U.S. Customs Duties Hit Record High: $16.3 Billion In April

Table of Contents

- Factors Contributing to the Record High U.S. Customs Duties

- Increased Import Volume

- Higher Tariff Rates on Certain Goods

- Enforcement of Customs Regulations

- Implications of the Record High U.S. Customs Duties

- Impact on Businesses

- Impact on Consumers

- Government Revenue and Fiscal Policy

- Conclusion: Understanding the Record High U.S. Customs Duties – What's Next?

Factors Contributing to the Record High U.S. Customs Duties

Several interconnected factors contributed to the unprecedented $16.3 billion in tariff revenue collected in April. Understanding these factors is crucial for navigating the evolving landscape of international trade and U.S. Customs regulations.

Increased Import Volume

The most significant factor is a substantial increase in the overall volume of goods imported into the United States. This surge in import volume across various sectors fueled the rise in U.S. Customs Duties.

- Electronics: Demand for consumer electronics remains strong, leading to a significant increase in imports.

- Consumer Goods: The import of various consumer goods, from apparel to household items, experienced notable growth.

- Specific Data: While precise data across all sectors is still being analyzed, preliminary reports indicate a double-digit percentage increase in import volume compared to April 2023. This substantial increase in Goods Imports directly translates to higher Tariff Revenue.

These Trade Statistics paint a clear picture of robust import activity, contributing significantly to the record-high Import Duties collected.

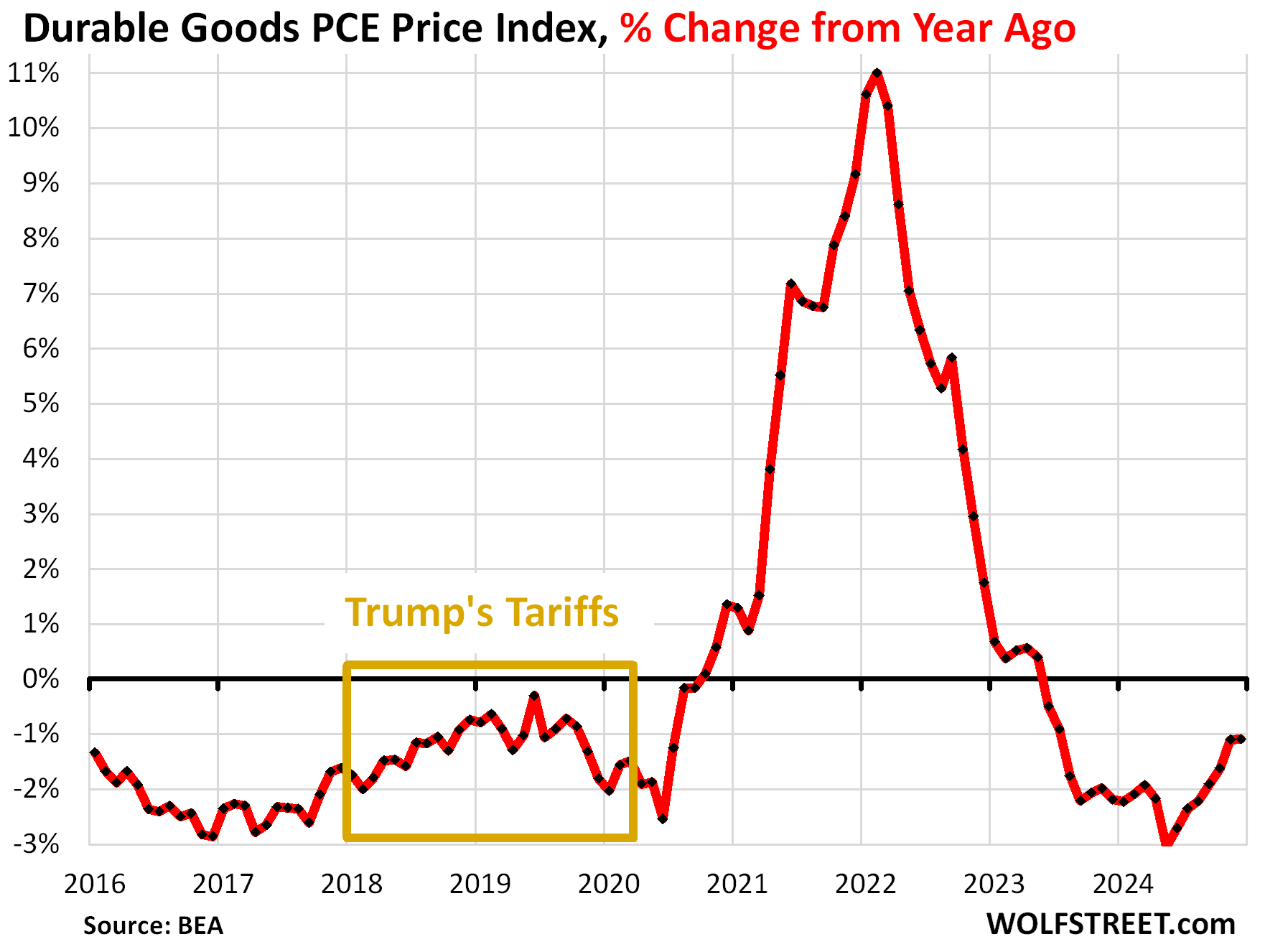

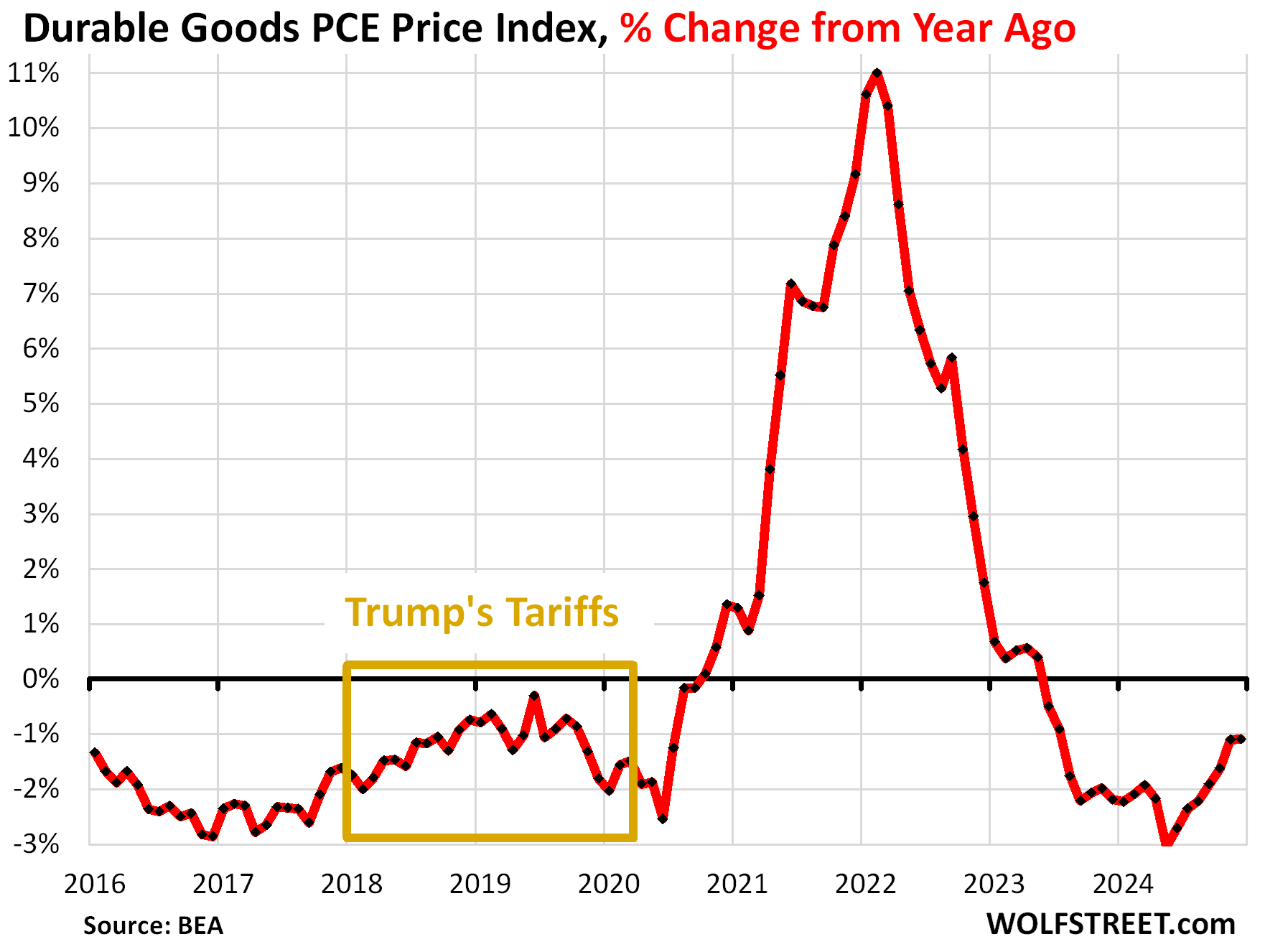

Higher Tariff Rates on Certain Goods

Existing tariffs, and in some cases, newly imposed or increased tariffs on specific goods, also played a role in boosting U.S. Customs Duties.

- Steel and Aluminum Tariffs: These tariffs, implemented in previous years, continue to impact import costs and contribute to the overall revenue collected.

- Section 301 Tariffs: Tariffs imposed under Section 301 of the Trade Act of 1974 on goods from certain countries remain in effect, adding to the cost of imports.

- Recent Tariff Increases: Any recent adjustments to Customs Tariffs or the introduction of new Trade Tariffs on specific products would also directly contribute to higher Tariff Rates and increased revenue.

The impact of these Import Tariffs is undeniable, substantially influencing the total Tariff Revenue generated.

Enforcement of Customs Regulations

Stricter enforcement of U.S. Customs regulations has also contributed to the increase in collected duties.

- Increased Seizures: More stringent border controls and improved detection methods have led to a rise in the seizure of smuggled goods, resulting in penalties that boost revenue.

- Improved Compliance: Stronger enforcement encourages better Trade Compliance, minimizing attempts to evade duties and increasing the accuracy of tariff assessments.

- Focus on Smuggling: A heightened focus on combating Smuggling activities has directly increased revenue by catching those attempting to avoid paying Customs Duties.

Effective Customs Enforcement measures are therefore a key factor in generating higher Import Duties.

Implications of the Record High U.S. Customs Duties

The record-high U.S. Customs Duties have far-reaching implications for businesses, consumers, and the government.

Impact on Businesses

Increased Import Duties directly translate to higher Import Costs for businesses relying on imported goods.

- Increased Production Costs: Higher Business Costs can impact profitability and competitiveness.

- Price Adjustments: Businesses may be forced to pass these increased costs onto consumers through higher prices.

- Supply Chain Disruptions: Higher Import Costs can disrupt supply chains, particularly for businesses with tight profit margins. This may result in reduced competitiveness and affect business decisions related to global sourcing and Supply Chain management.

The impact on business profitability is a significant concern related to rising Import Duties.

Impact on Consumers

Higher Customs Duties ultimately affect consumers through increased prices.

- Higher Retail Prices: Increased Import Costs are likely to be passed on to consumers, leading to higher prices for a wide range of goods.

- Reduced Consumer Spending: Higher prices may lead to reduced consumer spending, potentially impacting overall economic growth.

- Cost of Goods Sold: The rise in the Cost of Goods affects various consumer segments across the economy.

The impact of rising Consumer Prices is a key concern for economists and policymakers alike.

Government Revenue and Fiscal Policy

The surge in Government Revenue from increased Import Duties has implications for Fiscal Policy.

- Budget Surplus: The increased revenue could lead to a budget surplus, providing the government with additional funds for various initiatives.

- Fiscal Policy Decisions: The government now has increased resources for infrastructure projects, social programs, or debt reduction.

- Economic Stimulus: This revenue could also potentially be used to stimulate the economy.

This increase in revenue presents both opportunities and challenges for Fiscal Policy decisions.

Conclusion: Understanding the Record High U.S. Customs Duties – What's Next?

The record-high $16.3 billion in U.S. Customs Duties collected in April 2024 is a result of increased import volumes, higher tariff rates on certain goods, and stricter enforcement of customs regulations. This has significant implications for businesses facing higher import costs, consumers facing increased prices, and the government navigating increased revenue and its impact on fiscal policy. Looking forward, it's crucial to monitor ongoing changes in U.S. Customs Duties and their impact on the broader economy. Stay informed about changes in import regulations and their potential impact on your business or personal finances. Subscribe to our newsletter for updates on Import Duties, follow leading trade publications, or consult with a customs broker for assistance with U.S. Customs Duties. Understanding the complexities of Import Duties is key to navigating the current trade environment successfully.

Efl Highlights Catch Up On All The Action

Efl Highlights Catch Up On All The Action

Izmeneniya V Obrazovatelnykh Standartakh Fizika I Khimiya V Doshkolnom Obrazovanii

Izmeneniya V Obrazovatelnykh Standartakh Fizika I Khimiya V Doshkolnom Obrazovanii

Chicago Gun Laws And The Meg Thee Stallion Case A Comparison

Chicago Gun Laws And The Meg Thee Stallion Case A Comparison

Ryujinx Switch Emulator Project Ends After Reported Nintendo Intervention

Ryujinx Switch Emulator Project Ends After Reported Nintendo Intervention

Simu Liu Blown Away By Avengers Doomsdays Ensemble Cast

Simu Liu Blown Away By Avengers Doomsdays Ensemble Cast