U.S.-China Tariff Rollback: Impact On The American Economy

Table of Contents

Impact on Consumer Prices

A significant consequence of the U.S.-China tariff rollback would be its effect on consumer prices. The tariffs imposed during the trade war increased the cost of imported goods from China, leading to higher prices for consumers. A rollback would likely reverse this trend.

- Decreased prices on consumer goods: Products ranging from electronics and clothing to furniture and toys, many sourced from China, could become significantly cheaper, boosting consumer purchasing power.

- Potential increase in disposable income: Lower prices mean more disposable income for American households, potentially stimulating domestic spending and economic growth. This increased spending could have a ripple effect across various sectors of the economy.

- Reduced impact of tariffs on the cost of living: The reduction in the cost of imported goods directly contributes to a lower cost of living, offering relief to families struggling with inflation.

- Supporting Data: Several economic studies have demonstrated a direct correlation between tariffs and increased consumer prices. Analysis from organizations like the Federal Reserve and the Congressional Budget Office can provide further insight into the potential magnitude of price reductions following a tariff rollback.

Effects on American Businesses and Industries

The impact of a U.S.-China tariff rollback extends beyond consumer prices, significantly affecting American businesses and industries. Sectors heavily reliant on imported materials or competing with Chinese imports would experience the most pronounced changes.

- Increased profitability for businesses reliant on imported materials: Businesses in sectors like manufacturing that rely on imported components from China could see increased profitability due to lower input costs. This could lead to increased investment and expansion.

- Potential job creation in affected industries: Lower production costs could stimulate job growth in manufacturing and related industries.

- Enhanced supply chain efficiency: The reduction in trade friction could lead to more efficient and streamlined supply chains, reducing lead times and improving overall productivity.

- Increased competition from Chinese imports: While beneficial for some, the rollback might also lead to increased competition from cheaper Chinese imports, potentially challenging some domestic businesses. American companies will need to focus on innovation and efficiency to remain competitive.

The Role of Supply Chains

Global supply chains have become increasingly intertwined, with many relying heavily on both U.S. and Chinese goods and services. The U.S.-China tariff rollback could significantly reshape these complex networks.

- Reduced delays and disruptions in the supply chain: The trade war caused significant delays and disruptions to global supply chains. A tariff rollback can help to alleviate these issues, leading to more predictable and reliable deliveries.

- Lower transportation costs due to simplified trade processes: Simplified trade processes resulting from tariff reductions can lead to lower transportation costs for businesses.

- Improved access to raw materials and components: Easier access to raw materials and components from China could benefit many American manufacturers.

- Enhanced resilience of the supply chain against future disruptions: A more stable trade relationship between the U.S. and China contributes to a more resilient supply chain less vulnerable to future geopolitical shocks.

Geopolitical Implications of U.S.-China Tariff Rollbacks

The U.S.-China tariff rollback has far-reaching geopolitical implications beyond the purely economic. It can signal a shift in the overall relationship between the two countries.

- Improved diplomatic relations between the US and China: A reduction in trade tensions can contribute to improved overall diplomatic relations and increased cooperation on other global issues.

- Potential for increased global trade and economic cooperation: Reduced trade friction between the two largest economies could positively impact global trade and economic cooperation.

- Reduced trade tensions and uncertainties: A rollback lessens the uncertainty surrounding trade policy, potentially encouraging increased investment and trade globally.

- Long-term impacts on international trade agreements: The U.S.-China tariff rollback could set a precedent and influence future international trade agreements and negotiations.

Long-Term Economic Outlook after U.S.-China Tariff Rollback

Predicting the long-term economic effects of a U.S.-China tariff rollback requires a nuanced understanding of several interacting factors.

- Projected GDP growth rates: Many economists predict a modest boost in GDP growth following a substantial tariff rollback.

- Predictions for job market changes: The impact on the job market is expected to be positive in some sectors, while others might face challenges due to increased competition.

- Potential impacts on national debt and deficit: The long-term effects on the national debt and deficit are complex and depend on how the increased economic activity translates into government revenue.

- The need for ongoing economic policy adjustments: Even with a tariff rollback, ongoing adjustments to economic policy will be necessary to address evolving economic challenges and ensure sustainable growth.

Conclusion: Understanding the Implications of U.S.-China Tariff Rollback

The U.S.-China tariff rollback presents a complex scenario with potential benefits and challenges for the American economy. While lower consumer prices and increased business profitability are likely outcomes, careful consideration must be given to the potential for increased competition and the need for ongoing economic policy adjustments. Understanding these implications is crucial for businesses, consumers, and policymakers alike. Stay updated on the latest developments concerning the U.S.-China tariff rollback and its continuing impact on the American economy. Further research into specific industry sectors and policy changes is vital for a comprehensive understanding of this complex issue.

Featured Posts

-

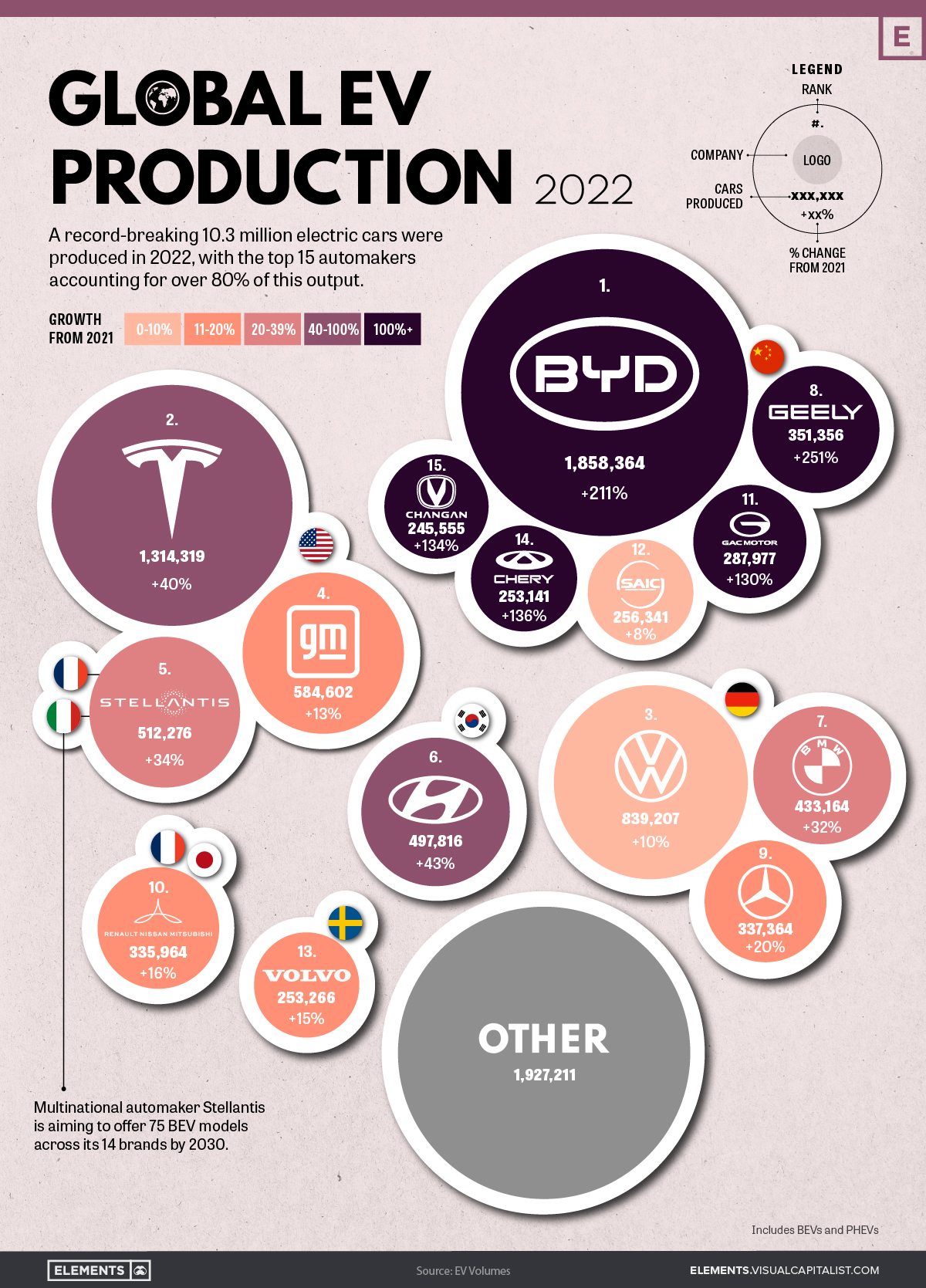

Case Study Addendum Byds Leadership In Ev Battery Manufacturing

May 13, 2025

Case Study Addendum Byds Leadership In Ev Battery Manufacturing

May 13, 2025 -

Maluf Fords Brazilian Legacy Fades As Byds Global Ev Dominance Rises

May 13, 2025

Maluf Fords Brazilian Legacy Fades As Byds Global Ev Dominance Rises

May 13, 2025 -

11

May 13, 2025

11

May 13, 2025 -

Leonardo Di Caprio Es A Heroinfueggoseg 30 Evnyi Kuezdelem

May 13, 2025

Leonardo Di Caprio Es A Heroinfueggoseg 30 Evnyi Kuezdelem

May 13, 2025 -

Keine Gefahr Mehr Entwarnung Nach Alarm An Grundschule In Braunschweig Niedersachsen And Bremen

May 13, 2025

Keine Gefahr Mehr Entwarnung Nach Alarm An Grundschule In Braunschweig Niedersachsen And Bremen

May 13, 2025