Trump's Trade War: Wall Street Bets' Perspective On The Economic Recovery

Table of Contents

The Initial Shockwaves: Market Reactions to Tariff Announcements

The initial announcements of tariffs on goods from China and other countries triggered immediate and significant market reactions. The increased uncertainty surrounding global trade led to increased market volatility, causing investors to reassess their portfolios.

- Specific Examples: The announcement of tariffs on steel and aluminum in 2018 led to immediate drops in the stock prices of affected companies. Conversely, some sectors, initially perceived as beneficiaries of protectionist measures, saw short-term gains.

- Sectoral Impact: The technology sector, heavily reliant on global supply chains, experienced significant volatility. The agricultural sector, facing retaliatory tariffs from China, suffered substantial losses. Manufacturing, already grappling with other economic challenges, faced added pressure.

- Increased Volatility: The uncertainty surrounding the trade war resulted in significantly higher market volatility, making accurate predictions challenging and increasing risk for investors. This period of heightened uncertainty forced investors to reassess their risk tolerance and adjust their strategies accordingly.

Shifting Investment Strategies: Adapting to Trade Uncertainty

Faced with the escalating trade war, Wall Street investors rapidly adjusted their investment strategies to mitigate risk and capitalize on emerging opportunities. The overriding concern was navigating the uncertainty created by the unpredictable nature of the trade policies.

- Defensive Sectors: Investment shifted towards defensive sectors like consumer staples, healthcare, and utilities, which are generally less susceptible to economic downturns and trade disputes. These sectors offered a degree of stability in an otherwise turbulent market.

- Global Diversification: Many investors sought to reduce their reliance on US-China trade by diversifying their portfolios globally. This strategy aimed to reduce exposure to the specific risks associated with the trade war and to benefit from growth opportunities in other markets.

- Increased Hedging: The use of hedging strategies, such as options and futures contracts, increased dramatically as investors sought to protect their portfolios against potential losses stemming from tariff-related market fluctuations.

The Long-Term Economic Outlook: Wall Street's Predictions

Wall Street analysts offered widely varying long-term economic predictions regarding the trade war's impact. The lack of clarity regarding the duration and intensity of the conflict made forecasting extremely difficult.

- Differing Opinions: Some analysts predicted a significant slowdown in global economic growth, citing the negative impact of trade barriers on international commerce. Others argued that the trade war could ultimately lead to a restructuring of global supply chains, benefiting domestic industries in the long run.

- Potential Scenarios: Forecasts ranged from continued trade tension leading to sustained economic uncertainty to a resolution of trade disputes resulting in a faster-than-expected economic recovery. The possibility of a prolonged "cold war" between the US and China was also considered.

- GDP, Inflation, and Unemployment: Predictions varied widely on the impact on GDP growth, inflation, and unemployment. Some economists predicted a significant increase in inflation due to tariffs, while others foresaw a decrease in overall economic growth and a rise in unemployment.

Winners and Losers: Sectoral Analysis of Trade War Effects

Trump's trade policies created a complex landscape of winners and losers across various economic sectors. Some industries benefited from increased domestic demand or reduced foreign competition, while others suffered significant losses due to tariffs and retaliatory measures.

- Beneficiaries: Certain domestic industries, particularly those producing goods previously heavily reliant on imports, experienced a surge in demand as consumers shifted to domestically produced alternatives.

- Victims: Industries heavily reliant on exports to China and other countries affected by tariffs faced significant challenges, often leading to job losses and business closures. The agricultural sector, for example, was severely impacted by retaliatory tariffs imposed by China.

- Employment Impact: The trade war had a demonstrable effect on employment across various sectors. While some industries saw an increase in jobs due to increased production, others faced significant job losses due to decreased demand or factory closures.

Conclusion: Trump's Trade War: Lasting Impacts and Future Considerations

Wall Street's perspective on the economic recovery following Trump's trade war reflects a period of significant market volatility, shifts in investment strategies, and widely varying long-term economic predictions. The initial market shocks, driven by tariff announcements, highlighted the inherent uncertainty of the trade conflict. Investors responded by shifting towards defensive sectors, diversifying globally, and employing hedging strategies to manage risk. The sectoral analysis revealed clear winners and losers, underscoring the uneven impact of the trade war on different industries and the workforce. The lasting impacts of Trump’s trade policies on global trade and the US economy continue to unfold, influencing future economic projections and investment decisions. Stay informed on the continuing impact of Trump's trade war and its effect on global markets. Further research into these effects can help you make informed investment decisions.

Featured Posts

-

Remy Cointreau Appoints Marilly As New Ceo Following Vallats Departure

May 29, 2025

Remy Cointreau Appoints Marilly As New Ceo Following Vallats Departure

May 29, 2025 -

Comparing Ancelotti And Capello Tactical Approaches And Achievements

May 29, 2025

Comparing Ancelotti And Capello Tactical Approaches And Achievements

May 29, 2025 -

Blake Sheltons Reaction To Morgan Wallens Snl Walkout

May 29, 2025

Blake Sheltons Reaction To Morgan Wallens Snl Walkout

May 29, 2025 -

Seattle Cid Investigation Underway Following Double Shooting

May 29, 2025

Seattle Cid Investigation Underway Following Double Shooting

May 29, 2025 -

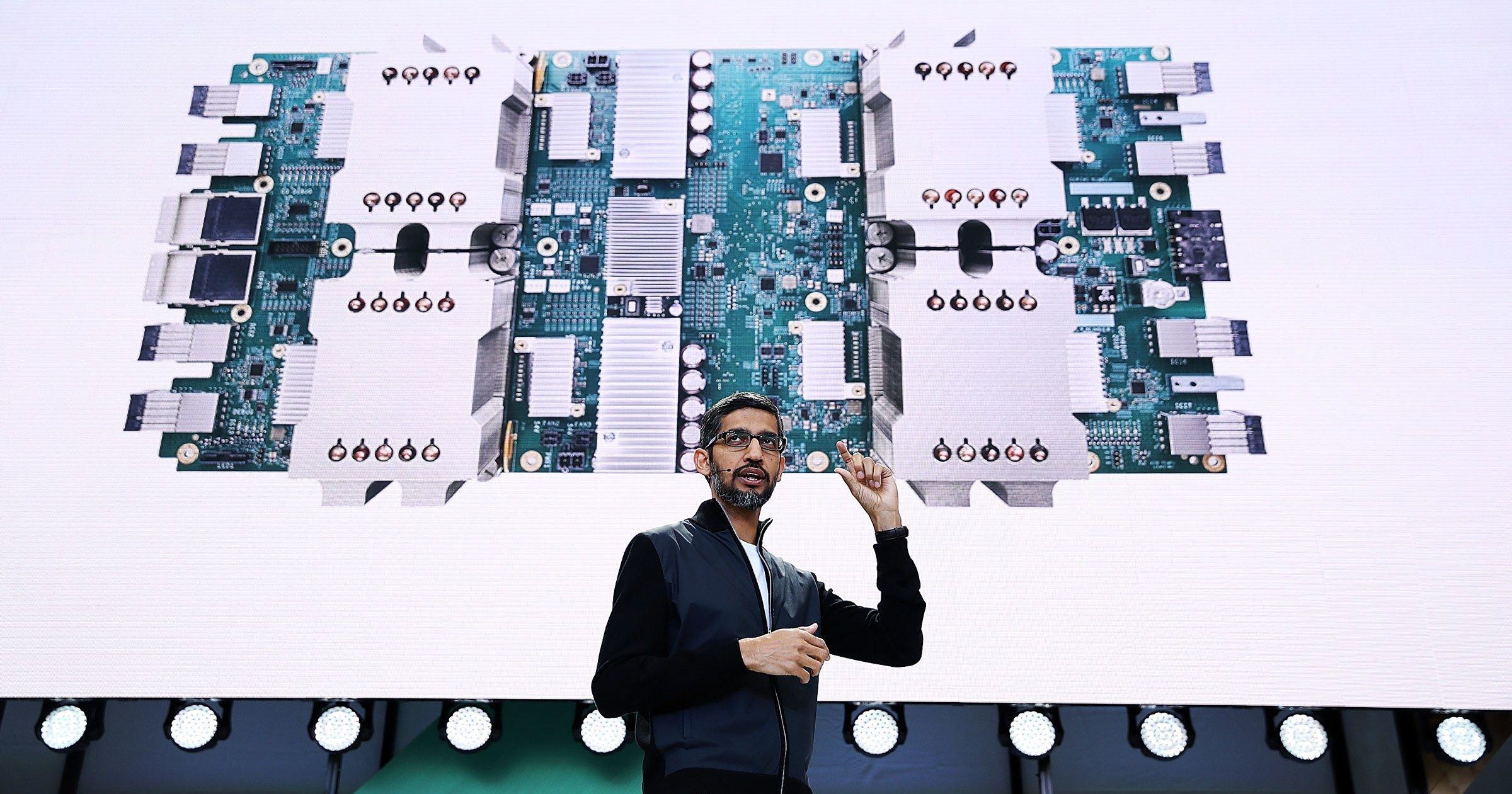

Googles Future Sundar Pichai On Search Ai And Chromes Role

May 29, 2025

Googles Future Sundar Pichai On Search Ai And Chromes Role

May 29, 2025