Trump's Trade War Threat: Impact On European Stock Market Strategies

Table of Contents

Understanding the Impact of Trump's Trade Policies on Europe

Increased Tariffs and Their Ripple Effect

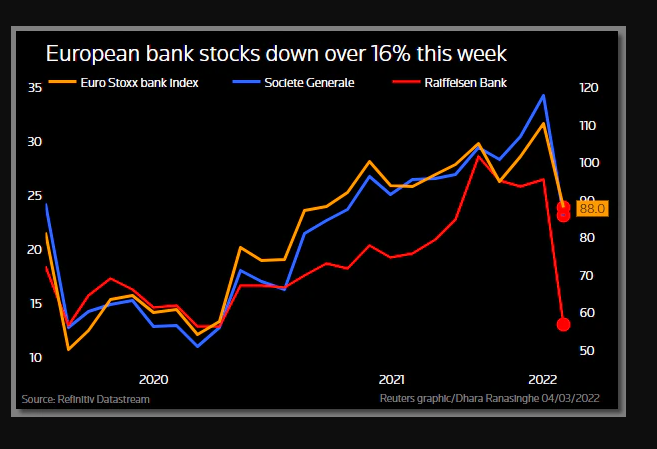

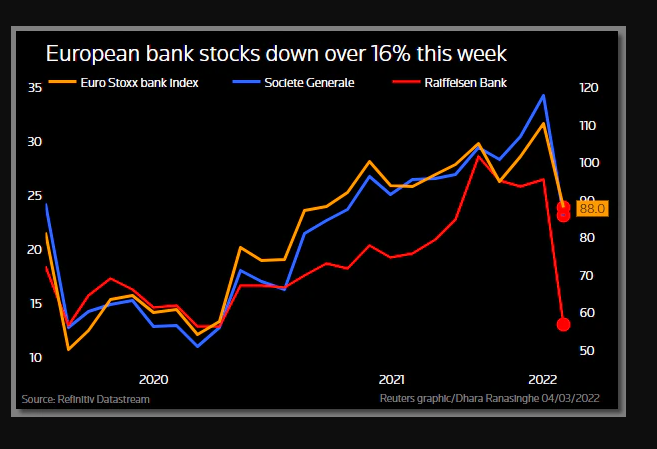

Trump's administration imposed substantial tariffs on various European goods, triggering a ripple effect across the EU economy. The automotive industry, for instance, faced significant challenges.

- Example 1: The 25% tariff on imported cars from the EU led to a sharp decline in exports to the US, impacting major European automakers like Volkswagen, BMW, and Daimler. This resulted in production cuts, job losses, and increased prices for American consumers.

- Example 2: Tariffs on agricultural products, such as cheese and wine, significantly hampered exports from France and Italy, impacting farmers and related businesses. The resulting price increases reduced consumer demand.

According to a report by the Centre for Economic Policy Research, the trade war initiated by the Trump administration cost the EU economy billions of euros in lost output. These figures highlight the severe consequences of escalating trade tensions.

Retaliatory Measures and Their Consequences

In response to Trump's tariffs, the EU implemented retaliatory measures, targeting various US goods. These actions further intensified trade tensions and contributed to global economic uncertainty.

- Example 1: The EU imposed tariffs on US agricultural products like soybeans and orange juice, impacting American farmers and exporters.

- Example 2: Tariffs on other goods, such as motorcycles and bourbon, further strained relations and contributed to the overall decline in transatlantic trade.

These retaliatory measures, while intended to protect European interests, added to the overall economic slowdown and market volatility. The resulting trade negotiations and agreements were often protracted and yielded limited progress, exacerbating the uncertainty for investors.

Adapting European Stock Market Strategies to Trade War Uncertainty

Diversification as a Key Strategy

To mitigate the risks associated with trade war volatility, diversification remains a crucial element of any robust European stock market strategy.

- Diversify Asset Classes: Investors should consider diversifying their portfolios across various asset classes, including bonds, real estate, and emerging markets, to reduce dependence on sectors vulnerable to trade disputes.

- Geographic Diversification: Investing in companies and markets outside of the EU and the US can further reduce exposure to trade war-related risks. Consider emerging markets which are less directly impacted.

- Sectoral Diversification: Diversification should include a selection of sectors with varying levels of sensitivity to trade policy changes.

Sector-Specific Strategies

Certain European sectors proved more resilient or vulnerable to the trade war than others. Tailored strategies are therefore needed.

- Vulnerable Sectors: Automobiles, agriculture, and certain manufacturing industries experienced significant challenges. Investors may consider reducing exposure to these sectors or employing hedging strategies.

- Resilient Sectors: Sectors such as technology, pharmaceuticals, and defense often display greater resilience to trade conflicts. These may present attractive investment opportunities.

- Growth Sectors: Focus on sectors less affected by trade disputes, such as renewable energy and healthcare, which often show consistent growth irrespective of global economic conditions.

Risk Management and Hedging Techniques

Effective risk management is paramount during periods of heightened market volatility. This includes:

- Hedging Strategies: Employing hedging techniques, such as using derivatives (e.g., options and futures contracts), can help mitigate potential losses from adverse market movements.

- Options Trading: Options trading provides flexibility to manage risk and potentially profit from market fluctuations. However, understanding the complexities of options trading is crucial before implementation.

- Risk Tolerance: Investors must assess their own risk tolerance before employing any complex risk management strategies. A conservative approach might prioritize capital preservation over aggressive growth.

Long-Term Outlook and Investment Opportunities

Identifying Growth Sectors

Despite the uncertainty, several sectors are positioned for long-term growth regardless of trade tensions.

- Renewable Energy: The global shift towards renewable energy sources presents significant growth opportunities.

- Healthcare: The aging population and rising demand for healthcare services ensure sustained growth in this sector.

- Technology: The tech sector, particularly in areas like software and cloud computing, is generally less susceptible to trade war impacts.

These sectors offer promising long-term investment opportunities, even in the face of global economic uncertainty.

The Importance of Due Diligence

Thorough research and analysis remain critical before making any investment decisions.

- Financial News: Stay informed by following reputable financial news sources.

- Analyst Reports: Consult with financial advisors and utilize industry analyst reports to gain insights into market trends and company performance.

- Company Fundamentals: Focus on understanding the financial health and future prospects of individual companies.

By conducting comprehensive due diligence, investors can enhance their decision-making process and build a more resilient portfolio.

Conclusion

Trump's trade war significantly impacted European stock markets, creating uncertainty and volatility. Adapting investment strategies to mitigate these risks requires careful planning and diversification. Prioritizing a diversified portfolio across asset classes and sectors, employing effective risk management techniques, and conducting thorough due diligence are crucial steps. By identifying growth sectors less vulnerable to trade wars and focusing on long-term opportunities, investors can build a robust Trump trade war resilient investment strategy tailored to their risk tolerance and long-term financial goals. Further resources on effective European stock market strategies during times of global economic uncertainty can be found through reputable financial institutions and research organizations.

Featured Posts

-

Sinners Cinematographer Captures The Mississippi Deltas Vastness

Apr 26, 2025

Sinners Cinematographer Captures The Mississippi Deltas Vastness

Apr 26, 2025 -

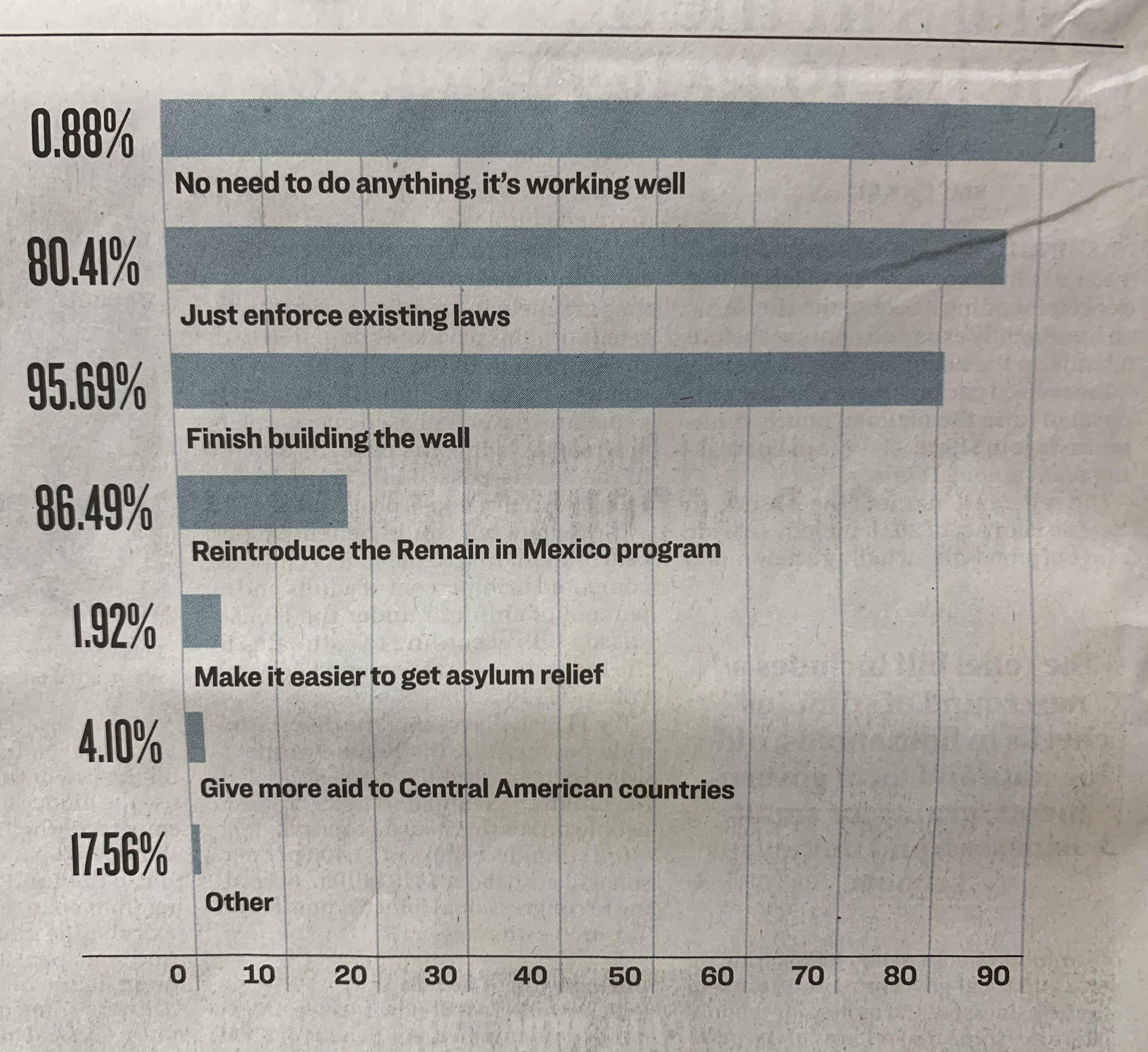

King Day Holiday Celebration Or Cancellation Public Opinion Poll Results

Apr 26, 2025

King Day Holiday Celebration Or Cancellation Public Opinion Poll Results

Apr 26, 2025 -

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 26, 2025

Stock Market Valuations Bof As Rationale For Investor Calm

Apr 26, 2025 -

Le Labo Du 8 Presente L Uvre Photographique De Pierre Terrasson

Apr 26, 2025

Le Labo Du 8 Presente L Uvre Photographique De Pierre Terrasson

Apr 26, 2025 -

Deion Sanders Son Shedeur Poised For High Nfl Draft Selection

Apr 26, 2025

Deion Sanders Son Shedeur Poised For High Nfl Draft Selection

Apr 26, 2025