Trump's Trade Threats Send Gold Prices Soaring

Table of Contents

The Safe Haven Appeal of Gold During Trade Wars

Gold has long been considered a safe haven asset, a store of value that holds its worth during times of economic and political uncertainty. This is due to several key factors:

-

Gold's historical performance during periods of market turmoil: Throughout history, gold has demonstrated a remarkable ability to retain its value, even during periods of significant market volatility. This is because it's not tied to the performance of any specific economy or currency. When markets crash, investors often flock to gold as a reliable store of value.

-

Diversification benefits of including gold in an investment portfolio: Gold often exhibits a low or negative correlation with traditional assets like stocks and bonds. This means that when the stock market falls, gold may rise, providing a valuable buffer against portfolio losses. Diversifying your portfolio with gold can significantly reduce overall risk.

-

Gold's lack of correlation with traditional assets like stocks and bonds: This characteristic makes gold an ideal asset for diversification. Its price movements are often independent of traditional market fluctuations, offering a hedge against market downturns.

Trump's trade threats, characterized by unpredictable tariffs and trade disputes, have amplified market uncertainty. This uncertainty drives investors towards safe haven assets like gold. For instance, the announcement of tariffs on steel and aluminum in 2018 saw a noticeable spike in gold prices, reflecting investor anxiety.

Impact of Trump's Trade Policies on Global Markets

Trump's trade policies have significantly increased market volatility. Specific actions like tariffs on steel and aluminum, the trade war with China, and threats against other nations have created an environment of uncertainty.

-

Examples of market reactions to specific Trump trade pronouncements: Each major trade announcement by the Trump administration has been met with immediate market reactions, often leading to increased volatility in stock markets and a surge in demand for safe haven assets, including gold.

-

Analysis of the impact on various sectors (e.g., manufacturing, technology): Sectors heavily reliant on international trade, like manufacturing and technology, have been particularly affected by Trump’s trade actions, leading to uncertainty and impacting investor confidence.

-

Mention of investor sentiment and its influence on gold prices: Negative investor sentiment, fueled by trade uncertainty, frequently drives investment towards perceived safe havens, causing a price increase in gold.

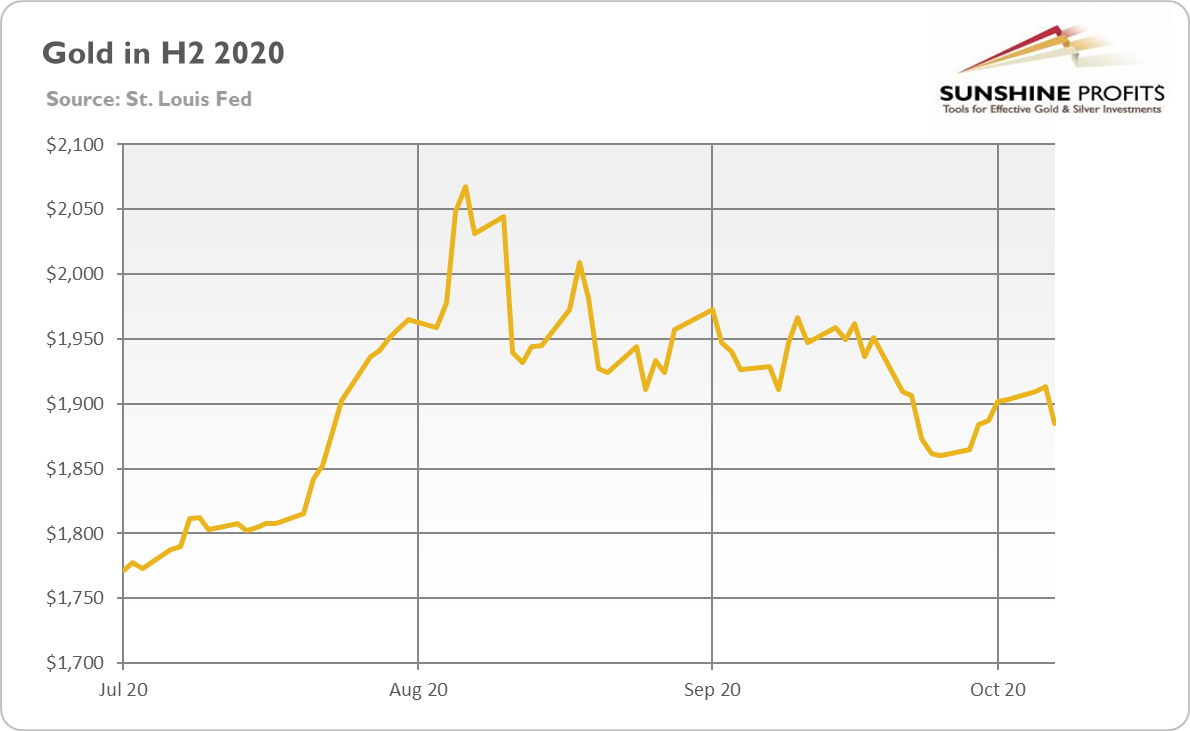

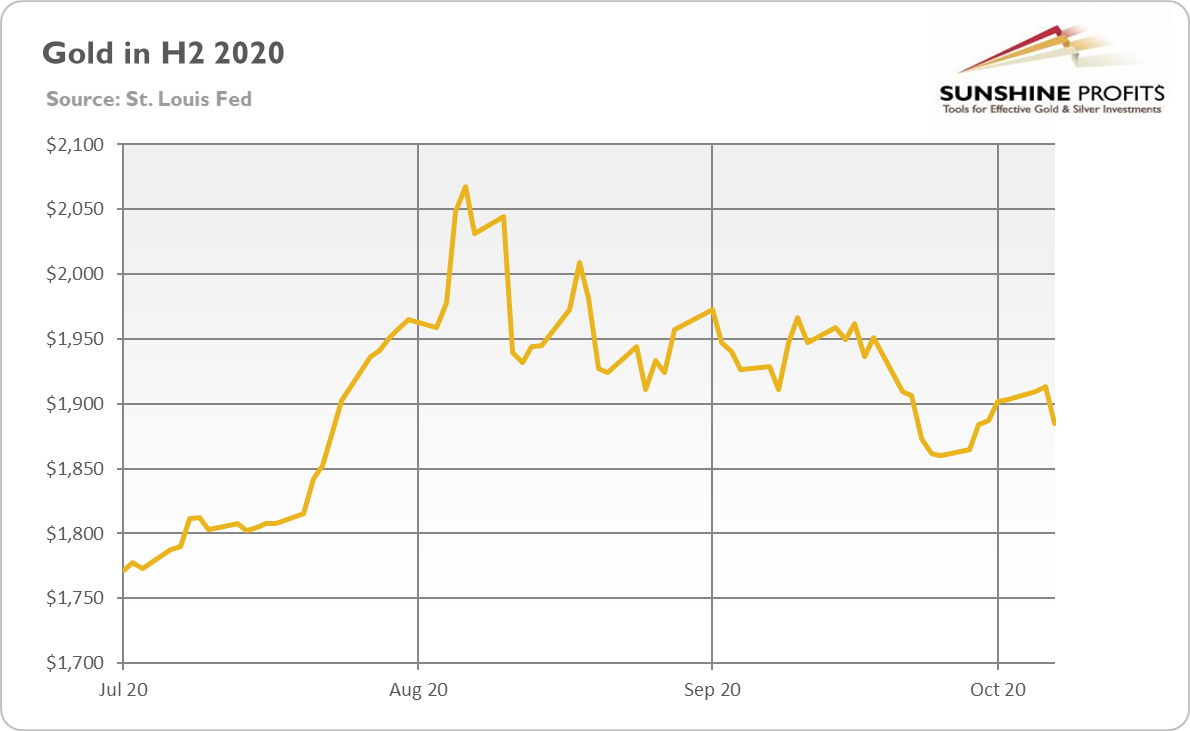

This uncertainty significantly impacts investor confidence, pushing investors towards the perceived safety of gold as a hedge against potential losses. Charts illustrating the correlation between specific trade announcements and gold price movements would further substantiate this point.

Analyzing the Gold Price Surge: Factors Beyond Trade Threats

While Trump's trade threats have undoubtedly contributed to the gold price surge, other factors have also played a role:

-

Explanation of the relationship between the US dollar and gold prices: Gold is inversely correlated with the US dollar. A weakening dollar generally leads to an increase in gold prices, as it becomes cheaper for investors holding other currencies to buy gold.

-

Impact of central bank policies (e.g., quantitative easing) on gold demand: Central bank policies such as quantitative easing, aimed at stimulating economic growth, can indirectly increase gold demand by causing inflation and devaluing fiat currencies.

-

Influence of global geopolitical events on investor sentiment towards gold: Geopolitical instability worldwide also contributes to gold's appeal as a safe haven asset.

The interplay between Trump's trade policies and these other factors creates a complex environment. While trade tensions contribute to uncertainty, other economic and geopolitical factors amplify the demand for gold, further driving up its price.

Predicting Future Gold Price Movements

Predicting future gold price movements is inherently challenging. The evolution of trade relations, macroeconomic factors, and geopolitical events all play a significant role. While Trump's trade policies remain a source of uncertainty, other global factors will equally influence gold's future performance. Thorough research is crucial before making any investment decisions.

Conclusion

Trump's trade threats have significantly contributed to a surge in gold prices, highlighting gold's role as a safe haven asset during times of economic uncertainty and market volatility. The combination of trade wars, a weakening dollar, and other global factors has created a perfect storm for increased gold investment. This analysis shows a strong correlation between increased market volatility stemming from Trump's trade policies and a subsequent rise in the price of gold.

Call to Action: Consider adding gold to your investment portfolio as a hedge against the market volatility created by Trump's trade threats and other global uncertainties. Learn more about hedging your investments with gold during these uncertain times and diversify your portfolio to mitigate risk. Consult with a financial advisor to explore appropriate gold investment options and strategies.

Featured Posts

-

Tim Cooks Challenges Navigating Apple Through Difficult Times

May 25, 2025

Tim Cooks Challenges Navigating Apple Through Difficult Times

May 25, 2025 -

Glastonbury 2025 Announced Lineup Sparks Outrage

May 25, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage

May 25, 2025 -

Moje Wrazenia Z Jazdy Porsche Cayenne Gts Coupe

May 25, 2025

Moje Wrazenia Z Jazdy Porsche Cayenne Gts Coupe

May 25, 2025 -

Florida Film Festival Celebrity Sightings Mia Farrow And Christina Ricci

May 25, 2025

Florida Film Festival Celebrity Sightings Mia Farrow And Christina Ricci

May 25, 2025 -

Paramedics Excellence At Police And Emergency Services Games

May 25, 2025

Paramedics Excellence At Police And Emergency Services Games

May 25, 2025