on potential drawbacks of a full ban?

Conclusion

Trump's Time interview provided valuable insight into the complex debate surrounding the proposed Congressional stock trading ban. While his position wasn't a clear endorsement or rejection, it highlighted the nuanced considerations involved, including the potential impact on the pool of qualified candidates and the challenges of balancing ethical concerns with individual liberties. Public opinion overwhelmingly favors stricter regulations, driven by concerns about insider trading and conflicts of interest. International comparisons reveal varying approaches to this issue, offering potential avenues for reform. Understanding the intricacies of the proposed Congressional stock trading ban is crucial for informed civic engagement. Stay informed on this vital issue and make your voice heard by researching the proposed legislation, contacting your representatives, and staying updated on relevant news developments. The debate over reforming Congressional stock trading practices continues, and your participation is essential.

Featured Posts

-

Cassidy Hutchinson Key Witness To Reveal All In Upcoming Memoir

Apr 26, 2025

Cassidy Hutchinson Key Witness To Reveal All In Upcoming Memoir

Apr 26, 2025 -

Economic Power Shift Californias Ascent To Fourth Largest Economy Globally

Apr 26, 2025

Economic Power Shift Californias Ascent To Fourth Largest Economy Globally

Apr 26, 2025 -

Analyzing Mission Impossible Dead Reckonings Selective Franchise References

Apr 26, 2025

Analyzing Mission Impossible Dead Reckonings Selective Franchise References

Apr 26, 2025 -

Chinas Impact On Bmw And Porsche Sales Market Headwinds For Luxury Brands

Apr 26, 2025

Chinas Impact On Bmw And Porsche Sales Market Headwinds For Luxury Brands

Apr 26, 2025 -

Dave Portnoys Furious Attack On Gavin Newsom What Happened

Apr 26, 2025

Dave Portnoys Furious Attack On Gavin Newsom What Happened

Apr 26, 2025